Investing In Quantum Computing: Should You Buy D-Wave Quantum (QBTS) Stock?

Table of Contents

The burgeoning field of quantum computing is attracting significant investor attention, and D-Wave Quantum (QBTS) is a prominent player. This article delves into the complexities of investing in QBTS stock, weighing the potential rewards against the inherent risks associated with this cutting-edge technology. We'll examine D-Wave's technology, market position, and financial performance to help you decide if QBTS is a suitable addition to your investment portfolio.

Understanding D-Wave Quantum and its Technology

What is D-Wave's Quantum Annealing Approach?

D-Wave's quantum computers utilize a technology called quantum annealing. Unlike gate-based quantum computers (used by companies like IBM and Google), which manipulate qubits using logic gates, quantum annealing solves specific types of optimization problems by finding the lowest energy state of a quantum system. This approach excels at tackling complex problems where finding the optimal solution among numerous possibilities is crucial.

- Applications of Quantum Annealing: Quantum annealing finds applications in various fields including:

- Logistics and Supply Chain Optimization: Finding the most efficient routes for delivery networks.

- Financial Modeling: Optimizing investment portfolios and risk management strategies.

- Materials Science: Discovering new materials with desired properties.

- Drug Discovery: Simulating molecular interactions to identify potential drug candidates.

Quantum annealing, however, has limitations. It's not a general-purpose computing approach like gate-based quantum computing. It's best suited for specific types of optimization problems, not all computational tasks.

D-Wave's Market Position and Competition

D-Wave is a pioneer in the quantum computing industry, being the first company to sell commercially available quantum computers. However, its market share is a subject of debate, as the quantum computing market is still nascent and lacks standardized metrics for comparison. While D-Wave leads in the specific niche of quantum annealing, it faces stiff competition from companies pursuing gate-based quantum computing approaches.

- Key Competitors and Their Technologies:

- IBM: Focuses on gate-based quantum computing, offering cloud access to its quantum systems.

- Google: Also employs gate-based quantum computing and has achieved quantum supremacy in specific tasks.

- IonQ: Uses trapped ion technology, another gate-based approach.

- Rigetti Computing: Develops both gate-based and analog quantum computers.

D-Wave's advantage lies in its years of experience and established customer base. However, the broader adoption of gate-based quantum computing poses a potential long-term challenge.

D-Wave's Current and Future Applications

D-Wave has already deployed its quantum annealers in various industries. These deployments offer valuable case studies demonstrating the technology's capabilities in solving complex optimization problems.

- Real-World Applications of D-Wave's Technology:

- Volkswagen: Uses D-Wave's system for traffic flow optimization.

- Los Alamos National Laboratory: Employs D-Wave's technology for materials science research.

- Various financial institutions: Explore applications in portfolio optimization and risk management.

Future applications are expected to span various sectors, including:

- Drug discovery and development: Accelerating the identification and design of new drugs.

- Artificial intelligence: Enhancing machine learning algorithms for improved performance.

- Materials science: Discovering new materials with enhanced properties for various applications.

Analyzing D-Wave Quantum (QBTS) Stock Performance and Financials

Understanding QBTS Stock Valuation

Valuing QBTS stock presents significant challenges. Traditional valuation methods like discounted cash flow (DCF) analysis are difficult to apply accurately due to the company's early stage and the uncertainty surrounding the future of the quantum computing market. Comparable company analysis is also limited, given the lack of many publicly traded companies in this nascent field.

- Key Financial Metrics to Consider:

- Revenue: Track D-Wave's revenue growth to gauge market acceptance.

- Expenses: Monitor research and development (R&D) spending as an indicator of innovation and future potential.

- Market Capitalization: Assess the company's overall valuation relative to its peers and future expectations.

Risk Assessment of Investing in QBTS

Investing in QBTS carries considerable risk. The quantum computing industry is still in its early stages, and D-Wave faces significant uncertainties:

- Specific Risks and Mitigation Strategies:

- Market Volatility: The stock price may fluctuate significantly due to market sentiment and technological advancements. Mitigation: Diversify your investment portfolio.

- Technological Uncertainty: The technology may not develop as anticipated, impacting future prospects. Mitigation: Thoroughly research the technology and the company's progress.

- Competition: Intense competition from established tech giants could hamper D-Wave's growth. Mitigation: Monitor the competitive landscape and assess D-Wave's competitive advantages.

Financial Performance and Future Outlook

D-Wave's recent financial performance should be carefully analyzed. Examining revenue growth, profitability, and cash flow is crucial. However, it is important to remember that projections for a company in a developing industry are inherently uncertain. Investors need to be comfortable with a high degree of risk.

- Key Financial Data Points and Projections: Access D-Wave's financial statements (usually available through the SEC's EDGAR database) and industry reports for an in-depth understanding of its financial health.

Considering Your Investment Strategy and Risk Tolerance

Quantum Computing Investment: Long-term vs. Short-term Perspective

Investing in quantum computing is generally considered a long-term endeavor. The technology's transformative potential is vast, but significant hurdles remain before widespread adoption.

- Advantages and Disadvantages of Each Approach:

- Long-term: Higher potential returns but requires patience and risk tolerance.

- Short-term: Lower potential returns but less exposure to long-term market uncertainties.

Diversification and Portfolio Allocation

Given the inherent risks, investing in QBTS should only be done as part of a well-diversified portfolio. Never invest more than you can afford to lose.

- Strategies for Managing Risk Through Diversification: Allocate only a small percentage of your portfolio to QBTS, balancing it with other assets in different sectors to reduce overall portfolio risk.

Conclusion

Investing in D-Wave Quantum (QBTS) presents both exciting opportunities and considerable risks. The long-term potential of quantum computing is undeniable, but the market is still in its early stages, making investment decisions complex. Thoroughly analyzing D-Wave's technology, market position, financial performance, and risk factors is crucial before making any investment. Consider your own investment strategy and risk tolerance carefully.

Call to Action: Before making any investment decisions regarding D-Wave Quantum (QBTS) stock, conduct your own thorough due diligence and seek professional financial advice. Learn more about quantum computing and D-Wave's advancements to make informed choices about investing in this transformative technology. Remember to always diversify your investment portfolio and manage risk effectively when considering investing in D-Wave Quantum (QBTS) or other quantum computing stocks.

Featured Posts

-

Dusan Tadic In Gelecegi Tarihe Gecme Potansiyeli

May 20, 2025

Dusan Tadic In Gelecegi Tarihe Gecme Potansiyeli

May 20, 2025 -

Exploring Agatha Christies Poirot His Cases Character And Enduring Legacy

May 20, 2025

Exploring Agatha Christies Poirot His Cases Character And Enduring Legacy

May 20, 2025 -

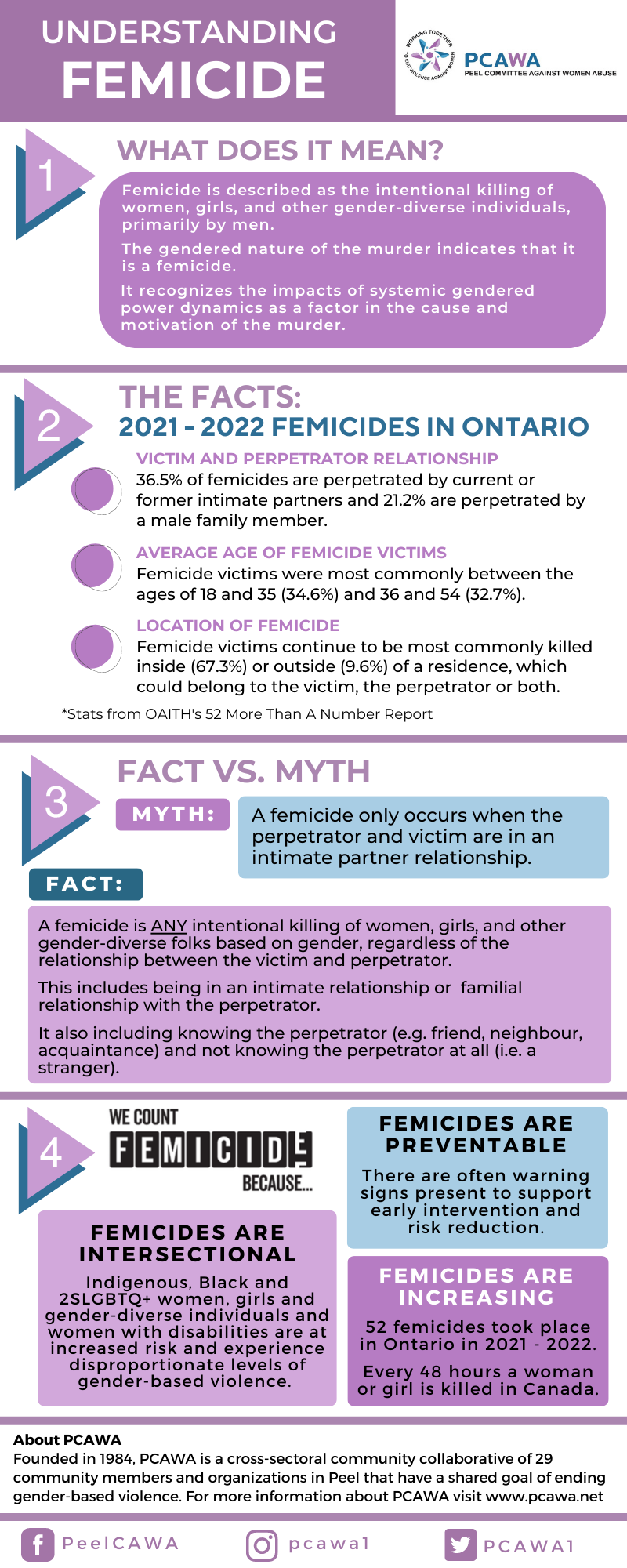

Understanding Femicide Causes And The Alarming Increase In Cases

May 20, 2025

Understanding Femicide Causes And The Alarming Increase In Cases

May 20, 2025 -

D Wave Quantum Qbts Stock Plunge Understanding Thursdays Decline

May 20, 2025

D Wave Quantum Qbts Stock Plunge Understanding Thursdays Decline

May 20, 2025 -

Australia Us Missile Test Chinas Concerns And The Strategic Implications

May 20, 2025

Australia Us Missile Test Chinas Concerns And The Strategic Implications

May 20, 2025

Latest Posts

-

Kaellman Ja Hoskonen Puola Ura Paeaettynyt

May 20, 2025

Kaellman Ja Hoskonen Puola Ura Paeaettynyt

May 20, 2025 -

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan

May 20, 2025

Huuhkajien Kaellman Ja Hoskonen Jaettaevaet Puolan

May 20, 2025 -

Yllaetysvalinnat Friisin Avauskokoonpano Heraettaeae Keskustelua

May 20, 2025

Yllaetysvalinnat Friisin Avauskokoonpano Heraettaeae Keskustelua

May 20, 2025 -

Jalkapallo Friisin Avauskokoonpano Kamara Ja Pukki Vaihtopenkillae

May 20, 2025

Jalkapallo Friisin Avauskokoonpano Kamara Ja Pukki Vaihtopenkillae

May 20, 2025 -

Benjamin Kaellman Onnistumisen Avaimet Analyysi Pelaajan Kehittymisestae Ja Potentiaalista

May 20, 2025

Benjamin Kaellman Onnistumisen Avaimet Analyysi Pelaajan Kehittymisestae Ja Potentiaalista

May 20, 2025