Is Palantir Technologies Stock A Buy Now? A Comprehensive Analysis

Table of Contents

Palantir's Business Model and Revenue Streams

Palantir's core business revolves around providing sophisticated data analytics and software solutions to government and commercial clients. Its success hinges on two primary platforms: Gotham and Foundry. Gotham caters to government agencies, offering advanced data integration and analysis capabilities for national security and intelligence applications. Foundry, on the other hand, is designed for commercial clients, enabling them to leverage their data for improved operational efficiency and strategic decision-making.

- Revenue Breakdown: Palantir's revenue is currently split between government and commercial sectors, with the government sector historically contributing a larger portion. However, the company is actively diversifying its revenue streams by focusing on growth in the commercial market.

- Key Contract Wins: Securing large, long-term contracts is crucial for Palantir's revenue predictability. Recent significant contract wins with major corporations and government agencies should be closely examined for their impact on future financial projections. Analyzing these contracts and their terms helps gauge the stability of Palantir's revenue stream.

- Long-Term Contracts: The nature of Palantir's contracts, many of which are long-term, provides a degree of revenue visibility and stability. This contrasts with some companies in the tech sector that rely heavily on shorter-term contracts.

Financial Performance and Valuation

Analyzing Palantir's financial statements—income statement, balance sheet, and cash flow statement—is essential for assessing its financial health. Key metrics like revenue growth, profitability margins (gross profit margin, operating margin, net margin), debt levels, and free cash flow should be carefully scrutinized.

- Year-over-Year Revenue Growth: Consistent and substantial year-over-year revenue growth is a positive indicator of Palantir's business performance. Analyzing this trend offers insights into the company's ability to acquire and retain clients.

- Profitability Margins: While Palantir has shown revenue growth, profitability margins need to be considered to fully understand the company's financial health. Tracking these margins over time helps assess the efficiency of its operations.

- Valuation Multiples: Comparing Palantir's Price-to-Sales (P/S) ratio and other valuation multiples to its competitors in the data analytics and software market provides context for its current valuation. Investors should be aware of the premium valuation placed on the company in relation to its profitability.

Competitive Landscape and Market Position

Palantir operates in a highly competitive data analytics and software market. Key competitors include established players like Databricks, Snowflake, and other large technology companies offering similar solutions. Palantir's competitive advantages lie in its proprietary technology, strong government relationships, and deep data expertise cultivated over years of experience.

- Competitive Advantages: Palantir's ability to integrate and analyze large, complex datasets is a key differentiator. Its established relationships within the government sector also provide a significant competitive edge.

- Market Share and Growth Potential: Assessing Palantir's current market share and potential for future growth is critical. The size and growth rate of the overall market will influence Palantir's future performance. Consider the addressable market and Palantir's potential to capture a larger share.

Future Outlook and Growth Potential

Palantir's future growth hinges on its ability to expand into new markets, particularly within the commercial sector, and to capitalize on technological advancements. Its continued success will depend on its ability to secure new contracts and retain existing clients.

- Revenue Growth Projections: Analyzing revenue growth projections for the next few years offers insight into Palantir's anticipated performance. These projections should be viewed with caution, as they are inherently uncertain.

- Expansion into New Markets: Palantir's plans for expansion into new sectors and geographical regions will significantly influence its future growth trajectory. Successful expansion into these areas will be crucial to its long-term success.

- Potential Risks: External factors, such as increased competition and regulatory changes, could pose significant risks to Palantir's growth prospects. A thorough risk assessment is essential.

Risks and Considerations for Investors

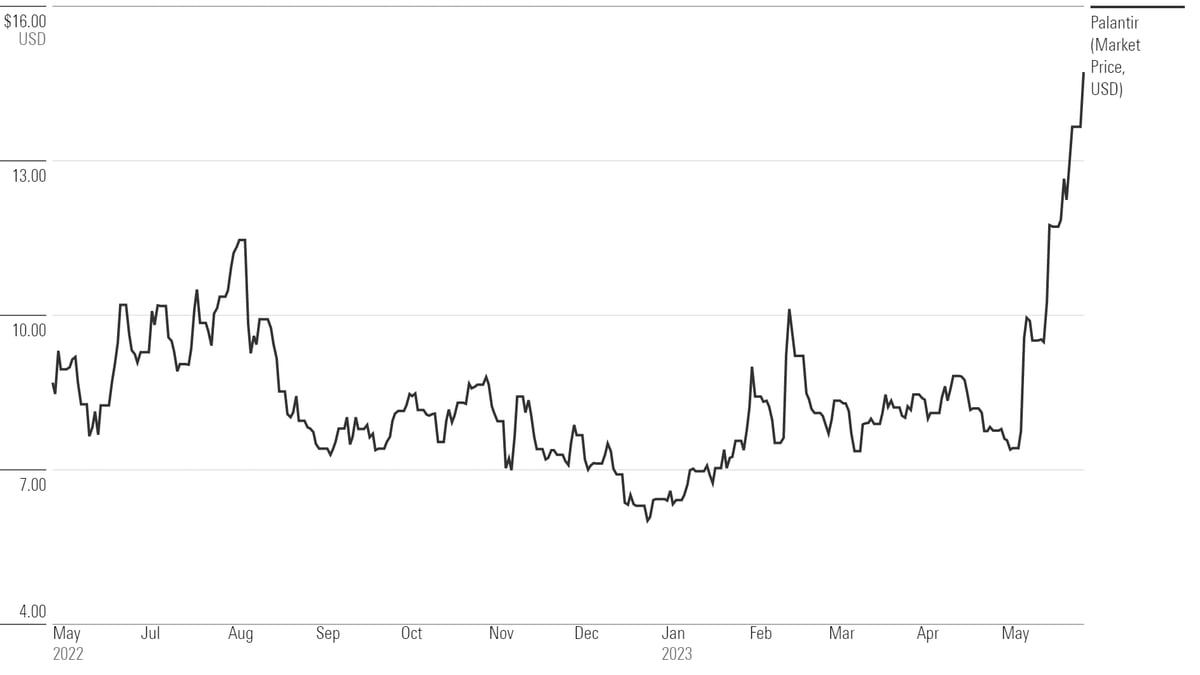

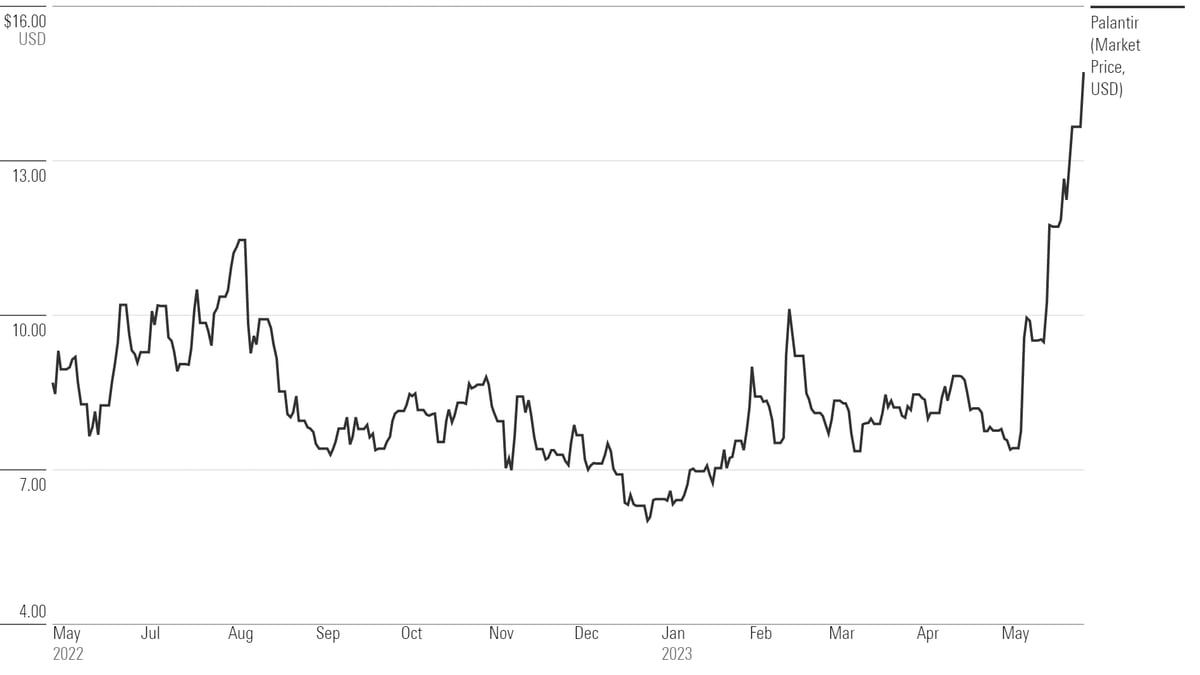

Investing in Palantir Technologies involves significant risks. The stock price can be highly volatile, influenced by factors like contract wins, financial results, and overall market sentiment.

- High Valuation: Palantir's current valuation is a significant factor to consider. Investors should carefully weigh this valuation against its profitability and future growth prospects.

- Government Contract Dependence: Palantir's significant reliance on government contracts exposes it to the potential risks associated with government budget changes and policy shifts.

- Intense Competition: The data analytics and software market is incredibly competitive, meaning Palantir faces substantial pressure from established and emerging players.

Conclusion:

So, is Palantir Technologies stock a buy now? Based on the analysis, Palantir presents both compelling opportunities and significant risks. Its innovative technology and strong government relationships offer considerable potential for growth, but its high valuation, dependence on government contracts, and intense competition warrant careful consideration. This analysis provides a framework for further investigation. Before investing in Palantir Technologies stock, conduct thorough due diligence, consult with a qualified financial advisor, and consider your own individual risk tolerance and financial situation. Remember, responsible investing in Palantir Technologies, or any stock, requires a deep understanding of the company and the broader market.

Featured Posts

-

Fast Paced Farce Takes Flight At St Albert Dinner Theatre

May 09, 2025

Fast Paced Farce Takes Flight At St Albert Dinner Theatre

May 09, 2025 -

Wynne Evanss Go Compare Future Uncertain After Strictly Incident

May 09, 2025

Wynne Evanss Go Compare Future Uncertain After Strictly Incident

May 09, 2025 -

Analyzing Dakota Johnsons Career Trajectory The Chris Martin Factor

May 09, 2025

Analyzing Dakota Johnsons Career Trajectory The Chris Martin Factor

May 09, 2025 -

Androids New Design Will It Attract Gen Z From I Phones

May 09, 2025

Androids New Design Will It Attract Gen Z From I Phones

May 09, 2025 -

Video Evidence Pam Bondis Plan To Kill American Citizens

May 09, 2025

Video Evidence Pam Bondis Plan To Kill American Citizens

May 09, 2025