Is Investing In Uber (UBER) Right For You?

Table of Contents

Understanding Uber's Business Model and Market Position

The Ride-Sharing Giant

Uber's core business is its ride-hailing service, connecting passengers with drivers through a convenient mobile app. Its global reach and substantial market share make it a dominant player in the transportation industry.

- Market dominance in various regions: Uber holds a significant portion of the ride-sharing market in numerous countries worldwide, establishing a strong brand presence and network effects.

- Competitive landscape (Lyft, taxis): While facing competition from rivals like Lyft and traditional taxi services, Uber maintains a leading position due to its brand recognition, extensive driver network, and technological advancements.

- Network effects: The more users and drivers Uber has, the more valuable the platform becomes for both groups, creating a powerful network effect that strengthens its market position. This is a key aspect of Uber's business model and a significant factor in its success. Understanding this network effect is crucial to understanding the long-term viability of the Uber ride-sharing business.

Keywords: Uber ride-sharing, Uber market share, Uber competitors, ride-hailing market

Beyond Rides: Diversification into Other Services

Uber's business strategy extends beyond its flagship ride-hailing service. Uber Eats, its food delivery platform, and Uber Freight, its logistics arm, contribute significantly to its overall revenue and growth.

- Revenue streams beyond ride-sharing: Diversification into food delivery, freight logistics, and other services creates multiple revenue streams, reducing reliance on a single sector and increasing overall financial resilience.

- Growth potential of these segments: The food delivery and freight sectors show considerable growth potential, with increasing demand for convenient food delivery and efficient logistics solutions.

- Market competition in each sector: While facing stiff competition in each of these sectors, Uber's established brand recognition and technological infrastructure provide a competitive advantage.

Keywords: Uber Eats, Uber Freight, Uber diversification, Uber revenue streams

Analyzing Uber's Financial Performance and Growth Potential

Examining Key Financial Metrics

Analyzing Uber's financial performance requires examining key metrics such as revenue growth, profitability, debt levels, and cash flow. While the company has demonstrated significant revenue growth, profitability remains a key challenge. Regular review of quarterly and annual reports is essential.

- Revenue growth rate: Uber has consistently shown strong revenue growth, although the rate of growth can fluctuate depending on various factors including economic conditions and competition.

- Profit margins (or losses): While Uber generates substantial revenue, achieving consistent profitability remains a focus for the company. Investors need to consider the company's ability to manage costs and achieve sustainable profitability.

- Debt-to-equity ratio: Understanding Uber's debt levels and its ability to manage its financial leverage is crucial for evaluating its long-term financial health.

- Cash flow: Analyzing Uber's cash flow provides insights into its operational efficiency and ability to generate cash from its operations.

Keywords: Uber financial performance, Uber revenue growth, Uber profitability, Uber stock valuation

Future Growth Prospects and Challenges

Uber's future growth hinges on several factors, including technological advancements, expansion into new markets, and its ability to navigate regulatory hurdles.

- Potential for technological advancements: Investments in autonomous vehicles and other technological innovations could significantly impact Uber's operations and efficiency in the future. However, the successful implementation of these technologies presents significant challenges.

- Expansion into underserved markets: Expanding into new geographical areas and exploring new service offerings present significant growth opportunities.

- Competitive threats: The competitive landscape in ride-sharing, food delivery, and freight logistics remains dynamic. Uber needs to adapt and innovate to maintain its market share.

- Regulatory risks: Regulatory changes and legal challenges related to driver classification, safety regulations, and data privacy can impact Uber's operations and profitability.

Keywords: Uber future growth, Uber autonomous vehicles, Uber expansion, Uber regulation

Assessing the Risks and Rewards of Investing in Uber Stock

Volatility and Market Sentiment

Investing in Uber stock involves inherent risks due to its volatility and susceptibility to market sentiment. The stock price can fluctuate significantly based on various factors including news, economic conditions, and changes in the company's performance.

- Factors influencing stock price: News regarding regulatory changes, financial results, technological advancements, and competitive developments all significantly influence Uber's stock price.

- Market fluctuations: Overall market fluctuations can also impact the stock price, regardless of Uber's specific performance.

- Potential for significant gains and losses: Investing in UBER stock carries the potential for substantial gains but also substantial losses.

Keywords: Uber stock price volatility, Uber stock risk, stock market risk

Long-Term vs. Short-Term Investment Strategies

Investors considering Uber should carefully evaluate their risk tolerance and investment timeline when choosing between long-term growth investing and short-term trading strategies.

- Advantages and disadvantages of each approach: Long-term investing offers the potential for higher returns but requires patience and can involve greater risk over shorter timeframes. Short-term trading offers the potential for quicker profits, but also carries a higher risk of losses.

- Risk tolerance: Investors should only invest an amount they are comfortable losing, considering their overall financial situation and risk appetite.

- Investment timeline: Your investment timeline should align with your financial goals and risk tolerance.

Keywords: Uber long-term investment, Uber short-term trading, investment strategy

Conclusion

Investing in Uber (UBER) requires careful consideration of its strengths, weaknesses, and market position. Its diversified business model offers potential for growth, but challenges remain in areas such as profitability and regulation. The inherent volatility of the stock market adds another layer of risk. Conduct thorough research and consult a financial advisor before making any investment decisions regarding UBER stock. Remember to carefully assess your own risk tolerance and investment goals before deciding if investing in Uber is right for you.

Featured Posts

-

Eurovision 2025 On The Bbc Everything You Need To Know

May 19, 2025

Eurovision 2025 On The Bbc Everything You Need To Know

May 19, 2025 -

Saving Jerseys Battle Of Flowers One Mans Determination

May 19, 2025

Saving Jerseys Battle Of Flowers One Mans Determination

May 19, 2025 -

Poitiers Decouvrez 46 Appartements Dans Des Batiments Historiques

May 19, 2025

Poitiers Decouvrez 46 Appartements Dans Des Batiments Historiques

May 19, 2025 -

Jyoti Malhotra Popular Travel Vlogger Arrested For Alleged Spying For Pakistan

May 19, 2025

Jyoti Malhotra Popular Travel Vlogger Arrested For Alleged Spying For Pakistan

May 19, 2025 -

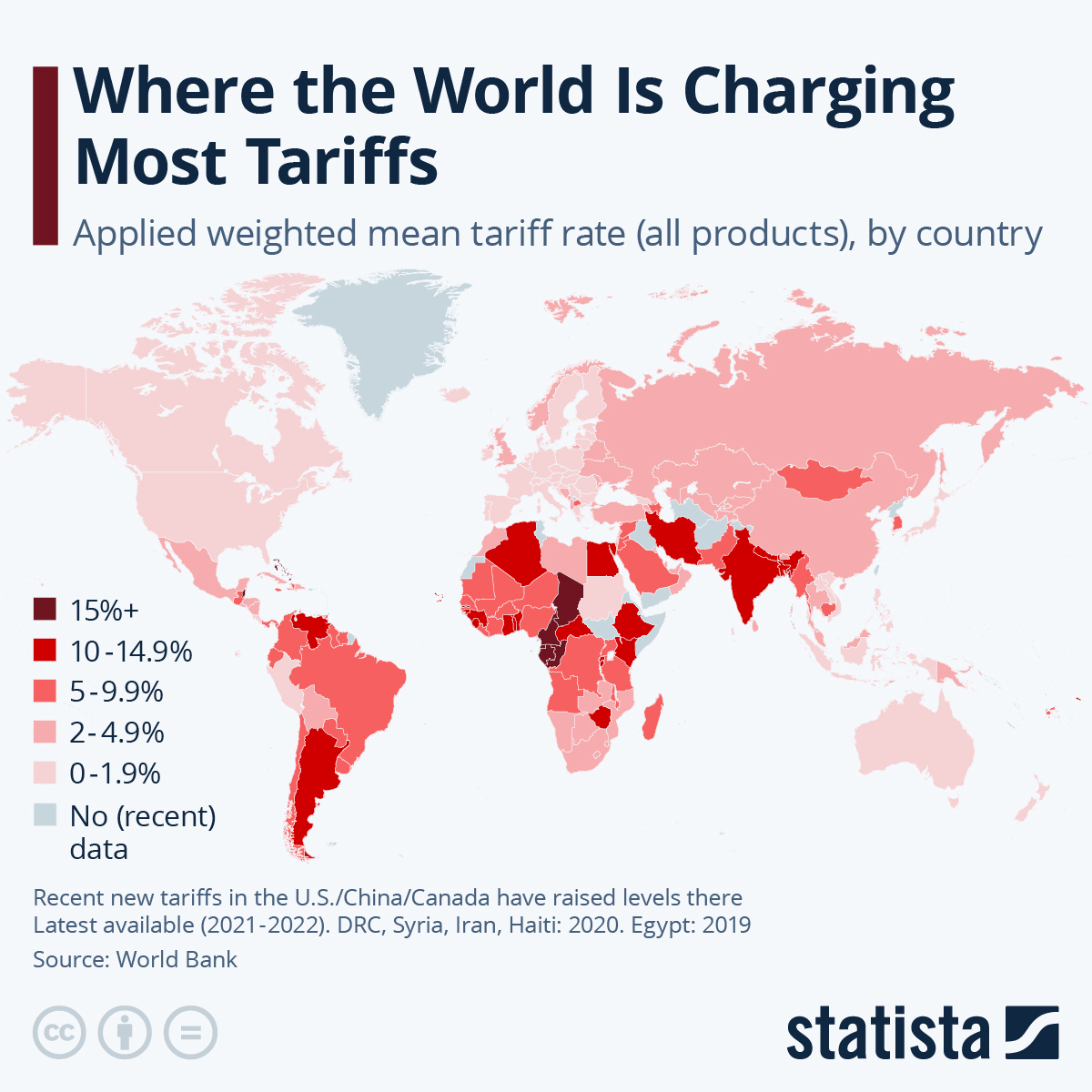

Canada Rejects Oxford Report Most Us Tariffs Remain

May 19, 2025

Canada Rejects Oxford Report Most Us Tariffs Remain

May 19, 2025