Is Apple Stock Still A Good Investment? Analyzing Wedbush's Prediction

Table of Contents

Wedbush's Bullish Prediction for Apple Stock

Wedbush Securities recently issued a bullish prediction for Apple stock, setting a price target significantly higher than the current market price. Their rationale centers on several key factors driving Apple's continued growth. This optimistic outlook suggests strong potential for Apple stock investment in the coming years. The specific target price and the detailed reasoning behind it are crucial elements in evaluating this prediction’s validity. Understanding the underpinnings of this bullish sentiment is key to assessing whether an Apple stock investment aligns with your risk profile.

Analyzing the iPhone's Continued Success

The iPhone remains the cornerstone of Apple's revenue generation, making its continued success paramount for Apple stock investment performance. Analyzing iPhone sales trends is crucial for evaluating the long-term prospects of an Apple stock investment.

- iPhone sales trends: While there might be periods of slower growth or even slight declines, the iPhone consistently maintains a significant market share. New innovations and features consistently drive sales, making it a resilient product.

- New iPhone models and their expected impact on sales: The anticipation surrounding new iPhone releases often creates significant pre-order demand and subsequent sales boosts. Innovative features and improvements play a crucial role in maintaining this demand.

- Factors influencing iPhone demand: Global economic conditions, competition from Android devices, and consumer sentiment all influence iPhone demand. Understanding these factors is crucial for forecasting future Apple stock performance. A strong global economy generally supports higher consumer spending on electronics, benefiting Apple.

The Growth of Apple's Services Ecosystem

Beyond hardware sales, Apple's services sector—comprising App Store revenue, iCloud storage, Apple Music subscriptions, Apple TV+, and more—is a critical driver of long-term growth and a key consideration for Apple stock investment. This recurring revenue stream provides stability and predictability, mitigating the cyclical nature of hardware sales.

- Growth rate of Apple's services segment: Apple's services revenue has consistently shown robust growth, outpacing the growth of its hardware segment in recent years. This signifies a shift towards a more sustainable and predictable revenue model.

- New services offerings and their potential: Apple continually expands its services portfolio, introducing new offerings to cater to diverse consumer needs. The potential for future service growth is considerable and directly impacts Apple stock value.

- Subscription model's impact on recurring revenue: The subscription-based nature of many Apple services ensures a steady stream of recurring revenue, reducing reliance on sporadic hardware sales and providing increased predictability for investors considering an Apple stock investment.

Potential Risks and Challenges Facing Apple Stock

While Wedbush's prediction is positive, potential risks and challenges must be considered before investing in Apple stock. A balanced perspective acknowledging both upside and downside potential is crucial for making an informed investment decision.

Competition in the Tech Sector

Apple faces stiff competition from tech giants like Samsung and Google. Analyzing the competitive landscape is essential for evaluating the long-term viability of an Apple stock investment.

- Key competitors and their market strategies: Samsung's Android-based phones and Google's Android operating system present significant competitive threats. Their strategies frequently focus on price competitiveness and diverse product offerings.

- Apple's competitive advantages and disadvantages: Apple's brand loyalty, user-friendly ecosystem, and premium pricing strategy are key advantages. However, its higher price point can limit market reach in price-sensitive segments.

- Potential disruptions to Apple's market dominance: Technological advancements and shifts in consumer preferences could disrupt Apple's market dominance. Staying ahead of the curve and adapting to market trends is critical for Apple's continued success.

Global Economic Uncertainty and Supply Chain Issues

Macroeconomic factors significantly influence Apple's performance and are crucial considerations for anyone considering an Apple stock investment.

- Inflation and its influence on consumer spending: High inflation can reduce consumer spending on discretionary items like iPhones, impacting Apple's sales.

- Supply chain disruptions and their potential consequences: Global supply chain disruptions can lead to production delays and shortages, affecting Apple's ability to meet demand.

- Geopolitical risks and their impact on Apple's operations: Geopolitical instability can impact Apple's operations in various regions, creating uncertainty for potential investors.

Comparing Apple Stock to Other Tech Investments

Before committing to an Apple stock investment, comparing it to other leading tech stocks like Microsoft, Google (Alphabet), and Amazon provides valuable context.

- Growth potential: Each company offers a different growth trajectory, influenced by their respective market positions and strategic directions.

- Risk profiles: Apple's relatively stable revenue streams present a different risk profile compared to the more volatile growth stocks of other tech companies.

- Dividend payouts: Consider the dividend policies of these companies; some may offer dividend payouts, while others reinvest profits for growth.

Conclusion

Whether Apple stock is a good investment depends on your individual risk tolerance and investment goals. While Wedbush's prediction is bullish, and Apple's services segment offers strong growth potential, factors such as competition, global economic uncertainty, and supply chain challenges present potential risks. This detailed analysis should provide a comprehensive understanding of the factors influencing Apple stock investment potential. Remember to conduct thorough research and consider consulting with a financial advisor before making any investment decisions concerning Apple stock. Remember to carefully assess your personal financial situation before investing in Apple stock or any other stock.

Featured Posts

-

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025

Escape To The Country Nicki Chapmans Chiswick Garden Revealed

May 24, 2025 -

Frankfurt Stock Exchange Dax Inches Closer To New Record High

May 24, 2025

Frankfurt Stock Exchange Dax Inches Closer To New Record High

May 24, 2025 -

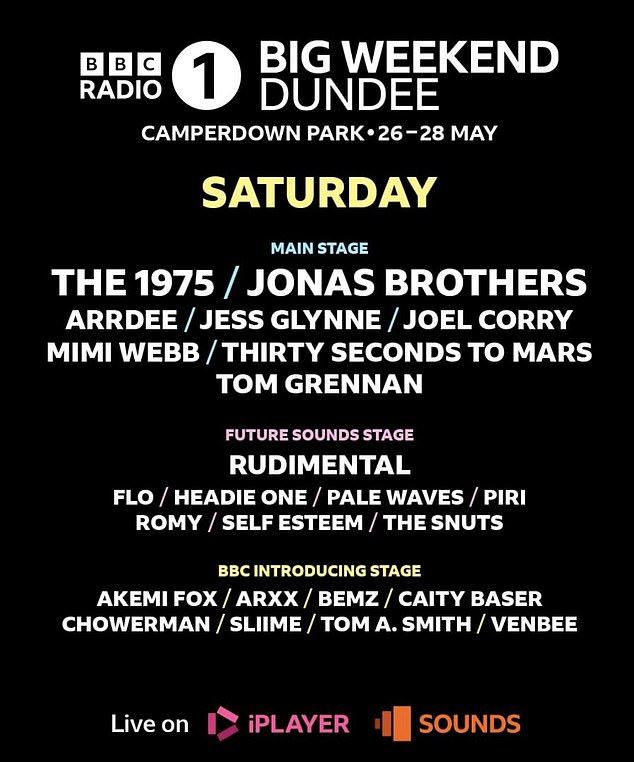

How To Get Bbc Big Weekend 2025 Sefton Park Tickets

May 24, 2025

How To Get Bbc Big Weekend 2025 Sefton Park Tickets

May 24, 2025 -

10 Let Pobediteley Evrovideniya Tvorcheskaya Zhizn Posle Pobedy

May 24, 2025

10 Let Pobediteley Evrovideniya Tvorcheskaya Zhizn Posle Pobedy

May 24, 2025 -

Are Airplane Accidents Common Visualizing The Reality Of Air Travel Safety

May 24, 2025

Are Airplane Accidents Common Visualizing The Reality Of Air Travel Safety

May 24, 2025

Latest Posts

-

Open Ais 2024 Event Streamlined Voice Assistant Development

May 24, 2025

Open Ais 2024 Event Streamlined Voice Assistant Development

May 24, 2025 -

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025

Trump Administrations Impact On Museum Funding And Cultural Institutions

May 24, 2025 -

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025

Analyzing The Long Term Effects Of Trumps Museum Funding Cuts

May 24, 2025 -

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025

The State Of Museum Programs Following Trumps Budget Reductions

May 24, 2025 -

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025

Funding Cuts And The Future Of Museum Programs A Post Trump Perspective

May 24, 2025