Is RTL Group Poised For Streaming Success? A Look At Profitability Projections

Table of Contents

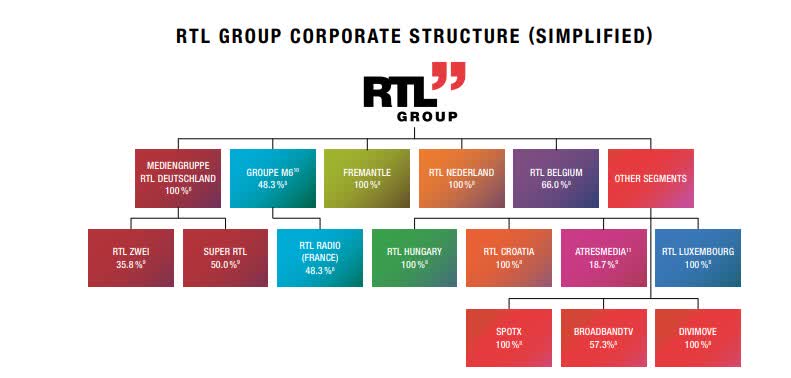

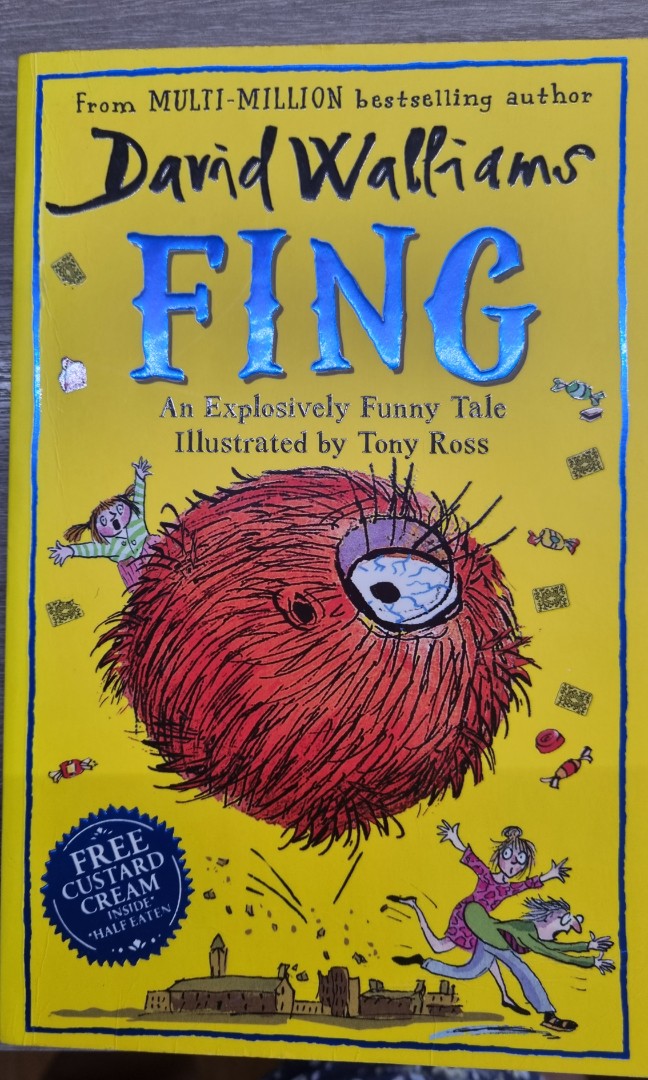

RTL Group's Streaming Strategy and Portfolio Analysis

RTL Group's streaming strategy centers around its diverse portfolio of services, aiming to capture significant market share in the European streaming market. Understanding its current position is crucial to predicting future profitability.

Key Streaming Platforms and Content Offerings

RTL Group's flagship streaming platform, RTL+, offers a compelling blend of local and international content. Its content library includes a mix of:

- Exclusive Series: Original productions designed to attract and retain subscribers, many focusing on German-speaking audiences. Examples include [insert specific show titles here if available].

- Popular International Shows: Licensing agreements provide access to a selection of globally recognized titles. [Include examples if available].

- Live TV Channels: The integration of live channels offers viewers a familiar experience alongside on-demand content.

While subscriber numbers for RTL+ are not publicly available in detail, reports suggest [insert any available data on subscriber growth or market share]. The company also holds stakes in other streaming ventures, further diversifying its portfolio and geographical reach. Analyzing the "RTL Group portfolio" in its entirety is essential to understanding its overall streaming strategy.

Competitive Landscape and Market Position

RTL Group faces stiff competition in the European streaming market from established players like Netflix, Disney+, and Amazon Prime Video. These competitors benefit from significant brand recognition, vast content libraries, and substantial marketing budgets. However, RTL Group possesses several key strengths:

- Strong Local Content: Its focus on locally produced content gives it a significant advantage in specific regional markets, where Netflix and Disney+ might lack comparable offerings.

- Established Brand Recognition: RTL Group’s legacy media brands provide a solid foundation for attracting subscribers.

- Strategic Partnerships: Collaborations with other media companies can enhance content offerings and expand reach.

Analyzing RTL Group's "competitive advantage" requires a comparison of key metrics, including:

- Market Share: Compared to Netflix’s dominance, RTL+ holds a [estimated] market share within its targeted regions.

- Subscriber Growth: The rate of subscriber acquisition needs to be analyzed against its competitors' growth trajectories.

- Content Differentiation: RTL+’s unique selling proposition lies in its locally relevant content, which gives it an edge against larger, more generic streaming platforms.

Profitability Projections and Financial Performance

To assess RTL Group's streaming potential, we must delve into its financial performance and profitability analysis.

Analyzing RTL Group's Financial Statements

RTL Group's financial statements reveal key insights into its streaming revenue and profitability. Recent reports indicate [insert specific data on revenue generated from streaming services, operating income, and subscriber acquisition costs, if available]. Any relevant press releases or analyst reports providing forecasts should be referenced here. Analyzing the "RTL Group financial performance" directly addresses the key question of its streaming viability. Key metrics to examine include:

- Streaming Revenue Growth: The year-on-year increase in revenue from its streaming services provides a clear indication of its success.

- Operating Income from Streaming: This metric accounts for costs involved, providing a clearer picture of profitability.

- Return on Investment (ROI): Assessing the ROI on investments in content, technology, and marketing is essential.

Factors Affecting Profitability

Several factors influence RTL Group's streaming profitability, including:

- Subscriber Acquisition Cost (CAC): The cost of acquiring new subscribers can significantly impact profitability. Aggressive marketing campaigns can drive growth, but at a high price.

- Content Licensing Fees: The cost of licensing popular shows can eat into profits. Producing original content might offer a long-term solution but also involves high initial investments.

- Marketing Expenditure: The cost of marketing and advertising is significant, particularly in the competitive streaming environment.

- Revenue Model: RTL Group uses a mix of AVOD (advertising-based video on demand) and SVOD (subscription video on demand) models. The balance between these models impacts profitability, with SVOD typically offering higher margins but slower subscriber growth.

Future Outlook and Challenges for RTL Group

The future success of RTL Group in the streaming market hinges on its growth strategies and ability to navigate potential challenges.

Growth Potential and Expansion Strategies

RTL Group's potential for growth lies in several key areas:

- Market Expansion: Entering new geographic markets beyond its current focus could significantly boost subscriber numbers.

- Strategic Partnerships: Collaborations with other media companies or tech giants could expand its content library and reach.

- Technology Investment: Upgrading its streaming platform to improve user experience and add innovative features is crucial. The introduction of personalized recommendations and improved search functionality will likely attract and retain users.

The company needs to continue focusing on original content to solidify its position.

Challenges and Risks

RTL Group faces numerous challenges:

- Increased Competition: The streaming market is becoming increasingly crowded, putting pressure on market share and subscriber acquisition.

- Piracy: Illegal streaming services pose a significant threat to revenue.

- Changing Consumer Preferences: Consumer viewing habits are constantly evolving; adapting to these changes is essential for survival.

- Regulatory Challenges: The changing regulatory landscape in Europe could introduce new restrictions and compliance costs.

- Economic Factors: Economic downturns might influence consumer spending, reducing subscriptions to streaming services.

Conclusion: Is RTL Group Ready to Conquer the Streaming World?

RTL Group’s streaming strategy shows promise, with a focus on local content and a diverse portfolio. However, its financial performance needs continued monitoring and growth. The competitive landscape presents significant challenges. While its strengths lie in its established brand recognition and locally relevant content, it needs to carefully manage costs, particularly subscriber acquisition costs and content licensing fees. Successfully navigating the challenges of increased competition, piracy, and changing consumer preferences will determine its long-term success.

To stay updated on RTL Group’s streaming progress and to further analyze RTL Group's streaming success, follow their financial reports and industry news. You can also research analyst reports to gain deeper insights into the company’s profitability and future outlook. Ultimately, the question of whether RTL Group will conquer the streaming world depends on its ability to adapt, innovate, and effectively manage the risks inherent in this rapidly evolving market.

Featured Posts

-

Complete Guide To The Nyt Mini Crossword May 13 2025

May 21, 2025

Complete Guide To The Nyt Mini Crossword May 13 2025

May 21, 2025 -

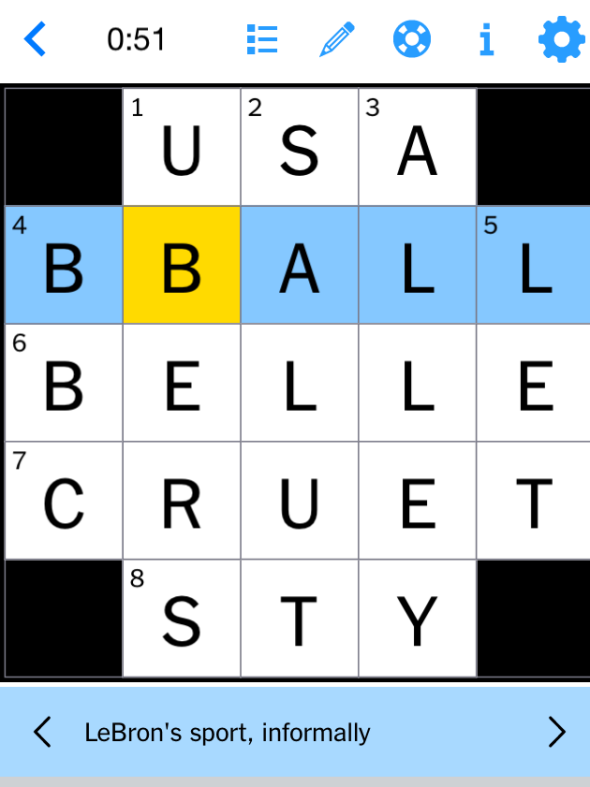

Stan Invests In David Walliams Fing Fantasy Film

May 21, 2025

Stan Invests In David Walliams Fing Fantasy Film

May 21, 2025 -

Trans Australia Run A New Record In Sight

May 21, 2025

Trans Australia Run A New Record In Sight

May 21, 2025 -

Southern French Alps Experience Unseasonal Snowfall And Strong Winds

May 21, 2025

Southern French Alps Experience Unseasonal Snowfall And Strong Winds

May 21, 2025 -

Get To Know Paulina Gretzky Dustin Johnsons Wife Career And Kids

May 21, 2025

Get To Know Paulina Gretzky Dustin Johnsons Wife Career And Kids

May 21, 2025

Latest Posts

-

Moncoutant Sur Sevre Et Clisson Evolution Et Diversification Economique

May 22, 2025

Moncoutant Sur Sevre Et Clisson Evolution Et Diversification Economique

May 22, 2025 -

Cassis Blackcurrant Cocktails A Mixologists Guide

May 22, 2025

Cassis Blackcurrant Cocktails A Mixologists Guide

May 22, 2025 -

Understanding Cassis Blackcurrant Production

May 22, 2025

Understanding Cassis Blackcurrant Production

May 22, 2025 -

Cassis Blackcurrant Uses And Recipes

May 22, 2025

Cassis Blackcurrant Uses And Recipes

May 22, 2025 -

Exploring The Flavors Of Cassis Blackcurrant

May 22, 2025

Exploring The Flavors Of Cassis Blackcurrant

May 22, 2025