Iron Ore Price Drop: Analysis Of China's Steel Industry Restrictions

Table of Contents

China's Steel Production Restrictions: The Driving Force

China's government has implemented a series of measures aimed at curbing pollution and achieving ambitious carbon emission reduction targets. These policies are significantly impacting steel production and, consequently, the demand for iron ore.

Environmental Regulations and Carbon Emission Targets

Stringent new environmental regulations are forcing Chinese steel mills to curtail their operations. These regulations include:

- Stricter emission standards: New, more demanding limits on emissions of pollutants like sulfur dioxide and particulate matter are forcing steel mills to invest heavily in upgrading their facilities or face penalties.

- Production limitations during peak pollution seasons: Many steel mills face mandatory production cuts during specific periods of the year to minimize environmental impact.

- Increased scrutiny and enforcement: The Chinese government has stepped up its monitoring and enforcement of environmental regulations, leading to greater compliance and reduced production.

The impact is quantifiable. Recent data suggests a reduction of X% in steel production in [Specific region/province] due to these restrictions, directly impacting the demand for iron ore. This decrease in production capacity has contributed significantly to the iron ore price drop.

Real Estate Market Slowdown and Reduced Steel Demand

The slowdown in China's real estate market is another significant factor driving down steel demand. Reduced construction activity translates directly into less steel needed for building infrastructure and housing. This is evident in:

- A decline in construction projects: The number of new construction projects has fallen significantly, leading to a reduced need for steel reinforcement bars and other steel products.

- Decreased housing starts: Fewer new homes being built mean lower demand for steel used in construction. This correlation between real estate activity and steel demand is clearly evident in recent market data. A [Specific percentage]% decrease in housing starts directly correlates to a [Specific percentage]% decrease in steel demand.

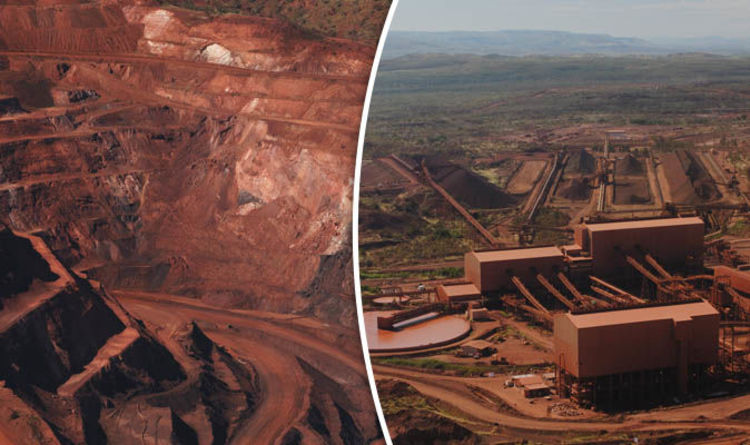

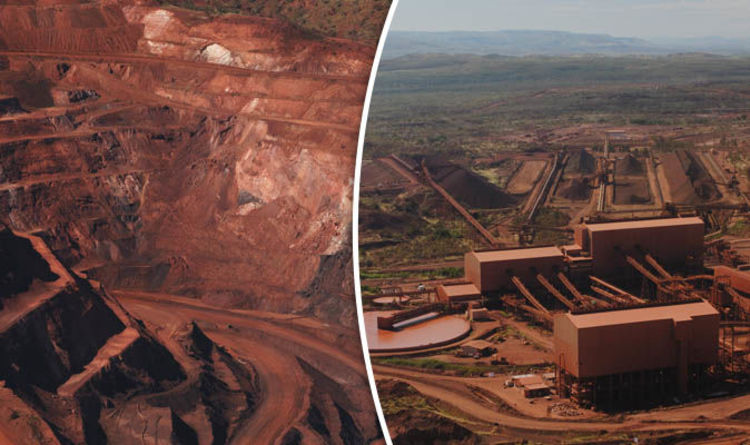

Impact on Global Iron Ore Markets

China's actions haven't been contained within its borders. The reduced demand for iron ore has created significant ripples across the global market.

Price Volatility and Market Uncertainty

The iron ore price has experienced significant volatility in recent months, creating uncertainty for producers and exporters. This is illustrated by:

- Sharp price fluctuations: Charts clearly show the dramatic swings in iron ore prices since [Date], reflecting the uncertainty in the market.

- Impact on major producers: Countries like Australia and Brazil, major iron ore exporters, are feeling the pinch, with decreased revenue and potential job losses in the mining sector.

This uncertainty is forcing producers to reassess their production strategies and potentially scale back operations.

Supply Chain Disruptions and Global Trade

The decreased demand for iron ore has also caused disruptions to the global supply chain:

- Reduced shipping volumes: Fewer iron ore shipments are needed, impacting shipping companies and potentially leading to idle vessels.

- Potential renegotiation of trade agreements: Iron ore exporters may need to renegotiate contracts or explore new markets to mitigate the impact of the reduced demand from China.

These disruptions highlight the interconnected nature of global trade and the far-reaching consequences of China's steel industry policies.

Potential Future Scenarios and Market Outlook

The future of iron ore prices remains uncertain, depending largely on China's future policy decisions and global economic conditions.

Government Policy Shifts and Their Potential Impact

Several scenarios are possible:

- Easing of restrictions: The Chinese government might decide to ease some restrictions on steel production to stimulate economic growth, potentially leading to increased iron ore demand.

- Adjustment of environmental targets: Changes to the environmental targets could influence the stringency of regulations impacting steel production.

These changes would directly impact iron ore prices, causing potential price increases or continued volatility. Expert forecasts vary widely, with some predicting a [Specific percentage]% increase in demand by [Date], while others remain cautious.

Long-Term Sustainability and the Future of Steel Production

The long-term outlook for the steel industry is inextricably linked to sustainability. The adoption of greener steel production methods will play a crucial role:

- Technological advancements: Innovations in steelmaking processes, such as using hydrogen instead of coal, could reduce carbon emissions and influence future iron ore demand.

- Green steel initiatives: Government incentives and industry efforts to adopt more sustainable practices will shape the future landscape of steel production and iron ore consumption.

The transition to a greener economy will likely lead to a shift in demand, favoring sustainable steel production methods and potentially altering the long-term outlook for iron ore.

Conclusion

The iron ore price drop is primarily a result of China's stringent steel industry restrictions, driven by environmental regulations and the slowdown in the real estate market. This has created significant volatility and uncertainty in the global iron ore market, impacting producers, exporters, and the global supply chain. The future trajectory of iron ore prices remains uncertain, depending on future government policy shifts and the adoption of sustainable steel production methods. To stay informed about the latest developments in this dynamic market and understand the ongoing impact of the iron ore price drop, subscribe to our newsletter and follow our blog for regular updates and in-depth analyses. Monitor the iron ore price drop closely to navigate the challenges and opportunities presented in the global commodities market.

Featured Posts

-

Will Leon Draisaitl Be Ready For The Oilers Playoffs

May 10, 2025

Will Leon Draisaitl Be Ready For The Oilers Playoffs

May 10, 2025 -

The Transgender Community And Trumps Executive Orders A Call For Your Experiences

May 10, 2025

The Transgender Community And Trumps Executive Orders A Call For Your Experiences

May 10, 2025 -

Judge Who Jailed Becker To Chair Nottingham Attacks Investigation

May 10, 2025

Judge Who Jailed Becker To Chair Nottingham Attacks Investigation

May 10, 2025 -

Dakota Johnson Ir Kraujas Is Nosies Tiesa Apie Nuotraukas

May 10, 2025

Dakota Johnson Ir Kraujas Is Nosies Tiesa Apie Nuotraukas

May 10, 2025 -

Oilers Vs Kings Playoffs Game 1 Expert Predictions And Betting Picks For Tonight

May 10, 2025

Oilers Vs Kings Playoffs Game 1 Expert Predictions And Betting Picks For Tonight

May 10, 2025