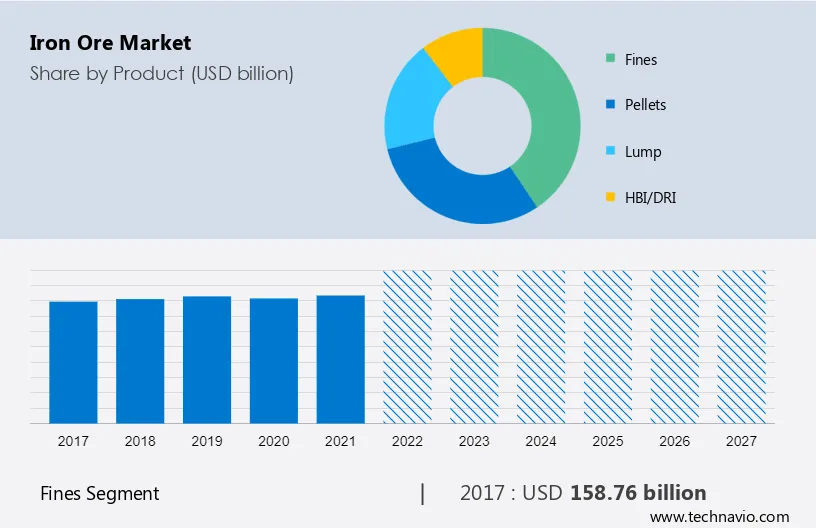

Iron Ore Market Forecast: Considering China's Steel Production Restrictions

Table of Contents

China's Steel Production Restrictions: The Driving Force

China's stringent steel production quotas and increasingly strict environmental regulations are fundamentally reshaping the iron ore market. The rationale behind these policies is multifaceted: a commitment to addressing environmental concerns, tackling overcapacity in its steel industry, and achieving ambitious carbon emission targets.

- Environmental Concerns: China's commitment to reducing its carbon footprint has led to stricter emission standards for steel mills, forcing them to either reduce production or invest heavily in cleaner technologies.

- Overcapacity: For years, China's steel industry suffered from significant overcapacity. The government's policies aim to consolidate the sector, leading to the closure or downsizing of less efficient mills.

- Implementation of Restrictions: These restrictions manifest in various forms:

- Production Quotas: Limits on the total amount of steel that mills can produce.

- Emission Standards: Stringent regulations on air and water pollution from steel production.

- Energy Consumption Limits: Restrictions on the amount of energy steel mills can consume.

Impact on Iron Ore Demand from China

The impact on iron ore demand from China is substantial. Reduced steel production directly translates to lower iron ore consumption. Experts predict a continued decrease in demand, with projections varying depending on the stringency of future policies and the pace of economic recovery.

- Decreased Demand: The reduced demand from China significantly impacts global iron ore prices, creating ripples throughout the entire supply chain.

- Price Volatility: The fluctuating nature of China's policies creates significant volatility in the iron ore market, making accurate iron ore demand China forecasting challenging. Reduced steel production impact is heavily felt in price fluctuations.

Global Iron Ore Supply Dynamics and their Influence on the Forecast

While China's policies are a major driver, global iron ore supply dynamics also play a crucial role in shaping the iron ore market forecast. Major players like Australia and Brazil, with their vast iron ore reserves, significantly influence global supply.

- Major Producing Countries: Australia and Brazil are the dominant iron ore producers, their production levels influencing global supply and price.

- Geopolitical Factors: Geopolitical risks, including trade disputes and resource nationalism, can disrupt supply chains and impact iron ore production.

- Supply Chain Disruptions: Unforeseen events like natural disasters, port congestion, or political instability in producing countries can further destabilize the market.

Supply Chain Bottlenecks and their Influence

Logistical challenges, like shipping constraints and port congestion, further complicate the supply-demand equation. These bottlenecks can lead to delays, increased transportation costs, and ultimately, impact iron ore prices and availability.

- Shipping and Transportation: Seaborne transportation is vital for iron ore; delays or disruptions in shipping can lead to shortages and price spikes.

- Port Congestion: Overcrowded ports can lead to delays in unloading and handling iron ore, further impacting market stability.

- Logistics Costs: Increased transportation costs due to congestion and fuel prices directly affect the final iron ore price.

Iron Ore Price Prediction and Market Volatility

Predicting iron ore prices with certainty is inherently challenging given the interplay of numerous factors. Current prices reflect the tension between reduced demand from China and the overall global iron ore production levels.

- Price Volatility: The iron ore market is notoriously volatile, influenced by speculation, macroeconomic factors, and unexpected supply chain disruptions.

- Forecast Scenarios: Several market forecast scenarios exist:

- Optimistic: Assumes a faster-than-expected recovery in Chinese steel demand and a stable global economy.

- Pessimistic: Predicts a prolonged period of reduced demand from China and significant supply chain disruptions.

- Neutral: Balances the optimistic and pessimistic scenarios, reflecting a more moderate outlook.

Analyzing Price Fluctuations and their Drivers

Several factors contribute to the price fluctuations in iron ore:

- Speculation and Investment: Investment strategies and speculation within the commodity markets can significantly impact prices.

- Macroeconomic Factors: Global economic growth, inflation rates, and currency fluctuations play a significant role in shaping iron ore prices.

- Policy Changes: Unexpected policy changes from either China or other major iron ore producing countries can create sharp price shifts.

Investment Strategies in the Iron Ore Market Considering the Forecast

Investing in the iron ore market requires a cautious approach given the inherent volatility and uncertainty.

- Risk Management: Diversification and hedging strategies are essential for mitigating risk in this dynamic market.

- Hedging: Using financial instruments to protect against price fluctuations can reduce the impact of unexpected market movements.

- Investment Opportunities: While risky, opportunities may exist for those who can navigate the complexities of the market and identify potential growth areas.

The Future of the Iron Ore Market: A Look Ahead

The iron ore market forecast is complex, heavily influenced by China's steel production restrictions and global supply chain dynamics. The ongoing uncertainty underscores the need for careful analysis and robust risk management strategies. China's commitment to environmental sustainability and its efforts to address overcapacity will continue to shape the iron ore market outlook and future iron ore prices for the foreseeable future. It's crucial to stay informed about the iron ore market forecast and conduct thorough research before making any investment decisions. Consider subscribing to market updates from reputable sources or consulting with experienced financial advisors specializing in commodity markets to understand the nuances of investing in this dynamic sector. Stay informed to navigate the complexities of the iron ore market forecast and make informed investment decisions.

Featured Posts

-

Harry Styles Disappointment Snl Impression Goes Wrong

May 09, 2025

Harry Styles Disappointment Snl Impression Goes Wrong

May 09, 2025 -

Hills 27 Saves Golden Knights Secure Win Against Blue Jackets

May 09, 2025

Hills 27 Saves Golden Knights Secure Win Against Blue Jackets

May 09, 2025 -

The Trump Administrations First 100 Days Its Effect On Elon Musks Fortune

May 09, 2025

The Trump Administrations First 100 Days Its Effect On Elon Musks Fortune

May 09, 2025 -

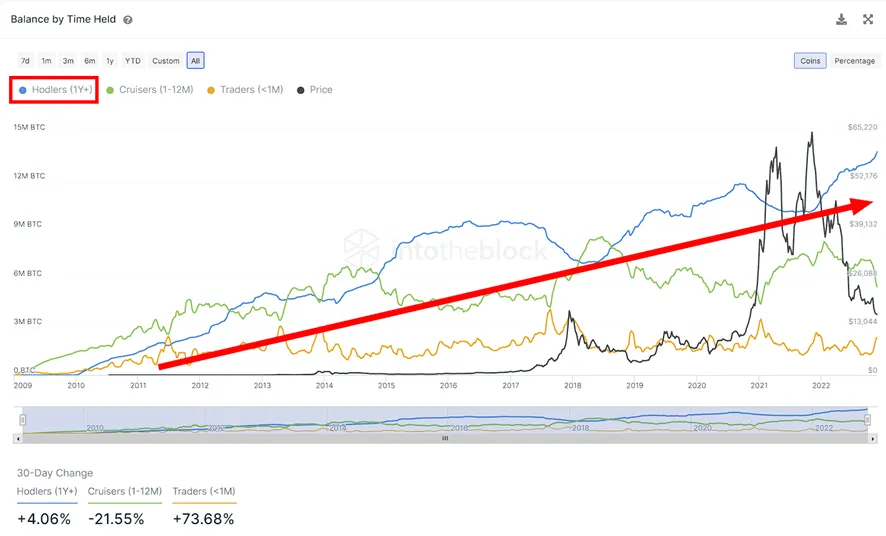

Is The Bitcoin Price Rebound Sustainable Experts Weigh In

May 09, 2025

Is The Bitcoin Price Rebound Sustainable Experts Weigh In

May 09, 2025 -

Stranger Things Vs It Stephen Kings Perspective

May 09, 2025

Stranger Things Vs It Stephen Kings Perspective

May 09, 2025