Investing In Palantir: A Practical Guide To PLTR Stock In 2024

Table of Contents

Understanding Palantir Technologies and its Business Model

Palantir Technologies is a prominent player in the big data analytics market, offering two primary software platforms: Gotham and Foundry. These platforms provide powerful data integration, analysis, and visualization capabilities, catering to diverse clients.

-

Gotham: This platform is primarily geared towards government agencies and focuses on national security applications. It helps government organizations analyze vast datasets to combat terrorism, improve intelligence gathering, and enhance cybersecurity. Gotham’s focus on high-value, long-term government contracts contributes significantly to Palantir's revenue stream.

-

Foundry: Designed for commercial clients, Foundry is a versatile platform used across numerous industries, including finance, healthcare, and manufacturing. Its ability to integrate disparate data sources and provide actionable insights makes it a valuable tool for businesses seeking to improve efficiency and decision-making. Foundry fuels Palantir's growth in the commercial sector, diversifying its revenue base.

Palantir's competitive advantages stem from its proprietary technology, robust data security measures, and extensive experience working with highly sensitive data for government clients. These factors foster trust and strong relationships with both government and commercial clients, leading to long-term contracts and recurring revenue.

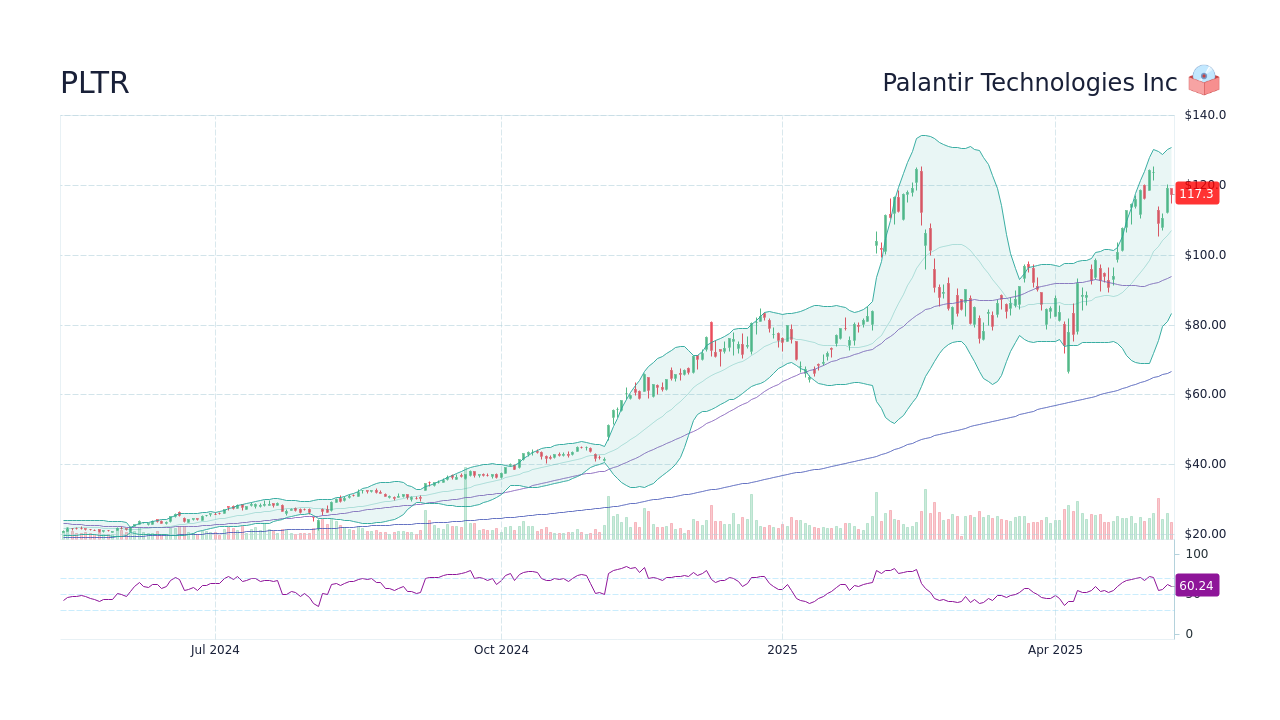

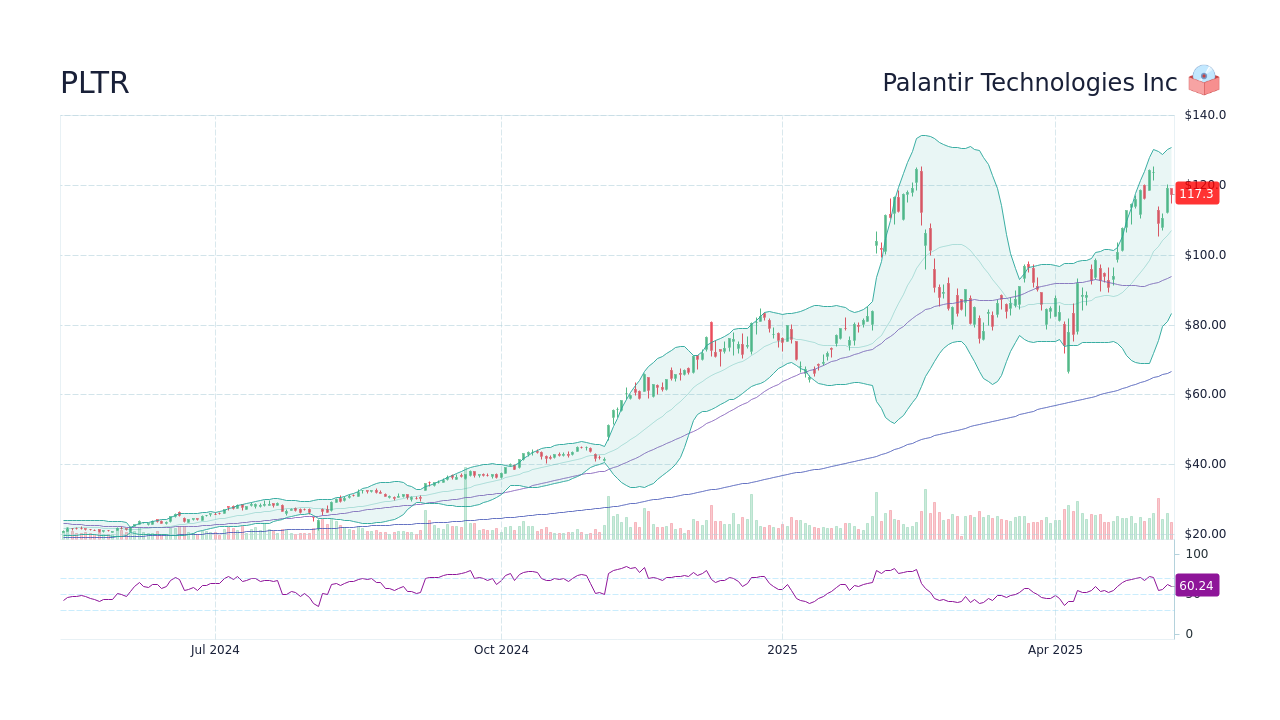

Analyzing PLTR Stock Performance and Valuation

Analyzing PLTR stock requires considering its historical performance, current valuation, and future growth prospects. While past performance is not indicative of future results, reviewing historical data provides valuable context. (Note: This section would ideally include charts and graphs illustrating PLTR's stock price movements over time, highlighting key events like earnings reports and significant partnerships.)

Key metrics to examine include:

- Market Capitalization: The overall market value of Palantir's outstanding shares.

- P/E Ratio (Price-to-Earnings Ratio): A valuation metric comparing the company's stock price to its earnings per share. A high P/E ratio may indicate high growth expectations, but also higher risk.

- Revenue Growth: A crucial indicator of Palantir's financial health and its ability to expand its business. Consistent revenue growth is a positive sign for investors.

Potential future growth drivers include:

- Expansion into new markets: Palantir continues to seek new opportunities in diverse sectors.

- Increased adoption of its platforms: Greater adoption by existing and new clients will contribute to revenue growth.

- Successful product development: Continuous innovation and improvements to Gotham and Foundry are crucial for maintaining competitiveness.

Analyzing recent financial reports and key performance indicators (KPIs) such as revenue, operating income, and customer acquisition cost is essential. It's also crucial to review analyst ratings and price targets for PLTR stock from reputable financial institutions, though these should be considered alongside your own due diligence. However, remember to consider the inherent risks, including potential competition from other data analytics firms, regulatory hurdles, and the dependence on government contracts for a significant portion of its revenue.

Developing an Investment Strategy for PLTR

Developing a sound investment strategy for PLTR requires careful consideration of your financial goals, risk tolerance, and investment horizon.

-

Long-term vs. short-term investment: A long-term approach (holding the stock for several years) might be suitable for investors with a higher risk tolerance and a belief in Palantir's long-term growth potential. A short-term strategy involves frequent trading based on market fluctuations, which carries higher risk.

-

Diversification and risk management: Diversifying your portfolio is crucial to mitigate risk. Don't invest all your capital in PLTR; spread your investments across different asset classes.

-

Buying and selling PLTR stock: Consider using limit orders to buy or sell at a specific price, and explore dollar-cost averaging to reduce the impact of market volatility.

Helpful resources for tracking PLTR stock performance include financial news websites (like Yahoo Finance, Google Finance), and your brokerage platform. Employing stop-loss orders to limit potential losses is a crucial risk management technique. Always conduct thorough due diligence before investing.

Considering the Risks of Investing in Palantir

Investing in PLTR, like any stock, involves inherent risks:

- Volatility: PLTR's stock price can be highly volatile, influenced by market sentiment and company-specific news.

- Dependence on government contracts: A substantial portion of Palantir's revenue comes from government contracts. Changes in government spending or policy could negatively impact the company's financial performance.

- Competitive landscape: The data analytics market is competitive, with established players and emerging startups vying for market share.

Understanding your own risk tolerance is paramount before investing in PLTR. If you're risk-averse, consider diversifying your portfolio heavily or exploring less volatile investment options.

Conclusion

This guide has provided a practical overview of investing in Palantir Technologies (PLTR) stock in 2024. We've examined the company's business model, analyzed its stock performance, and discussed strategies for managing risk. Remember that investing in the stock market always involves risk.

Before making any investment decisions concerning Palantir (PLTR) stock, conduct your own thorough research and consider consulting with a financial advisor. Understanding the potential risks and rewards associated with PLTR is crucial for making informed investment decisions in 2024 and beyond. Start your due diligence on Palantir today!

Featured Posts

-

High Potential Who Portrays David In Episode 13 An Analysis Of The Casting Decision

May 10, 2025

High Potential Who Portrays David In Episode 13 An Analysis Of The Casting Decision

May 10, 2025 -

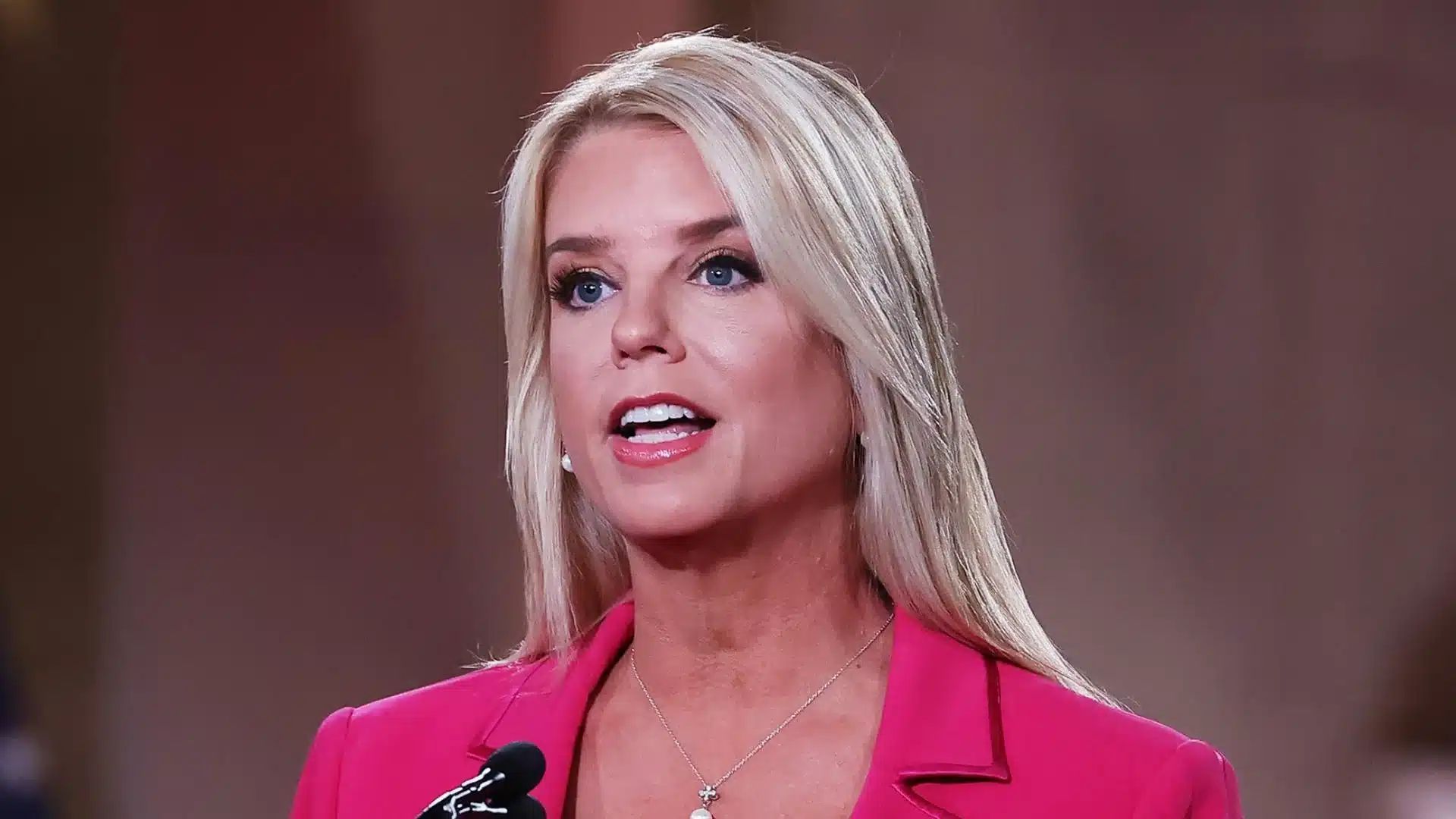

James Comers Epstein Files Pam Bondis Response And Laughter

May 10, 2025

James Comers Epstein Files Pam Bondis Response And Laughter

May 10, 2025 -

Brian Brobbey Physical Power Poses Europa League Threat

May 10, 2025

Brian Brobbey Physical Power Poses Europa League Threat

May 10, 2025 -

Zolotaya Malina 2024 Dakota Dzhonson I Khudshie Filmy Goda

May 10, 2025

Zolotaya Malina 2024 Dakota Dzhonson I Khudshie Filmy Goda

May 10, 2025 -

Melanie Griffith And Dakota Johnsons Siblings At Materialist Premiere

May 10, 2025

Melanie Griffith And Dakota Johnsons Siblings At Materialist Premiere

May 10, 2025