Is Palantir Technologies Stock A Buy Now? A Comprehensive Investment Analysis

Table of Contents

Palantir Technologies is a data analytics company specializing in big data integration and analytics platforms. Its flagship products, Gotham and Foundry, cater to government and commercial clients, providing powerful tools for data analysis and decision-making. This analysis will delve into the various factors affecting Palantir's stock price to help you make an informed investment decision.

Palantir's Business Model and Revenue Streams

Palantir's business model revolves around its proprietary platforms, Gotham and Foundry. Gotham primarily serves government agencies, offering solutions for national security and intelligence operations. Foundry targets commercial clients across diverse sectors, helping them leverage their data for improved efficiency and strategic insights. The revenue model is primarily subscription-based, with additional revenue generated from consulting and implementation services.

The company’s revenue is split between government and commercial sectors. While government contracts have historically been a major revenue driver for Palantir, the company is actively expanding its presence in the commercial market. This diversification strategy is crucial to mitigate the inherent risks associated with reliance on government contracts.

- Growth in government contracts: Palantir continues to secure significant government contracts, demonstrating strong demand for its solutions in the public sector.

- Expansion into commercial markets: The company is actively targeting growth in sectors like finance, healthcare, and manufacturing, demonstrating a broader market appeal.

- Potential for new product offerings: Palantir is constantly innovating and developing new products and services to meet evolving customer needs and stay ahead of competitors.

- Risks associated with government contract reliance: The dependence on government contracts exposes Palantir to the risks of budget cuts, changes in government priorities, and political uncertainties.

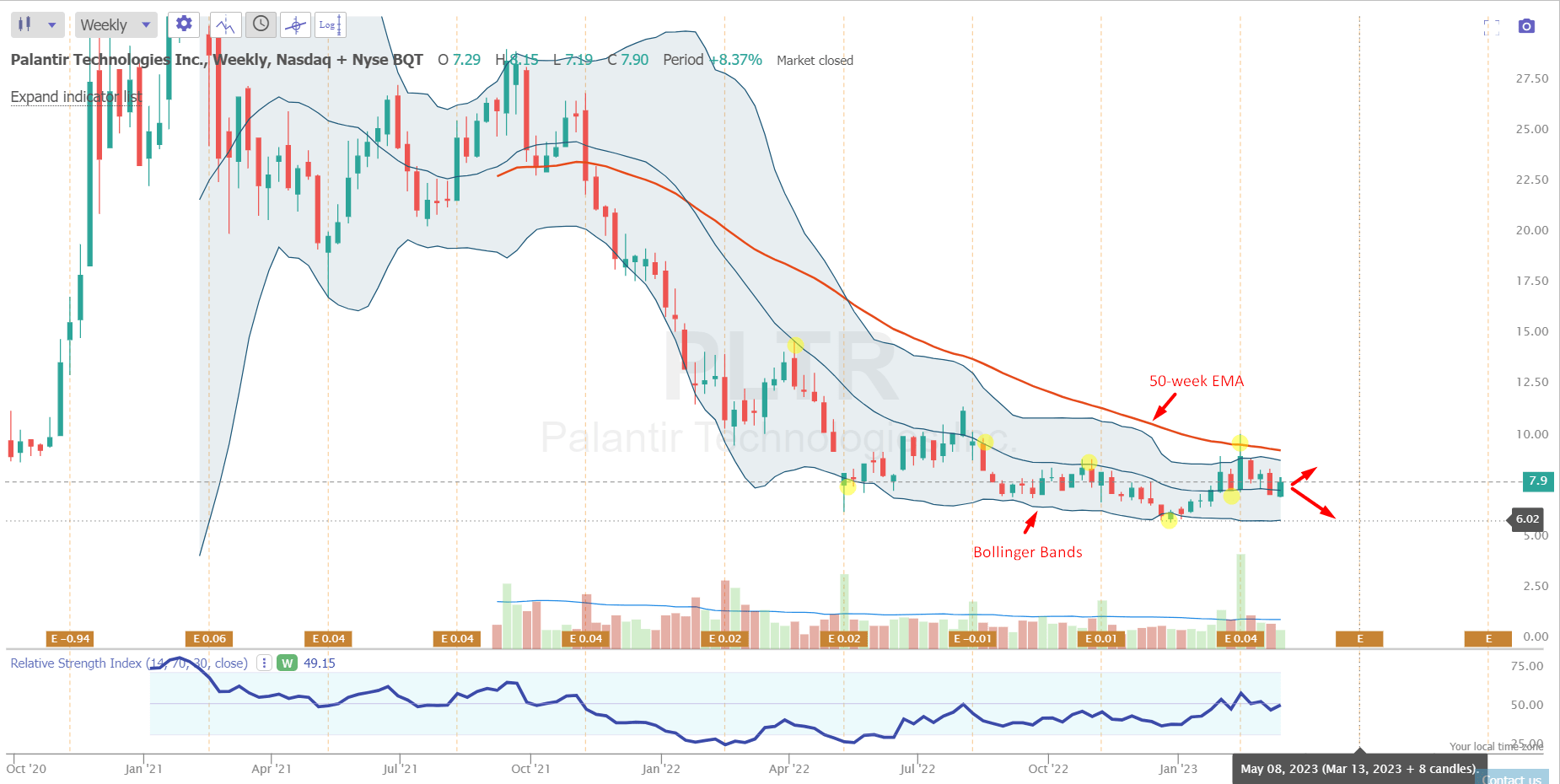

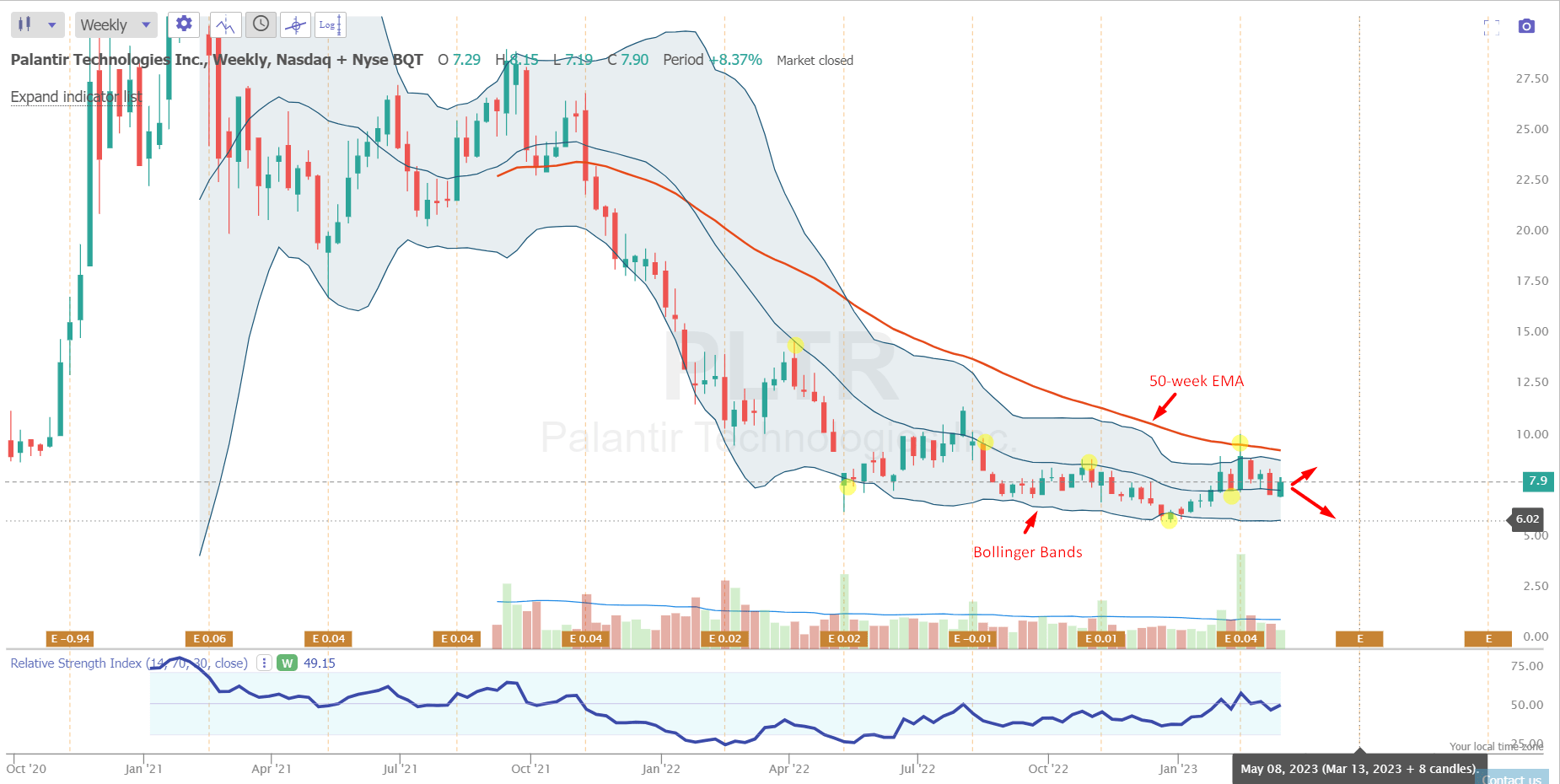

Financial Performance and Valuation

Analyzing Palantir's financial performance requires looking at key metrics such as revenue growth, profitability, and cash flow. While the company has shown significant revenue growth, its profitability has been inconsistent. Investors should carefully assess its path to sustainable profitability. Furthermore, Palantir's valuation, often assessed using metrics like the price-to-sales (P/S) ratio, needs to be compared to its competitors and industry benchmarks. A high valuation may reflect future growth potential, but it also presents a higher risk for investors.

- Recent quarterly earnings reports: A detailed analysis of recent earnings reports is vital for understanding Palantir's financial performance and progress towards profitability.

- Long-term growth prospects: Palantir's long-term growth potential is linked to its ability to maintain innovation and expand its customer base across both government and commercial sectors.

- Debt levels and financial health: Assessing Palantir's debt levels and overall financial health is critical for determining its financial stability and resilience in economic downturns.

- Comparison to industry benchmarks: Comparing Palantir's valuation and key performance indicators (KPIs) to those of its competitors helps assess its relative attractiveness as an investment.

Competitive Landscape and Market Opportunities

Palantir faces competition from major players like Amazon Web Services (AWS), Microsoft Azure, and other big data analytics companies. However, Palantir possesses distinct competitive advantages, including specialized expertise in data integration and strong relationships within government agencies. The overall market for big data analytics is experiencing significant growth, presenting substantial opportunities for Palantir to expand its market share.

- Market share analysis: Tracking Palantir's market share provides insights into its competitive positioning and growth trajectory.

- Competitive threats and opportunities: Analyzing competitive threats and opportunities helps anticipate potential challenges and identify strategic areas for growth.

- Potential for market consolidation: The big data analytics sector is susceptible to consolidation, and Palantir's positioning in this dynamic environment should be considered.

- Technological innovation and disruption: Continuous technological advancements and disruptive innovations will shape the future competitive landscape of the big data analytics market.

Risks and Challenges

Investing in Palantir Technologies stock entails considerable risks. The high valuation, reliance on government contracts, and intense competition are significant concerns. Macroeconomic factors, such as economic downturns and geopolitical instability, can also negatively impact Palantir's performance. Furthermore, regulatory changes and data privacy concerns pose additional challenges.

- Geopolitical risks: Global geopolitical events can significantly impact government spending and the demand for Palantir's services.

- Economic downturns: Economic recessions can lead to reduced spending by both government and commercial clients.

- Changes in government policy: Shifts in government priorities and policies can affect the demand for Palantir's government-focused solutions.

- Data privacy concerns: Increasing concerns around data privacy and security can influence regulatory scrutiny and customer adoption.

Analyst Ratings and Price Targets

Financial analysts offer a range of opinions on Palantir Technologies stock, with ratings varying from "buy" to "sell." It's crucial to examine the reasoning behind these different assessments and consider the potential range of price targets. This information provides further context to the overall investment outlook.

- Summary of recent analyst reports: Reviewing recent analyst reports provides a comprehensive overview of current market sentiment and future predictions.

- Average price target: The average price target from multiple analysts provides a benchmark for evaluating the stock's potential value.

- Range of price targets: The range of price targets highlights the uncertainty associated with future price movements.

- Factors influencing analyst ratings: Understanding the factors that influence analyst ratings is vital for assessing the credibility and reliability of their recommendations.

Conclusion

Determining whether Palantir Technologies stock is a buy now requires a careful evaluation of its business model, financial performance, competitive landscape, and inherent risks. While Palantir possesses significant growth potential and technological advantages, its high valuation and dependence on government contracts present substantial challenges. The analysis presented here provides valuable insights, but it's not a substitute for your own research. Based on the current information, a balanced approach, perhaps considering a smaller, diversified position, could be prudent for risk-averse investors. Before making any investment decisions, conduct your own thorough due diligence and consult with a financial advisor. Remember, this analysis is for informational purposes only and does not constitute financial advice. Is Palantir Technologies stock right for your portfolio? The answer depends on your risk tolerance and investment goals.

Featured Posts

-

The Kreischer Marriage Comedy Sex Jokes And Netflix Specials

May 10, 2025

The Kreischer Marriage Comedy Sex Jokes And Netflix Specials

May 10, 2025 -

High Potential A Lasting Impact On The Psych Spiritual Landscape After A Decade

May 10, 2025

High Potential A Lasting Impact On The Psych Spiritual Landscape After A Decade

May 10, 2025 -

Real Id Enforcement Summer Travel Planning Guide

May 10, 2025

Real Id Enforcement Summer Travel Planning Guide

May 10, 2025 -

Wynne And Joanna All At Sea Where To Find The Book

May 10, 2025

Wynne And Joanna All At Sea Where To Find The Book

May 10, 2025 -

The Trump Factor How Threats Reshaped Greenlands Relationship With Denmark

May 10, 2025

The Trump Factor How Threats Reshaped Greenlands Relationship With Denmark

May 10, 2025