Is Palantir Stock A Buy In 2024 Before A Potential 40% Surge In 2025?

Table of Contents

Palantir's Current Market Position and Financial Performance

Understanding Palantir's current market position is crucial before assessing its future potential. As of [Insert Current Date], Palantir's stock price is [Insert Current Stock Price], giving it a market capitalization of [Insert Current Market Cap]. Analyzing recent financial reports paints a more detailed picture. While Palantir has demonstrated significant revenue growth year-over-year, profitability remains a key focus.

- Revenue Growth Year-over-Year: [Insert Data - cite source]. This growth is driven by [Explain key drivers, e.g., increased government contracts, expansion into commercial markets].

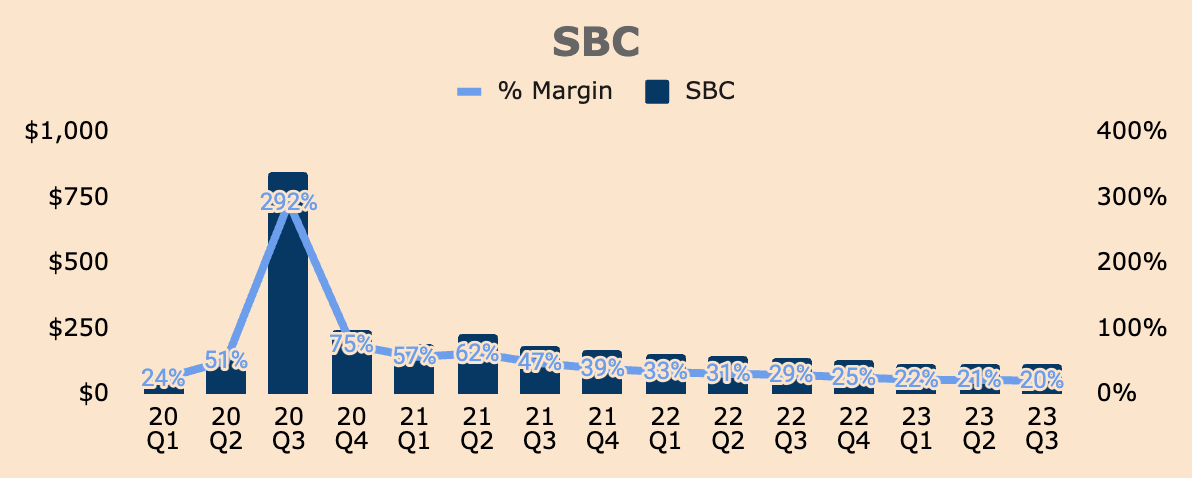

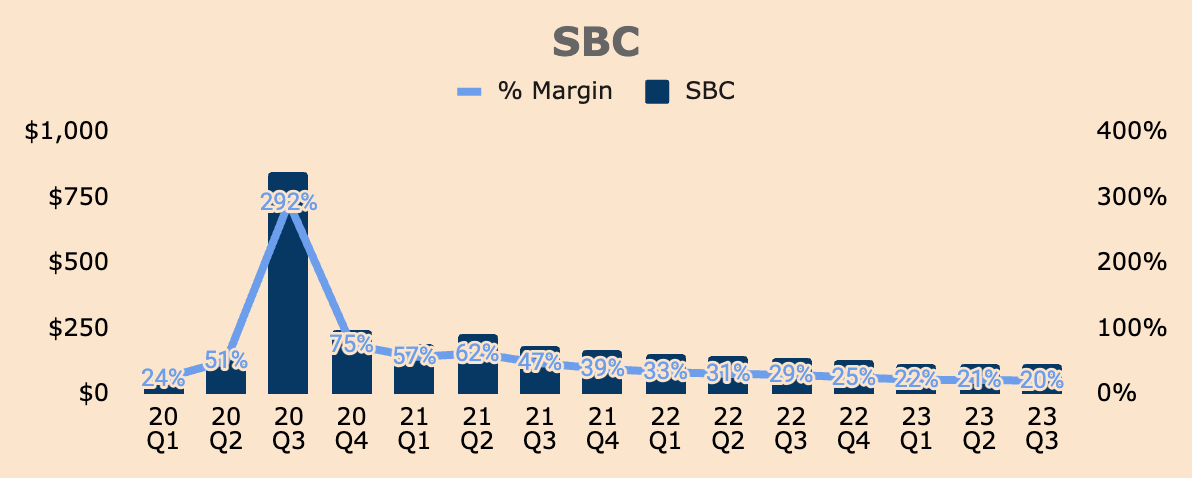

- Profitability Margins: [Insert Data - cite source]. Palantir is actively working on improving its margins through [Explain strategies, e.g., operational efficiency improvements, cost-cutting measures].

- Debt Levels: [Insert Data - cite source]. The company's debt position is [Explain the implications of the debt levels, e.g., manageable, concerning].

- Customer Acquisition and Retention: [Insert Data - cite source]. Palantir's success in acquiring and retaining high-value clients is a positive indicator of its long-term growth potential.

Comparing Palantir's performance to competitors like [Mention Competitors, e.g., Microsoft, AWS] reveals [Compare key performance indicators and market share, highlighting Palantir's strengths and weaknesses].

Catalysts for Potential Growth: Why a 40% Surge?

The prediction of a 40% surge in Palantir stock by 2025 is fueled by several potential growth drivers. These factors suggest a significant upside, though it's crucial to remember that these are predictions, not guarantees.

- Increased Government Contracts and Partnerships: Palantir's strong presence in government contracting, particularly with defense and intelligence agencies, is a significant revenue stream. Further expansion in this sector, along with new partnerships, could drive substantial growth.

- Expansion into New Commercial Markets: Palantir's push into commercial sectors like finance, healthcare, and energy is showing promising results. Success in these diverse markets could significantly broaden its revenue base.

- Technological Advancements and Product Innovation: Palantir continues to invest heavily in R&D, leading to innovations in its data analytics platforms. These advancements could attract new clients and enhance its existing offerings.

- Strategic Acquisitions: Strategic acquisitions of smaller companies with complementary technologies could further accelerate Palantir's growth trajectory.

Several analysts share optimistic views, citing these factors as contributing to a potential 40% surge. [Cite specific analyst reports and forecasts].

Risks and Challenges Facing Palantir

Investing in Palantir stock involves significant risks. While the potential rewards are enticing, a balanced perspective necessitates acknowledging potential downsides.

-

Competition from Established Players: Palantir faces stiff competition from established tech giants with extensive resources and market share. Maintaining its competitive edge requires continuous innovation and strategic maneuvering.

-

Dependence on Government Contracts: A significant portion of Palantir's revenue stems from government contracts. Changes in government policies or priorities could negatively impact its financial performance.

-

Economic Downturns Impacting Spending: Economic downturns can lead to reduced government spending and decreased demand from commercial clients, impacting Palantir's growth.

-

Geopolitical Risks: Palantir's operations are impacted by geopolitical events and instability in regions where it operates.

-

Other Risks: [List other potential risks, e.g., regulatory hurdles, cybersecurity threats, talent retention].

Valuation and Investment Strategy: Is Palantir Stock a Buy?

Assessing Palantir's valuation using metrics like the P/E ratio and PEG ratio is crucial before making an investment decision. [Provide current valuation data and compare it to industry benchmarks and historical data]. A long-term investment strategy might be more suitable given the company's growth potential, though this requires higher risk tolerance.

Consider alternative investment opportunities in the tech sector. [Suggest a few other tech companies with different risk profiles]. Ultimately, the decision to buy Palantir stock hinges on your individual risk tolerance, investment goals, and diversification strategy.

Conclusion: Should You Invest in Palantir Stock in 2024?

Palantir's potential for a 40% surge in 2025 is tantalizing, supported by strong revenue growth and promising growth catalysts. However, the risks associated with investing in Palantir stock are substantial. The dependence on government contracts, competitive landscape, and macroeconomic factors introduce significant uncertainty.

Therefore, while the potential upside is considerable, it's essential to thoroughly weigh the risks. A comprehensive due diligence process, including independent research and consultation with a financial advisor, is highly recommended before investing in Palantir stock. Ultimately, the decision of whether to buy Palantir stock rests with you. Conduct your own thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Broken Family Seeks Accountability After Racist Murder

May 10, 2025

Broken Family Seeks Accountability After Racist Murder

May 10, 2025 -

First Listen Mariah The Scientists Burning Blue

May 10, 2025

First Listen Mariah The Scientists Burning Blue

May 10, 2025 -

Fox News Jeanine Pirro Named Top Dc Prosecutor By Trump Implications And Analysis

May 10, 2025

Fox News Jeanine Pirro Named Top Dc Prosecutor By Trump Implications And Analysis

May 10, 2025 -

Nyt Strands Saturday April 12th Game 405 Answers And Clues

May 10, 2025

Nyt Strands Saturday April 12th Game 405 Answers And Clues

May 10, 2025 -

Bangkok Post Highlights Urgent Need For Transgender Rights

May 10, 2025

Bangkok Post Highlights Urgent Need For Transgender Rights

May 10, 2025