Is D-Wave Quantum Inc. (QBTS) The Best Quantum Computing Stock For Investment?

Table of Contents

D-Wave's Technology and Market Position

D-Wave's approach to quantum computing differs significantly from its competitors. While many companies focus on gate-based quantum computing, D-Wave utilizes quantum annealing. This unique technology allows for solving specific optimization problems more efficiently than classical computers. However, this specialization limits its applicability compared to more general-purpose gate-based systems.

D-Wave boasts an established customer base, including major corporations and government agencies, demonstrating its early mover advantage in the quantum computing market. This translates to a certain degree of market share, although quantifying precisely is challenging due to the evolving nature of the industry. Key partnerships and collaborations further solidify its presence.

-

Strengths:

- Early mover advantage in the quantum annealing market.

- Established customer base with proven applications.

- Specific strengths in optimization problem-solving.

-

Weaknesses:

- Limited applicability compared to gate-based quantum computers.

- Potential for technological obsolescence as gate-based systems advance.

- Dependence on the continued relevance of quantum annealing.

Financial Performance and Investment Metrics

Analyzing QBTS's financial statements reveals a complex picture. While revenue growth is showing positive trends, consistent profitability remains elusive. The company is still heavily invested in research and development, impacting its short-term profit margins. Valuation metrics like the P/E ratio and market capitalization need careful consideration, as they are influenced by the high degree of uncertainty inherent in the quantum computing sector. Comparing QBTS's performance to other quantum computing stocks requires a nuanced approach, acknowledging the differing technological approaches and stages of development.

-

Revenue growth trajectory and predictions: While currently showing growth, predicting future revenue requires consideration of market adoption and technological advancements.

-

Profitability prospects (short-term vs. long-term): Short-term profitability is unlikely due to ongoing R&D investment. Long-term profitability depends on market adoption and technological breakthroughs.

-

Risk assessment based on financial performance: The high degree of uncertainty and dependence on future technological successes creates substantial investment risk.

Competitive Landscape and Future Outlook

The quantum computing landscape is fiercely competitive. Major players like IBM, Google, IonQ, and Rigetti are investing heavily in both gate-based and other quantum computing technologies. While D-Wave holds a unique position with its quantum annealing systems, its competitors are rapidly advancing their own technologies, posing a significant risk to D-Wave's long-term market share. Government funding and technological advancements will play a crucial role in shaping the future of the quantum computing market and D-Wave's place within it.

-

Strengths in specific niche applications: D-Wave's specialization in optimization problems may provide a niche advantage in certain industries.

-

Risks posed by competitors' advancements: The rapid advancement of gate-based quantum computing threatens D-Wave's market position.

-

Potential for future technological breakthroughs and their impact on QBTS: Disruptive innovations could significantly impact D-Wave's market share and profitability.

Risks and Considerations for Investors

Investing in QBTS, or any quantum computing stock, carries inherent risks. The technology is still in its early stages, and the path to widespread adoption is uncertain. Regulatory challenges could also impact the industry's growth. Market volatility, a characteristic of emerging technology sectors, adds another layer of risk. Diversification within your investment portfolio is crucial to mitigate these risks.

-

Technological risks: Failure to meet development milestones or the emergence of superior technologies poses a significant threat.

-

Market risks: Decreased investor interest or slow market adoption could negatively impact QBTS's stock price.

-

Financial risks: The company's high R&D spending and the uncertainty of future revenue creates potential for significant losses.

Conclusion: Is D-Wave Quantum Inc. (QBTS) Right for Your Investment Portfolio?

Our analysis reveals that D-Wave Quantum Inc. (QBTS) presents both exciting opportunities and significant risks. While its early mover advantage and unique technology are noteworthy, the competitive landscape and inherent uncertainties of the quantum computing market must be carefully considered. The limited applicability of quantum annealing compared to gate-based systems is a major concern. Ultimately, whether QBTS is right for your portfolio depends on your risk tolerance and investment goals. Before investing in QBTS or any other quantum computing stock, thorough due diligence is essential. Invest wisely in quantum computing by conducting comprehensive research and understanding the risks involved. Explore different D-Wave Quantum investment strategies and diversify your portfolio to mitigate potential losses. Remember, researching quantum computing stocks is crucial before making any investment decisions.

Featured Posts

-

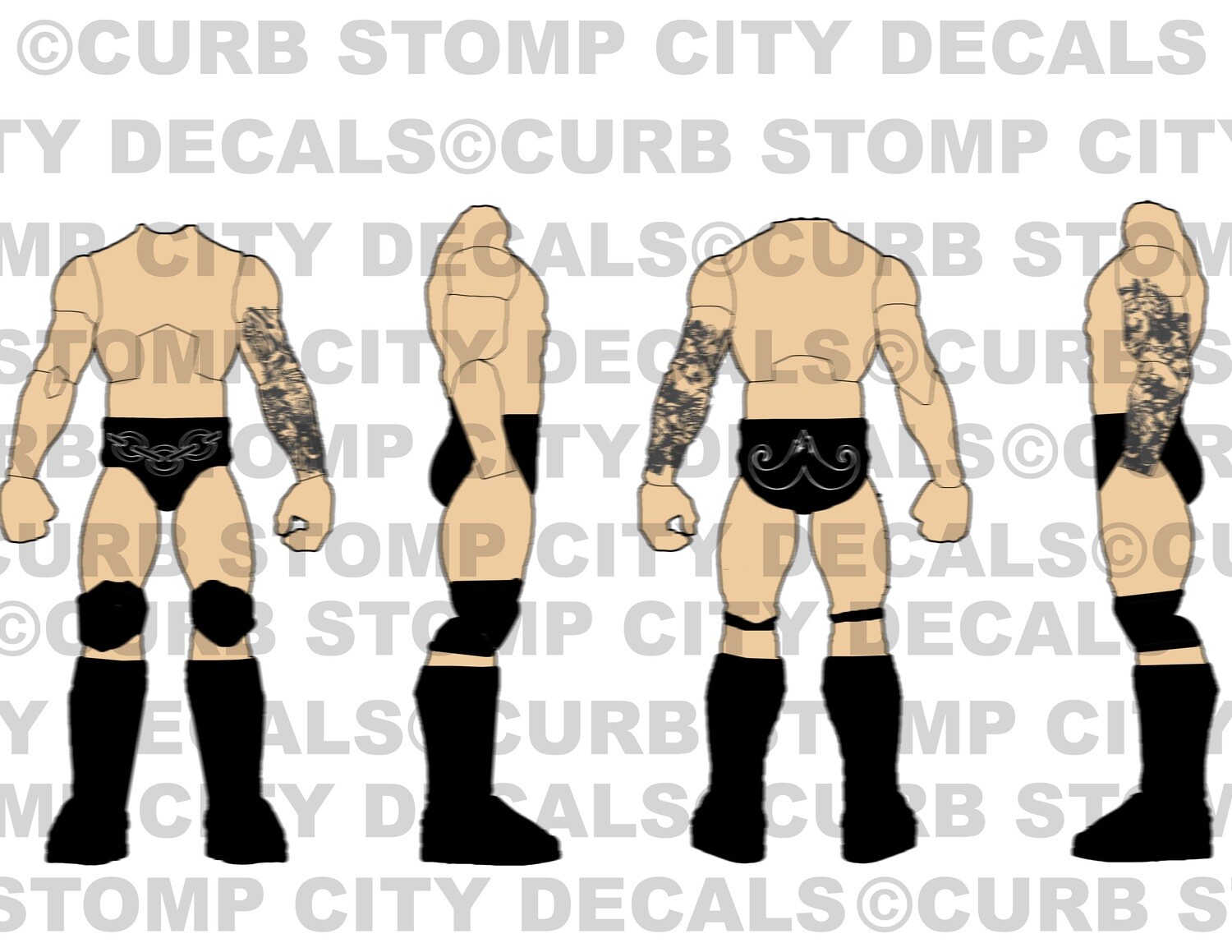

Tyler Bate Back On Wwe Television A Breakdown Of His Comeback

May 20, 2025

Tyler Bate Back On Wwe Television A Breakdown Of His Comeback

May 20, 2025 -

Chivas Regals Collaboration With Charles Leclerc Details And Impact

May 20, 2025

Chivas Regals Collaboration With Charles Leclerc Details And Impact

May 20, 2025 -

Efimeries Iatron Patras Savvatokyriako

May 20, 2025

Efimeries Iatron Patras Savvatokyriako

May 20, 2025 -

Ajatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Jdydt Libdaeatha

May 20, 2025

Ajatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Jdydt Libdaeatha

May 20, 2025 -

Chinas Criticism Of Philippine Missile System In Contested Waters

May 20, 2025

Chinas Criticism Of Philippine Missile System In Contested Waters

May 20, 2025

Latest Posts

-

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025

How A Billionaire Boy Shapes The World Philanthropy Power And Politics

May 20, 2025 -

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025

Billionaire Boy Exploring The Challenges And Responsibilities Of Extreme Wealth

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025 -

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025

The Life And Times Of A Billionaire Boy Inheritance Influence And Impact

May 20, 2025 -

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025

79 Manazerov Uprednostnuje Osobne Stretnutia Home Office Vs Kancelaria

May 20, 2025