Investing In The Amundi Dow Jones Industrial Average UCITS ETF: NAV And Performance

Table of Contents

Deep Dive into NAV (Net Asset Value): Understanding the Amundi DJIA ETF's Pricing

What is NAV?

The Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. It's calculated daily by subtracting the ETF's liabilities from the total market value of its holdings, then dividing by the number of outstanding shares. Essentially, it reflects the intrinsic worth of each share in the Amundi DJIA ETF.

Factors Affecting Amundi DJIA ETF NAV

Several factors influence the daily fluctuations of the Amundi DJIA ETF's NAV. The primary driver is the performance of the 30 companies comprising the Dow Jones Industrial Average. If these companies' share prices rise, the ETF's NAV will generally increase, and vice-versa. Currency exchange rates can also play a role, particularly if the ETF holds assets denominated in currencies other than the base currency of the ETF.

- Finding the Daily NAV: The daily NAV is typically published on the ETF provider's website, major financial news sources, and your brokerage account platform.

- NAV vs. Market Price: The market price of an ETF can deviate slightly from its NAV due to supply and demand. However, these discrepancies are usually minor and tend to correct themselves throughout the trading day.

- NAV's Importance: Understanding the NAV is crucial when making buy and sell decisions. It helps you assess whether you're paying a fair price for the ETF shares.

Analyzing the Amundi Dow Jones Industrial Average UCITS ETF Performance

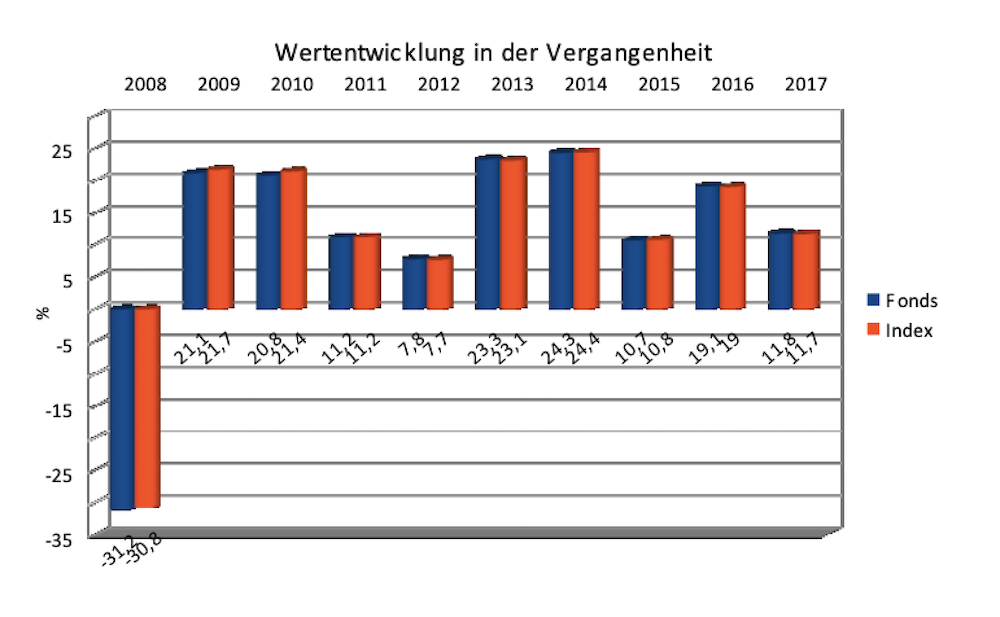

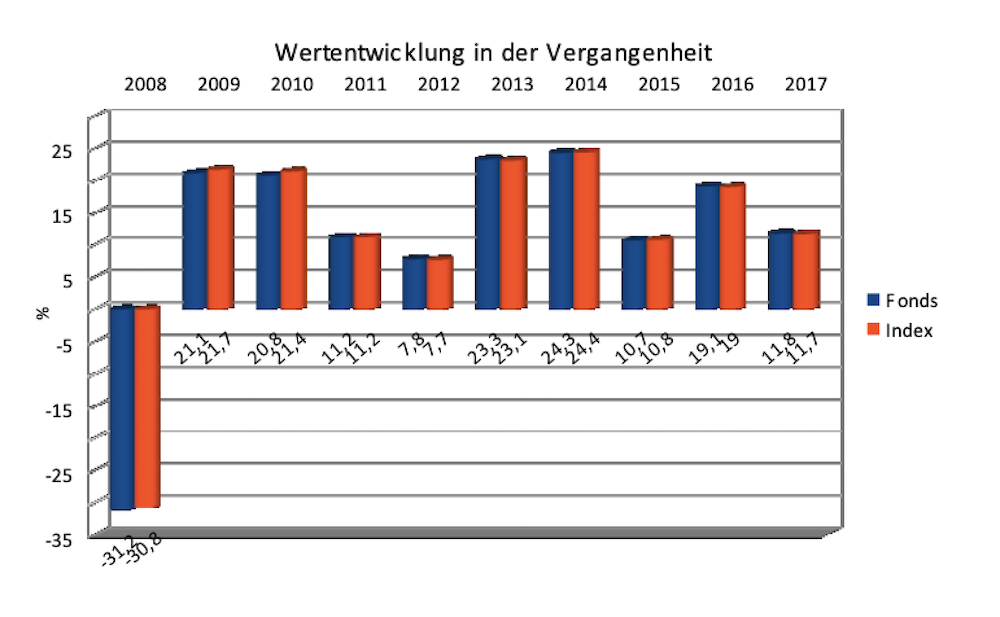

Historical Performance

The Amundi Dow Jones Industrial Average UCITS ETF has demonstrated [Insert specific 1-year, 3-year, and 5-year return data here, with source citation]. (Please replace bracketed information with actual data and source). Visual representations like charts and graphs would further illustrate this performance. It's crucial to remember that past performance is not indicative of future results.

Benchmark Comparison

A key metric to assess the ETF's performance is its tracking error—the difference between the ETF's returns and the returns of the Dow Jones Industrial Average index itself. A lower tracking error indicates that the ETF is effectively mirroring the index's performance. [Insert data comparing the ETF's performance to the DJIA, with source citation]. (Please replace bracketed information with actual data and source).

Risk and Volatility

Investing in the Amundi Dow Jones Industrial Average UCITS ETF carries inherent risks. Market risk—the possibility of overall market declines—is a significant factor. Sector concentration risk is also present, as the ETF's performance is tied to the 30 specific companies in the Dow Jones Industrial Average. The volatility of the ETF generally mirrors the volatility of the Dow Jones itself.

- Performance Data: [Insert additional performance data points, such as Sharpe ratio, standard deviation, and expense ratio with sources]. (Please replace bracketed information with actual data and source).

- Expense Ratios: The expense ratio significantly impacts long-term returns. A lower expense ratio means more of your investment earnings are reinvested.

Amundi DJIA ETF: Fees and Expenses

The Amundi Dow Jones Industrial Average UCITS ETF has an expense ratio of [Insert expense ratio here]. (Please replace bracketed information with actual data). This is [Insert comparison: higher/lower/similar] compared to similar Dow Jones tracking ETFs. Even seemingly small expense ratios can significantly impact your investment returns over the long term, compounding over years. It's essential to compare expense ratios when selecting an ETF.

Investing in the Amundi Dow Jones Industrial Average UCITS ETF: A Practical Guide

Eligibility and Account Types

This ETF can be held in various brokerage accounts, including individual retirement accounts (IRAs), taxable brokerage accounts, and potentially within certain retirement plans. Check with your broker to confirm eligibility.

Buying and Selling the ETF

Buying and selling shares of the Amundi DJIA ETF is generally straightforward through most online brokerage platforms. However, be aware of potential brokerage commissions or trading fees that may apply.

Diversification Strategies

While the Amundi DJIA ETF provides exposure to 30 large US companies, it's crucial to consider it within a broader investment portfolio. Diversification across different asset classes (stocks, bonds, real estate, etc.) and geographic regions is key to managing risk.

Conclusion: Is the Amundi Dow Jones Industrial Average UCITS ETF Right for You?

The Amundi Dow Jones Industrial Average UCITS ETF offers a convenient way to gain exposure to the Dow Jones Industrial Average. Understanding its NAV and analyzing its historical performance are vital steps before investing. Remember that while it offers potential for growth, it also carries market and sector concentration risks. Before investing, conduct thorough research, compare it to other Dow Jones ETFs, and consider your individual risk tolerance and investment goals. Seeking professional financial advice is highly recommended. Learn more about the Amundi Dow Jones Industrial Average UCITS ETF and its potential for your investment portfolio. Start your research on [link to relevant resource].

Featured Posts

-

Net Asset Value Nav Explained Amundi Msci World Ex Us Ucits Etf Acc

May 25, 2025

Net Asset Value Nav Explained Amundi Msci World Ex Us Ucits Etf Acc

May 25, 2025 -

Real Madrid Deki Sorusturma Doert Yildiz Oyuncunun Gelecegi Tehlikede

May 25, 2025

Real Madrid Deki Sorusturma Doert Yildiz Oyuncunun Gelecegi Tehlikede

May 25, 2025 -

Selling Sunset Star Highlights Landlord Price Gouging Following La Fires

May 25, 2025

Selling Sunset Star Highlights Landlord Price Gouging Following La Fires

May 25, 2025 -

This Dad Rowed To Raise 2 2 Million For His Sons Life Saving Treatment

May 25, 2025

This Dad Rowed To Raise 2 2 Million For His Sons Life Saving Treatment

May 25, 2025 -

Konchita Vurst O Evrovidenii 2025 Imena Chetyrekh Buduschikh Pobediteley

May 25, 2025

Konchita Vurst O Evrovidenii 2025 Imena Chetyrekh Buduschikh Pobediteley

May 25, 2025