Is BigBear.ai Stock A Good Buy In 2024? A Data-Driven Perspective

Table of Contents

The stock market's volatility can be daunting, making informed investment decisions crucial. BigBear.ai, a company specializing in AI and big data solutions for both government and commercial sectors, presents an interesting case study. Its potential for growth is undeniable, but is BigBear.ai stock the right investment for you in 2024? This article aims to provide a data-driven analysis to help you determine whether BigBear.ai shares are a worthwhile addition to your portfolio. We'll examine BigBear.ai's financial performance, market position, and inherent risks to offer a comprehensive perspective on BigBear.ai investment opportunities.

BigBear.ai's Financial Performance and Valuation

Revenue Growth and Profitability

BigBear.ai's revenue growth trajectory needs careful scrutiny to understand its financial health. Analyzing the past few years reveals [Insert data on revenue growth – e.g., a specific percentage increase or decrease year-over-year, with supporting links to financial reports]. This growth (or lack thereof) needs to be considered alongside profitability. While [Insert data on profitability – e.g., net income, operating income, or gross margins with supporting data and links], it's crucial to look at key financial ratios. For example, the company's revenue growth rate, profit margins, and debt-to-equity ratio are all essential indicators of its financial stability. [Include a chart or graph visually representing this data]. A high debt-to-equity ratio, for instance, could signal increased financial risk associated with BigBear.ai investment.

Valuation Metrics

Valuing BigBear.ai stock requires comparing its Price-to-Earnings (P/E) ratio with industry peers. A high P/E ratio might suggest the market anticipates significant future growth, but it could also indicate overvaluation. Conversely, a low P/E ratio may point to undervaluation or potential future underperformance. Similarly, the Price-to-Sales (P/S) ratio provides another perspective on valuation. [Insert data on P/E and P/S ratios, comparing them to industry averages, and provide context and links to sources]. Factors like market sentiment and projected future growth heavily influence the valuation of BigBear.ai shares. Considering these factors in conjunction with the financial ratios offers a clearer picture of whether BigBear.ai stock is overvalued, undervalued, or fairly priced.

Market Position and Competitive Landscape

Market Share and Growth Potential

BigBear.ai operates in the rapidly expanding AI and big data market. Understanding its market share within this sector is critical. [Insert data on BigBear.ai's market share with sources]. The growth potential of this market segment is significant, driven by [mention factors like increasing government spending on AI, growing demand for data analytics in various industries, etc.]. However, BigBear.ai faces competition from established players like [list key competitors and briefly describe their strengths]. BigBear.ai's competitive advantages might include [list its key advantages, e.g., specialized expertise, unique technology, strong government relationships]. Conversely, its disadvantages could include [mention potential disadvantages, e.g., limited resources compared to larger competitors, dependence on specific government contracts].

Technological Innovation and Future Outlook

BigBear.ai's technological capabilities and its innovation pipeline are paramount. Its success hinges on continuous innovation in AI and big data analytics. [Describe its key technologies and innovation efforts. Include details on research and development spending and any recent breakthroughs or patents]. Analyzing the company's research and development (R&D) investments provides insight into its commitment to future growth. Potential disruptions, such as advancements by competitors or shifts in market demand, pose risks that need careful consideration. Understanding the technological landscape and its evolution is critical when evaluating BigBear.ai shares as an investment.

Risk Assessment and Potential Downsides

Financial Risks

Investing in BigBear.ai stock carries inherent financial risks. [Analyze its financial risks, for example, high debt levels, cash flow inconsistencies, or over-reliance on government contracts. Support your claims with data and references]. The company's financial stability and its ability to weather economic downturns need careful evaluation. High debt levels, for instance, could restrict its flexibility and increase its vulnerability to economic shocks.

Market Risks

Market risks are also substantial. Increased competition, changing government regulations (particularly impacting government contracts), or shifts in overall market demand could negatively impact BigBear.ai's performance. The volatility of BigBear.ai's stock price is another major consideration for potential investors. Past price fluctuations should be analyzed to assess the risk tolerance needed for this investment.

Operational Risks

Operational risks, such as cybersecurity threats, data breaches, or difficulties scaling operations, could significantly affect BigBear.ai. The company's ability to protect sensitive data and maintain operational efficiency is crucial for long-term success. A thorough assessment of these operational risks is essential before considering a BigBear.ai investment.

Conclusion: Is BigBear.ai Stock a Buy, Sell, or Hold in 2024?

Based on the data-driven analysis presented above, [state your recommendation – buy, sell, or hold]. While BigBear.ai shows potential in the growing AI and big data market, its financial performance, valuation, and exposure to various risks must be carefully weighed. The company’s revenue growth, profitability, market position, and competitive landscape all play a significant role in determining the viability of BigBear.ai stock as a sound investment. Remember, this analysis does not constitute financial advice. Investors should conduct their own thorough research, consulting with financial advisors if needed, before making any investment decisions concerning BigBear.ai stock. Further research into BigBear.ai's financials and industry trends, through reputable financial news websites and analyst reports, is highly recommended before making any decisions related to BigBear.ai shares.

Featured Posts

-

Quantum Computing And Ai D Waves Qbts Breakthrough In Drug Discovery

May 20, 2025

Quantum Computing And Ai D Waves Qbts Breakthrough In Drug Discovery

May 20, 2025 -

Voice Recognition Revolutionizes Hmrc Call Centre Operations

May 20, 2025

Voice Recognition Revolutionizes Hmrc Call Centre Operations

May 20, 2025 -

Find The Answers Nyt Mini Crossword April 25th

May 20, 2025

Find The Answers Nyt Mini Crossword April 25th

May 20, 2025 -

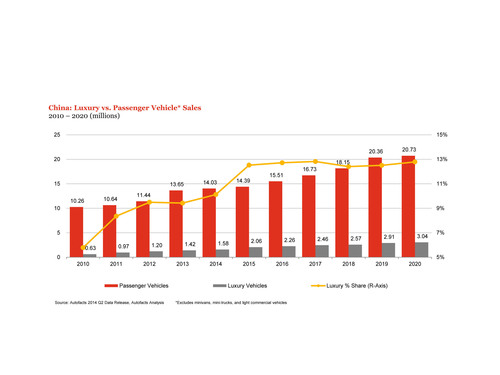

Navigating The Complexities Luxury Automakers And The Chinese Market

May 20, 2025

Navigating The Complexities Luxury Automakers And The Chinese Market

May 20, 2025 -

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025

Latest Posts

-

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025 -

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025 -

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025 -

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025