Is Palantir Stock A Good Investment? Evaluating The Risks And Rewards

Table of Contents

Palantir's Business Model and Market Position

Palantir Government Contracts and Revenue Streams

Palantir's revenue significantly relies on government contracts, primarily with the US government. This dependence offers both stability and predictability, as government contracts often span multiple years. However, it also presents risks, as budget cuts or shifts in political priorities could impact revenue streams.

- Stability: Long-term contracts provide a reliable revenue base.

- Risk: Dependence on a single major client (the US government) creates vulnerability.

- Diversification: Palantir is actively diversifying into commercial markets, aiming to reduce this reliance.

Palantir's revenue breakdown reveals a substantial portion derived from government agencies, but the growth in commercial clients is crucial for long-term sustainability. Analyzing PLTR revenue growth reveals a fluctuating pattern, dependent on contract wins and commercial market penetration. Data on the exact revenue breakdown should be sourced from Palantir's financial reports for the most up-to-date information. Understanding the balance between Palantir government contracts and commercial clients is key to assessing the overall risk profile of the stock.

Competitive Landscape and Market Share

Palantir faces stiff competition in the data analytics market, with major players like Databricks and Snowflake vying for market share. However, Palantir possesses several competitive advantages:

- Proprietary Technology: Palantir's Gotham and Foundry platforms offer unique capabilities in data integration and analysis.

- Strong Government Relationships: Its established presence within government agencies provides a significant barrier to entry for competitors.

While precise market share figures are difficult to obtain, Palantir's strong reputation and unique technological offerings suggest a robust position within niche government and commercial markets. Analyzing Palantir's market share within specific sectors is crucial for evaluating its long-term growth potential. Understanding the competitive dynamics of the data analytics market and how Palantir is positioned within it is a critical step in assessing PLTR stock.

Financial Performance and Valuation

Profitability and Growth Metrics

Assessing Palantir's financial health requires examining its revenue, profitability, and earnings per share (EPS). While revenue has demonstrated growth, consistent profitability has been elusive. Key financial ratios like the price-to-sales ratio (P/S) and price-to-earnings ratio (P/E) provide insights into its valuation relative to its performance and future expectations. Analysis of Palantir's financials reveals:

- Revenue Growth: Consistent revenue growth, though profitability remains a challenge.

- EPS: EPS fluctuations reflect the company's journey toward consistent profitability.

- Cash Flow and Debt: Examining Palantir's cash flow and debt levels will reveal its financial stability and ability to fund future growth.

Analyzing Palantir's revenue growth, EPS, and its P/E and P/S ratios relative to its competitors provide a deeper understanding of its financial health and future potential.

Valuation and Future Projections

Valuing Palantir requires various approaches, including discounted cash flow (DCF) analysis. Comparing the current market valuation to historical data and analyzing analyst forecasts offers a broader perspective. Future growth projections depend on many factors, including:

- Successful Commercial Expansion: Palantir's ability to successfully expand into commercial markets will be a major driver of future growth.

- Technological Innovation: Continuous innovation and adaptation to evolving market needs are critical for long-term success.

- Government Contract Renewals: The renewal of existing government contracts plays a significant role in revenue predictability.

Considering different valuation methodologies and comparing them against analyst projections provides a more comprehensive view of Palantir's potential future value.

Risks Associated with Investing in Palantir Stock

Dependence on Government Contracts

The reliance on government contracts remains a significant risk. Budget cuts, shifting political priorities, and changes in government policy could negatively impact revenue.

Competition and Market Saturation

The increasing competition in the data analytics sector and potential market saturation pose considerable challenges to Palantir's growth prospects.

Profitability Concerns

The continued challenge in achieving consistent profitability represents a considerable investment risk. Investors need to carefully assess the likelihood of Palantir reaching consistent and sustainable profitability.

Valuation Risk

Palantir's current valuation might reflect optimism about future growth, potentially leading to overvaluation if these expectations are not met.

Conclusion

Investing in Palantir stock (PLTR) presents a compelling opportunity due to its innovative technology, strong government relationships, and growth potential. However, significant risks exist, including dependence on government contracts, intense competition, and the challenge of achieving sustained profitability. The current valuation must be carefully considered against these risks. Ultimately, whether Palantir stock is a good investment for you depends on your risk tolerance and investment goals. Conduct thorough research, perform your due diligence, and consider consulting a financial advisor before making any investment decisions related to Palantir stock (PLTR). Remember to regularly review your investment strategy and adjust as needed based on new information and market changes.

Featured Posts

-

Blue Origin Young Thug Not Among Upcoming Passengers

May 10, 2025

Blue Origin Young Thug Not Among Upcoming Passengers

May 10, 2025 -

2025 Assessing Stephen Kings Year Despite A Potential The Monkey Flop

May 10, 2025

2025 Assessing Stephen Kings Year Despite A Potential The Monkey Flop

May 10, 2025 -

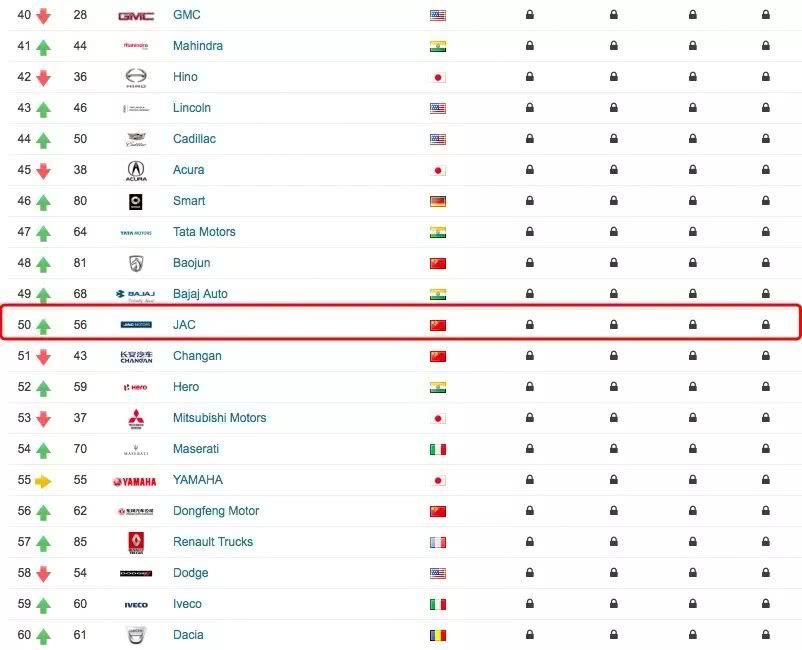

The China Factor Assessing Risks And Opportunities For Global Auto Brands

May 10, 2025

The China Factor Assessing Risks And Opportunities For Global Auto Brands

May 10, 2025 -

China Seeks New Canola Sources Following Canada Trade Dispute

May 10, 2025

China Seeks New Canola Sources Following Canada Trade Dispute

May 10, 2025 -

Barbashevs Ot Winner Knights Edge Wild Series Tied 2 2

May 10, 2025

Barbashevs Ot Winner Knights Edge Wild Series Tied 2 2

May 10, 2025