Iron Ore Falls: China's Steel Production Cuts Impact Global Markets

Table of Contents

China's Steel Production Cuts: The Driving Force

Reasons Behind the Production Cuts

China's decision to curb steel production stems from a confluence of factors. The country is increasingly focused on environmental sustainability and meeting ambitious carbon emission reduction targets. This has resulted in stricter regulations on steel mills, leading to production limitations and closures.

- Environmental Regulations: The implementation of stricter emission standards and penalties for non-compliance has forced many less efficient steel plants to reduce output or shut down completely. The focus on achieving carbon neutrality by 2060 is a significant driver.

- Government Policies: The Chinese government has actively pursued policies aimed at addressing overcapacity within the steel industry. This includes consolidating smaller, less efficient producers and encouraging mergers and acquisitions to create larger, more competitive entities.

- Weakening Domestic Demand: A slowing Chinese economy has resulted in decreased domestic demand for steel, impacting production levels. Construction activity, a major consumer of steel, has slowed in recent years.

- Scrutiny of "Zombie Companies": The government is increasingly scrutinizing financially distressed "zombie companies"—inefficient steel plants that continue operating despite losses—leading to closures and reduced production. This is part of a broader effort to improve overall industrial efficiency.

- Specific Policy Changes: Examples include the introduction of stricter environmental impact assessments for new steel projects and the implementation of carbon trading schemes designed to incentivize emissions reductions.

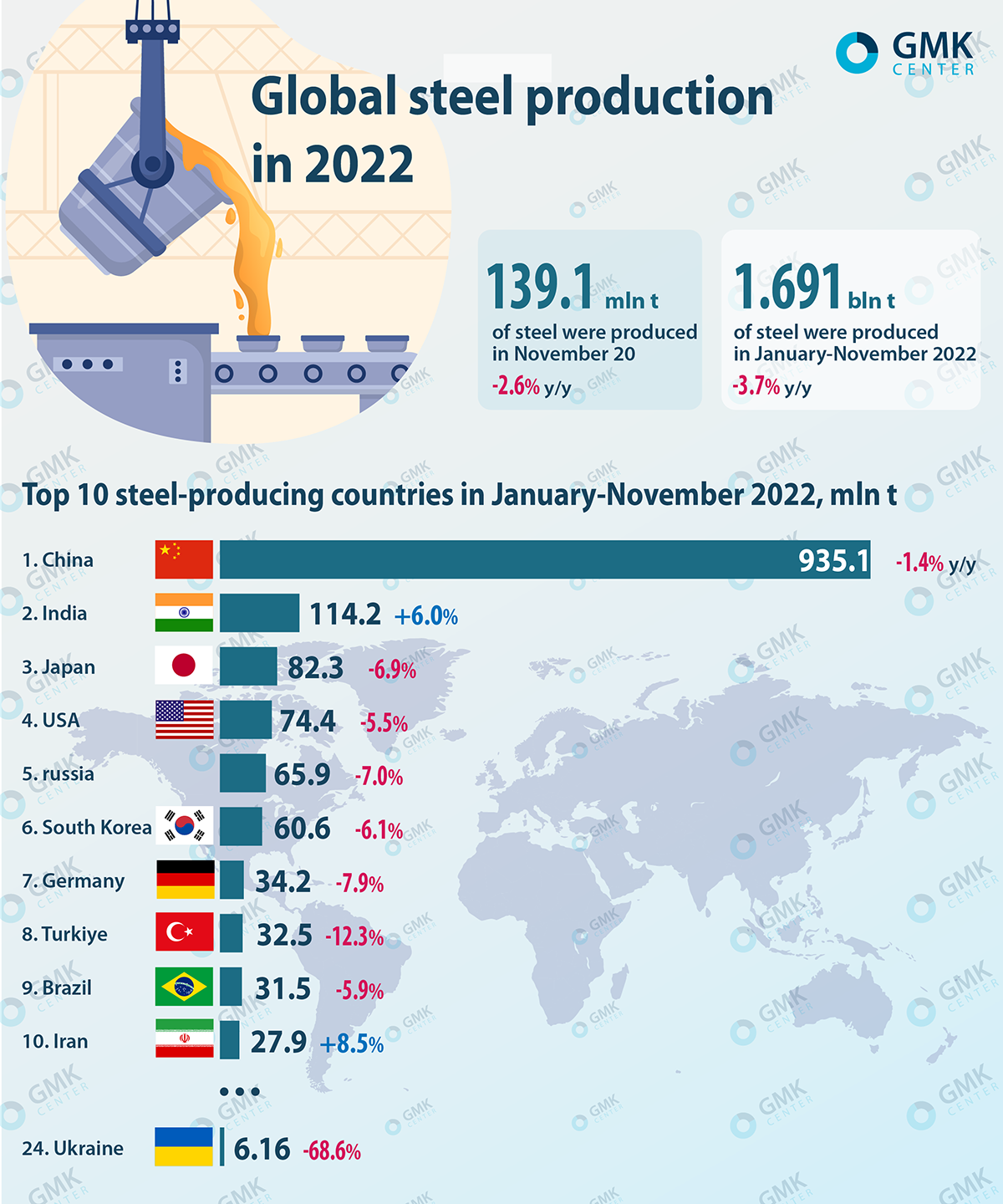

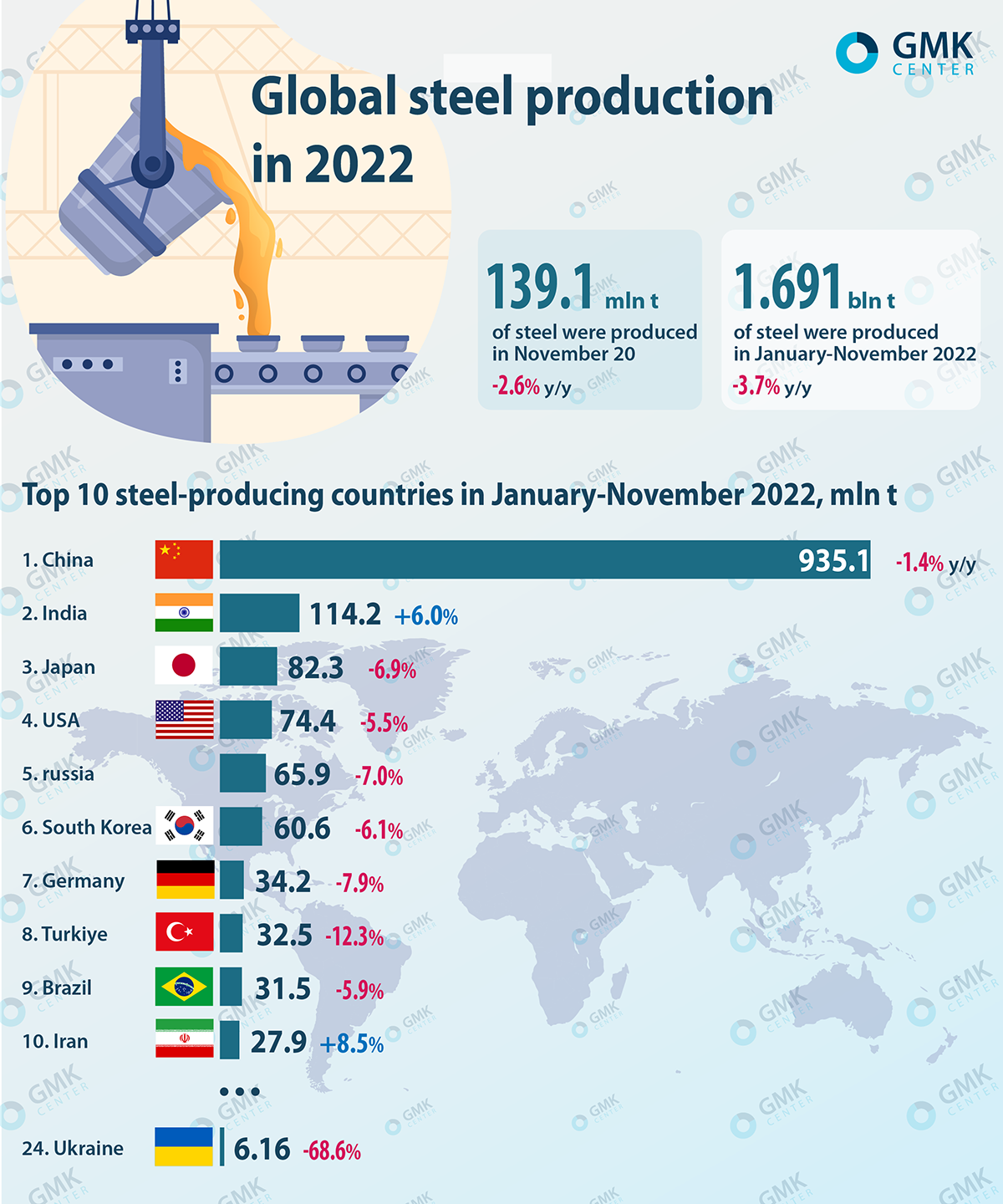

Scale of the Production Cuts

The reduction in Chinese steel production has been substantial. While precise figures fluctuate, reports indicate a decrease of [Insert Percentage]% in [Insert Time Period], compared to the previous year. This represents a significant drop in global steel production, considering China's position as the world's largest steel producer. [Insert Chart/Graph if available showing production levels]. Specific regions like [mention specific regions] have been particularly affected by the production cuts, with several major steel mills significantly reducing their output.

Impact on Global Iron Ore Prices

Supply and Demand Dynamics

The relationship between steel production and iron ore demand is directly proportional. Steel production requires vast quantities of iron ore as a primary raw material. Therefore, a significant reduction in Chinese steel production directly translates to decreased demand for iron ore. This decreased demand, combined with relatively stable supply, has created a surplus of iron ore in the global market.

Price Volatility and Market Reactions

The reduced demand has led to considerable volatility in iron ore prices. We have seen a dramatic [Insert Percentage]% fall in prices since [Insert Time Period]. [Insert Chart/Graph illustrating price fluctuations]. Major iron ore producers like BHP, Rio Tinto, and Vale have all felt the impact, experiencing significant drops in their stock prices and profits. The market reaction has been characterized by uncertainty and adjustments to production strategies by these major players.

Global Market Implications Beyond Iron Ore

Impact on Other Related Industries

The decline in steel production and the subsequent fall in iron ore prices have wider implications. Industries heavily reliant on steel, including construction, automotive manufacturing, and infrastructure development, are experiencing increased input costs and potential supply chain disruptions. This can lead to job losses and reduced economic activity in these sectors.

Geopolitical Considerations

The shift in China's steel production has geopolitical implications. It alters the dynamics of international trade in iron ore, affecting competition among producing countries like Australia, Brazil, and others. The reduced demand from China could lead to a reshuffling of market power and influence, potentially benefiting some producers while harming others.

Future Outlook and Predictions for Iron Ore

Short-Term and Long-Term Projections

Predicting future iron ore prices is challenging. However, short-term projections suggest continued price volatility, potentially influenced by factors like global economic growth, Chinese government policies, and the pace of environmental regulations. Long-term, a gradual recovery is possible, but it will depend on the pace of global economic growth and any shifts in China’s steel production strategy. Technological advancements in steel production could also impact iron ore demand.

Potential for Market Recovery or Further Decline

The possibility of a market rebound exists, particularly if global economic growth accelerates and demand for steel increases. However, if China continues its stringent environmental policies and focuses on reducing overcapacity, further declines in iron ore prices are possible. The interplay between these factors will determine the future trajectory of iron ore prices.

Conclusion

China's steel production cuts are significantly impacting global iron ore prices and markets. The decreased demand for steel has resulted in a surplus of iron ore and considerable price volatility. This has ripple effects on various related industries and international trade relations. Understanding the dynamics of iron ore falls and their global impact is crucial for investors, businesses, and policymakers alike. Stay updated on the latest news and analyses to navigate this evolving market effectively, and understand the continued implications of iron ore falls and China’s steel production policies.

Featured Posts

-

Palantir Stock A Comprehensive Look Before The May 5th Earnings

May 10, 2025

Palantir Stock A Comprehensive Look Before The May 5th Earnings

May 10, 2025 -

Dakota Johnsons Family Rallies At Materialist Premiere

May 10, 2025

Dakota Johnsons Family Rallies At Materialist Premiere

May 10, 2025 -

First Up Imf To Review Pakistans 1 3 Billion Loan Package Amidst Regional Tensions

May 10, 2025

First Up Imf To Review Pakistans 1 3 Billion Loan Package Amidst Regional Tensions

May 10, 2025 -

Trumps Tariff Threat Commercial Aircraft And Engines In The Crosshairs

May 10, 2025

Trumps Tariff Threat Commercial Aircraft And Engines In The Crosshairs

May 10, 2025 -

How Luis Enrique Secured Psgs Ligue 1 Championship

May 10, 2025

How Luis Enrique Secured Psgs Ligue 1 Championship

May 10, 2025