Is A Trillion-Dollar Palantir Possible By 2030? Analyzing The Company's Growth Prospects

Table of Contents

Palantir's Current Market Position and Strengths

Palantir's success story is built on a foundation of strong market positioning and inherent technological advantages. Let's examine the key pillars supporting its current valuation and future growth potential.

Dominating Niche Markets

Palantir has established a commanding presence in government and intelligence sectors globally. Its proprietary software, renowned for its sophisticated data integration capabilities and robust security features, has become indispensable to numerous national security agencies and defense organizations.

- Market share: While precise figures aren't publicly available, Palantir holds a significant, arguably dominant, share in the highly specialized market of government and intelligence data analytics.

- Competitive advantages: Palantir's competitive edge stems from its unique ability to integrate diverse, often siloed, data sources, providing a comprehensive and actionable intelligence picture. Its platform's customization capabilities, tailored to meet the specific needs of each client, further strengthen its position.

- Successful deployments: Numerous case studies highlight Palantir's contributions to counter-terrorism efforts, crime prevention, and national security operations. While specifics are often classified, the company's reputation for successful deployments is widely recognized.

Expanding into Commercial Markets

While Palantir’s government contracts form a significant part of its revenue, its expansion into the commercial sector is crucial for achieving a trillion-dollar valuation. This presents both opportunities and challenges.

- Growth in commercial clients: Palantir is actively expanding its clientele in various commercial sectors, including financial services, healthcare, and aerospace. Significant progress has been made, but the pace of adoption needs to accelerate to meet the trillion-dollar target.

- Success stories in commercial applications: Palantir’s platform aids in supply chain optimization, fraud detection, and risk management, demonstrating its versatility across industries. These successes need to be widely publicized to attract further commercial adoption.

- Competition analysis: The commercial market is far more competitive than the government sector. Key competitors include companies like Databricks, Snowflake, and even established tech giants like Google and Amazon. Palantir needs to differentiate itself effectively to maintain a strong market share.

Growth Drivers and Potential Challenges

Achieving a trillion-dollar valuation requires sustained, exponential growth. Several factors will determine whether Palantir can achieve this ambitious goal.

Technological Innovation and R&D

Palantir's commitment to research and development is paramount to its future success. Continued innovation is essential to maintaining a competitive edge and expanding its product offerings.

- New product developments: Palantir is continuously developing new features and capabilities within its existing platforms, as well as exploring new product lines leveraging AI and machine learning. The success of these initiatives will be vital.

- Investment in AI and machine learning: The integration of advanced AI and machine learning capabilities is crucial for enhancing Palantir's data analytics capabilities and providing more sophisticated insights to its clients.

- Patents and intellectual property: A strong intellectual property portfolio provides a significant competitive moat, safeguarding Palantir's technological advantage.

Financial Performance and Projections

Analyzing Palantir's financial performance and growth projections is crucial for assessing the feasibility of a trillion-dollar valuation.

- Revenue growth trends: Palantir’s revenue growth needs to be consistently strong and accelerate significantly in the coming years to justify such a high valuation.

- Profitability and margins: Achieving sustained profitability and healthy margins is critical for attracting investors and sustaining long-term growth.

- Stock valuation and market capitalization: The current market capitalization provides a baseline, but the trajectory of the stock price will be highly indicative of investor confidence in Palantir's ability to reach its ambitious goals.

- Analyst predictions: While analyst predictions should be viewed with caution, they provide insights into market expectations and the perceived likelihood of Palantir achieving a trillion-dollar valuation.

Geopolitical Factors and Regulatory Landscape

External factors can significantly influence Palantir's growth trajectory.

- Government contracts and their stability: The stability and volume of government contracts are crucial for Palantir's revenue stream. Changes in government priorities or budget cuts could impact its growth.

- Data privacy regulations and compliance: Stringent data privacy regulations, such as GDPR and CCPA, necessitate ongoing compliance efforts, impacting operational costs and potentially limiting market access.

- International expansion opportunities and challenges: Expanding into new international markets presents significant opportunities but also necessitates navigating diverse regulatory landscapes and cultural nuances.

Conclusion: The Trillion-Dollar Palantir Question – A Verdict

Whether Palantir can reach a trillion-dollar valuation by 2030 is a complex question. While the company possesses significant strengths – including its dominant position in niche markets, proprietary technology, and expanding commercial reach – it also faces considerable challenges, such as intense competition in the commercial sector and the inherent volatility of the global political and regulatory environment. Sustained high revenue growth, increased profitability, and successful expansion into new markets are all critical for achieving this ambitious goal. The trajectory of Palantir's stock price and the company's strategic execution will ultimately determine whether a trillion-dollar Palantir remains a realistic aspiration or a far-fetched dream. Continue following Palantir's journey to see if a trillion-dollar valuation remains a realistic goal. Stay tuned for future updates on Palantir's growth and market performance.

Featured Posts

-

First Listen Mariah The Scientists Burning Blue

May 10, 2025

First Listen Mariah The Scientists Burning Blue

May 10, 2025 -

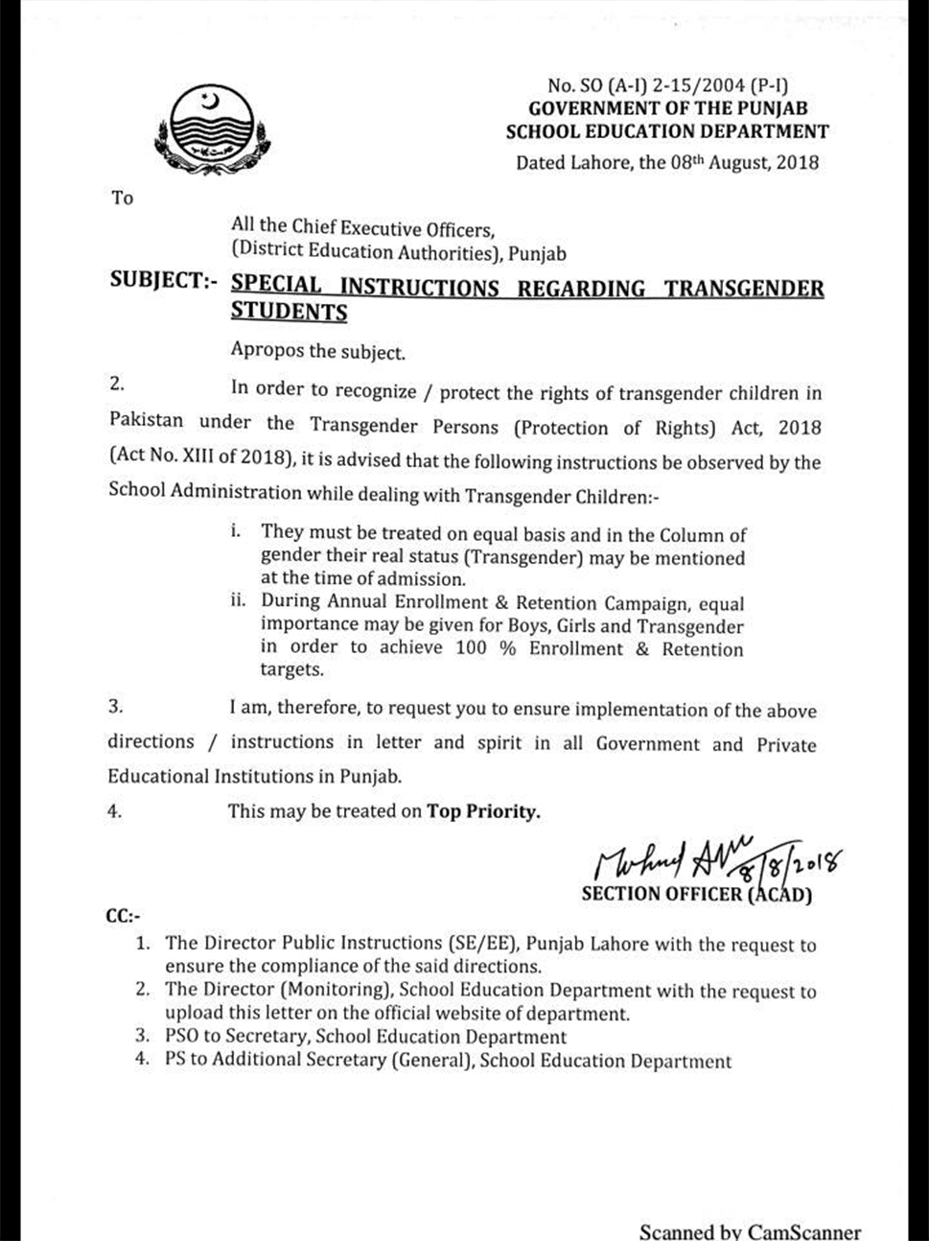

Have Trumps Executive Orders Affected You Transgender Voices

May 10, 2025

Have Trumps Executive Orders Affected You Transgender Voices

May 10, 2025 -

Kas Nutiko Dakotai Johnson Nuotraukos Ir Paaiskinimai

May 10, 2025

Kas Nutiko Dakotai Johnson Nuotraukos Ir Paaiskinimai

May 10, 2025 -

New Program Offers Technical Skills Training To Transgender People In Punjab

May 10, 2025

New Program Offers Technical Skills Training To Transgender People In Punjab

May 10, 2025 -

Descubre El Bolso Hereu El Accesorio Imprescindible Segun Dakota Johnson

May 10, 2025

Descubre El Bolso Hereu El Accesorio Imprescindible Segun Dakota Johnson

May 10, 2025