Investing In The Amundi Dow Jones Industrial Average UCITS ETF: NAV Analysis

Table of Contents

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF NAV

The Amundi Dow Jones Industrial Average UCITS ETF NAV is directly influenced by several key factors. Understanding these factors is critical for interpreting NAV movements and making sound investment choices.

-

Market Performance and its Impact: The most significant factor impacting the ETF's NAV is the performance of the Dow Jones Industrial Average (DJIA) itself. A strong upward trend in the DJIA generally leads to an increase in the ETF's NAV, while a decline in the DJIA usually results in a decrease in the NAV. This correlation is extremely high, as the ETF aims to track the DJIA's performance closely. The individual performance of the 30 constituent companies within the Dow Jones index also plays a role; strong performance by major components will positively influence the NAV, while underperformance will have the opposite effect.

-

Currency Fluctuations: Since the ETF is denominated in a particular currency (likely Euros, given its UCITS structure), fluctuations in exchange rates can affect the NAV for investors holding the ETF in a different currency. For example, a strengthening Euro against the US dollar will positively impact the NAV for US dollar-based investors.

-

ETF Expenses (Management Fees): The management fees charged by Amundi will subtly impact the NAV over time. These fees are deducted from the ETF's assets, leading to a slight reduction in the NAV. While usually small, these fees should be considered when evaluating the overall performance.

Key Factors Affecting NAV:

- Market trends (bullish or bearish)

- Currency exchange rate fluctuations

- Management fees and other expenses

Analyzing Historical NAV Data of the Amundi Dow Jones Industrial Average UCITS ETF

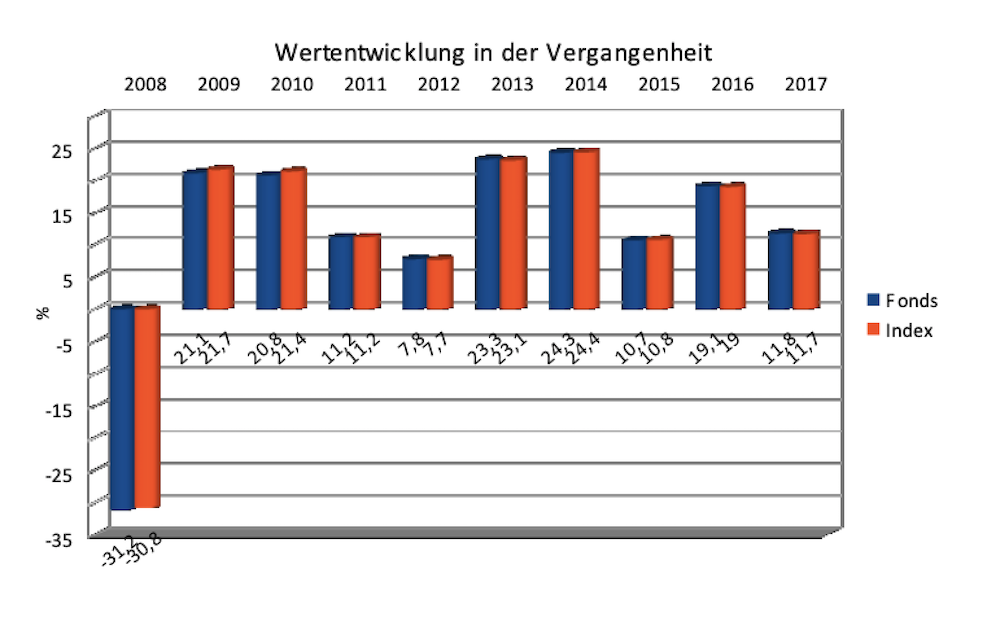

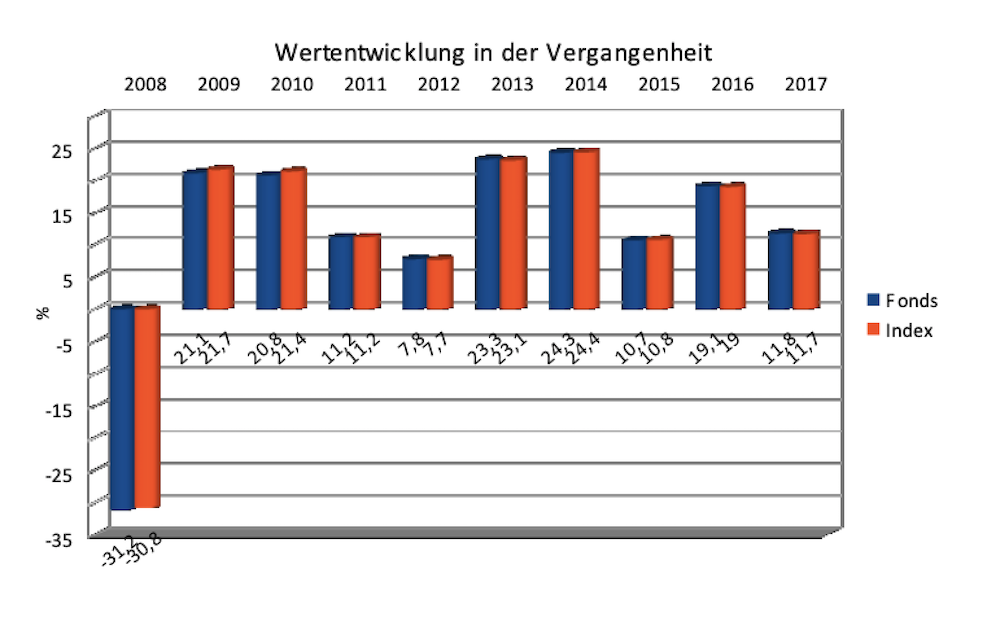

Analyzing historical Amundi Dow Jones ETF NAV data is essential for understanding past performance and predicting future trends (though past performance is not indicative of future results). (Insert a chart or graph here showing the historical NAV performance of the Amundi Dow Jones Industrial Average UCITS ETF. Clearly label the axes and any significant periods)

The chart above reveals key trends and patterns in the ETF's NAV. For example, (mention specific periods of significant growth or decline, referencing the chart. Explain the contributing factors, like market corrections, economic events, or specific company performance within the DJIA). By comparing the ETF's NAV performance to the actual performance of the Dow Jones Industrial Average over the same period, we can assess the ETF's tracking accuracy. Any significant deviations should be investigated to understand underlying reasons.

Key Periods of Growth and Decline:

- *(Specific date range) - Growth driven by (reason)

- *(Specific date range) - Decline attributed to (reason)

- *(Specific date range) - Strong correlation with DJIA performance

Evaluating the Amundi Dow Jones Industrial Average UCITS ETF NAV for Investment Decisions

Before investing in the Amundi Dow Jones Industrial Average UCITS ETF, it's crucial to compare its NAV and performance with other similar ETFs tracking the Dow Jones Industrial Average or broader US market indices. This comparative analysis helps in determining whether the Amundi ETF offers competitive returns and fees.

Analyzing the NAV helps identify potential buying or selling opportunities. For instance, a significant drop in the NAV (relative to the DJIA) might signal a potential buying opportunity, while a sharp rise might suggest considering selling some holdings to lock in profits. However, it’s crucial to remember that timing the market is notoriously difficult.

Investing in this ETF, like any investment, carries risk. Market downturns can significantly impact the NAV, leading to potential losses. Diversification across different asset classes is vital to mitigate this risk.

Key Considerations for Investment Decision-Making:

- Risk tolerance and investment timeline

- Comparison with similar ETFs

- Diversification within a broader portfolio

Conclusion: Making Informed Decisions with Amundi Dow Jones Industrial Average UCITS ETF NAV Analysis

Analyzing the Amundi Dow Jones Industrial Average UCITS ETF NAV provides valuable insights for potential investors. We've examined key factors influencing the NAV, reviewed historical data, and discussed the implications for investment strategies. Remember that ongoing monitoring of the NAV is crucial for making informed decisions and adapting your investment approach as needed. Conduct thorough research, understand the associated risks, and consider consulting a financial advisor before investing. Learn more about effectively using Amundi Dow Jones Industrial Average UCITS ETF NAV analysis to optimize your investment strategy. Consult the ETF's fact sheet for detailed information and consider seeking professional advice to tailor your investment plan.

Featured Posts

-

I Mercedes Kai I Pithanotita Gia Ton Verstappen Allagi Stratigikis

May 25, 2025

I Mercedes Kai I Pithanotita Gia Ton Verstappen Allagi Stratigikis

May 25, 2025 -

What Is A Flash Flood Emergency Definition Causes And Prevention

May 25, 2025

What Is A Flash Flood Emergency Definition Causes And Prevention

May 25, 2025 -

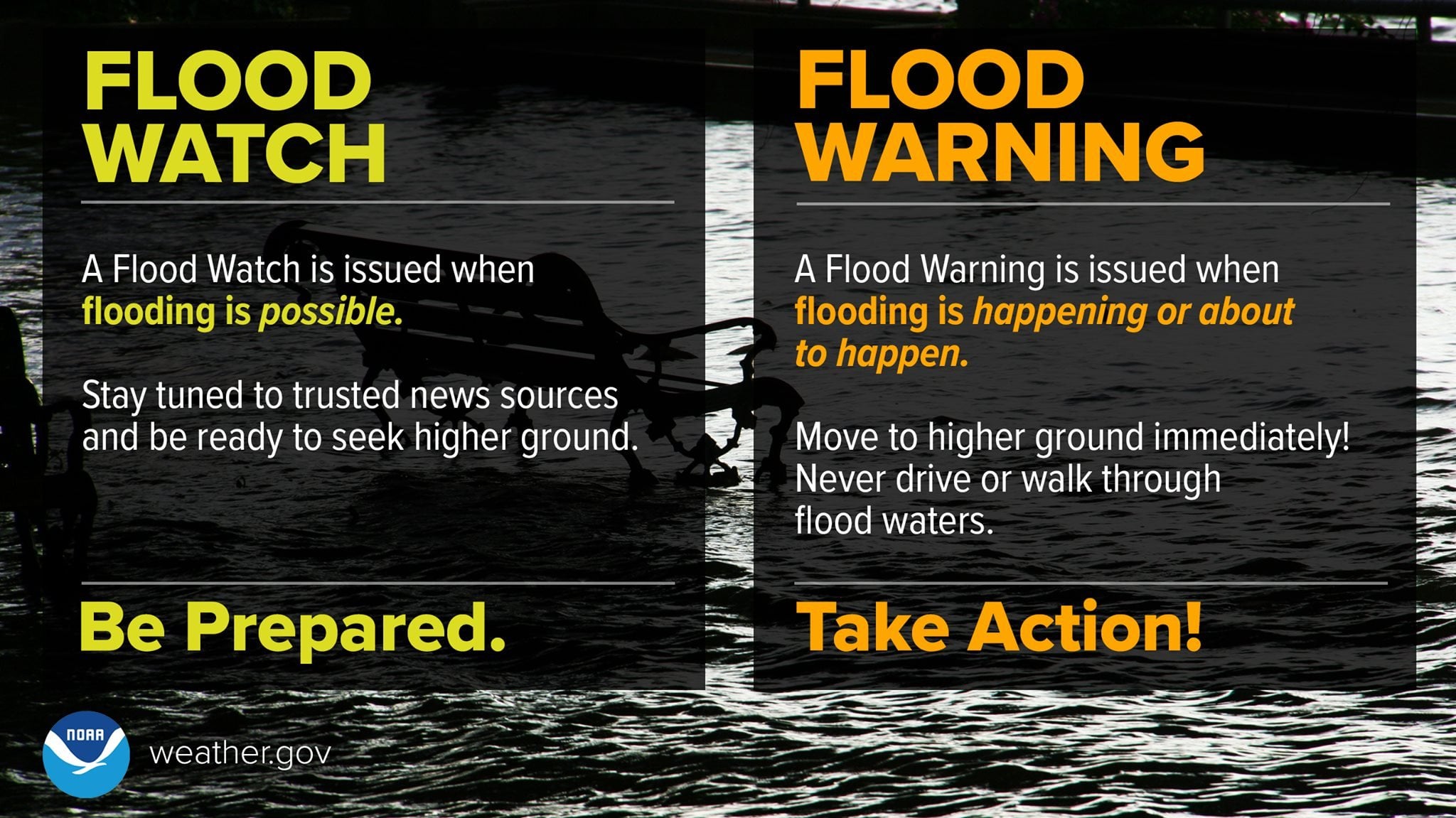

Nws Flood Warning Safety Tips And Actions To Take This Morning

May 25, 2025

Nws Flood Warning Safety Tips And Actions To Take This Morning

May 25, 2025 -

Naujas Porsche Elektromobiliu Ikrovimo Centras Europoje

May 25, 2025

Naujas Porsche Elektromobiliu Ikrovimo Centras Europoje

May 25, 2025 -

Listen Now Joy Crookes Drops New Single Carmen

May 25, 2025

Listen Now Joy Crookes Drops New Single Carmen

May 25, 2025