Investment Opportunity? Palantir Stock Falls 30%

Table of Contents

Analyzing the 30% Stock Price Drop

The precipitous 30% fall in Palantir stock wasn't a single event but rather a culmination of factors impacting investor sentiment. Before the drop, PLTR was trading around [insert price before drop], but following the news, the price plummeted to [insert price after drop]. Trading volume significantly increased during this period, indicating considerable market activity and investor reaction. Let's break down the contributing factors:

-

Reason 1: Disappointing Earnings Report: Palantir's [most recent quarter] earnings report fell short of analysts' expectations. Revenue growth slowed to [insert percentage] compared to the previous quarter, while net income [increased/decreased] by [insert percentage]. This missed target fueled concerns about the company's future growth trajectory.

-

Reason 2: Broader Market Sentiment: The recent downturn in the broader technology sector also played a role. Investor anxieties surrounding [mention relevant market factors, e.g., interest rate hikes, inflation] negatively impacted many tech stocks, including Palantir. This created a sell-off across the board, exacerbating the decline in PLTR.

-

Reason 3: Concerns about Government Contract Dependence: Some analysts expressed concerns about Palantir's reliance on government contracts. While these contracts provide substantial revenue, their renewal isn't always guaranteed, creating a degree of uncertainty for investors.

Palantir's Financial Performance and Future Outlook

Understanding Palantir's financial health is crucial to assessing the investment opportunity. While the recent earnings report caused concern, a broader look at the company's performance reveals a complex picture.

-

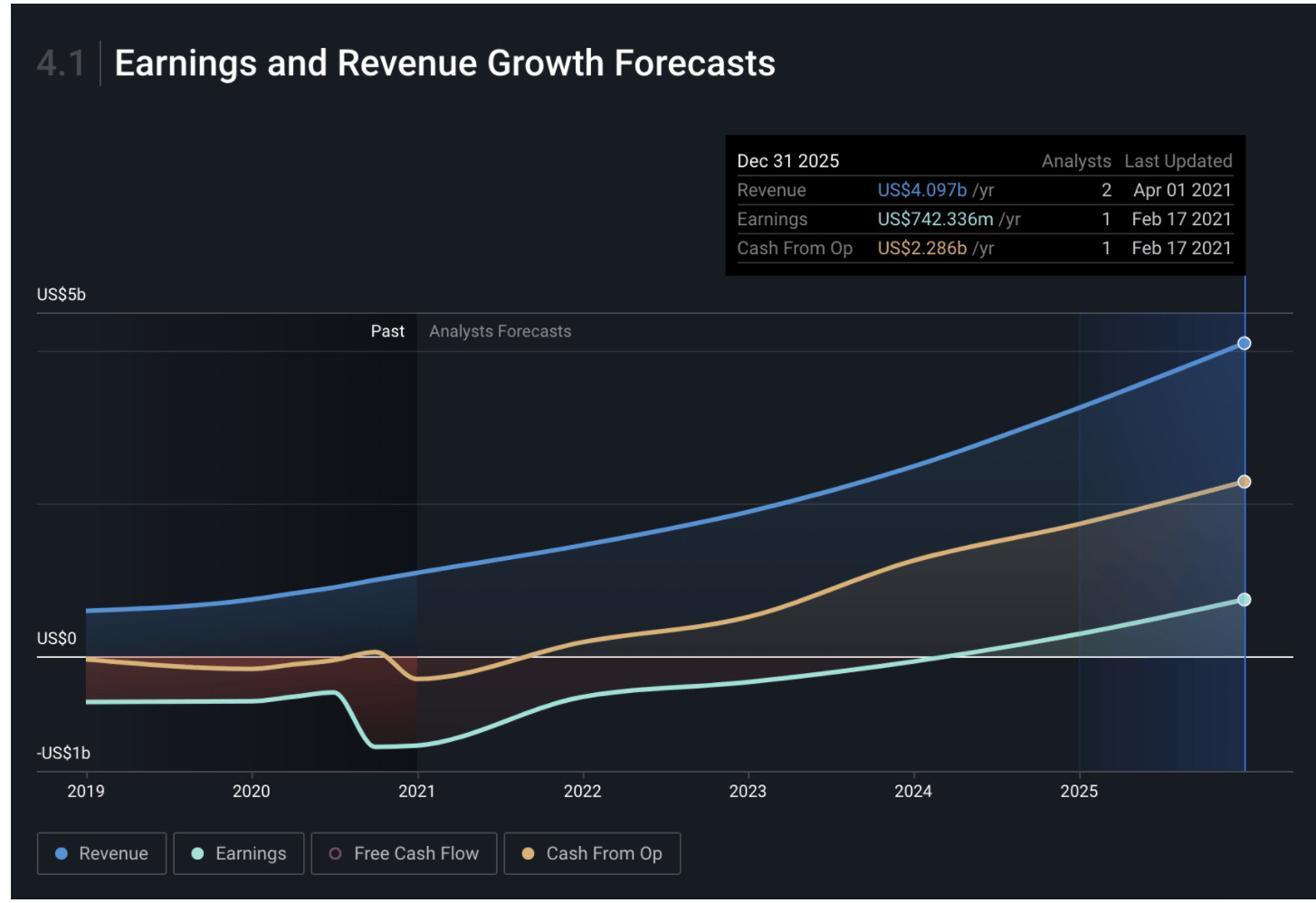

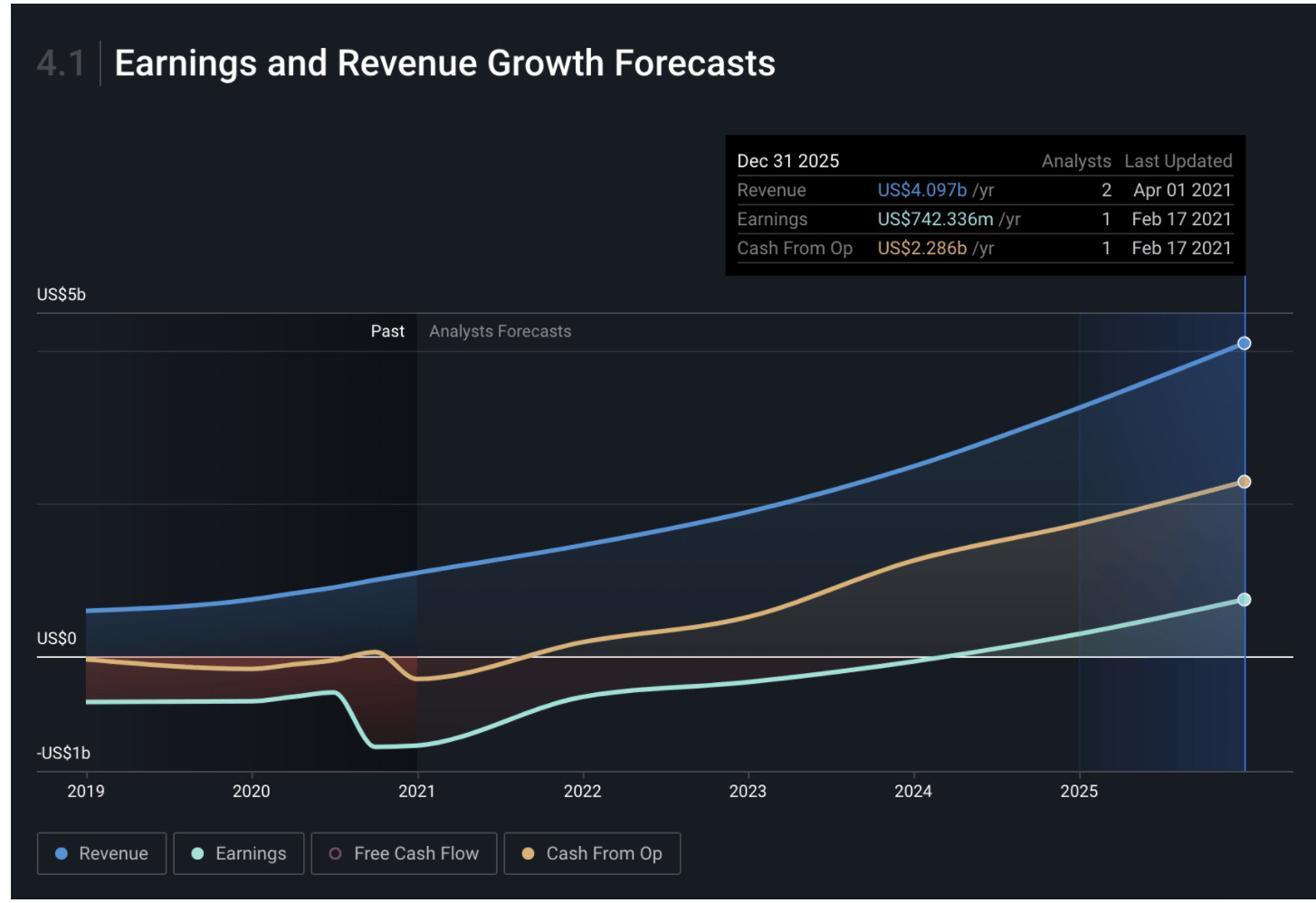

Revenue growth trends: While the recent quarter showed a slowdown, Palantir has historically demonstrated strong year-over-year revenue growth, particularly in its commercial sector. [Include specific data points if available].

-

Profitability: Palantir is still working towards consistent profitability, but its margins are improving. [Insert relevant data on profit margins and net income]. The company has demonstrated a commitment to improving its operational efficiency.

-

Key government and commercial contracts: Palantir boasts a diverse portfolio of contracts with major government agencies and commercial clients across various sectors. These contracts provide a stable revenue stream and showcase the demand for Palantir's big data analytics solutions. [Mention key clients or sectors].

-

Potential for future growth: Palantir's innovative technology positions it for growth in several high-demand sectors, including artificial intelligence, cybersecurity, and cloud computing. Further expansion into international markets also offers considerable growth potential.

Assessing the Risk and Reward of Investing in Palantir Stock

Investing in Palantir stock, like any investment, involves both risks and rewards. A careful assessment of both is essential.

-

Risk factors: The high valuation of Palantir stock, intense competition in the data analytics market, and reliance on government contracts all present significant risks. Regulatory hurdles and geopolitical uncertainty also pose challenges.

-

Reward factors: Palantir’s potential for high growth, its innovative technology, and its strong position in the government and commercial sectors are attractive to many investors. The potential for significant returns is a key reward.

-

Comparison to similar tech stocks: Comparing Palantir's valuation, growth rate, and risk profile to similar companies in the data analytics and software sectors can provide additional context for evaluating the investment opportunity.

Technical Analysis of PLTR Stock

While not the focus of this article, a brief look at technical indicators might offer additional insights. Support levels around [insert price] and resistance levels around [insert price] could provide clues regarding potential price movements. [Optional: Include a simple chart showing relevant technical indicators if appropriate for your audience]. However, it is essential to remember that technical analysis alone is insufficient for making investment decisions.

Conclusion: Is Palantir Stock Still a Viable Investment?

The recent 30% drop in Palantir stock (PLTR) is undeniably significant, stemming from a combination of disappointing earnings, broader market sentiment, and concerns about its reliance on government contracts. However, Palantir’s long-term growth potential, its innovative technology, and its strong position in key markets also need consideration. While the drop presents a potential buying opportunity for some, thorough research and careful consideration of the risks involved are crucial. Do your due diligence before investing in Palantir stock (PLTR) and remember that past performance is not indicative of future results. The decision of whether to invest in Palantir stock rests on your individual risk tolerance and investment strategy.

Featured Posts

-

Growth Of The Wireless Mesh Networks Market A 9 8 Cagr Analysis

May 09, 2025

Growth Of The Wireless Mesh Networks Market A 9 8 Cagr Analysis

May 09, 2025 -

Aoc Vs Fox News A Fiery Exchange Over Trump

May 09, 2025

Aoc Vs Fox News A Fiery Exchange Over Trump

May 09, 2025 -

Save On Elizabeth Arden Skincare Walmart And More

May 09, 2025

Save On Elizabeth Arden Skincare Walmart And More

May 09, 2025 -

Bbc Strictly Come Dancing Wynne Evanss Statement On Potential Return

May 09, 2025

Bbc Strictly Come Dancing Wynne Evanss Statement On Potential Return

May 09, 2025 -

The Kilmar Abrego Garcia Case El Salvadoran Refugee And Us Political Debate

May 09, 2025

The Kilmar Abrego Garcia Case El Salvadoran Refugee And Us Political Debate

May 09, 2025