InterRent REIT Acquisition: Sovereign Wealth Fund And Executive Chair's Bid

Table of Contents

The Bidders: Sovereign Wealth Fund and Executive Chair

The InterRent REIT acquisition bid is a joint effort from a prominent sovereign wealth fund and the company's executive chair. Understanding the players is crucial to comprehending the deal's potential outcomes.

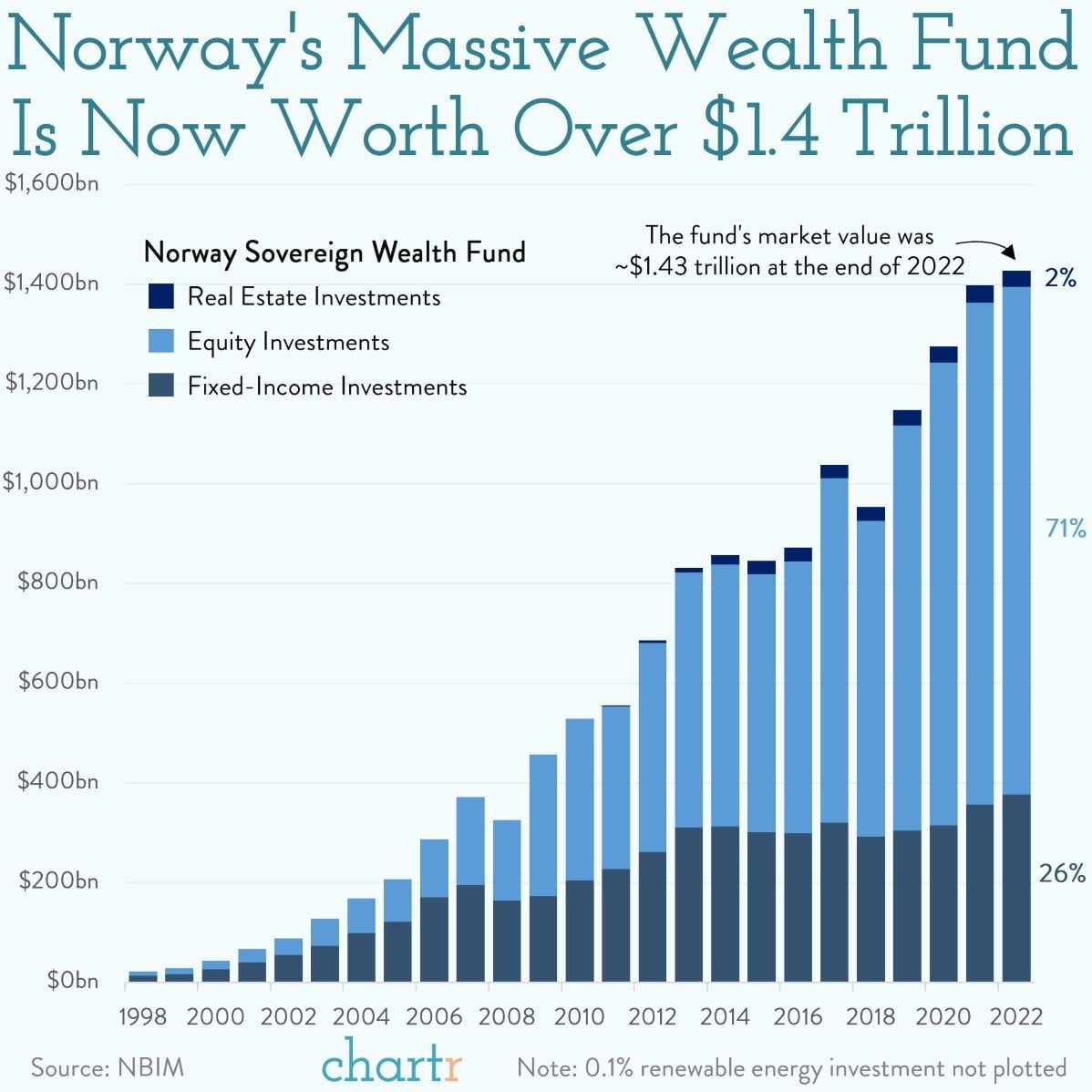

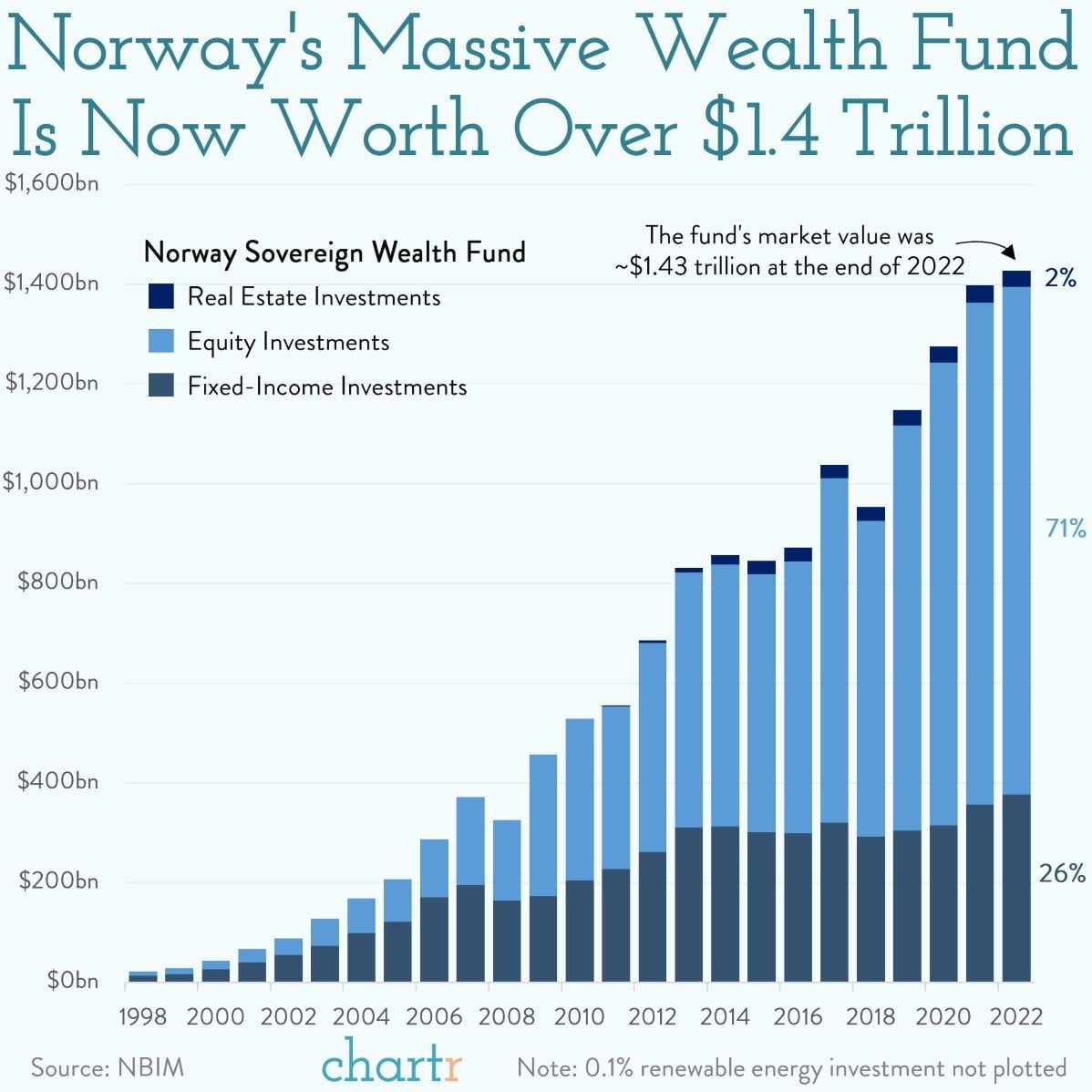

The sovereign wealth fund involved is [Name of Sovereign Wealth Fund], based in [Country of Origin]. Known for its significant investments in global real estate, [Name of Sovereign Wealth Fund] manages assets exceeding [Size and scale of assets under management], making it a major force in the international investment landscape. Their strategic focus on long-term, stable returns aligns well with the established portfolio of InterRent REIT.

On the other side, we have [Executive Chair's Name], the executive chair of InterRent REIT, who has been instrumental in shaping the company's growth for [Tenure at InterRent REIT] years. Their significant personal stake in InterRent REIT, currently estimated at [Executive Chair's current shareholding in InterRent REIT], adds an element of personal interest to the acquisition bid, raising potential questions about conflicts of interest. The involvement of the executive chair creates a unique dynamic within this acquisition.

- Name of the sovereign wealth fund: [Name of Sovereign Wealth Fund]

- Country of origin: [Country of Origin]

- Assets under management: [Size and scale of assets under management]

- Executive Chair's name: [Executive Chair's Name]

- Tenure at InterRent REIT: [Tenure at InterRent REIT]

- Executive Chair's current shareholding: [Executive Chair's current shareholding in InterRent REIT]

- Potential conflicts of interest: [Discussion of potential conflicts]

The Acquisition Proposal: Key Terms and Conditions

The acquisition proposal outlines a [friendly/hostile] takeover bid. The proposed terms include an offer price of [Offer price per share] per share, valuing InterRent REIT at a total of [Total value of the acquisition]. The payment method is expected to be [Payment method - cash, stock, or combination]. The timeline for completion is projected to be [Timeline for completion], contingent on several conditions precedent. These conditions include, but are not limited to, securing necessary regulatory approvals and meeting other standard closing conditions common in real estate transactions of this size and complexity.

- Offer price per share: [Offer price per share]

- Total value of the acquisition: [Total value of the acquisition]

- Payment method: [Payment method]

- Timeline for completion: [Timeline for completion]

- Conditions precedent: [List of conditions]

Market Reaction and Analyst Opinions

The announcement of the InterRent REIT acquisition has sparked considerable market activity. The stock price initially reacted with [Describe initial stock price reaction], reflecting investor [Sentiment – positive, negative, or mixed]. Subsequent trading days saw [Describe subsequent stock price fluctuations]. Media coverage has been extensive, with major financial news outlets reporting on the deal and its potential implications.

Financial analysts offer varying opinions on the acquisition's success. [Analyst Name] at [Analyst Firm] projects [Analyst's prediction/rating], citing [Reasons]. Conversely, [Another Analyst Name] at [Another Analyst Firm] suggests [Another Analyst's prediction/rating], highlighting [Reasons]. The impact on InterRent REIT's competitors remains to be seen, but early indications suggest [Describe potential impacts on competitors]. The broader real estate market may also experience [Describe potential impacts on broader market], depending on the deal's outcome and its ripple effects.

- Stock price changes: [Detailed description of stock price changes]

- Key analyst quotes: [Include relevant quotes and attributions]

- Impact on competitors: [Analysis of competitive landscape]

- Impact on broader market: [Analysis of market-wide impacts]

Potential Synergies and Benefits

The acquisition holds the potential for significant synergies. The combination of InterRent REIT's established portfolio with the financial resources of the sovereign wealth fund could unlock numerous opportunities. Operational efficiencies might be achieved through [Examples of operational synergies], leading to cost savings. Furthermore, the acquisition could facilitate expansion into new geographic markets and product segments, broadening InterRent REIT's reach and revenue streams. The infusion of capital might allow for upgrades and improvements to existing properties, enhancing their value and attractiveness. Ultimately, these factors could lead to substantial improvements in InterRent REIT's financial performance.

- Potential for operational synergies: [List potential synergies]

- Opportunities for expansion: [List potential expansion areas]

- Expected improvements in financial performance: [Describe potential improvements]

Regulatory and Legal Implications

The InterRent REIT acquisition will require navigating several regulatory hurdles. [List relevant regulatory bodies] will likely scrutinize the deal for compliance with antitrust regulations and other relevant laws. The timeline for securing these approvals is uncertain, but delays are possible, particularly if any significant concerns are raised by regulatory authorities. Potential legal challenges could also arise from [Describe potential legal challenges – e.g., minority shareholder lawsuits]. The overall process is likely to be complex and time-consuming, requiring careful legal and regulatory navigation.

- Relevant regulatory bodies: [List of regulatory bodies]

- Timeline for regulatory approvals: [Estimated timeline]

- Potential legal challenges: [Description of potential legal issues]

Conclusion

The InterRent REIT acquisition, involving a significant sovereign wealth fund and the company's executive chair, presents a unique and complex scenario within the real estate sector. The proposed terms, market reactions, and potential synergies all suggest a deal with significant implications. However, regulatory hurdles and potential legal challenges must be carefully considered. The outcome will shape not only the future of InterRent REIT but also have broader implications for the real estate market. Stay informed about further developments in the InterRent REIT Acquisition and share your thoughts on the deal in the comments section below. For further reading on sovereign wealth fund investments in real estate and REIT mergers and acquisitions, check out [Link to relevant resources].

Featured Posts

-

Liverpool News Real Madrids Speed Demon Close To Anfield Move

May 29, 2025

Liverpool News Real Madrids Speed Demon Close To Anfield Move

May 29, 2025 -

Harry Potter Remake A Deeper Dive Into Snape Mc Gonagall And The Original Films Vision

May 29, 2025

Harry Potter Remake A Deeper Dive Into Snape Mc Gonagall And The Original Films Vision

May 29, 2025 -

Create A Beautiful And Functional Living Fence Your Guide

May 29, 2025

Create A Beautiful And Functional Living Fence Your Guide

May 29, 2025 -

Urgent Action Needed Advocacy Body Reveals Crisis Facing Australian Music Targets Key Electorates

May 29, 2025

Urgent Action Needed Advocacy Body Reveals Crisis Facing Australian Music Targets Key Electorates

May 29, 2025 -

Deschamps Lauds Mbappes Leadership In Frances Penalty Shootout Win Over Croatia

May 29, 2025

Deschamps Lauds Mbappes Leadership In Frances Penalty Shootout Win Over Croatia

May 29, 2025

Latest Posts

-

Ex Nypd Commissioner Keriks Hospitalization Update On His Condition

May 31, 2025

Ex Nypd Commissioner Keriks Hospitalization Update On His Condition

May 31, 2025 -

Bernard Kerik And The Nypd Remembering 9 11 And Its Aftermath

May 31, 2025

Bernard Kerik And The Nypd Remembering 9 11 And Its Aftermath

May 31, 2025 -

Bernard Kerik A Fearless Leaders Legacy After 9 11

May 31, 2025

Bernard Kerik A Fearless Leaders Legacy After 9 11

May 31, 2025 -

Find Your New Home Two Weeks Of Free Housing In A German City

May 31, 2025

Find Your New Home Two Weeks Of Free Housing In A German City

May 31, 2025 -

Bernard Kerik Ex Nypd Commissioner Receives Medical Treatment Full Recovery Anticipated

May 31, 2025

Bernard Kerik Ex Nypd Commissioner Receives Medical Treatment Full Recovery Anticipated

May 31, 2025