Is A Wall Street Revival A Threat To The DAX's Recent Success?

Table of Contents

Analyzing the Current State of the DAX

Recent DAX Performance and Key Drivers

The DAX's recent positive performance can be attributed to several key factors. Germany's relatively strong economy, coupled with a broader European Union recovery, has fueled investor confidence. Specific sectors within the DAX have also significantly outperformed.

- Strong export numbers from Germany: Germany's robust export sector has played a crucial role in its economic strength, contributing directly to DAX growth.

- Positive investor sentiment towards European markets: A general feeling of optimism surrounding European markets has attracted significant investment into the DAX.

- Specific sectors outperforming within the DAX: The automotive and technology sectors, for example, have seen particularly strong growth, boosting the overall DAX performance.

- Impact of low interest rates and government stimulus: Monetary policies and government interventions have also played a part in supporting the DAX's upward trajectory.

Vulnerabilities of the DAX

Despite its recent success, the DAX is not without its vulnerabilities. Several factors could impact its future performance.

- Global supply chain disruptions: Ongoing supply chain issues continue to pose a risk to German industries and, consequently, the DAX.

- Rising energy prices impacting German industries: Soaring energy costs present a significant challenge to German businesses, potentially dampening economic growth and DAX performance.

- Geopolitical tensions and their impact on investor confidence: Global political instability can negatively affect investor sentiment, leading to market volatility and potentially impacting the DAX.

The Wall Street Revival: Factors and Implications

Drivers of Wall Street's Resurgence

The revival on Wall Street is fueled by several factors, indicating a strong US economy.

- Strong US economic indicators: Positive economic data, such as strong employment figures and consumer spending, have boosted investor confidence.

- Federal Reserve monetary policy adjustments: The Federal Reserve's actions, while impacting inflation, have also influenced market sentiment and investment flows.

- Positive investor sentiment driven by technological advancements: Continued innovation in technology sectors is driving significant investment and contributing to Wall Street's growth.

Potential Impact on Global Markets

A robust Wall Street can significantly influence global markets.

- Increased competition for investment capital: A thriving US market may draw investment away from other regions, including Europe.

- Potential shift in investor preferences: Investors might reallocate their portfolios, favoring US assets over European ones, impacting the DAX.

- Impact on the Euro/Dollar exchange rate: The relative strength of the US dollar compared to the Euro could also affect the DAX's performance.

Correlation Between Wall Street and the DAX

Historically, the DAX and the US stock market have shown a degree of correlation, although it's not always perfectly aligned. Periods of convergence and divergence exist. Factors like global economic conditions and overall investor sentiment heavily influence the strength of this relationship. Analyzing historical data reveals periods where the two markets moved in tandem and others where they diverged significantly. The future could see either increased interdependence or potential decoupling, depending on various global factors.

Assessing the Threat Level

Based on the analysis above, a Wall Street revival poses a potential, but not necessarily insurmountable, threat to the DAX's recent success. Several scenarios are possible:

- Low-threat scenario: Both markets experience continued growth, with limited impact on each other.

- Medium-threat scenario: Wall Street's growth outpaces the DAX, leading to some capital outflow from Europe.

- High-threat scenario: A significant shift in investor preference towards the US causes a considerable downturn in DAX performance.

However, mitigating factors exist, such as continued strength in the German economy and specific sectors within the DAX. Opportunities may still exist for the DAX, even with a strong Wall Street.

Conclusion: Wall Street Revival and the Future of the DAX – A Cautious Outlook

In conclusion, while a Wall Street revival presents a potential threat to the DAX's continued success, it doesn't necessarily doom the German index. The DAX's performance is influenced by a multitude of factors, and its resilience should not be underestimated. The interplay between these two major markets is complex and dynamic. To make informed investment decisions, it is crucial to monitor DAX performance closely and stay updated on Wall Street trends. Understanding the interplay between DAX and Wall Street performance is paramount. Continuous monitoring and analysis are key to navigating this evolving market landscape.

Featured Posts

-

L Effetto Dei Dazi Sulle Importazioni Di Moda Negli Stati Uniti

May 25, 2025

L Effetto Dei Dazi Sulle Importazioni Di Moda Negli Stati Uniti

May 25, 2025 -

Tariffs And The Fed Jerome Powells Concerns About Economic Stability

May 25, 2025

Tariffs And The Fed Jerome Powells Concerns About Economic Stability

May 25, 2025 -

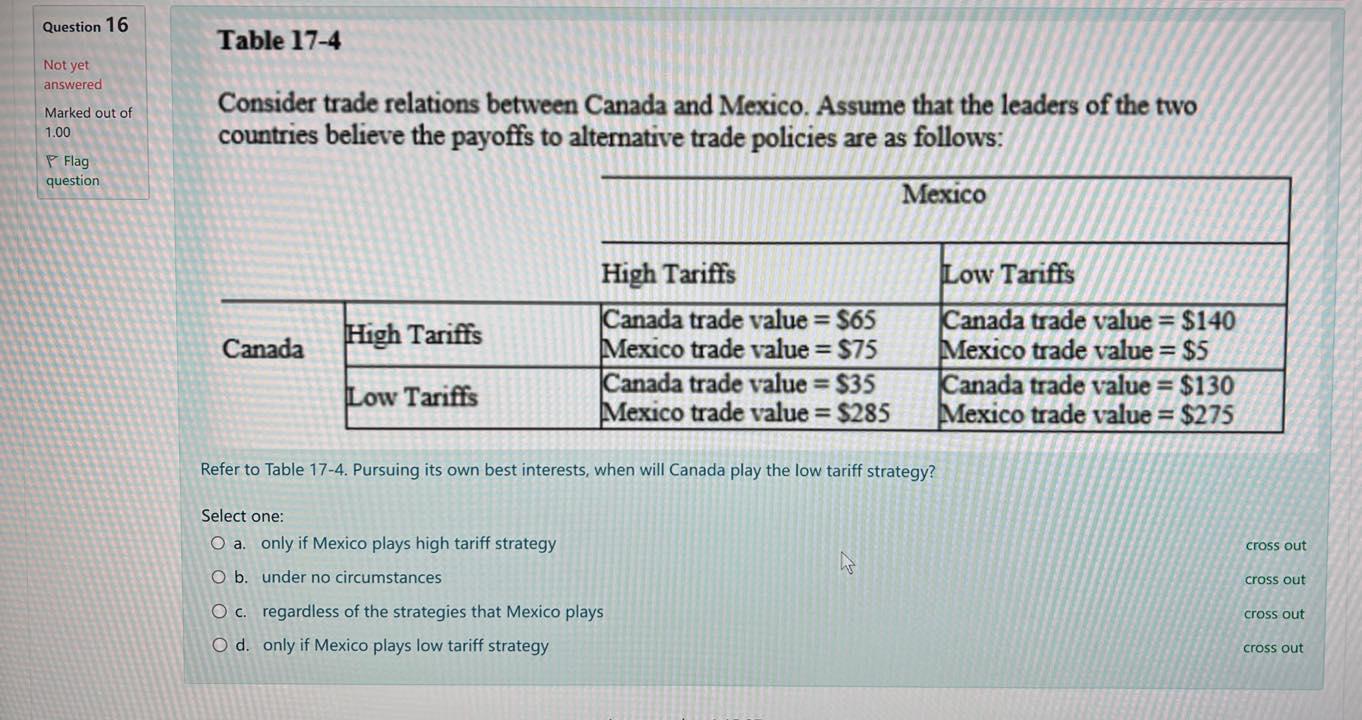

Strengthening Canada Mexico Trade Relations In The Face Of Us Protectionism

May 25, 2025

Strengthening Canada Mexico Trade Relations In The Face Of Us Protectionism

May 25, 2025 -

Umfjoellun Um Fyrstu Rafutgafu Porsche Macan

May 25, 2025

Umfjoellun Um Fyrstu Rafutgafu Porsche Macan

May 25, 2025 -

Flash Flood Emergency Response Essential Safety Tips

May 25, 2025

Flash Flood Emergency Response Essential Safety Tips

May 25, 2025