Investing In BigBear.ai (BBAI): A Penny Stock Perspective On AI Investments

Table of Contents

Understanding BigBear.ai (BBAI) and its Business Model

BigBear.ai (BBAI) is a technology company specializing in providing AI-powered solutions and data analytics services. Its core offerings focus on delivering advanced analytics, AI-driven decision support, and mission-critical software to a diverse range of clients, with a significant focus on the national security and government sectors. The company operates in a competitive landscape populated by both large established tech firms and smaller specialized AI companies. Understanding BBAI's position within this market is crucial for any potential investor.

- Key services and technologies offered by BBAI: These include advanced analytics platforms, AI-driven modeling and simulation, geospatial intelligence, and cybersecurity solutions. They leverage cutting-edge technologies like machine learning and deep learning to provide actionable insights for their clients.

- Major clients and contracts: BBAI has secured numerous contracts, notably with various government agencies and departments, showcasing its expertise in delivering mission-critical AI solutions for national security applications. The details of these contracts, often publicly available through SEC filings, provide valuable insights into the company's revenue streams and operational stability.

- Competitive advantages and disadvantages: While BBAI boasts specialized expertise in national security AI and strong government relationships, it faces competition from larger, more established companies with broader resources and brand recognition. A key factor to consider is BBAI’s ability to innovate and maintain a competitive edge in the rapidly evolving AI market.

- Recent news and developments impacting BBAI’s operations: Keeping abreast of recent news, press releases, and SEC filings is paramount. These announcements can significantly impact BBAI's stock price and overall investor sentiment.

Analyzing the Risks of Investing in BBAI as a Penny Stock

Investing in penny stocks like BBAI inherently carries significant risk. These are speculative investments, characterized by high volatility and the potential for substantial losses. Due diligence is paramount before considering any investment in this category.

- High price fluctuations and potential for significant losses: Penny stocks are known for their dramatic price swings, making them highly susceptible to market sentiment and news events. Investors must be prepared for the possibility of substantial losses.

- Limited liquidity and difficulty in buying or selling shares: Finding buyers and sellers can be challenging for penny stocks, potentially making it difficult to exit a position quickly if needed. This illiquidity amplifies the risk.

- Financial stability and potential for bankruptcy: Penny stocks often represent companies with weaker financial foundations compared to established corporations. Thoroughly examining their financial statements is crucial to assess the risk of bankruptcy.

- Lack of robust financial history compared to established companies: A shorter and less consistent financial track record makes it harder to accurately predict future performance and assess long-term viability.

- Importance of thorough research before investing: Before investing in BBAI or any other penny stock, rigorous research, including financial statement analysis and understanding the company's competitive landscape, is absolutely crucial.

The Appeal of AI Penny Stocks: BBAI and the Broader Market

Despite the risks, investing in AI, even through penny stocks like BBAI, holds significant appeal. The potential for substantial returns, driven by the explosive growth of the AI market, is a major draw.

- The long-term growth potential of the AI market: AI is transforming numerous industries, promising massive long-term growth. Investing in AI-related companies, even risky ones, allows participation in this potential boom.

- Potential for high returns (with high risk): The high-risk, high-reward nature of penny stocks offers the potential for outsized gains, though equally significant losses are possible.

- Comparison to investing in established, high-priced AI companies (cost vs. risk/reward): Investing in established AI companies can be expensive, limiting the potential for high returns compared to the more affordable, albeit riskier, penny stock options.

- Identifying other AI penny stocks: While we focus on BBAI, other AI penny stocks exist. However, it's crucial to conduct thorough research before investing in any of them. This is not an endorsement of any specific company.

Due Diligence and Investing Strategies for BBAI

Successful investing in BBAI requires a robust due diligence process and a well-defined investment strategy. Risk management is paramount.

- Reviewing BBAI's financial statements and SEC filings: Analyzing financial reports, including income statements, balance sheets, and cash flow statements, is essential to understanding the company's financial health.

- Analyzing industry trends and competitive landscape: Understanding the broader AI market, BBAI's competitive positioning, and emerging technologies is crucial for evaluating its potential for growth.

- Assessing the management team's experience and expertise: The competence and experience of the management team are critical indicators of the company's ability to navigate the challenges of the AI sector.

- Understanding the company's debt and equity structure: Analyzing the company's financial leverage and capital structure will help in assessing its financial risk.

- Diversifying your portfolio to mitigate risk: Never put all your eggs in one basket. Diversifying your investments across different asset classes reduces the overall risk of your portfolio.

Conclusion

Investing in BigBear.ai (BBAI) presents a high-risk, high-reward opportunity within the exciting but volatile world of AI penny stocks. The potential for significant growth in the AI sector is undeniable, but investors must conduct thorough due diligence and manage risk effectively. Remember, BBAI is a speculative investment with considerable risks. Before making any investment decisions concerning BigBear.ai (BBAI) or any other AI penny stock, conduct extensive research and consider consulting a qualified financial advisor. Thoroughly understanding the risks associated with AI penny stock investing is crucial before committing your capital. Remember, this article is for informational purposes only and does not constitute financial advice.

Featured Posts

-

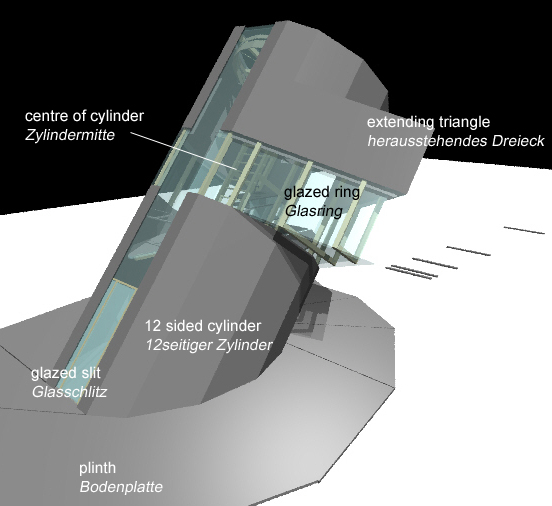

Endgueltige Formgebung Durch Architektin Vor Ort Bestimmt

May 21, 2025

Endgueltige Formgebung Durch Architektin Vor Ort Bestimmt

May 21, 2025 -

Sofrep Evening Brief Key Developments Yemen Missile Russia Amnesty International Conflict

May 21, 2025

Sofrep Evening Brief Key Developments Yemen Missile Russia Amnesty International Conflict

May 21, 2025 -

O Baggelis Giakoymakis Bullying Basanismoi Kai T Hanatos

May 21, 2025

O Baggelis Giakoymakis Bullying Basanismoi Kai T Hanatos

May 21, 2025 -

Robin Roberts Getting Fancy Remark Amid Gma Layoffs What It Means

May 21, 2025

Robin Roberts Getting Fancy Remark Amid Gma Layoffs What It Means

May 21, 2025 -

Vybz Kartel Live In New York Details On The Highly Anticipated Concert

May 21, 2025

Vybz Kartel Live In New York Details On The Highly Anticipated Concert

May 21, 2025

Latest Posts

-

Vybz Kartels Brooklyn Shows A Night To Remember For Fans

May 22, 2025

Vybz Kartels Brooklyn Shows A Night To Remember For Fans

May 22, 2025 -

The Influence Of Rum Culture On Kartels A Stabroek News Report

May 22, 2025

The Influence Of Rum Culture On Kartels A Stabroek News Report

May 22, 2025 -

Vybz Kartels Sold Out Brooklyn Shows A Triumphant Return

May 22, 2025

Vybz Kartels Sold Out Brooklyn Shows A Triumphant Return

May 22, 2025 -

Stabroek News Examining The Intersection Of Kartel And Rum Culture

May 22, 2025

Stabroek News Examining The Intersection Of Kartel And Rum Culture

May 22, 2025 -

Minister Limits Vybz Kartels Activities In Trinidad And Tobago

May 22, 2025

Minister Limits Vybz Kartels Activities In Trinidad And Tobago

May 22, 2025