Is Palantir Stock A Buy Before May 5th? Analysis And Predictions

Table of Contents

Palantir's Recent Financial Performance and Growth Prospects

Revenue Growth and Profitability

Palantir's financial performance has been a mixed bag. While the company has demonstrated consistent revenue growth, profitability remains a key focus area. Recent reports show [insert specific revenue figures and growth percentages from recent quarters]. Key contracts with [mention specific government or commercial clients] have significantly contributed to revenue. However, [mention any areas of concern regarding profitability, e.g., operating expenses, net income].

- Q[Quarter] 2024 Revenue: [Insert Specific Number] (Growth of [Percentage] YoY)

- Q[Quarter] 2024 Net Income/Loss: [Insert Specific Number]

- Key Contract Wins: [List significant contracts and their estimated value]

- Future Growth Potential: Expansion into new markets (e.g., [mention specific sectors]) and further development of its AI capabilities present significant growth opportunities for Palantir.

Market Share and Competition

Palantir operates in a competitive landscape, facing established players like [mention key competitors, e.g., Microsoft, AWS] and emerging startups. Palantir's strengths lie in its [mention key strengths, e.g., proprietary data analytics platform, strong government relationships]. However, increasing competition and the evolving landscape of data analytics pose challenges.

- Key Competitors: [List key competitors and briefly describe their strengths]

- Palantir's Unique Selling Propositions (USPs): [List key differentiators, e.g., highly secure platform, focus on complex data problems]

- Market Trends: The growing demand for AI-driven data analytics presents a significant opportunity, but also increases competitive pressure.

Analyzing Key Factors Influencing Palantir Stock Price

Macroeconomic Factors and Geopolitical Risks

Broader macroeconomic conditions significantly impact Palantir stock. Rising inflation and interest rate hikes could dampen investor sentiment and affect spending on software and data analytics solutions. Geopolitical events, particularly those affecting government spending, also play a crucial role.

- Inflation and Interest Rates: High inflation and increased interest rates could lead to reduced investment in technology.

- Geopolitical Risks: [Mention specific geopolitical factors and their potential impact on Palantir's government contracts.]

- Global Economic Outlook: A pessimistic global economic outlook could negatively affect investor confidence in PLTR stock.

Technological Advancements and Innovation

Palantir's future growth hinges on its ability to innovate and adapt to changing technological trends. Its ongoing investments in AI and machine learning are crucial for maintaining its competitive edge. New product launches and advancements in its core platform will be key drivers of future performance.

- AI and Machine Learning Investments: [Mention specific examples of Palantir’s AI initiatives]

- New Product Launches: [Mention any anticipated new product releases before May 5th]

- Technological Disruptions: The potential for disruptive technologies could impact Palantir's market position.

Analyst Ratings and Price Targets

Analyst opinions on Palantir stock are diverse. [Mention specific analyst firms and their price targets]. The consensus view among analysts is [summarize the general sentiment – bullish, bearish, or neutral]. It's important to consider the range of opinions and the underlying assumptions when interpreting these forecasts.

- [Analyst Firm 1]: Price Target – [Price], Rating – [Buy/Sell/Hold]

- [Analyst Firm 2]: Price Target – [Price], Rating – [Buy/Sell/Hold]

- [Analyst Firm 3]: Price Target – [Price], Rating – [Buy/Sell/Hold]

Predicting Palantir Stock Performance Before May 5th

Potential Catalysts for Price Movement

Several events before May 5th could significantly impact Palantir's stock price. These include [mention potential catalysts, e.g., earnings reports, new contract announcements, product releases, or any significant partnerships]. Positive news could lead to a surge in the stock price, while negative news could trigger a decline.

- Earnings Reports: The release of quarterly earnings could be a major catalyst.

- Contract Wins: Securing large contracts, especially from government agencies, could boost investor confidence.

- Product Launches: The launch of new products or features could also drive price movements.

Risk Assessment and Potential Downsides

Investing in Palantir stock carries significant risks. The company's dependence on government contracts exposes it to political and budgetary uncertainties. Increased competition and slower-than-expected growth could also impact the stock price.

- Government Contract Dependence: A reduction in government spending could negatively affect Palantir’s revenue.

- Competition: Intense competition from established and emerging players poses a risk.

- Market Sentiment: Negative market sentiment could put downward pressure on the stock.

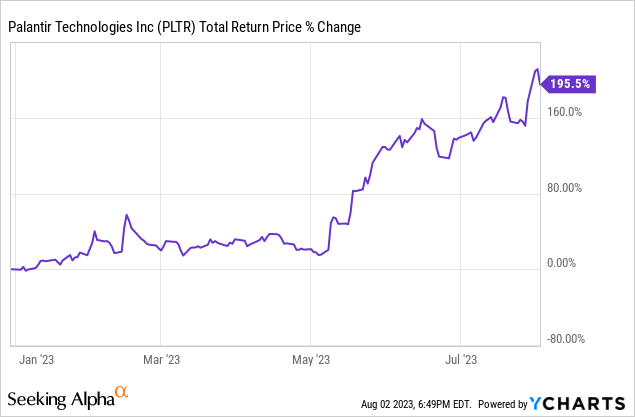

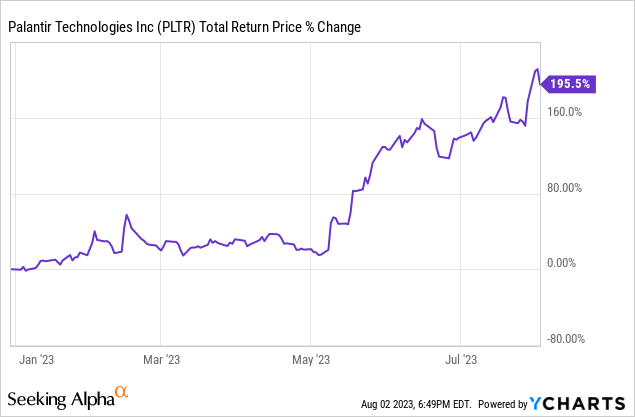

Technical Analysis and Chart Patterns (Optional)

[If you choose to include technical analysis, provide a brief overview of relevant chart patterns, support and resistance levels, and trading volume. Remember to clearly state the limitations of technical analysis and its subjective nature.]

Conclusion: Should You Buy Palantir Stock Before May 5th? A Final Verdict

Based on our analysis of Palantir's financial performance, market position, and potential future catalysts, the decision of whether to buy Palantir stock before May 5th is complex. While the company shows potential for growth in the long term, the short-term outlook is uncertain due to macroeconomic factors, competitive pressures, and the inherent volatility of the stock.

Recommendation: Given the potential risks and uncertainties, a cautious approach is advised. While Palantir's long-term prospects might be promising, short-term investors might want to wait for more clarity before investing. Thorough due diligence is crucial.

Call to Action: Before making any investment decisions, conduct your own thorough research and consider consulting with a financial advisor. Learn more about Palantir's investment potential by reviewing their financial reports and analyst ratings. Consider investing in Palantir stock only if you have a high-risk tolerance and a long-term investment horizon. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Help With Nyt Strands Puzzle 354 February 20th

May 09, 2025

Help With Nyt Strands Puzzle 354 February 20th

May 09, 2025 -

High Potential Episode Count Will There Be A Season 2

May 09, 2025

High Potential Episode Count Will There Be A Season 2

May 09, 2025 -

Dakota Dzhonson V Spiske Khudshikh Obzor Nominantov Zolotoy Maliny

May 09, 2025

Dakota Dzhonson V Spiske Khudshikh Obzor Nominantov Zolotoy Maliny

May 09, 2025 -

100 Days 194 Billion Lost The Cost Of Tech Billionaires Trump Inauguration Support

May 09, 2025

100 Days 194 Billion Lost The Cost Of Tech Billionaires Trump Inauguration Support

May 09, 2025 -

Anchor Brewing Companys Closure What Happens Now

May 09, 2025

Anchor Brewing Companys Closure What Happens Now

May 09, 2025