Is It Too Late To Invest In Palantir Stock Before The Predicted 40% Rise In 2025?

Table of Contents

Palantir's Current Market Position and Future Growth Projections

Palantir Technologies, a prominent player in the big data and data analytics space, boasts a unique business model focusing on providing powerful software platforms to both government and commercial clients. Understanding Palantir's current financial performance is crucial before assessing future investment potential. Analyzing key metrics like revenue growth, profit margins, and market cap paints a clearer picture. Palantir’s recent financial reports show consistent revenue growth, though profitability remains a key area of focus for investors. The current market capitalization reflects investor sentiment and expectations for future growth.

Several factors contribute to the predicted 40% rise in Palantir's stock price by 2025:

-

Expanding Government Contracts: Palantir has a strong track record of securing lucrative government contracts, particularly within defense spending and intelligence agencies. Continued investment in national security and the increasing reliance on advanced data analytics for defense and intelligence operations bode well for Palantir's future government contract wins. These contracts often involve long-term partnerships, providing stable revenue streams.

-

Growth in the Commercial Sector: While initially focused on government clients, Palantir is successfully expanding its commercial customer base. They are targeting key industries like finance, healthcare, and aerospace, offering tailored data analytics platforms to enhance operational efficiency and decision-making. This diversification reduces reliance on government contracts and opens avenues for substantial revenue growth. Key commercial clients are contributing significantly to revenue increases and demonstrate the platform's wide applicability.

-

Technological Innovation and Product Development: Palantir continues to invest heavily in research and development, focusing on advancements in AI, machine learning, and data integration. These investments are key to maintaining a competitive edge and attracting new clients in a rapidly evolving data analytics market. Their commitment to product innovation ensures their platform remains at the forefront of technological advancements.

Risk Assessment: Potential Downsides of Investing in Palantir

While Palantir's growth potential is significant, investors must acknowledge several inherent risks:

-

Volatility of the Stock Market: The stock market is inherently volatile, and Palantir's stock price is susceptible to market fluctuations. Unexpected economic downturns or shifts in investor sentiment can significantly impact the stock price, regardless of the company's performance.

-

Competition in the Data Analytics Market: Palantir faces stiff competition from both established players and emerging startups in the data analytics market. Maintaining a competitive edge requires continuous innovation and adaptation to market demands. Competition from companies with larger market shares and established client bases poses a significant challenge.

-

Dependence on Government Contracts: While diversification into the commercial sector is a positive development, Palantir's revenue still significantly relies on government contracts. Changes in government spending priorities or political shifts could negatively impact their revenue streams.

Analyzing the Timing of Investment: Is Now the Right Time?

The question of whether now is the right time to invest in Palantir is complex. While the predicted 40% rise is enticing, it's crucial to consider the risks. Investing now could potentially lead to higher returns if the predictions materialize, but it also exposes you to higher market volatility. Waiting could mitigate some risk, but it might also mean missing out on potential gains. A detailed analysis of Palantir's financial statements, competitor landscape, and future growth projections is vital. [Insert relevant chart or graph visualizing Palantir's stock performance and projections here]. Considering an investment strategy that aligns with your personal risk tolerance and financial goals is paramount.

Conclusion: Making Informed Decisions About Palantir Stock

Investing in Palantir stock presents a compelling opportunity, with the potential for substantial returns based on the predicted 40% rise by 2025. However, it's crucial to acknowledge the risks associated with market volatility, competition, and dependence on government contracts. Thorough due diligence is essential before making any investment decisions. Consult a financial advisor to discuss your risk tolerance and investment goals. Analyze Palantir’s financial performance, understand its competitive landscape, and assess the long-term prospects of its business model. Don't miss out on the potential of Palantir's growth; invest wisely and strategically.

Featured Posts

-

Your Nl Federal Riding Candidate Profiles And Platforms

May 10, 2025

Your Nl Federal Riding Candidate Profiles And Platforms

May 10, 2025 -

Identifying Emerging Business Opportunities A Map Of Promising Locations

May 10, 2025

Identifying Emerging Business Opportunities A Map Of Promising Locations

May 10, 2025 -

Jeanine Pirros Biography Exploring Her Education Career And Net Worth

May 10, 2025

Jeanine Pirros Biography Exploring Her Education Career And Net Worth

May 10, 2025 -

Dakota Dzhonson Sredi Laureatov Zolotoy Maliny Proval Goda

May 10, 2025

Dakota Dzhonson Sredi Laureatov Zolotoy Maliny Proval Goda

May 10, 2025 -

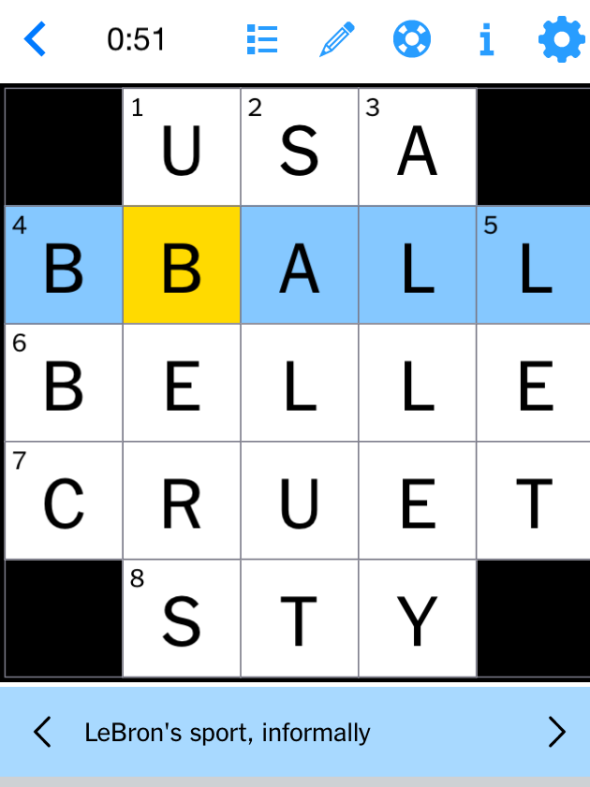

Nyt Strands Saturday April 12th Game 405 Answers And Clues

May 10, 2025

Nyt Strands Saturday April 12th Game 405 Answers And Clues

May 10, 2025