Interest Rate Cuts: Why The Fed Is Taking A Different Approach

Table of Contents

The Shifting Economic Landscape

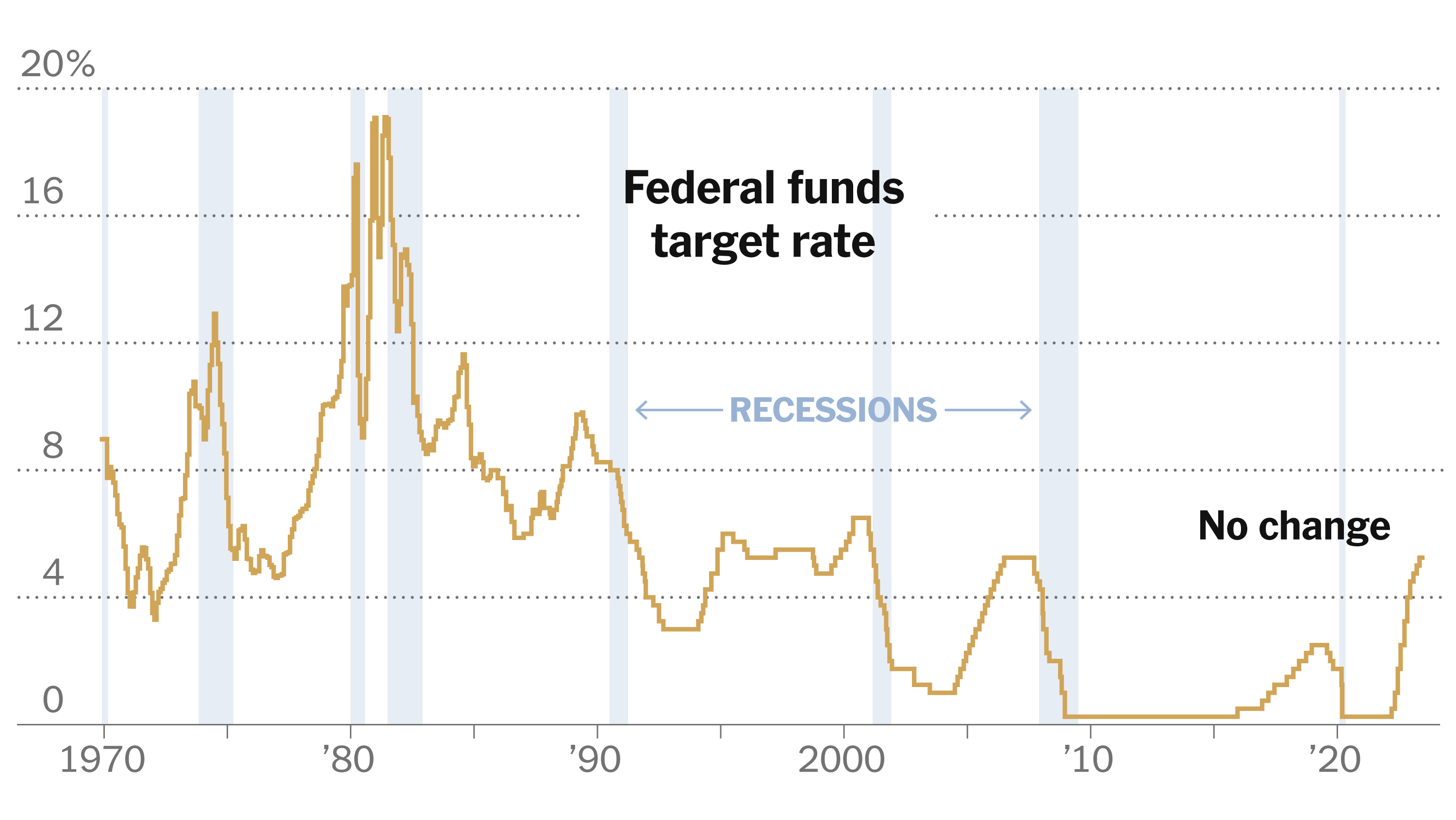

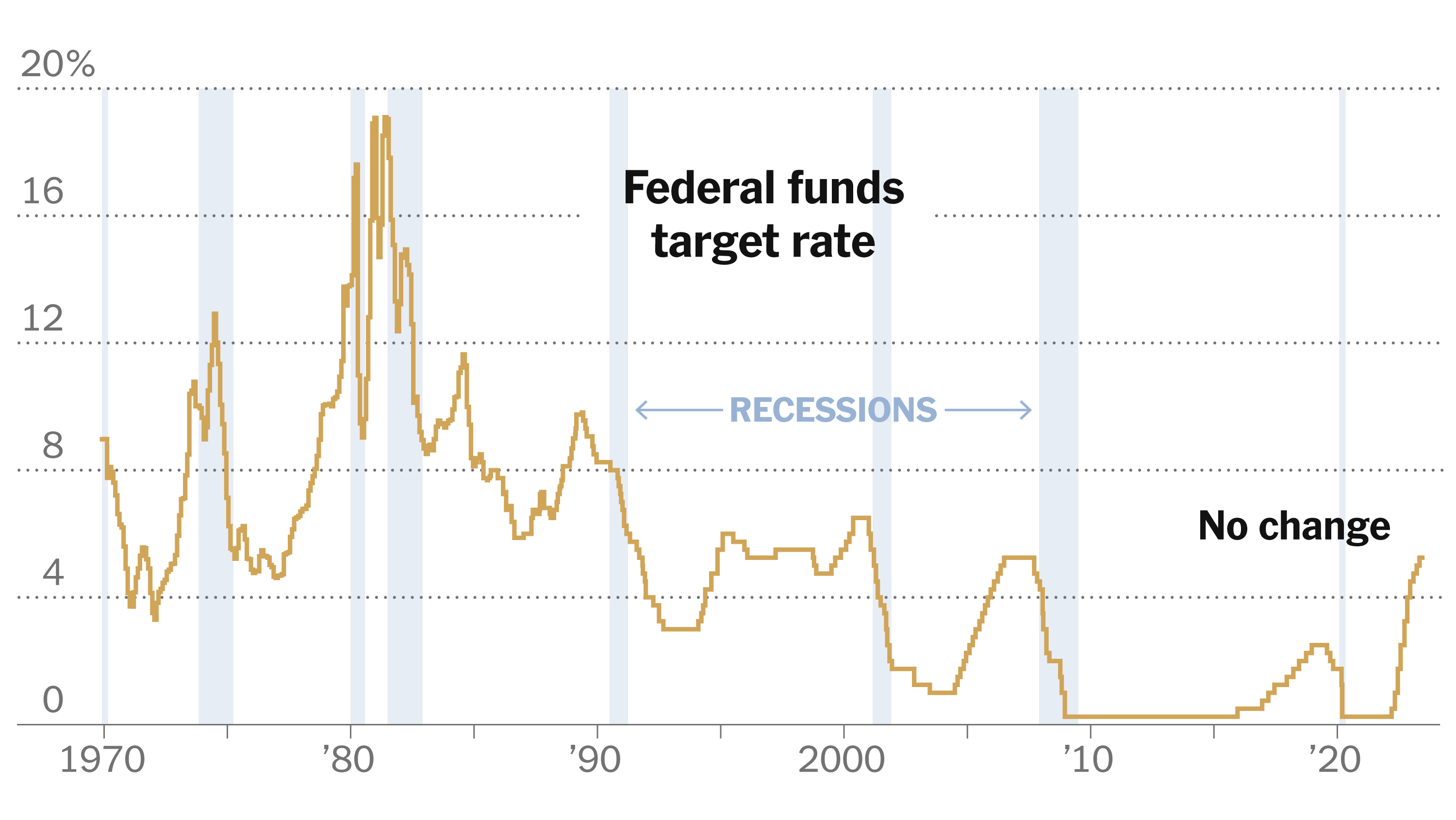

The Fed's approach to monetary policy, including interest rate cuts, is typically guided by indicators like inflation and unemployment. However, the current economic landscape presents a unique challenge.

Persistent Inflation

Inflation remains stubbornly high, defying historical trends and posing a significant hurdle for the Fed. This persistent inflation is fueled by several factors:

- Supply chain disruptions: Lingering supply chain bottlenecks continue to constrain production and drive up prices for goods.

- Elevated energy prices: Soaring energy costs, exacerbated by geopolitical instability, contribute significantly to overall inflation.

- Demand-pull inflation: Strong consumer demand, coupled with limited supply, puts upward pressure on prices across various sectors.

This persistent inflation challenges the traditional approach to interest rate cuts. Historically, rate cuts have been used to stimulate economic growth during periods of low inflation and high unemployment. However, cutting rates aggressively in the face of persistent inflation risks further fueling price increases, potentially leading to a wage-price spiral.

Strong Labor Market

Adding to the complexity is an unexpectedly robust labor market. Unemployment remains low, wage growth is relatively strong, and job openings are plentiful. This presents a conundrum:

- Low unemployment: Indicates a healthy economy, but also contributes to upward pressure on wages.

- Strong wage growth: While beneficial for workers, it can exacerbate inflationary pressures if not managed carefully.

The strong labor market complicates the usual relationship between interest rate cuts and employment. Typically, rate cuts aim to stimulate job creation, but in this environment, further stimulating demand could worsen already high inflation without significantly impacting unemployment.

The Fed's Unconventional Strategy

Given the unusual economic circumstances, the Fed is employing a more cautious and nuanced approach to monetary policy.

Gradual Approach to Rate Cuts

Instead of aggressive rate cuts, the Fed is opting for a more gradual and measured approach. This strategy stems from several concerns:

- Risk of exacerbating inflation: Rapid rate cuts risk reigniting inflationary pressures, potentially undoing any progress made in taming price increases.

- Need for data-driven decision making: The Fed is prioritizing a data-driven approach, closely monitoring economic indicators before making significant adjustments to interest rates.

- Maintaining credibility: A gradual approach helps maintain the Fed's credibility and avoid erratic policy changes that could undermine market confidence.

By proceeding cautiously, the Fed aims to balance the need to support economic growth with the imperative to control inflation.

Focus on Quantitative Tightening (QT)

Alongside interest rate adjustments, the Fed is emphasizing quantitative tightening (QT). QT involves reducing the size of its balance sheet by allowing Treasury securities and agency mortgage-backed securities to mature without reinvestment.

- Mechanism of QT: By reducing the money supply, QT helps to curb inflation.

- Complementary role to rate cuts: QT complements interest rate cuts by providing an additional tool for controlling inflation without solely relying on interest rate adjustments.

- Gradual reduction: The Fed is implementing QT gradually to avoid disrupting financial markets.

Alternative Considerations

The Fed's decision-making process regarding interest rate cuts extends beyond domestic economic indicators.

Geopolitical Factors

Global events significantly impact the US economy and influence the Fed's approach to interest rate cuts.

- Energy crisis: The ongoing global energy crisis contributes to inflation and necessitates careful consideration of the impact of interest rate adjustments on energy prices.

- Geopolitical instability: War and other geopolitical uncertainties introduce volatility into global markets, complicating the predictability of economic indicators.

These external factors make it challenging to predict the effectiveness of traditional monetary policy tools, requiring a more nuanced and adaptable approach.

Long-Term Economic Outlook

The Fed's assessment of long-term economic prospects plays a critical role in shaping its interest rate strategy. The Fed analyzes:

- Projected economic growth: The Fed's long-term projections for economic growth inform its decisions on the pace and magnitude of interest rate adjustments.

- Inflation expectations: The Fed carefully monitors inflation expectations to assess the potential for inflation to become entrenched.

- Unemployment forecasts: Long-term unemployment forecasts influence the Fed's consideration of the potential trade-offs between controlling inflation and supporting employment.

These long-term projections guide the decision-making process surrounding interest rate cuts, ensuring a sustainable and balanced approach to monetary policy.

Conclusion

The Fed's unconventional approach to interest rate cuts reflects the unique challenges presented by the current economic environment. Persistent inflation, a strong labor market, the implementation of quantitative tightening, geopolitical factors, and long-term economic projections all contribute to a more cautious and data-driven strategy. Understanding this nuanced context is crucial for navigating the complexities of the current economic landscape. Stay updated on future interest rate cuts and monitor the Fed's announcements regarding interest rate cuts to better understand their implications for your financial well-being and business decisions. Learn more about the implications of interest rate cuts and their impact on the broader economy.

Featured Posts

-

Gap Safety And Wheelchair Access Improvements Needed On The Elizabeth Line

May 09, 2025

Gap Safety And Wheelchair Access Improvements Needed On The Elizabeth Line

May 09, 2025 -

Dakota Johnsons Role Selection Chris Martins Potential Influence

May 09, 2025

Dakota Johnsons Role Selection Chris Martins Potential Influence

May 09, 2025 -

Polish National And Female Acquaintance Deny Mc Cann Home Visit

May 09, 2025

Polish National And Female Acquaintance Deny Mc Cann Home Visit

May 09, 2025 -

High Potential Episode 13 Revealing The Identity Of The Actor Playing David

May 09, 2025

High Potential Episode 13 Revealing The Identity Of The Actor Playing David

May 09, 2025 -

Champions League Prediction Rio Ferdinand Picks His Winner Before Arsenal Vs Psg

May 09, 2025

Champions League Prediction Rio Ferdinand Picks His Winner Before Arsenal Vs Psg

May 09, 2025

Latest Posts

-

76ers Sufren Novena Derrota Anunoby Anota 27 Para Los Knicks

May 12, 2025

76ers Sufren Novena Derrota Anunoby Anota 27 Para Los Knicks

May 12, 2025 -

Anunoby Lidera A Knicks Con 27 Puntos En Victoria Sobre 76ers

May 12, 2025

Anunoby Lidera A Knicks Con 27 Puntos En Victoria Sobre 76ers

May 12, 2025 -

Anunoby Anota 27 Knicks Vencen A Sixers En Emocionante Partido

May 12, 2025

Anunoby Anota 27 Knicks Vencen A Sixers En Emocionante Partido

May 12, 2025 -

Magic Johnsons Expert Analysis Who Wins The Knicks Pistons Matchup

May 12, 2025

Magic Johnsons Expert Analysis Who Wins The Knicks Pistons Matchup

May 12, 2025 -

Nba Playoffs Magic Johnson Weighs In On Knicks Pistons Series

May 12, 2025

Nba Playoffs Magic Johnson Weighs In On Knicks Pistons Series

May 12, 2025