Is BigBear.ai Stock Worth Buying In 2024?

Table of Contents

BigBear.ai's Business Model and Financial Performance

BigBear.ai provides AI-powered solutions, primarily targeting government and commercial clients. Their offerings span various sectors, leveraging advanced analytics and machine learning to solve complex problems. This includes areas like national security, cybersecurity, and data analytics for businesses. Understanding BigBear.ai's financial performance is crucial to assessing its investment viability. While specific figures will fluctuate, a thorough review of their quarterly and annual reports is essential. Analyzing key metrics such as revenue growth, profit margins, and debt levels will reveal the financial health and stability of the company. Unfortunately, detailed financial projections are difficult to provide due to market fluctuations.

- Key Revenue Streams: Government contracts, commercial partnerships, subscription-based services.

- Profit Margins and Growth Trajectory: Requires analysis of BigBear.ai's financial statements for up-to-date information. Look for consistent growth or signs of improvement over time.

- Significant Contracts Won or Lost: News releases and SEC filings provide updates on contract wins and losses, impacting the BigBear.ai share price.

- Comparison to Competitors: Benchmarking BigBear.ai against competitors like Palantir Technologies or other AI-focused companies is important for evaluating market positioning and relative performance.

Market Analysis and Future Growth Potential

The AI market is booming, with projections indicating exponential growth in the coming years. Several reputable market research firms have published detailed forecasts that highlight the enormous potential of this sector. BigBear.ai's positioning within this market is critical to assessing its future growth potential. Their focus on government and commercial contracts puts them in a position to benefit from increased demand for advanced AI solutions.

- Market Size and Growth Rate Predictions: Research reports from Gartner, IDC, or other reputable firms offer insights into the projected growth of the AI market.

- BigBear.ai's Market Share and Competitive Advantages: Examining BigBear.ai's market share and competitive strengths – such as their proprietary algorithms or unique partnerships – is crucial.

- Potential for Expansion into New Markets or Service Offerings: Analyze BigBear.ai's strategic plans for expansion into new market segments or the development of new service offerings.

- Risks Associated with the AI Market and BigBear.ai’s Position within it: Consider the risks inherent in the AI market, such as technological disruptions, increased competition, and regulatory changes, and how these might affect BigBear.ai.

Risk Assessment and Investment Considerations

Investing in BigBear.ai stock, like any stock, involves risk. Before investing, a comprehensive risk assessment is necessary. This includes considering both market-wide risks and those specific to BigBear.ai.

- Key Financial Risks (e.g., debt, profitability): Review BigBear.ai's debt levels and profitability to assess their financial stability.

- Market Risks (e.g., competition, economic downturn): Consider the impact of increased competition and potential economic downturns on the company's performance and the BigBear.ai share price.

- Company-Specific Risks (e.g., technology disruption, regulatory changes): Assess risks related to technological advancements that could render BigBear.ai's technology obsolete, as well as regulatory changes that might impact their operations.

- Valuation Metrics (e.g., P/E ratio, market capitalization): Compare BigBear.ai's valuation metrics to its competitors to determine if it's fairly priced.

Alternative Investment Options in the AI Sector

Diversification is key in any investment portfolio. Exploring alternative AI stocks allows for a balanced approach, reducing risk. Several other companies operate in the AI space, each with its own strengths and weaknesses. Comparing BigBear.ai to these alternatives provides valuable perspective.

- Examples of Comparable AI Companies: Research companies like Palantir, C3.ai, or other publicly traded AI companies.

- Comparative Analysis of Risk/Reward Profiles: Compare the risk and reward profiles of BigBear.ai and its competitors.

- Diversification Strategies for AI Investments: Consider diversifying your AI investments across several companies to mitigate risk.

Conclusion: Is BigBear.ai Stock Right for You in 2024?

Ultimately, deciding whether to invest in BigBear.ai stock in 2024 requires careful consideration of its financial performance, market position, and inherent risks. While the AI market offers significant growth potential, the volatility of the sector necessitates a thorough due diligence process before making any investment decisions related to BigBear.ai stock. Our analysis suggests the potential for growth, but also highlights considerable risks. Consider your risk tolerance, your investment horizon, and conduct your own thorough research before investing in BigBear.ai or any AI stock. The decision regarding BigBear.ai stock is entirely dependent on your individual investment strategy and risk appetite. Remember to consult a financial advisor before making any investment decisions.

Featured Posts

-

Severe Weather Alert High Winds And Fast Moving Storms

May 21, 2025

Severe Weather Alert High Winds And Fast Moving Storms

May 21, 2025 -

Sabalenka Dominates Mertens Advances To Madrid Open Round Of 16

May 21, 2025

Sabalenka Dominates Mertens Advances To Madrid Open Round Of 16

May 21, 2025 -

Revenirea Fratilor Tate In Romania Imagini De La Defilarea Prin Bucuresti

May 21, 2025

Revenirea Fratilor Tate In Romania Imagini De La Defilarea Prin Bucuresti

May 21, 2025 -

Kroyz Azoyl Telikos Champions League I Poreia Toy Giakoymaki

May 21, 2025

Kroyz Azoyl Telikos Champions League I Poreia Toy Giakoymaki

May 21, 2025 -

The Goldbergs A Nostalgic Look At 80s Family Life

May 21, 2025

The Goldbergs A Nostalgic Look At 80s Family Life

May 21, 2025

Latest Posts

-

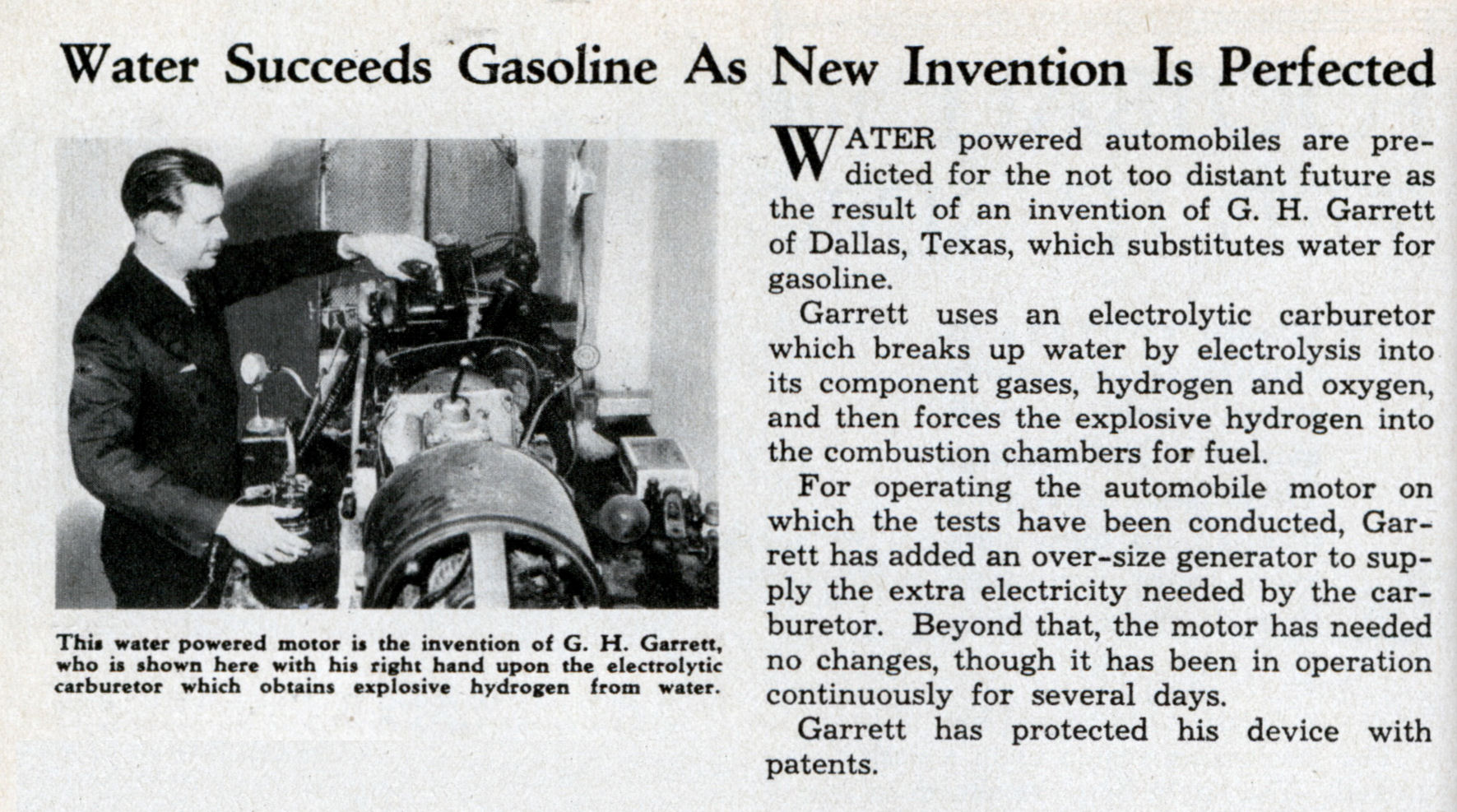

Cientificos Britanicos Crean Motor De Combustion Con Tecnologia De Agua

May 23, 2025

Cientificos Britanicos Crean Motor De Combustion Con Tecnologia De Agua

May 23, 2025 -

Cummins And Partners Announce Successful Hydrogen Engine Project Completion

May 23, 2025

Cummins And Partners Announce Successful Hydrogen Engine Project Completion

May 23, 2025 -

Motor De Combustion Revolucionario El Reino Unido Quema Particulas De Agua

May 23, 2025

Motor De Combustion Revolucionario El Reino Unido Quema Particulas De Agua

May 23, 2025 -

Reino Unido Desarrolla Motor De Combustion Que Supera La Ciencia Ficcion Tecnologia De Particulas De Agua

May 23, 2025

Reino Unido Desarrolla Motor De Combustion Que Supera La Ciencia Ficcion Tecnologia De Particulas De Agua

May 23, 2025 -

Significant Acquisition Honeywell And Johnson Mattheys 1 8 Billion Deal Update

May 23, 2025

Significant Acquisition Honeywell And Johnson Mattheys 1 8 Billion Deal Update

May 23, 2025