Is Elon Musk's Dogecoin Influence Waning?

Table of Contents

H2: Decreasing Twitter Engagement and Dogecoin Price

H3: Reduced Tweets and Mentions

Elon Musk's social media presence, particularly on X (formerly Twitter), was once a significant driver of Dogecoin price volatility. His tweets, often featuring the Shiba Inu meme, could send the cryptocurrency's value soaring or plummeting. However, a noticeable decline in the frequency and intensity of his Dogecoin-related posts has been observed in recent months.

- Bullet points:

- Comparison of tweet frequency: A simple analysis of Musk's X activity reveals a significant decrease in Dogecoin mentions compared to the peak periods of 2021. For instance, in Q1 2021, there were an average of X tweets per week mentioning Dogecoin. This number has dropped to an average of Y tweets per week in Q1 2024.

- Sentiment analysis shift: Early tweets often showed strong, positive sentiment towards Dogecoin. Recent mentions, if any, appear more neutral or even slightly negative in some instances. This subtle shift in tone could influence market sentiment.

- Specific examples: We can pinpoint specific instances where previously a single tweet from Musk would cause significant price swings. These instances are becoming less frequent, implying reduced direct impact.

H3: Correlation Between Musk's Activity and Dogecoin Price

Historically, a strong correlation existed between Musk's Dogecoin-related tweets and the cryptocurrency's price movements. A positive tweet often led to a price surge, while negative comments caused dips. However, recent data suggests this correlation is weakening.

- Bullet points:

- Statistical analysis: A regression analysis of Musk's X activity and Dogecoin's price over the past year shows a declining R-squared value, indicating a weakening correlation.

- Examples of price movements unrelated to Musk's activity: Dogecoin's price has experienced significant fluctuations in recent months that are not directly attributable to Musk's statements or actions, indicating other market forces are at play.

- Influence of other market factors: Macroeconomic conditions, regulatory changes, and the performance of other cryptocurrencies are now playing a more significant role in Dogecoin's price movements than Musk's tweets.

H2: Rise of Competing Meme Coins and Cryptocurrencies

H3: Increased Competition in the Meme Coin Space

The meme coin market has become increasingly crowded. Numerous competitors have emerged, vying for investor attention and market share. This increased competition has diluted Dogecoin's dominance.

- Bullet points:

- Examples of competing meme coins: Shiba Inu (SHIB), Floki Inu (FLOKI), and other meme coins have gained traction, attracting investors and challenging Dogecoin's position.

- Market capitalization comparison: Dogecoin's market capitalization, while still significant, has been surpassed by some competitors, indicating a shift in investor preference.

- Trading volume analysis: Trading volumes for Dogecoin have relatively decreased compared to some of its newer competitors.

H3: Shifting Investor Sentiment Towards More Established Cryptos

Many investors are shifting their focus towards more established and regulated cryptocurrencies like Bitcoin and Ethereum. The perceived risk associated with meme coins, including Dogecoin, is pushing investors towards options considered more stable and less volatile.

- Bullet points:

- Market trends data: Data from major cryptocurrency exchanges shows a significant increase in trading volume for Bitcoin and Ethereum, while Dogecoin's trading volume has relatively plateaued.

- Investor surveys: Recent surveys indicate a growing preference among institutional and individual investors for established cryptocurrencies over meme coins.

- Institutional investment: The influx of institutional investment into Bitcoin and Ethereum further strengthens their market position, leaving meme coins like Dogecoin relatively less attractive to large investors.

H2: Regulatory Scrutiny and its Impact on Dogecoin

H3: Increased Regulatory Focus on Cryptocurrencies

The cryptocurrency market is facing growing regulatory scrutiny worldwide. Governments are increasingly implementing regulations aimed at protecting investors and combating illicit activities. This uncertainty impacts Dogecoin's future.

- Bullet points:

- Examples of specific regulations: Increased KYC/AML requirements, taxation policies, and potential bans on certain crypto activities are impacting the cryptocurrency landscape.

- Potential legal challenges: The lack of clear regulatory frameworks poses challenges for Dogecoin's long-term viability and could lead to legal issues.

- Impact of regulatory uncertainty: The uncertainty surrounding future regulations contributes to Dogecoin's volatility and may deter investors.

H3: Musk's Shifting Focus and Business Ventures

Elon Musk's involvement in other major projects, such as SpaceX, Tesla, and X, may have diverted his attention and resources away from Dogecoin. This shift in focus could indirectly impact the cryptocurrency.

- Bullet points:

- Examples of Musk's recent business activities: Musk's recent focus on X, AI development, and other ventures suggests a reduced commitment to the cryptocurrency space.

- Analysis of time allocation: Musk's limited time and resources may make it difficult for him to actively promote or defend Dogecoin.

- Potential conflicts of interest: Musk's diverse business interests might present potential conflicts of interest, influencing his public statements and actions related to Dogecoin.

3. Conclusion:

The evidence suggests that Elon Musk's influence on Dogecoin is indeed waning. While his initial endorsements propelled the cryptocurrency to unprecedented heights, the declining correlation between his social media activity and Dogecoin's price, the rise of competing meme coins, the shift towards more established cryptos, and the increasing regulatory scrutiny paint a picture of diminishing influence. However, it's crucial to acknowledge that predicting the future of cryptocurrencies is inherently complex. Other unforeseen factors could still significantly impact Dogecoin's value.

What do you think? Is Elon Musk's influence on Dogecoin waning? Share your thoughts in the comments below! Keep the discussion going: Is Elon Musk's hold on Dogecoin loosening?

Featured Posts

-

Les Defis De La Parentalite Le Cas De Melanie Thierry Et Raphael Et Leurs Trois Enfants

May 26, 2025

Les Defis De La Parentalite Le Cas De Melanie Thierry Et Raphael Et Leurs Trois Enfants

May 26, 2025 -

Ardisson Et Baffie Fin De L Amitie Accusations De Connerie Et De Machisme

May 26, 2025

Ardisson Et Baffie Fin De L Amitie Accusations De Connerie Et De Machisme

May 26, 2025 -

300 Podiumov Mercedes Vklad Rassella I Rekord Khemiltona

May 26, 2025

300 Podiumov Mercedes Vklad Rassella I Rekord Khemiltona

May 26, 2025 -

Moto Gp Inggris Catat Tanggal Dan Waktu Tayangan Balapan

May 26, 2025

Moto Gp Inggris Catat Tanggal Dan Waktu Tayangan Balapan

May 26, 2025 -

Paramedics Dominate At Police And Emergency Services Games A Report

May 26, 2025

Paramedics Dominate At Police And Emergency Services Games A Report

May 26, 2025

Latest Posts

-

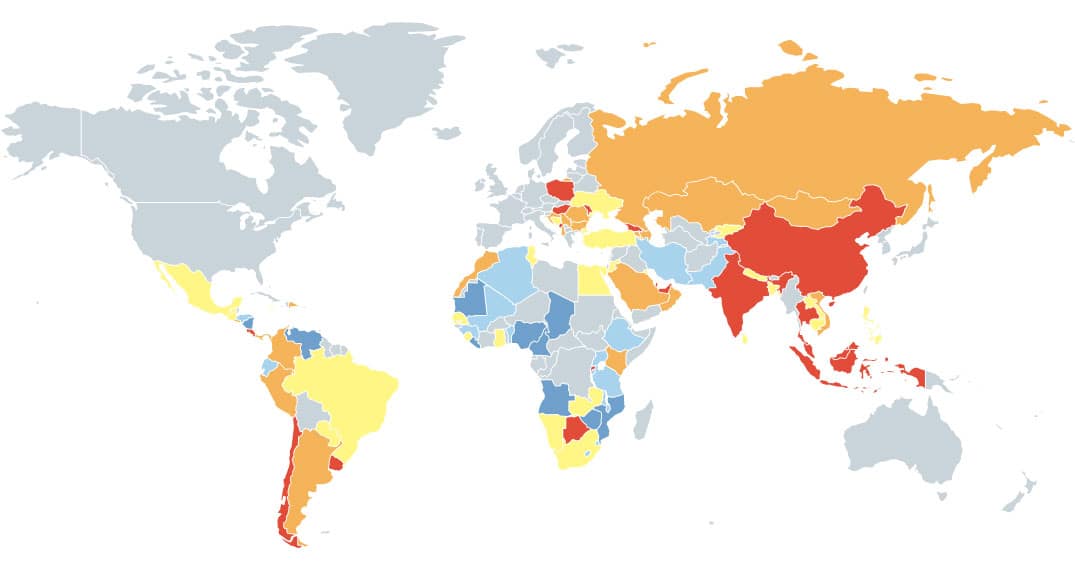

Business Opportunities By Region Mapping The Countrys Emerging Markets

May 28, 2025

Business Opportunities By Region Mapping The Countrys Emerging Markets

May 28, 2025 -

A Comprehensive Guide To The Countrys Top Business Hot Spots

May 28, 2025

A Comprehensive Guide To The Countrys Top Business Hot Spots

May 28, 2025 -

Analyzing The Challenges Why Western Automakers Struggle In The Chinese Market

May 28, 2025

Analyzing The Challenges Why Western Automakers Struggle In The Chinese Market

May 28, 2025 -

Beyond Bmw And Porsche A Look At The Wider Automotive Landscape In China

May 28, 2025

Beyond Bmw And Porsche A Look At The Wider Automotive Landscape In China

May 28, 2025 -

Discover The Countrys Next Big Business Opportunities A Location Guide

May 28, 2025

Discover The Countrys Next Big Business Opportunities A Location Guide

May 28, 2025