Investing In SPACs: A Deep Dive Into The Latest MicroStrategy Competitor

Table of Contents

Understanding SPACs and their Investment Potential

SPACs, or Special Purpose Acquisition Companies, are publicly traded companies with no commercial operations. Their sole purpose is to raise capital through an initial public offering (SPAC IPO) to acquire a private company. This acquisition, known as a de-SPAC transaction or SPAC merger, takes the private company public without the traditional IPO process. The SPAC structure involves a trust holding the raised capital until a suitable acquisition target is identified and a merger is approved by shareholders.

Advantages of Investing in SPACs:

- Early Access to Promising Companies: Investors gain exposure to potentially high-growth companies before they're publicly traded, potentially capturing significant early returns.

- Potential for High Returns: Successful SPAC mergers can generate substantial returns for investors if the acquired company performs well.

- Diversification Opportunities: SPACs offer a way to diversify a portfolio beyond traditional stocks and bonds, accessing a broader range of companies and sectors.

Disadvantages of Investing in SPACs:

- Risk of Losing the Entire Investment: If the SPAC fails to find a suitable acquisition target or the acquired company underperforms, investors could lose their entire investment.

- Lack of Transparency Before the Merger: Investors typically have limited information about the target company before the merger is announced, making due diligence challenging.

- Management Team's Track Record is Crucial: The success of a SPAC heavily relies on the experience and expertise of its management team in identifying and integrating promising acquisition targets.

MicroStrategy's Business Model and its Competitors

MicroStrategy is a leading provider of business intelligence, analytics, and cloud-based services. Its business model revolves around providing software and services that help organizations analyze data and make better decisions. However, the market is dynamic, and new competitors are constantly emerging.

Let's consider a hypothetical competitor, "DataWise," entering the market via a SPAC. DataWise focuses on a niche market segment within business intelligence, offering innovative AI-powered analytics platforms tailored for small and medium-sized enterprises (SMEs).

DataWise vs. MicroStrategy:

- DataWise's Competitive Advantages: Innovative AI-powered analytics, focus on a high-growth niche market (SMEs), potentially faster growth trajectory.

- DataWise's Competitive Disadvantages: Smaller market capitalization compared to MicroStrategy, higher risk due to being a relatively new player, potential dependence on securing further funding.

- Valuation and Market Capitalization: DataWise's valuation and market capitalization would likely be significantly smaller than MicroStrategy's, reflecting its stage of development and market share.

Analyzing the Risks and Rewards of Investing in SPACs Targeting MicroStrategy Competitors

Investing in SPACs targeting competitors like DataWise demands a thorough due diligence process.

Due Diligence Process:

- Analyzing the Management Team's Experience: Evaluate the track record and expertise of the SPAC's management team in identifying and integrating successful acquisitions.

- Scrutinizing the Target Company's Financials and Business Plan: Deeply analyze the target company's financial statements, business model, and competitive landscape.

- Assessing the Overall Market Conditions: Consider macroeconomic factors and industry trends that may impact the target company's performance.

Risk Mitigation Strategies:

- Diversifying your SPAC Investments: Don't put all your eggs in one basket. Spread your investments across multiple SPACs to reduce the impact of individual failures.

- Setting a Stop-Loss Order: Protect yourself from significant losses by setting a stop-loss order to automatically sell your shares if the price falls below a certain level.

- Only Investing What You Can Afford to Lose: Never invest more than you can afford to lose, as SPACs are inherently high-risk investments.

Practical Steps for Investing in SPACs (Including those targeting MicroStrategy Competitors)

Investing in SPACs:

- Opening a Brokerage Account: You'll need a brokerage account to buy and sell SPAC shares.

- Identifying Potential SPAC Investments: Research and screen SPACs based on their management team, target industry, and investment thesis.

- Placing an Order to Buy Shares: Once you've identified a promising SPAC, place an order to buy shares through your brokerage account.

Investment Strategies:

- Buying shares at the IPO price: This strategy offers potential upside if the SPAC successfully merges with a valuable target.

- Waiting for the merger announcement: This strategy allows for more information gathering but might mean missing out on early gains.

- Investing in warrants: Warrants give you the right, but not the obligation, to buy shares at a predetermined price, offering leveraged returns but also higher risk.

Remember to stay informed by following regulatory filings (like SEC filings) and news related to your chosen SPACs.

Conclusion

Investing in SPACs, particularly those aiming to disrupt established players like MicroStrategy, presents both significant opportunities and substantial risks. Thorough due diligence, a clear understanding of the SPAC structure, and a well-defined investment strategy are crucial for success. Remember to carefully evaluate the management team, the target company's business plan, and the overall market conditions before committing your capital. By understanding the potential rewards and mitigating the inherent risks, you can effectively navigate the exciting world of SPAC investing and potentially capitalize on the next big competitor to MicroStrategy. Start your research today and learn more about identifying promising SPACs and diversifying your investment portfolio.

Featured Posts

-

Mariah The Scientists Burning Blue A Highly Anticipated Return

May 09, 2025

Mariah The Scientists Burning Blue A Highly Anticipated Return

May 09, 2025 -

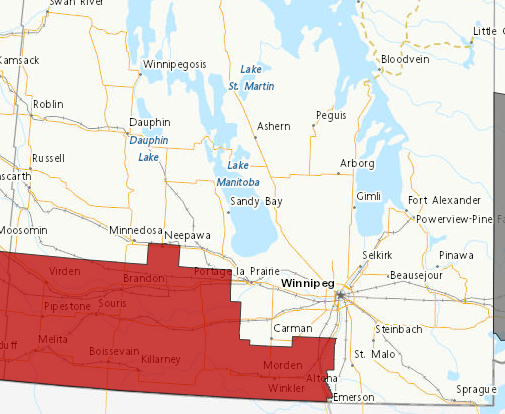

Parts Of Western Manitoba Under Snowfall Warning 10 20cm Expected Tuesday

May 09, 2025

Parts Of Western Manitoba Under Snowfall Warning 10 20cm Expected Tuesday

May 09, 2025 -

Sensex Today 700 Point Surge Nifty Above 23 800 Live Market Updates

May 09, 2025

Sensex Today 700 Point Surge Nifty Above 23 800 Live Market Updates

May 09, 2025 -

Fanatics Your Source For Boston Celtics Gear During Their Back To Back Finals Run

May 09, 2025

Fanatics Your Source For Boston Celtics Gear During Their Back To Back Finals Run

May 09, 2025 -

Uk Government Plans New Visa Regulations Pakistan Nigeria And Sri Lanka Affected

May 09, 2025

Uk Government Plans New Visa Regulations Pakistan Nigeria And Sri Lanka Affected

May 09, 2025