Is Palantir Stock A Good Investment Before May 5th Earnings Report?

Table of Contents

Palantir's Recent Performance and Market Trends

Palantir's stock price has experienced considerable volatility in recent months, mirroring broader trends within the technology sector. Interest rate hikes and concerns about a potential recession have weighed on the valuations of many growth stocks, including Palantir shares. Understanding these macro-economic factors is crucial to evaluating the current Palantir investment landscape.

- Key Performance Indicators (KPIs): Recent quarterly reports have shown [insert actual data here – e.g., X% revenue growth, Y% increase in customer count, Z% increase or decrease in operating income]. Analyzing these KPIs provides valuable insight into the company's operational performance and trajectory.

- Competitor Analysis: Palantir faces competition from established players like [mention key competitors, e.g., Microsoft Azure, Google Cloud, Snowflake] in the data analytics and cloud computing markets. Its competitive advantages lie in [mention Palantir's unique selling propositions, e.g., its specialized government clientele, its proprietary software, its focus on specific sectors].

- Significant News and Events: Any significant news impacting Palantir, such as new contract wins, product launches, or regulatory changes, should be considered when evaluating Palantir investment potential. For example, [mention any recent significant news that impacted the stock price].

Analyzing Palantir's Upcoming Earnings Report (May 5th)

The May 5th earnings report is paramount for investors assessing Palantir stock. It will offer a critical update on the company's financial health and growth prospects. Investors should closely monitor several key metrics:

-

Revenue Growth: Sustained revenue growth is vital to demonstrating Palantir's market traction and long-term viability. A significant deviation from analyst expectations could heavily impact the Palantir share price.

-

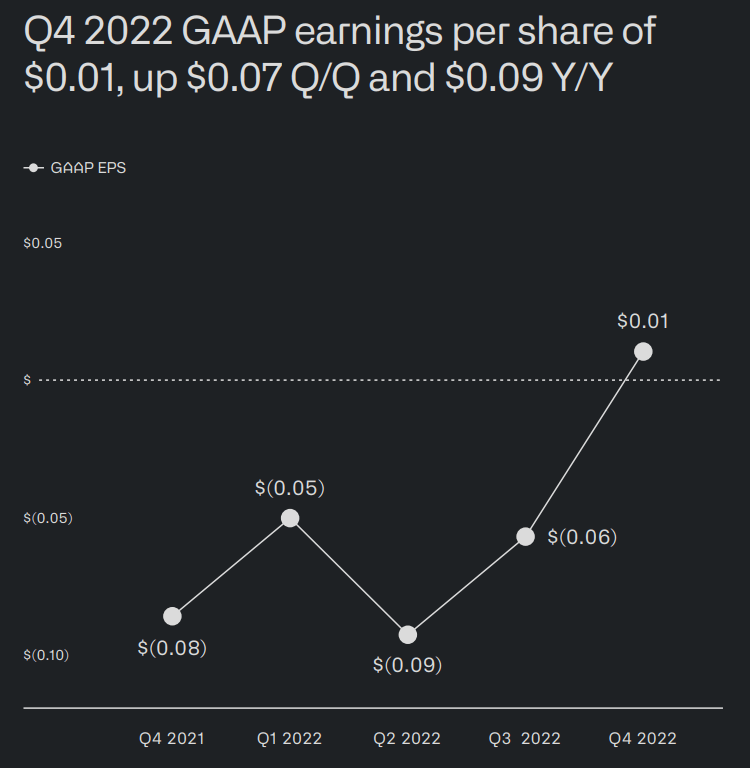

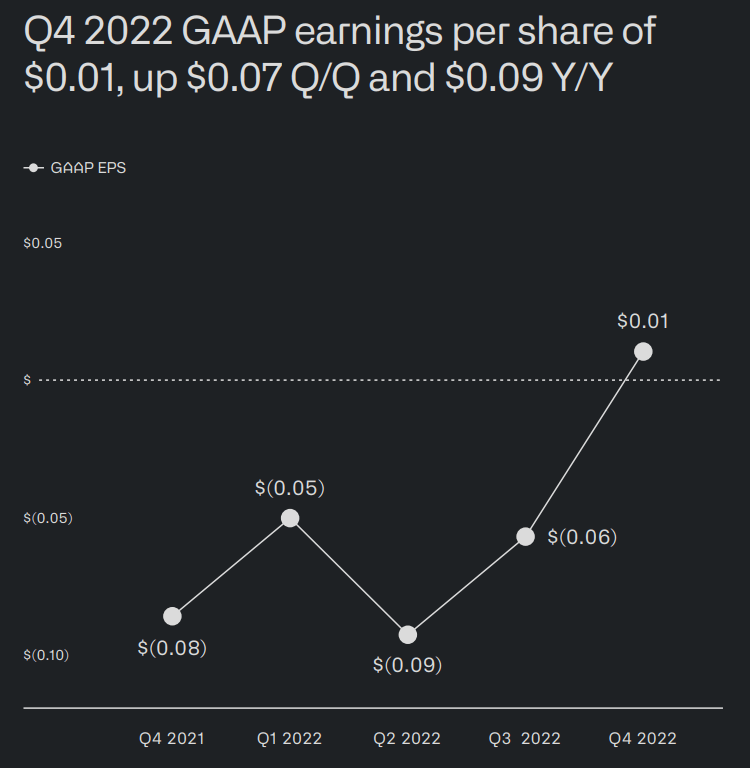

Profitability: Achieving profitability or demonstrating clear progress toward it is a key factor in assessing the long-term value of Palantir investment.

-

Customer Acquisition: The number of new clients acquired, particularly in target sectors, will provide insights into the company's growth potential.

-

Potential Surprises: The report could reveal positive surprises such as exceeding revenue expectations or securing major new contracts, or negative surprises like slower-than-expected growth or increased operating costs.

-

Analyst Expectations: Beating or missing analyst expectations will significantly affect the immediate market reaction to the earnings report. Understanding the consensus forecast is critical.

-

Future Guidance: Palantir's guidance for future quarters will offer vital information about the company's outlook and potentially influence investor sentiment.

Assessing the Risks and Rewards of Investing in Palantir Stock

Investing in Palantir stock, like any investment, involves both risks and potential rewards. A thorough risk assessment is crucial before committing capital.

-

Risks: Palantir's stock is known for its volatility. Dependence on government contracts presents another risk, as does the intense competition in the data analytics market. Economic downturns can also impact its growth trajectory.

-

Rewards: The long-term growth potential within the booming data analytics market is a significant draw. Increased profitability, strategic partnerships, and successful product innovation can significantly increase the value of Palantir shares.

-

Risk Assessment: Based on the current market conditions and Palantir's financial health [insert your own assessment here based on available data], the risk profile is [high/medium/low].

-

Potential ROI: Different market outcomes will lead to varying returns. A scenario analysis considering different growth rates and market conditions is advisable.

-

Comparative Risk Profile: Compared to [mention comparable investments], Palantir presents a [higher/lower/similar] risk profile.

Expert Opinions and Analyst Predictions

Analyzing expert opinions provides valuable context for your investment decision. It's important to consider a range of perspectives.

- Analyst Ratings: A range of analysts currently rate Palantir stock as [insert a summary of buy, hold, and sell ratings and their reasoning].

- Price Targets: Analysts have set price targets for Palantir stock ranging from [insert range of price targets].

- Consensus View: The overall consensus on Palantir's future prospects is [summarize the dominant view].

Conclusion: Should You Invest in Palantir Stock Before May 5th?

This analysis highlights both the potential rewards and risks associated with investing in Palantir stock before the May 5th earnings report. The upcoming report will be a significant catalyst for the stock price, influenced by factors like revenue growth, profitability, and future guidance. While Palantir operates in a dynamic and high-growth market, the inherent volatility and reliance on specific sectors must be considered. The range of analyst opinions underscores the need for careful individual assessment.

While this analysis provides valuable insights into whether Palantir stock is a good investment before May 5th, remember to conduct your own due diligence before making any investment decisions. Carefully consider your risk tolerance and investment goals when evaluating Palantir stock and other potential investments. Understanding Palantir's business model and carefully reviewing the May 5th earnings report are critical before making any investment decisions related to Palantir shares.

Featured Posts

-

Navigating The Elizabeth Line A Wheelchair Users Guide To Gap Safety

May 09, 2025

Navigating The Elizabeth Line A Wheelchair Users Guide To Gap Safety

May 09, 2025 -

Nyt Strands Hints And Answers Saturday February 15 Game 349

May 09, 2025

Nyt Strands Hints And Answers Saturday February 15 Game 349

May 09, 2025 -

Bitcoin Mining Boom Exploring The Factors Behind The Rise

May 09, 2025

Bitcoin Mining Boom Exploring The Factors Behind The Rise

May 09, 2025 -

Fur Rondy Shorter Race Unwavering Mushers

May 09, 2025

Fur Rondy Shorter Race Unwavering Mushers

May 09, 2025 -

R3

May 09, 2025

R3

May 09, 2025