Is Apple Stock A Buy Ahead Of Its Q2 Report? Analysis Of Current Levels

Table of Contents

Apple's Recent Performance and Market Trends

Analyzing Q1 2024 Results and Their Implications

Apple's Q1 2024 results offered a mixed bag. While the company exceeded expectations in certain areas, others fell short, highlighting the challenges faced by the tech sector. Key performance indicators will need to be analyzed closely to understand the overall picture. For example, while iPhone sales might have remained strong, a decline in Mac sales could point to weakening demand in specific product categories.

- Positive Aspects: Strong iPhone sales, growth in services revenue, exceeding earnings-per-share (EPS) expectations.

- Negative Aspects: Decline in Mac sales, concerns about overall consumer spending impacting sales, impact of global economic uncertainty.

- Macroeconomic Impact: Inflation and recessionary fears continue to impact consumer spending, potentially affecting Apple's future performance. Comparing Q1 2024 to previous quarters and industry benchmarks will be critical to gauge the company’s resilience against these macroeconomic headwinds.

Current Market Sentiment Towards Tech Stocks

The overall market sentiment toward tech stocks remains cautious. The Nasdaq, a key indicator of tech performance, has experienced volatility in recent months, reflecting investor concerns about interest rates, inflation, and geopolitical instability. This uncertainty directly affects Apple's valuation, as investor confidence plays a significant role in its stock price.

- Nasdaq Performance: Analyzing the Nasdaq's performance in relation to Apple's stock price can provide insights into the correlation between the broader tech sector and Apple's specific performance.

- Investor Confidence: Factors such as regulatory changes and geopolitical events can significantly influence investor confidence in the tech sector, creating both risks and opportunities for Apple.

- Competitor Analysis: Examining the performance of Apple's competitors, such as Samsung and Microsoft, helps assess its market share and competitive positioning.

Analyzing Apple's Q2 Expectations and Predictions

Analyst Predictions and Price Targets

Analyst predictions for Apple's Q2 earnings vary considerably, reflecting the uncertainty surrounding the company's performance. While some analysts maintain a "buy" rating with high price targets, others express caution, suggesting a "hold" or even "sell" rating. This divergence in opinions highlights the need for thorough due diligence before investing.

- Buy Ratings: Analysts citing strong iPhone demand and growth in services as reasons for optimism.

- Hold/Sell Ratings: Analysts expressing concern over potential macroeconomic headwinds and weakening consumer demand.

- Price Target Range: A broad range of price targets will be observed, reflecting the uncertainty surrounding the Q2 report. Sources for all predictions and data should be clearly cited.

Key Factors Influencing Q2 Performance

Several crucial factors could significantly impact Apple's Q2 results. These include new product launches (e.g., new iPhones, potential AR/VR headset release), supply chain disruptions, consumer spending patterns, and geopolitical instability. Each of these factors warrants careful consideration.

- New Product Launches: Successful new product launches can boost sales and positively impact the Q2 report. However, failures or delays can have the opposite effect.

- Supply Chain Issues: Ongoing global supply chain challenges can constrain production and negatively impact revenue.

- Consumer Spending: The overall health of the global economy will inevitably impact consumer willingness to spend on Apple products.

- Geopolitical Events: Unforeseen geopolitical events can create further uncertainty and affect Apple's financial performance.

Valuation and Investment Considerations

Apple's Current Valuation Metrics

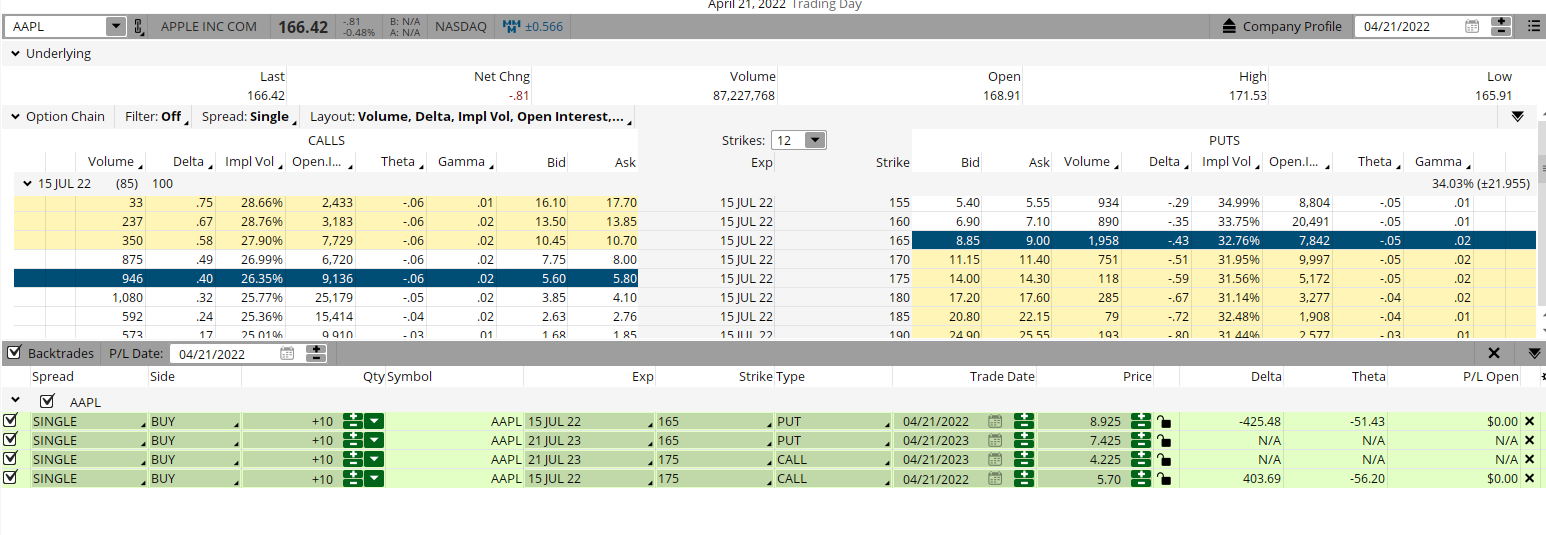

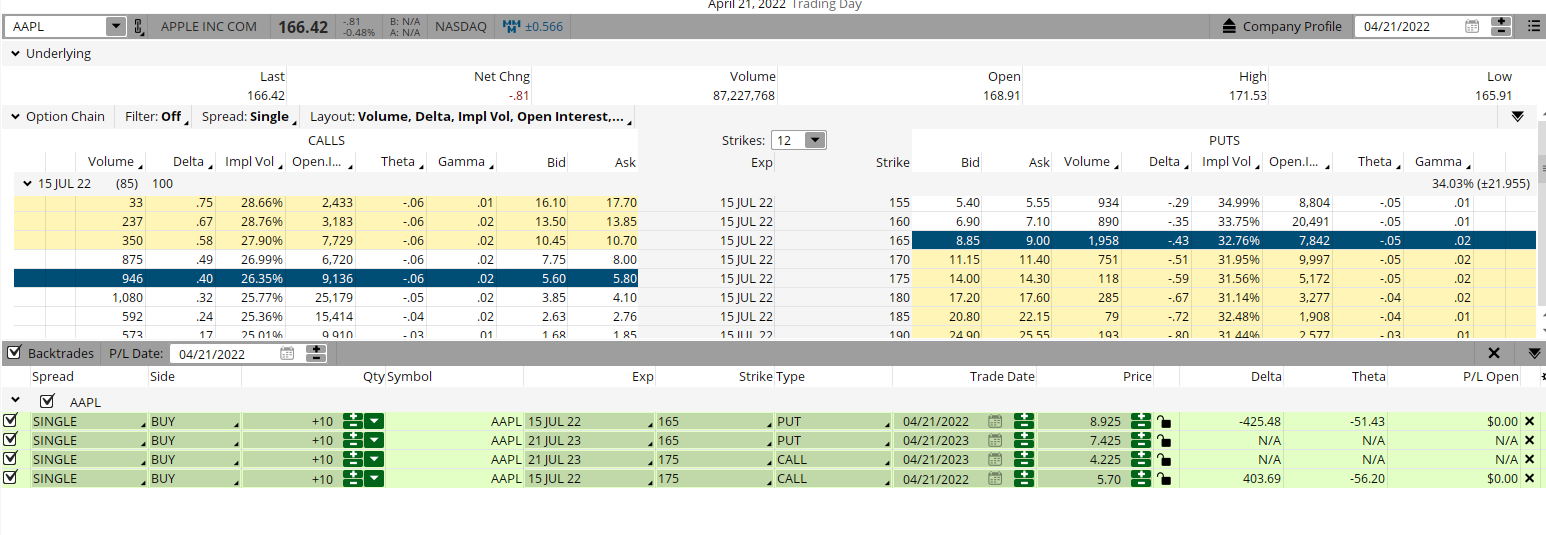

Analyzing Apple's valuation using key metrics such as the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and other relevant indicators, is essential. Comparing these metrics to historical data and industry competitors helps determine whether Apple is currently overvalued, undervalued, or fairly valued.

- P/E Ratio: Comparing Apple’s current P/E ratio to its historical average and to those of its competitors helps evaluate its relative valuation.

- P/S Ratio: The P/S ratio can provide insights into the market's assessment of Apple’s revenue growth potential.

- Valuation Implications: Understanding Apple's valuation is crucial in making informed investment decisions. An overvalued stock might be more vulnerable to price corrections, while an undervalued stock could offer better growth potential.

Risks and Rewards of Investing in Apple Stock

Before investing in Apple stock, it's essential to weigh the potential risks and rewards. Both short-term and long-term investment strategies need to be considered.

- Risks: Competition from other tech companies, economic downturns, regulatory changes, supply chain disruptions, and changes in consumer preferences pose significant risks.

- Rewards: Apple's strong brand recognition, consistent innovation, and potential for long-term growth offer significant rewards, including potential dividend payouts.

Conclusion: Is Apple Stock a Buy? A Final Verdict Based on Q2 Expectations

This analysis of Apple's recent performance, Q2 expectations, and valuation reveals a mixed picture. While Apple's strong brand and innovation capacity suggest significant long-term growth potential, current macroeconomic headwinds and market uncertainty introduce considerable risk. There is no definitive "buy" or "sell" recommendation; the decision depends on your personal risk tolerance and investment horizon.

While this analysis provides insights into whether Apple stock is a buy ahead of its Q2 report, remember to conduct your own comprehensive research before making any investment decisions. Continuously monitor Apple stock performance and stay updated on market trends to make informed choices about your Apple stock investments.

Featured Posts

-

The Importance Of Middle Managers A Key To Employee Engagement And Productivity

May 24, 2025

The Importance Of Middle Managers A Key To Employee Engagement And Productivity

May 24, 2025 -

Artfae Daks Alalmany Tjawz Mstwa Mars Alqyasy

May 24, 2025

Artfae Daks Alalmany Tjawz Mstwa Mars Alqyasy

May 24, 2025 -

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 24, 2025

Tracking The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 24, 2025 -

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025 -

The Fallout Annie Kilners Public Statements After Kyle Walkers Night Out

May 24, 2025

The Fallout Annie Kilners Public Statements After Kyle Walkers Night Out

May 24, 2025

Latest Posts

-

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025 -

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025 -

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025 -

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025 -

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025

Trumps Budget Cuts Threaten Museum Programs A Critical Analysis

May 24, 2025