Investing In BigBear.ai: A Practical Guide Based On Motley Fool Insights

Table of Contents

Understanding BigBear.ai's Business Model and Services

Core Offerings and Target Markets

BigBear.ai offers a diverse portfolio of AI-powered solutions designed to tackle complex challenges across various sectors. Their core services leverage cutting-edge artificial intelligence, machine learning, and data analytics to deliver actionable insights and innovative solutions.

- Artificial Intelligence (AI) & Machine Learning (ML) Driven Analytics: BigBear.ai provides advanced analytics capabilities for diverse data sets, enabling better decision-making across various industries.

- Cybersecurity Solutions: They offer robust cybersecurity solutions to protect sensitive data and infrastructure for government and enterprise clients. This includes threat detection, response, and prevention services.

- Geospatial Intelligence: BigBear.ai leverages geospatial data analysis to provide insights for defense, intelligence, and commercial applications.

- Target Markets: Their primary target markets include the U.S. government (defense, intelligence agencies), large enterprises needing advanced data analytics and cybersecurity, and other commercial clients. They are actively pursuing growth in these key sectors.

Competitive Advantages and Technological Prowess

BigBear.ai's competitive edge stems from several factors:

- Proprietary AI Technology: They possess proprietary AI and machine learning algorithms that give them a distinct advantage in processing and analyzing complex data.

- Strong Government Partnerships: BigBear.ai boasts a significant number of government contracts, demonstrating their credibility and ability to deliver effective solutions.

- Experienced Team: A team of highly skilled data scientists, engineers, and cybersecurity experts fuels their innovation.

- Data Science Expertise: Their deep expertise in data science enables them to develop tailored solutions to meet diverse client needs.

Financial Performance and Growth Projections

BigBear.ai's financial performance and growth projections are crucial factors for potential investors. Analyzing revenue growth, earnings per share (EPS), market capitalization, and overall financial outlook is vital. (Note: Specific financial data should be obtained from reputable financial sources and updated regularly). Look for indicators of:

- Revenue Growth: Consistent and substantial revenue growth is a positive sign.

- Earnings Per Share (EPS): Positive and growing EPS shows increasing profitability.

- Market Capitalization: This metric reflects the overall market value of the company.

- Financial Outlook: Analyst forecasts and the company's guidance provide insights into future financial performance.

Analyzing the Investment Risks Associated with BigBear.ai

Investing in BigBear.ai, or any stock, involves inherent risks. A thorough understanding of these risks is crucial before investing.

Volatility and Market Sentiment

The stock market is inherently volatile, and BigBear.ai's stock price is subject to fluctuations influenced by various factors:

- Stock Market Volatility: Overall market conditions can significantly impact stock prices.

- Investor Sentiment: Positive or negative news, industry trends, and overall investor confidence can influence the stock price.

- Geopolitical Risks: Global events can create uncertainty and affect investor sentiment.

Competition and Technological Disruption

BigBear.ai faces competition in the AI and cybersecurity sectors. Technological disruption also poses a risk:

- Competitive Landscape: Numerous companies compete in the AI and cybersecurity markets, creating a competitive landscape.

- Technological Disruption: Rapid advancements in AI and related technologies can render existing products and services obsolete.

- Market Share: Maintaining and growing market share requires continuous innovation and adaptation.

Financial Risks and Debt Levels

BigBear.ai's financial health, including its debt levels and cash flow, is a critical factor to consider:

- Debt-to-Equity Ratio: A high debt-to-equity ratio indicates higher financial risk.

- Cash Flow: Strong positive cash flow indicates the company's ability to generate revenue and meet its obligations.

- Profitability: Consistent profitability is essential for long-term sustainability.

- Financial Stability: Overall financial health and stability influence investor confidence.

Leveraging Motley Fool Insights for Informed Investment Decisions

The Motley Fool offers valuable insights into BigBear.ai and related companies. Utilizing their analyses can inform your investment decisions.

Key Motley Fool Articles and Analyses

(This section needs to be populated with actual links and summaries of relevant Motley Fool articles. Replace the bracketed information below.)

- [Link to Motley Fool Article 1]: [Summary of Key Insights from Article 1]

- [Link to Motley Fool Article 2]: [Summary of Key Insights from Article 2]

- [Link to Motley Fool Article 3]: [Summary of Key Insights from Article 3]

Comparing BigBear.ai to Competitors

The Motley Fool often provides comparative analyses of BigBear.ai against its competitors. This information helps in assessing relative strengths and weaknesses:

- [Summary of Motley Fool's comparison of BigBear.ai with Competitor A]

- [Summary of Motley Fool's comparison of BigBear.ai with Competitor B]

Conclusion

Investing in BigBear.ai presents both opportunities and risks. Understanding its business model, financial performance, competitive landscape, and potential technological disruptions is crucial. Leveraging insights from reputable sources like the Motley Fool can aid in informed decision-making. However, remember that investing in BigBear.ai or any stock carries inherent risk.

Call to Action: Before making any investment decisions regarding BigBear.ai, conduct your own thorough research and consult with a financial advisor. Consider carefully the information presented here, combined with your own due diligence, to determine if investing in BigBear.ai aligns with your investment strategy and risk tolerance. Remember, investing in BigBear.ai, like any stock investment, involves risk.

Featured Posts

-

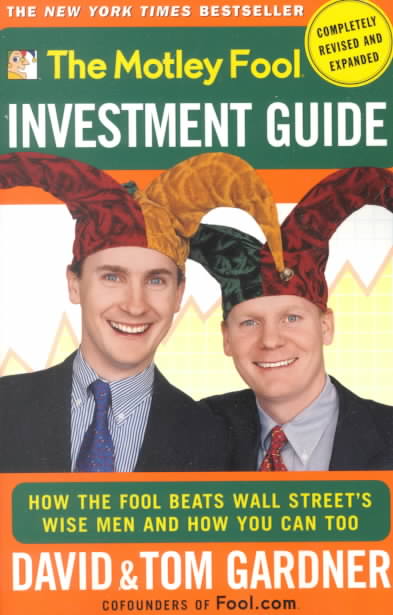

Protecting Your Property Preparing For Damaging Winds From Fast Storms

May 21, 2025

Protecting Your Property Preparing For Damaging Winds From Fast Storms

May 21, 2025 -

Racial Hatred Tweet Ex Councillors Wife Seeks Sentence Appeal

May 21, 2025

Racial Hatred Tweet Ex Councillors Wife Seeks Sentence Appeal

May 21, 2025 -

Hout Bay Fcs Success The Klopp Connection

May 21, 2025

Hout Bay Fcs Success The Klopp Connection

May 21, 2025 -

Pelatih Liverpool Yang Membawa The Reds Raih Gelar Liga Inggris 2024 2025

May 21, 2025

Pelatih Liverpool Yang Membawa The Reds Raih Gelar Liga Inggris 2024 2025

May 21, 2025 -

Service De Navette Gratuit En Test Liaison La Haye Fouassiere Haute Goulaine

May 21, 2025

Service De Navette Gratuit En Test Liaison La Haye Fouassiere Haute Goulaine

May 21, 2025

Latest Posts

-

The Versatile Use Of Cassis Blackcurrant In Culinary And Mixology

May 22, 2025

The Versatile Use Of Cassis Blackcurrant In Culinary And Mixology

May 22, 2025 -

Exploring The Rich Flavors Of Creme De Cassis Blackcurrant

May 22, 2025

Exploring The Rich Flavors Of Creme De Cassis Blackcurrant

May 22, 2025 -

Cassis Blackcurrant Liqueur Production Taste Profile And Cocktail Applications

May 22, 2025

Cassis Blackcurrant Liqueur Production Taste Profile And Cocktail Applications

May 22, 2025 -

Swiss Foreign Minister Cassis Condemns Pahalgam Terror Attack

May 22, 2025

Swiss Foreign Minister Cassis Condemns Pahalgam Terror Attack

May 22, 2025 -

Superalimentos Por Que Este Supera Al Arandano En Beneficios Para La Salud

May 22, 2025

Superalimentos Por Que Este Supera Al Arandano En Beneficios Para La Salud

May 22, 2025