Is Palantir Stock A Good Investment Before Its May 5th Report?

Table of Contents

Palantir Technologies (PLTR) is set to release its earnings report on May 5th, leaving investors wondering: is Palantir stock a good investment right now? This article analyzes the company's recent performance, future prospects, and potential risks to help you determine if adding Palantir to your portfolio before the report makes sense. We'll explore key factors to consider before making your investment decision, helping you navigate the complexities of this intriguing tech stock.

Palantir's Recent Financial Performance and Growth Trajectory

Revenue Growth and Profitability

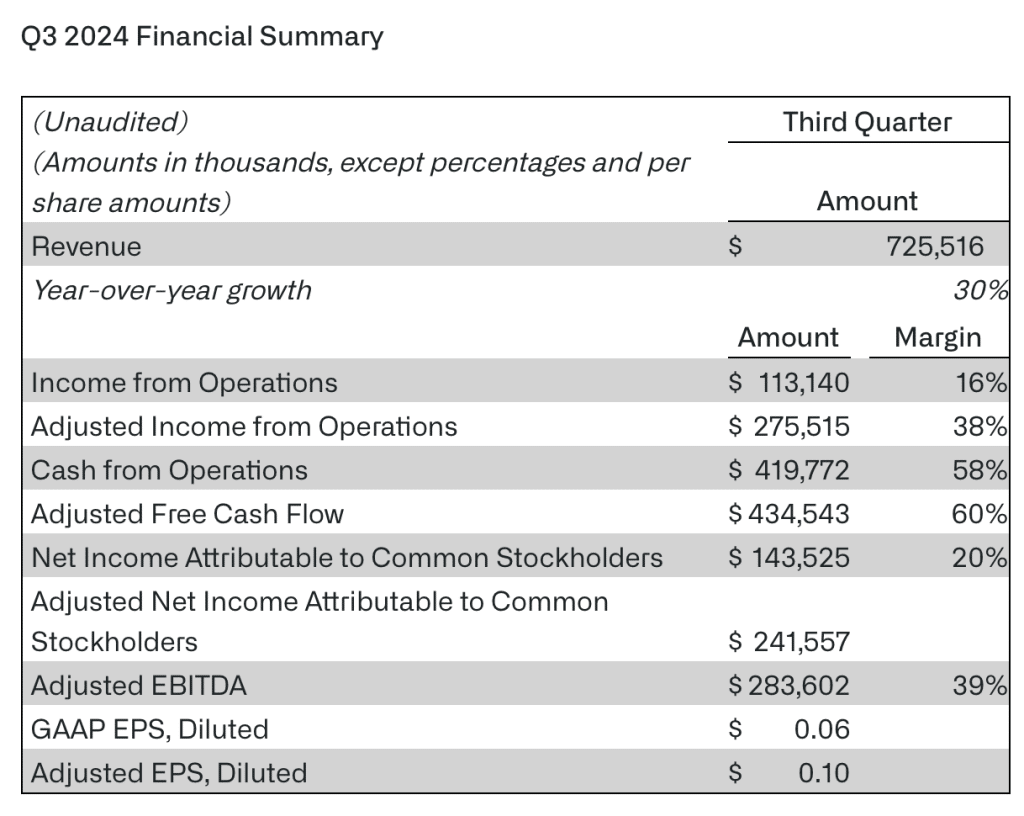

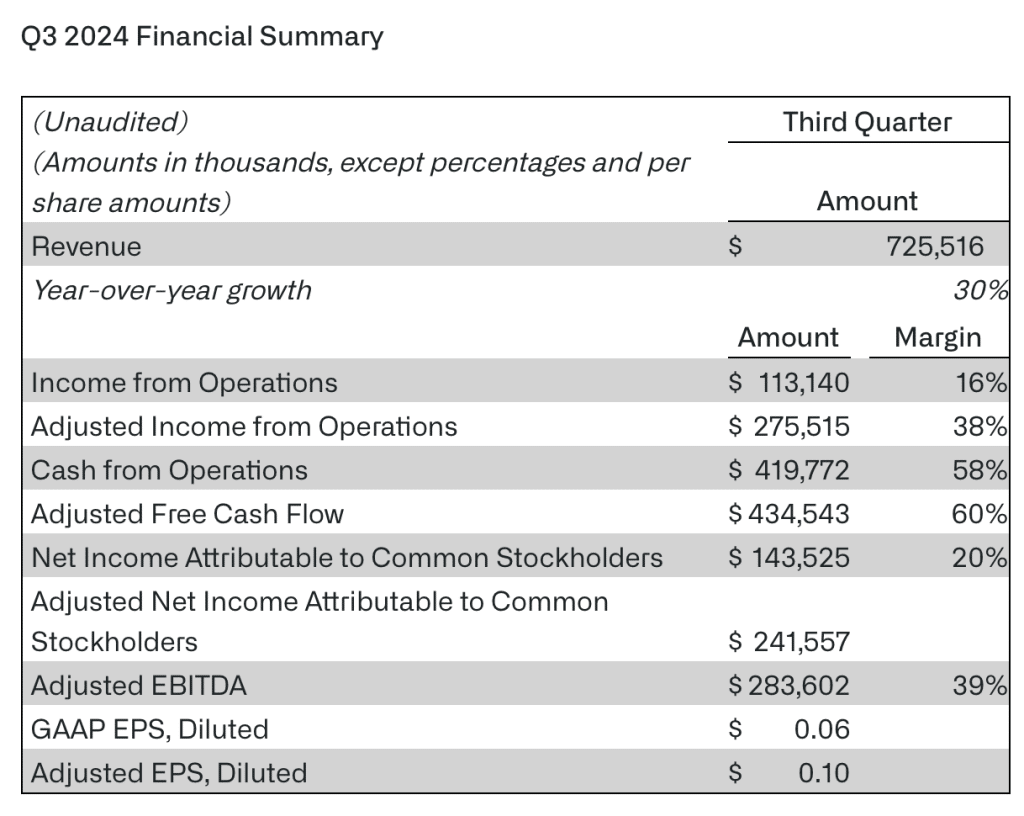

Palantir's financial performance has been a subject of intense scrutiny. Examining recent quarterly and annual reports reveals a mixed bag. While revenue has shown consistent growth, profitability remains a key area of focus for investors. Let's delve into the specifics:

- Q4 2022 Revenue: [Insert actual Q4 2022 revenue figures]. This represents a [percentage]% increase compared to Q4 2021, showcasing continued growth. However, analysts will be closely examining the breakdown of revenue sources.

- Profitability Margins: Gross margins have [increased/decreased] to [insert percentage]%, while operating margins stand at [insert percentage]%. Net income [increased/decreased] compared to the previous year. The company’s ability to improve its profitability margins, particularly in its commercial sector, will be key to its long-term success.

- Government vs. Commercial Contracts: Palantir's reliance on government contracts significantly impacts its profitability. While these contracts often provide stable revenue streams, they may not offer the same high margins as commercial partnerships. The company’s efforts to diversify into the commercial sector will be a crucial factor for future profitability.

Key Financial Metrics

Beyond revenue and profitability, other key financial metrics offer a more comprehensive picture of Palantir's financial health:

- Cash Flow: Palantir's cash flow from operations has [increased/decreased] in recent quarters. Strong positive cash flow indicates the company's ability to generate cash from its core business operations, which is essential for future growth and potential investments.

- Debt Levels: The company's debt levels have [increased/decreased], currently standing at [insert figure]. Investors will scrutinize this aspect, considering the impact of debt servicing on future profitability and growth potential.

- Free Cash Flow (FCF): Free cash flow represents cash available after accounting for capital expenditures. A healthy FCF is crucial for dividends, share buybacks, and further investments. Palantir's FCF trajectory will be a crucial indicator for investors.

Market Sentiment and Analyst Predictions for Palantir Stock

Stock Price Performance

PLTR stock has experienced significant volatility in recent times. [Insert a chart visualizing stock price performance over the last year]. Key factors influencing these price movements include:

- Earnings Reports: Past earnings reports have significantly influenced PLTR's stock price, highlighting the importance of the upcoming May 5th report.

- Market Sentiment: Overall market conditions and investor sentiment towards the tech sector have played a role in PLTR's stock price fluctuations.

- News and Announcements: Significant news announcements, such as new contracts or partnerships, have also impacted the stock price.

Analyst Ratings and Price Targets

Analyst opinions on Palantir stock are varied. While some analysts maintain a bullish outlook, others express more cautious views:

- Buy Ratings: [Number] analysts have a "Buy" rating, citing [reasons].

- Hold Ratings: [Number] analysts recommend a "Hold" rating, citing concerns about [factors].

- Sell Ratings: [Number] analysts have a "Sell" rating, pointing to [risks].

- Price Targets: Analyst price targets range from [lowest price] to [highest price], reflecting a wide range of expectations for future stock performance.

Risks and Opportunities Associated with Investing in Palantir

Competition and Market Saturation

Palantir operates in a competitive landscape:

- Key Competitors: Major competitors include [list key competitors] who offer similar big data analytics and software solutions.

- Market Saturation: The big data analytics market is becoming increasingly saturated, increasing the pressure on Palantir to differentiate its offerings and secure market share.

- Niche Markets: Palantir is focusing on specific niche markets (government, defense, etc.), but even in these niches, intense competition exists.

Dependence on Government Contracts

Palantir's significant reliance on government contracts presents both opportunities and risks:

- Revenue Percentage: A substantial percentage of Palantir's revenue comes from government contracts, exposing the company to potential risks associated with changes in government spending or policy.

- Geopolitical Risks: International relations and geopolitical stability can influence government contracts and revenue streams.

- Diversification Efforts: Palantir is actively trying to diversify its revenue streams by expanding into commercial markets, which is crucial for reducing its reliance on government contracts and mitigating risk.

The Impact of the May 5th Earnings Report on Palantir Stock

Expected Announcements and Their Potential Influence

The May 5th earnings report will be closely scrutinized for the following:

- Revenue Growth: Investors will look for evidence of sustained revenue growth and the breakdown of revenue between government and commercial sectors.

- Earnings Per Share (EPS): Meeting or exceeding EPS expectations will be crucial for a positive market reaction.

- Guidance: Future guidance provided by Palantir management on revenue and profitability will significantly impact investor sentiment.

- New Contracts/Partnerships: Announcements of new contracts, particularly large commercial partnerships, could significantly boost investor confidence.

Post-Earnings Report Trading Strategies

Depending on the May 5th report's outcome, different investment strategies may be appropriate:

- Positive Report: A strong report exceeding expectations might lead some investors to maintain or increase their positions.

- Negative Report: A disappointing report could trigger a sell-off, potentially creating a buying opportunity for long-term investors with a higher risk tolerance.

- Risk Management: Regardless of the report's outcome, it's crucial to practice effective risk management strategies. Consult a financial advisor before making significant investment decisions.

Conclusion

Investing in Palantir stock before its May 5th earnings report requires careful consideration of its financial performance, market dynamics, and inherent risks. While Palantir possesses significant potential in the big data analytics market, its reliance on government contracts and competitive landscape pose challenges. The May 5th report will be pivotal; analyzing it carefully, along with ongoing market trends and expert predictions, is crucial. Ultimately, whether Palantir stock is a good investment for you depends on your individual risk tolerance and investment objectives. Conduct thorough research and consult a financial advisor before making any investment decisions. Remember to carefully analyze the May 5th report before making any adjustments to your Palantir investment strategy.

Featured Posts

-

Kaitlin Olson And The Return Of High Potential Shows On Abc In March 2025

May 10, 2025

Kaitlin Olson And The Return Of High Potential Shows On Abc In March 2025

May 10, 2025 -

Frances Minister For Europe Advocates For Joint Nuclear Power

May 10, 2025

Frances Minister For Europe Advocates For Joint Nuclear Power

May 10, 2025 -

Golden Knights Face Potential Hertl Absence Following Lightning Hit

May 10, 2025

Golden Knights Face Potential Hertl Absence Following Lightning Hit

May 10, 2025 -

Why Is The Us Attorney General On Fox News Daily A More Important Question Than The Epstein Case

May 10, 2025

Why Is The Us Attorney General On Fox News Daily A More Important Question Than The Epstein Case

May 10, 2025 -

Stiven King Noviy Konflikt S Ilonom Maskom Na Platforme X

May 10, 2025

Stiven King Noviy Konflikt S Ilonom Maskom Na Platforme X

May 10, 2025