Is Apple Vulnerable? Analyzing The Impact Of Past Tariffs On Buffett's Holdings

Table of Contents

Past Tariff Battles and Their Effect on Apple's Pricing and Profitability

The Trade War with China

The US-China trade war, escalating from 2018, significantly impacted Apple. Tariffs imposed on goods manufactured in China directly increased Apple's production costs. This forced Apple to implement several strategies to mitigate the impact.

- Increased production costs: Tariffs added a significant percentage to the cost of manufacturing iPhones, iPads, and other products assembled in China.

- Price increases for consumers: To maintain profit margins, Apple partially passed these increased costs onto consumers through higher prices, impacting sales volume.

- Impact on Apple's profit margins: Despite price increases, profit margins were squeezed due to the substantial increase in manufacturing costs.

- Shifts in manufacturing locations: Apple began diversifying its manufacturing base, shifting some production to countries like India and Vietnam to reduce reliance on China and avoid tariffs.

For example, the 25% tariff on certain imported components directly affected the cost of the iPhone, as documented in Apple's quarterly financial reports during that period. News outlets widely reported on the price increases implemented by Apple in response to the escalating tariffs.

Other Tariff Impacts

Beyond the China trade war, other tariff disputes impacted Apple's supply chain. Tariffs on specific components or raw materials sourced from various countries disrupted production and forced Apple to seek alternative suppliers.

- Supply chain disruptions: Tariffs caused delays and uncertainty in the supply chain, impacting product availability and potentially delaying product launches.

- Alternative sourcing strategies: Apple actively sought alternative suppliers and manufacturing locations to circumvent tariff-related issues and maintain supply stability.

- Long-term effects on manufacturing efficiency: The constant need to adapt to changing tariff landscapes affected long-term manufacturing efficiency and planning.

These adjustments, while successful in the short term, demonstrate the inherent vulnerability of relying on a global supply chain susceptible to fluctuating trade policies.

Warren Buffett's Investment Strategy and Risk Tolerance

Buffett's Long-Term Perspective

Warren Buffett's investment philosophy centers on a long-term outlook, focusing on fundamentally sound companies with strong growth potential. This long-term strategy influences his assessment of risks associated with Apple.

- Buffett's confidence in Apple's long-term prospects: Buffett's investment in Apple demonstrates his confidence in the company's enduring brand strength and market position.

- The impact of short-term fluctuations on his strategy: Short-term market volatility, including fluctuations caused by tariffs, generally doesn't significantly deter Buffett from his long-term investment plans.

- His history of weathering market downturns: Buffett's history shows a capacity to navigate economic downturns and market fluctuations, suggesting resilience to tariff-related shocks.

Buffett’s public statements and Berkshire Hathaway's investment decisions consistently showcase this patient, long-term approach.

Diversification and Portfolio Resilience

Apple constitutes a significant but not overwhelming portion of Berkshire Hathaway's diverse portfolio. This diversification is crucial in mitigating risks related to any single investment, including Apple.

- The diversification of Berkshire Hathaway's holdings: Berkshire Hathaway invests across various sectors, reducing the impact of any single sector's underperformance.

- How Apple contributes to overall portfolio stability: While significant, Apple's contribution is balanced by other investments, providing overall portfolio stability.

- The potential for offsetting losses from other sectors: Strong performance in other sectors can offset potential losses from Apple caused by external factors like tariffs.

The broad diversification of Berkshire Hathaway's portfolio acts as a significant buffer against the risks associated with Apple’s vulnerability to external factors.

Future Tariff Risks and Their Potential Impact on Apple and Buffett's Investment

Geopolitical Uncertainty and Trade Relations

The current geopolitical landscape presents significant uncertainty regarding future trade relations and potential tariffs. This uncertainty poses ongoing risks for Apple.

- Potential for future trade disputes: Future trade conflicts could lead to new tariffs, impacting Apple's supply chain and profitability.

- The likelihood of further tariff increases: Depending on international relations, the possibility of further tariff increases remains a real threat.

- The vulnerability of Apple's supply chains: Apple’s global supply chains remain vulnerable to disruptions caused by protectionist trade policies.

Predicting the future is impossible, but analyzing potential scenarios and their impact on Apple is crucial for risk assessment.

Mitigation Strategies and Apple's Adaptability

Apple has already demonstrated adaptability in response to past tariffs, and it's likely to continue developing strategies to mitigate future risks.

- Diversification of manufacturing locations: Further expansion of manufacturing into diverse regions reduces dependence on any single country.

- Development of alternative supply chains: Building robust and diverse supply chains helps minimize disruptions from tariff-related issues.

- Lobbying efforts to influence trade policy: Apple, alongside other tech companies, may engage in lobbying efforts to influence trade policy and reduce tariff risks.

The effectiveness of these strategies will ultimately determine the long-term resilience of Apple's business model and the safety of Buffett's investment.

Conclusion: Is Apple Still a Safe Bet? Assessing the Vulnerability of Buffett's Holdings

Historically, tariffs have impacted Apple's pricing, profitability, and supply chain. While Apple has shown adaptability, the ongoing geopolitical uncertainty and potential for future trade disputes suggest a degree of vulnerability. Warren Buffett's long-term investment strategy and Berkshire Hathaway's diversified portfolio mitigate these risks to some extent. However, the potential for future tariff increases and disruptions remains a factor to consider.

This analysis reiterates the importance of considering tariff risks when assessing Apple's future prospects. While Apple’s inherent strengths remain significant, the potential impact of future trade policies cannot be ignored. Stay informed about the ongoing impact of tariffs on Apple and the vulnerability of significant investments. Further research into Apple’s financial performance, international trade policies, and Warren Buffett’s investment strategies will provide a more comprehensive understanding of this complex issue.

Featured Posts

-

Motorcycle Crash Claims Life Of Hells Angels Member Clubs Reaction

May 25, 2025

Motorcycle Crash Claims Life Of Hells Angels Member Clubs Reaction

May 25, 2025 -

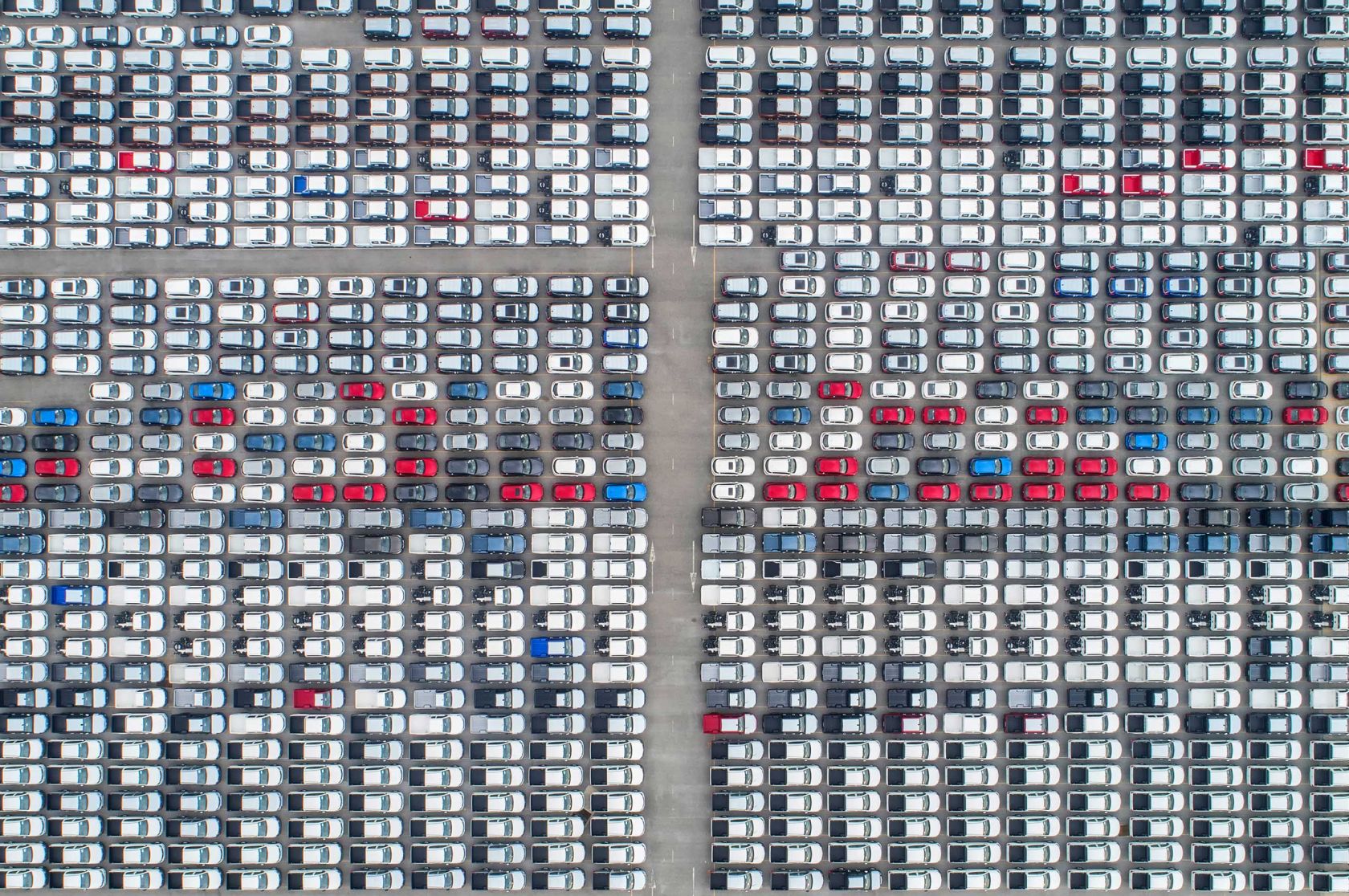

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Automakers

May 25, 2025

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Automakers

May 25, 2025 -

Exploring The World Of The Hells Angels

May 25, 2025

Exploring The World Of The Hells Angels

May 25, 2025 -

Annie Kilner Shows Off Diamond Ring After Walker Sighting

May 25, 2025

Annie Kilner Shows Off Diamond Ring After Walker Sighting

May 25, 2025 -

Three Set Battle Gauff Triumphs Over Zheng At Italian Open

May 25, 2025

Three Set Battle Gauff Triumphs Over Zheng At Italian Open

May 25, 2025