Investing In Quantum Computing Stocks: Rigetti, IonQ, And Beyond In 2025

Table of Contents

Understanding the Quantum Computing Stock Market in 2025

Risk and Reward in Quantum Computing Investments:

Investing in quantum computing stocks in 2025 presents a classic high-risk, high-reward scenario. The technology is still in its early stages of development, meaning significant hurdles remain before widespread commercialization. However, the potential rewards are enormous, with the possibility of exponential growth and market disruption across multiple sectors. The market itself is highly volatile, characterized by significant price swings reflecting the inherent uncertainties of this nascent technology. A long-term investment strategy is crucial for weathering these fluctuations and capitalizing on the eventual payoff.

-

Potential Risks:

- Technological hurdles: Overcoming significant engineering challenges in building and scaling stable quantum computers.

- Regulatory uncertainties: The lack of clear regulatory frameworks for quantum technologies could hinder adoption and investment.

- Intense competition: A rapidly growing number of companies are vying for market share in this competitive landscape.

- Financial instability of some companies in the sector.

-

Potential Rewards:

- Exponential growth: The market for quantum computing is projected to grow exponentially in the coming years.

- Market disruption: Quantum computing has the potential to revolutionize various industries, leading to significant economic benefits.

- First-mover advantage: Early investors in successful quantum computing companies could reap substantial returns.

Key Players in the Quantum Computing Stock Market: Rigetti & IonQ

Rigetti Computing (RGTI): A Deep Dive:

Rigetti Computing is a leading player in the quantum computing space, known for its focus on building modular quantum computers. Their business model involves both the development of their own quantum processors and the provision of cloud-based access to these systems. Rigetti's advancements in superconducting qubit technology place them in a strong position for future growth, although challenges remain in scaling their technology to a commercially viable level.

- Key Milestones: Successful fabrication of multi-qubit processors; partnerships with various research institutions and corporations.

- Upcoming Product Launches: Next-generation quantum processors with increased qubit counts and improved coherence times.

- Competitive Advantages: Focus on modularity, potentially allowing for easier scalability compared to some competitors.

- Financial Performance: (Insert relevant financial data and analysis if available – consult financial news sources).

IonQ (IONQ): A Competitor Analysis:

IonQ utilizes trapped ion technology to build its quantum computers, offering a different approach compared to Rigetti's superconducting qubits. This technology offers certain advantages in terms of qubit coherence, but scaling it up presents its own set of challenges. IonQ has secured several high-profile partnerships and is actively pursuing commercial applications for its quantum systems.

- Key Differentiators: Trapped ion technology offering potentially longer coherence times compared to some superconducting approaches.

- Financial Performance: (Insert relevant financial data and analysis if available – consult financial news sources).

- Potential Market Share: IonQ is well-positioned to capture a significant share of the market, particularly in specific applications leveraging its technology's strengths.

- Risks and Opportunities: Scaling challenges remain a key risk, while partnerships and strategic alliances represent significant opportunities.

Beyond Rigetti and IonQ: Exploring Other Quantum Computing Investment Opportunities in 2025

Diversification Strategies for Quantum Computing Investments:

Diversification is crucial in the quantum computing investment landscape. While Rigetti and IonQ are prominent players, focusing solely on these companies exposes investors to significant risk. A diversified portfolio should include investments across multiple quantum computing companies and related sectors.

- Other Notable Players: D-Wave Systems (though focusing on adiabatic quantum computing, a different approach), IBM (with its quantum computing cloud services and research efforts). Note that the stock market implications of these companies vary and should be researched individually.

- Diversification Benefits: Reduces overall portfolio risk, mitigates the impact of potential failures of individual companies.

- Examples of Diverse Investments: Exchange-traded funds (ETFs) focused on technology, individual stocks in various quantum computing companies, and potentially private equity investments in earlier-stage companies (higher risk).

Due Diligence and Investment Strategies for Quantum Computing Stocks

Essential Research Before Investing:

Thorough research is paramount before investing in quantum computing stocks. Understand the underlying technology, the business models of the companies, and the market risks involved.

- Key Factors to Consider:

- Financial statements: Assess the company's financial health and growth potential.

- Management team: Evaluate the expertise and experience of the leadership team.

- Technological advancements: Analyze the company's progress in developing and commercializing its quantum computing technology.

- Competitive landscape: Assess the company's competitive position within the industry.

- Resources for Due Diligence: Financial news websites, industry research reports, company investor relations pages.

Long-Term vs. Short-Term Investment Strategies:

Quantum computing is a long-term play. Patience is key, as significant returns are unlikely to materialize overnight. However, a well-defined investment strategy is crucial whether you prefer a long-term or short-term approach. Aligning your investment goals with your risk tolerance is vital.

- Long-Term Strategy Advantages: Potential for significant returns over time, weathering short-term market fluctuations.

- Short-Term Strategy Advantages: Potential to capitalize on short-term price movements (but with significantly higher risk).

- Risk Management: Diversification, setting stop-loss orders, and regularly reviewing your portfolio are key risk management techniques regardless of your chosen investment horizon.

Investing Wisely in the Quantum Revolution of 2025 and Beyond

Quantum computing represents a transformative technology with the potential to generate significant returns for long-term investors. However, this is a high-risk investment requiring thorough due diligence and careful consideration of your risk tolerance. Diversification across different companies and investment vehicles is strongly recommended. Remember to conduct in-depth research into individual quantum computing stocks before making any investment decisions. By carefully navigating this exciting landscape, you can position yourself to benefit from the unfolding quantum computing revolution. Start your research today and consider investing in promising quantum computing stocks in 2025 and beyond.

Featured Posts

-

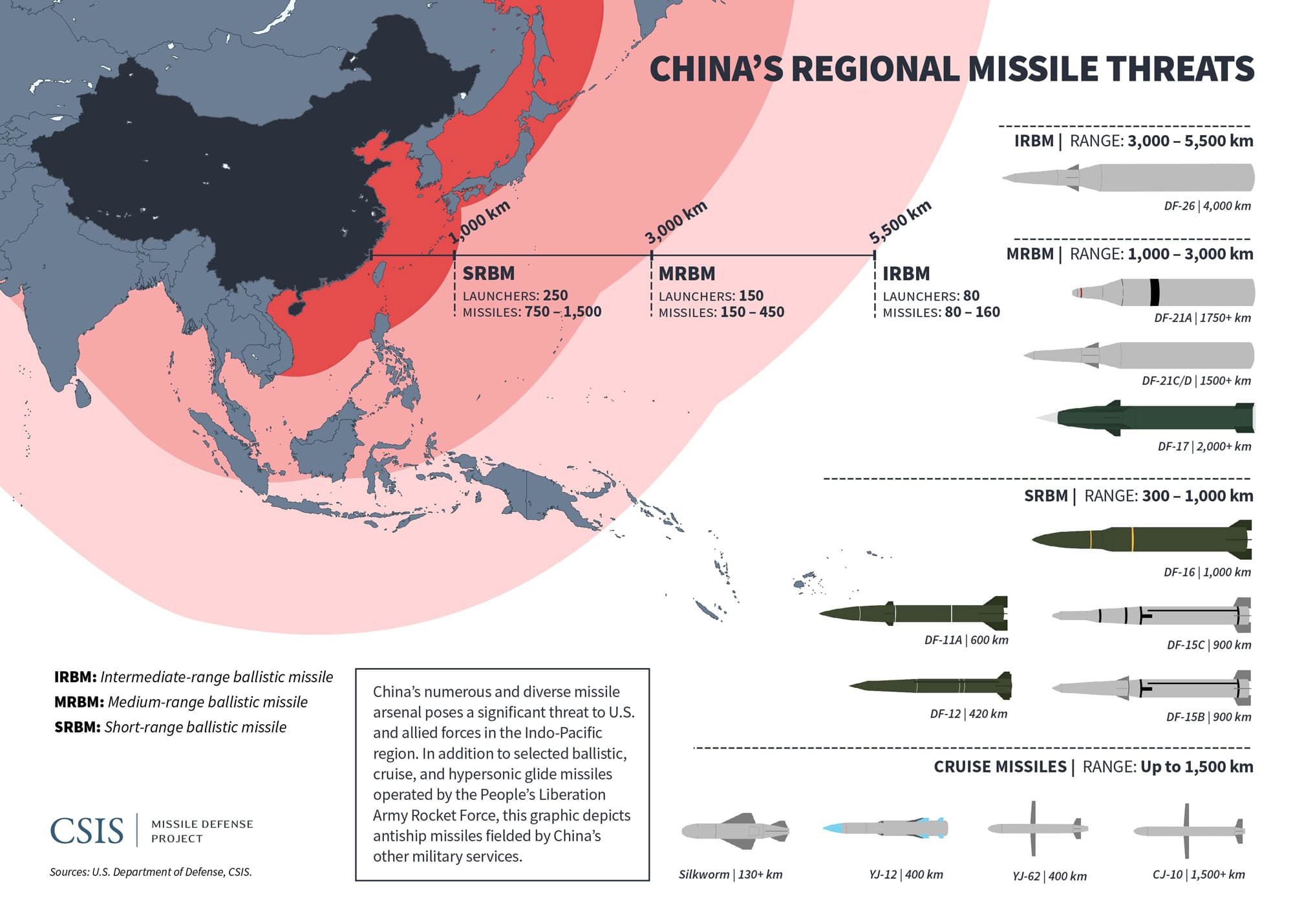

Philippines Military Deployment In South China Sea A Chinese Perspective

May 20, 2025

Philippines Military Deployment In South China Sea A Chinese Perspective

May 20, 2025 -

Japanese Manga Sparks Travel Fears Disaster Prediction Impact

May 20, 2025

Japanese Manga Sparks Travel Fears Disaster Prediction Impact

May 20, 2025 -

New Hmrc Rules For Side Hustles Increased Scrutiny And Tax Enforcement

May 20, 2025

New Hmrc Rules For Side Hustles Increased Scrutiny And Tax Enforcement

May 20, 2025 -

Charles Leclerc Partners With Chivas Regal In New Global Campaign

May 20, 2025

Charles Leclerc Partners With Chivas Regal In New Global Campaign

May 20, 2025 -

Naujas Seimos Narys Jennifer Lawrence Pagimde Antra Vaika

May 20, 2025

Naujas Seimos Narys Jennifer Lawrence Pagimde Antra Vaika

May 20, 2025

Latest Posts

-

Lorraine Kellys Awkward Tv Moment David Walliams Cancelled Comment

May 20, 2025

Lorraine Kellys Awkward Tv Moment David Walliams Cancelled Comment

May 20, 2025 -

Matt Lucas And David Walliams Cliff Richard Musical The One Big Snag

May 20, 2025

Matt Lucas And David Walliams Cliff Richard Musical The One Big Snag

May 20, 2025 -

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025 -

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025