Is Apple Stock Going To $254? A Wall Street Analyst's Prediction And Investment Analysis

Table of Contents

H2: The Analyst's Rationale Behind the $254 Apple Stock Prediction

The prediction of Apple stock reaching $254 originates from a prominent Wall Street analyst, [Analyst Name], at [Analyst Firm]. Their forecast is based on several key arguments, summarized below:

- Revolutionary New Product Line: The analyst points to the anticipated success of [mention specific product line or technology, e.g., the next-generation Apple AR/VR headset or significant advancements in Apple Silicon] as a major catalyst for growth. They project substantial demand and market penetration, driving significant revenue increases.

- Sustained Market Share Growth: [Analyst Name] highlights Apple's continued dominance in the premium smartphone market and its expanding presence in other sectors, like wearables and services. They anticipate further market share gains, contributing to revenue diversification and stability.

- Strong Financial Fundamentals: The analyst underscores Apple's robust financial position, characterized by high profit margins, strong cash flow, and effective cost management. These fundamentals provide a solid foundation for future growth and shareholder returns. The "$254 Apple stock target" is, in their view, a reflection of these strong fundamentals.

Chart/Graph: (Insert a relevant chart or graph illustrating the analyst's projected growth trajectory for Apple stock, clearly labelled with sources.)

The analyst's "Apple stock price prediction" relies heavily on these factors, with the "$254 Apple stock target" representing a confluence of optimistic projections. This "Analyst Apple stock forecast" is certainly ambitious, but let's delve deeper.

H2: Analyzing Apple's Current Financial Performance and Future Outlook

Apple's recent financial reports showcase impressive performance. Revenue growth [Insert percentage and period], earnings per share [Insert figures], and consistent growth in key areas such as services revenue provide a positive outlook. Key Performance Indicators (KPIs) such as customer loyalty, app store revenue, and the success of new product categories all point to continued strength. However, the road isn't without obstacles.

- Strengths: Strong brand recognition, loyal customer base, robust ecosystem, innovative products, and a diversified revenue stream.

- Weaknesses: High dependence on iPhone sales, increasing competition in the smartphone market (Android), potential supply chain disruptions, and increasing regulatory scrutiny.

These factors, combined with macroeconomic conditions, will significantly impact Apple's "Apple stock valuation" and whether the "$254 Apple stock target" is attainable. Understanding Apple's "Apple financial performance" in this context is crucial for investors.

H2: Factors That Could Impact Apple Stock Reaching $254

Reaching the $254 Apple stock target isn't guaranteed. Several factors could significantly impact the trajectory of Apple stock:

- Macroeconomic Headwinds: Inflation, rising interest rates, and a potential recession could dampen consumer spending and impact Apple's sales.

- Geopolitical Uncertainty: Global political instability and trade tensions could disrupt Apple's supply chain and negatively affect its operations.

- Supply Chain Disruptions: Ongoing supply chain challenges, including component shortages or manufacturing delays, could hinder production and impact Apple's ability to meet demand.

These "Apple stock risk factors" must be carefully considered. The "Apple stock market outlook" is subject to these unpredictable variables, impacting the "Apple stock volatility."

H2: Alternative Investment Strategies Considering the $254 Apple Stock Prediction

The $254 Apple stock prediction shouldn't be the sole factor driving your investment strategy. Diversification is key.

- Buying Apple Stock: A direct investment offers potential high returns if the prediction materializes, but carries significant risk.

- Apple Stock Options: Call options provide leveraged exposure to potential upside, but also amplify potential losses.

- ETFs Tracking Apple: Diversifying your portfolio with ETFs that include Apple mitigates risk while still benefiting from Apple's potential growth.

Each "Apple stock investment strategy" has its own set of risks and rewards. Carefully consider your risk tolerance and financial goals before making any investment decisions.

Conclusion: Is the $254 Apple Stock Target Achievable? Your Next Steps

The analyst's prediction of Apple stock reaching $254 is ambitious, predicated on several positive factors including new product success and continued market share growth. However, significant risks remain, including macroeconomic headwinds, geopolitical uncertainty, and potential supply chain disruptions. Whether this "Apple stock $254" prediction proves accurate depends on the interplay of these various factors. While Apple's financial performance is currently strong, the path to $254 is not without hurdles.

Before investing in Apple stock targeting $254, conduct thorough due diligence. Analyze the latest Apple stock forecasts, assess your risk tolerance, and diversify your portfolio appropriately. Learn more about Apple stock’s potential and remember that every investment decision carries inherent risk. Carefully consider all factors before pursuing any Apple stock investment strategy.

Featured Posts

-

Le Silence De Thierry Ardisson Face Aux Accusations De Sexisme

May 25, 2025

Le Silence De Thierry Ardisson Face Aux Accusations De Sexisme

May 25, 2025 -

Novo Ferrari 296 Speciale Impressoes E Avaliacao Do Hibrido De 880 Cv

May 25, 2025

Novo Ferrari 296 Speciale Impressoes E Avaliacao Do Hibrido De 880 Cv

May 25, 2025 -

Jenson Fw 22 Extended New Styles And Details

May 25, 2025

Jenson Fw 22 Extended New Styles And Details

May 25, 2025 -

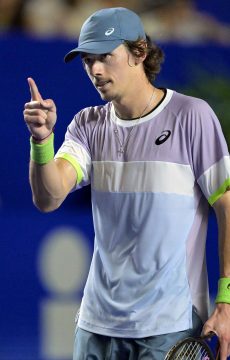

Madrid Open Update De Minaurs Early Exit And Swiateks Dominant Win

May 25, 2025

Madrid Open Update De Minaurs Early Exit And Swiateks Dominant Win

May 25, 2025 -

The Hells Angels Unmasking The Brotherhood

May 25, 2025

The Hells Angels Unmasking The Brotherhood

May 25, 2025