Investor Concerns About Stock Market Valuations: BofA's Reassurance

Table of Contents

BofA's Counterarguments to Overvaluation Concerns

BofA counters the prevailing narrative of overvaluation with several key arguments, offering investors a more nuanced understanding of the current market conditions.

Strong Corporate Earnings Growth

BofA highlights robust corporate earnings growth as a primary justification for current valuations. Sustained earnings growth can support higher P/E ratios, as investors are willing to pay more for companies demonstrating consistent profitability.

- Specific sectors showing strong earnings growth: The technology and healthcare sectors, in particular, have exhibited impressive earnings growth in recent quarters, driving a significant portion of the overall market valuation.

- Sustained earnings growth and P/E ratios: Companies with a history of consistent earnings growth often command higher P/E multiples because investors anticipate future profitability. This is a key factor in BofA's assessment of current market valuations.

- Understanding corporate earnings: Analyzing corporate earnings reports, including revenue growth, profit margins, and earnings per share (EPS), is crucial for understanding the sustainability of current valuations.

Low Interest Rates and Monetary Policy

The impact of low interest rates on stock valuations is significant. When interest rates are low, equities become more attractive relative to bonds, as the return on bonds is diminished.

- Low interest rates and equity attractiveness: Low interest rates incentivize investors to seek higher returns in the stock market, increasing demand and potentially driving up valuations.

- Federal Reserve's monetary policy: The Federal Reserve's (Fed) monetary policy, including quantitative easing (QE) programs, has directly influenced interest rates and, consequently, stock market valuations. QE injected liquidity into the market, lowering borrowing costs and boosting asset prices.

- Quantitative easing (QE) and stock prices: QE programs have historically led to increased stock prices as investors search for yields in a low-interest-rate environment. This impact is a critical element in BofA’s analysis.

Long-Term Economic Outlook

BofA maintains a positive outlook on long-term economic growth, a key factor supporting their assessment of current valuations.

- Factors supporting long-term growth: Technological innovation, globalization, and ongoing expansion into emerging markets are cited as significant drivers of future economic growth.

- Potential risks to the long-term outlook: While BofA presents a positive outlook, risks such as geopolitical instability, inflation, and supply chain disruptions need to be acknowledged and assessed.

- BofA's risk assessment: A thorough risk assessment is integral to BofA's analysis, balancing potential upside with potential downsides to the long-term economic outlook.

Factors Still Driving Investor Anxiety

Despite BofA's reassurances, several factors continue to fuel investor anxiety and contribute to market volatility.

Geopolitical Risks

Geopolitical instability remains a significant source of uncertainty and can significantly impact investor sentiment and market valuations.

- Examples of geopolitical risks: Ongoing trade disputes, international conflicts, and political uncertainties can all create volatility and negatively affect investor confidence.

- Impact on stock market valuations: Geopolitical risks often lead to increased market volatility, as investors react to uncertain global events by adjusting their portfolios.

- Investor confidence and market volatility: Maintaining investor confidence requires transparency and clear communication regarding geopolitical risks and their potential impact.

Inflationary Pressures

Rising inflation poses a significant threat to corporate profits and investor returns, adding to investor concerns.

- Inflation's impact on corporate profits: Inflation can erode profit margins if companies cannot pass on rising costs to consumers.

- Central bank responses to inflation: Central banks often respond to inflation by raising interest rates, which can negatively affect stock valuations.

- Monetary tightening and investor returns: Monetary tightening measures implemented by central banks to curb inflation can lead to decreased investor returns.

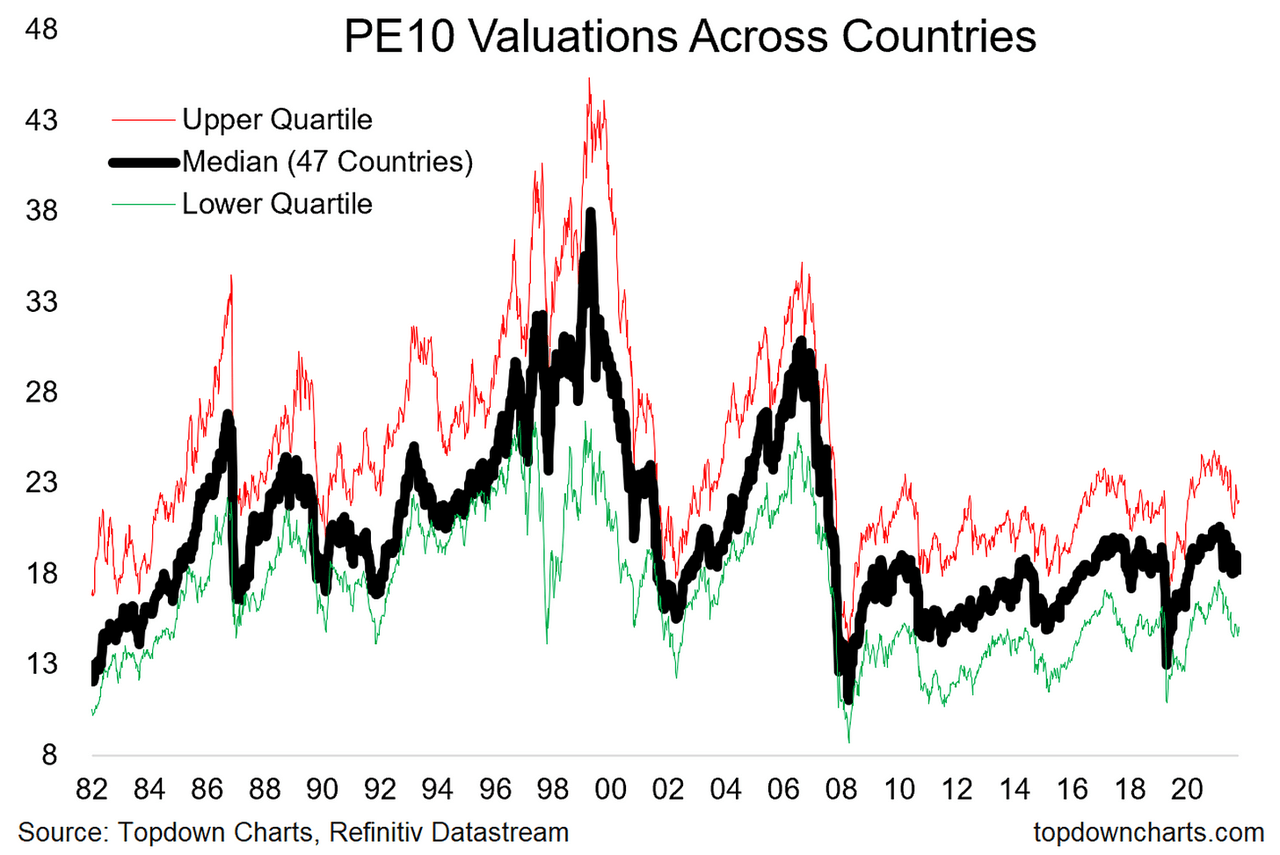

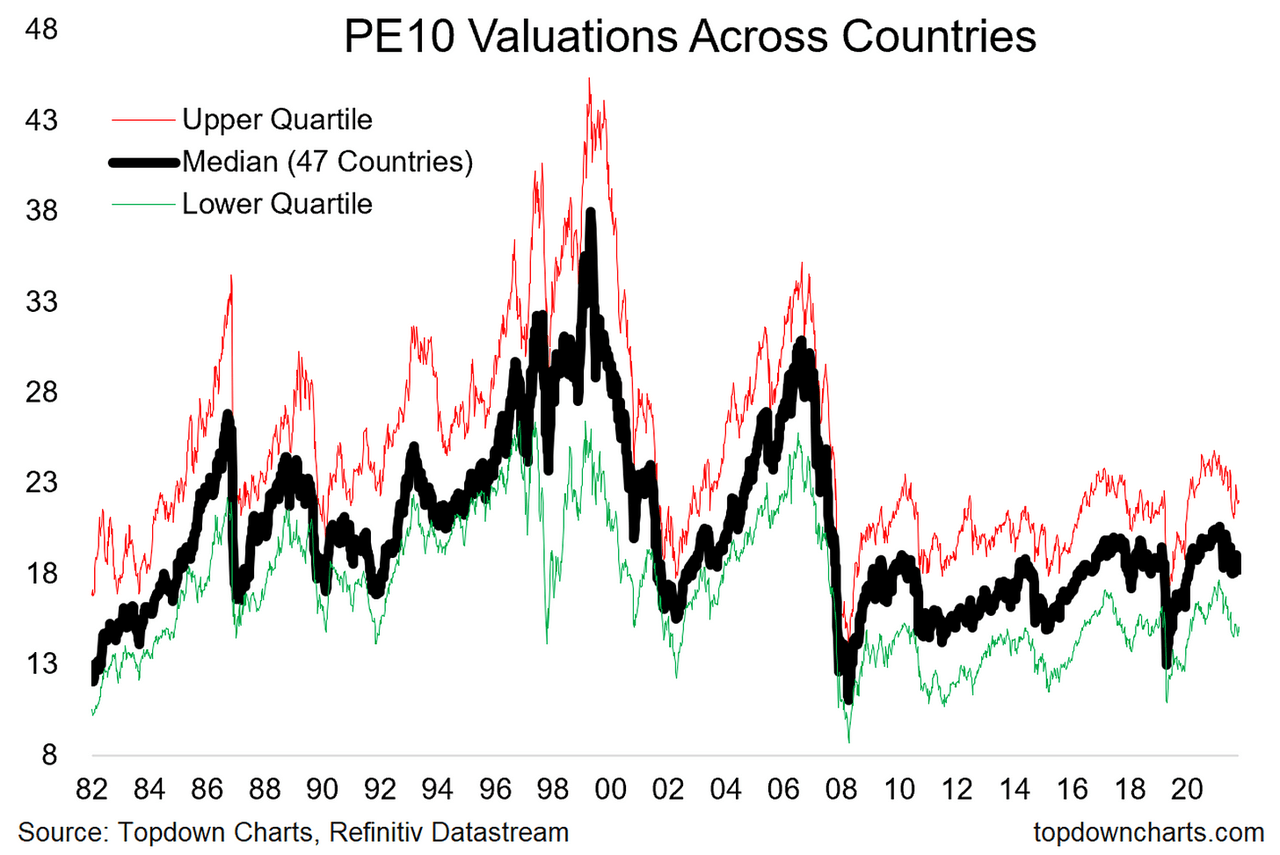

Valuation Multiples Compared to Historical Data

While BofA argues against overvaluation, it’s important to acknowledge that certain valuation metrics are elevated compared to historical averages.

- Comparison of current P/E ratios to historical data: Current P/E ratios in certain sectors are higher than their historical averages.

- Other relevant valuation multiples: Analyzing additional metrics like price-to-sales (P/S) ratios and price-to-book (P/B) ratios provides a more comprehensive valuation picture.

- Limitations of historical comparisons: Comparing current valuations solely to historical averages might not fully account for the impact of low interest rates and other factors influencing current market conditions.

Conclusion

BofA's analysis presents a relatively optimistic outlook on stock market valuations, emphasizing strong corporate earnings growth, low interest rates, and a positive long-term economic outlook. However, geopolitical risks, inflationary pressures, and elevated valuation multiples compared to historical averages remain valid concerns. Investors should consider both the bullish and bearish perspectives, conducting thorough due diligence before making any investment decisions. Don't let investor concerns about stock market valuations paralyze your investment decisions. Conduct thorough due diligence, understand the nuances of BofA's analysis, and create a diversified investment portfolio aligned with your risk tolerance. A well-informed investment strategy, informed by a comprehensive understanding of stock market valuations and current market analyses, is crucial for navigating the complexities of the market.

Featured Posts

-

Your Escape To The Country Choosing The Right Property

May 25, 2025

Your Escape To The Country Choosing The Right Property

May 25, 2025 -

Flash Flood Emergency What To Do Before During And After

May 25, 2025

Flash Flood Emergency What To Do Before During And After

May 25, 2025 -

Frank Sinatras Four Marriages A Look At His Wives And Love Lives

May 25, 2025

Frank Sinatras Four Marriages A Look At His Wives And Love Lives

May 25, 2025 -

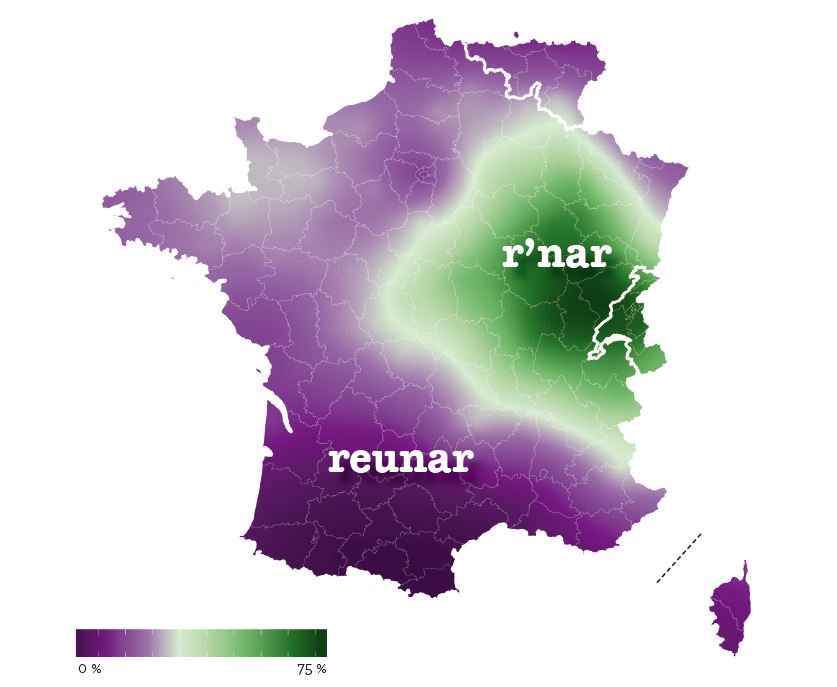

Mathieu Avanzi Depasser Les Cliches Sur La Langue Francaise

May 25, 2025

Mathieu Avanzi Depasser Les Cliches Sur La Langue Francaise

May 25, 2025 -

Dogecoins Future Will Elon Musks Departure Impact Its Price

May 25, 2025

Dogecoins Future Will Elon Musks Departure Impact Its Price

May 25, 2025