Is The Public Sector Pension System Sustainable? A Cost Analysis

Table of Contents

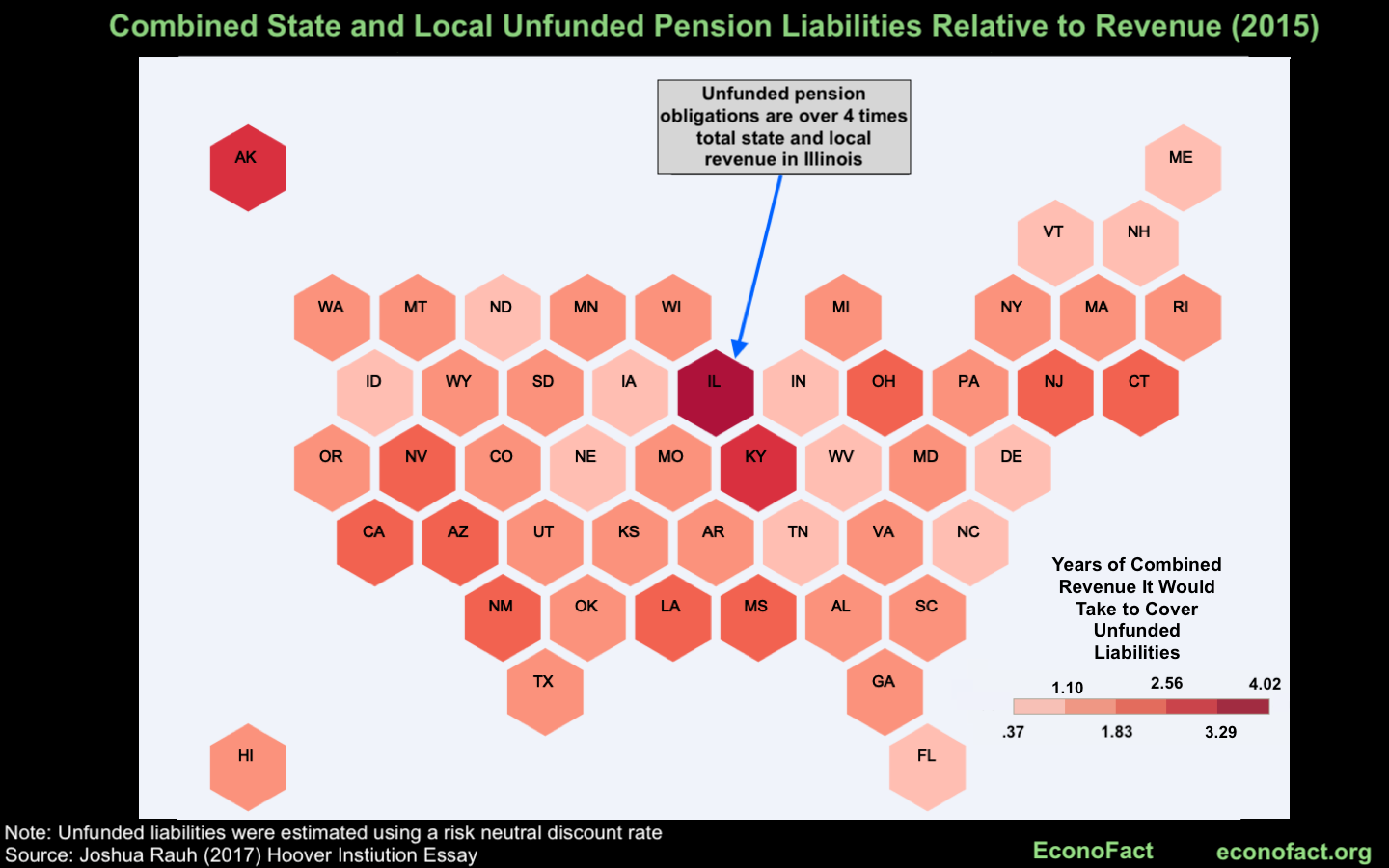

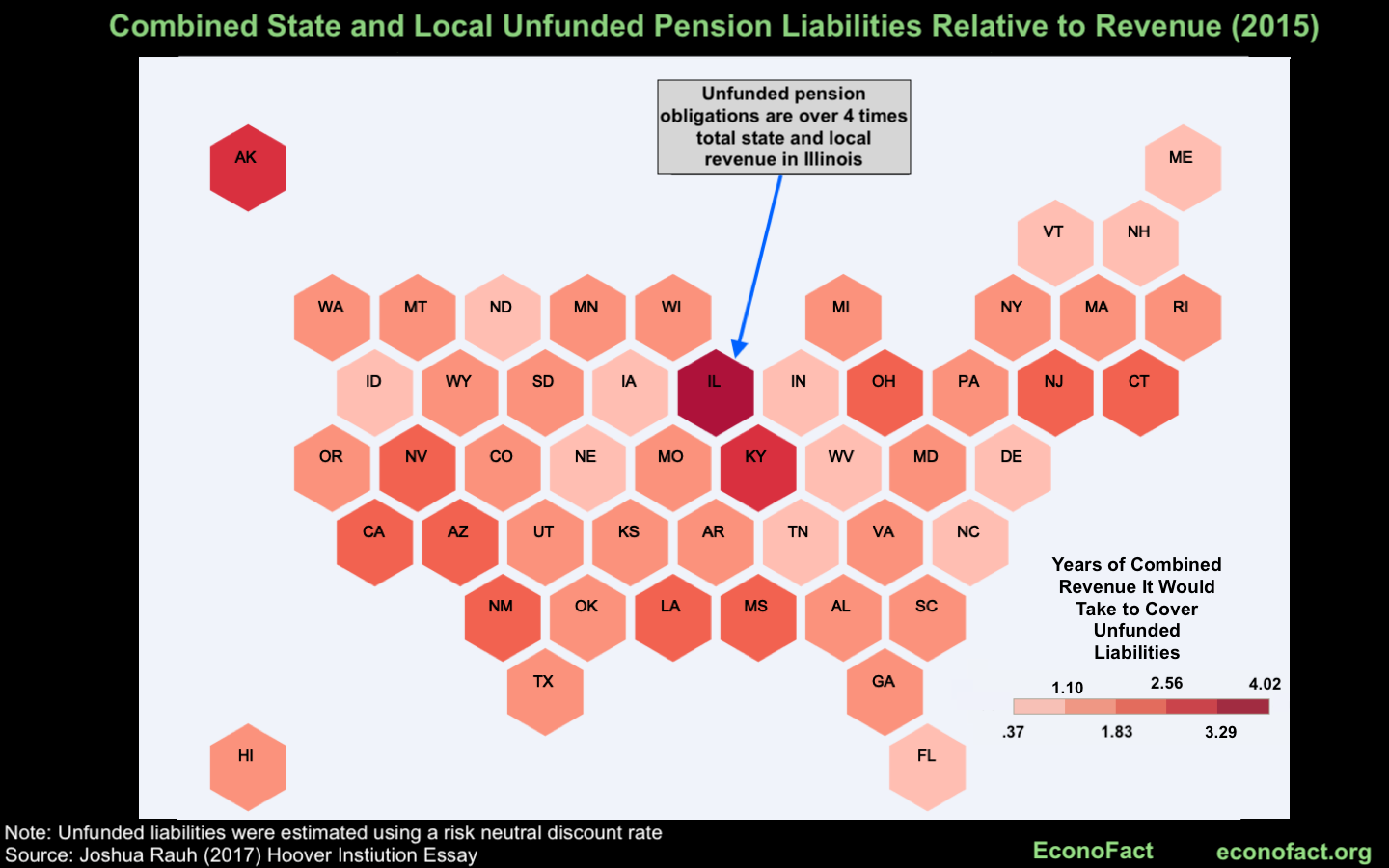

Rising Costs and Funding Gaps

The core challenge to public sector pension sustainability stems from a confluence of factors driving up costs and creating significant funding gaps.

Demographic Shifts

Demographic shifts are a primary driver of increased pressure on public sector pension systems.

- Aging populations: An increasing proportion of retirees relative to the working-age population means fewer contributors supporting a larger number of beneficiaries. This creates a widening gap between pension obligations and available resources. Effective management of public sector pension demographic pressures is crucial.

- Declining birth rates: Lower birth rates further exacerbate the problem by reducing the pool of future contributors to the pension system. This shrinking workforce must shoulder the burden of supporting a growing retiree population. Addressing this requires a long-term strategic plan to mitigate pension funding gap analysis.

- Increased longevity: People are living longer, which, while positive from a health perspective, increases the duration for which individuals receive pension payments. This extended payout period significantly increases the overall cost of the system.

Increased Healthcare Costs

The rising cost of healthcare, particularly for an aging population, places an additional strain on public sector pension systems.

- Public pension healthcare costs are a substantial and growing component of overall pension expenditure. As retirees require more extensive and costly healthcare services, the financial burden on the system increases.

- The escalating cost of healthcare consumes resources that could otherwise be allocated to pension payments, potentially leading to benefit reductions or increased tax burdens to maintain the sustainability of pension systems.

- This interplay between healthcare and pension costs necessitates integrated strategies to manage both effectively.

Inflationary Pressures

Inflation erodes the purchasing power of pension payments, necessitating adjustments to maintain the real value of benefits for retirees.

- Regular pension inflation adjustment is essential to ensure that retirees maintain a reasonable standard of living. However, these adjustments significantly impact the long-term financial stability of the system.

- Failure to adequately account for pension inflation adjustment leads to a decline in the real value of benefits, reducing retirees’ living standards and potentially increasing reliance on other social safety nets.

- Understanding the cost of living impact on pensions is vital for making informed decisions about benefit adjustments and long-term financial planning.

Reform Strategies for Improved Sustainability

To ensure the long-term sustainability of public sector pension systems, several reform strategies can be implemented.

Raising the Retirement Age

Gradually increasing the retirement age is a common strategy to extend the period of contribution to the system, thereby reducing the burden on current contributors.

- Retirement age reform can significantly impact the long-term financial health of pension systems, but requires careful consideration of its impact on employment opportunities and the well-being of older workers.

- Successful implementation demands a phased approach, allowing for adaptation and minimizing potential negative consequences. Public acceptance and transparent communication are crucial for buy-in from the population.

- The impact of retirement age reform on workforce participation and economic growth needs careful analysis to ensure a balance between fiscal responsibility and social equity.

Increasing Contributions

Increasing contribution rates from both employers and employees can improve funding levels and enhance the financial soundness of pension systems.

- Raising pension contribution rates requires careful consideration of the potential impact on economic growth and employee morale. Finding the right balance is key.

- The affordability of increased contributions needs thorough examination to avoid placing undue financial strain on individuals and businesses.

- Careful communication and engagement with stakeholders are crucial to garner support for increases in pension contribution rates. Transparency builds trust.

Pension Benefit Reforms

Exploring alternative pension benefit structures, such as defined contribution plans or tiered benefit systems, can help manage costs and improve the long-term sustainability of public sector pensions.

- Public sector pension benefits reform should aim for a balance between cost control and providing adequate income security for retirees.

- Reforms must be carefully designed to protect the income security of current and future retirees while mitigating long-term financial risks.

- Transparency and clear communication are key to achieving public acceptance of public sector pension benefits reform.

The Role of Government Intervention

Governments play a crucial role in ensuring the financial health and sustainability of public sector pension systems.

- Effective budgeting, strategic planning, and transparent communication are essential for maintaining public trust and fostering confidence in the system.

- Proactive measures to address funding shortfalls must be taken to prevent future crises and safeguard the financial security of retirees.

- The government's role in government role in pension sustainability extends to promoting responsible investment strategies and ensuring the effective management of pension assets. Strong public sector pension funding is essential.

Conclusion

The sustainability of public sector pension systems is a complex issue requiring a multifaceted approach. Addressing rising costs and funding gaps necessitates a strategic combination of reforms, including adjustments to benefit structures, contribution rates, and the retirement age. Governments must act proactively, implementing strategies to ensure the long-term viability of these crucial systems. Ignoring the issue of Public Sector Pension Sustainability could have catastrophic consequences for current and future retirees and the overall financial health of nations. A comprehensive strategy focusing on careful planning, responsible budgeting and transparent communication is vital for safeguarding the future of public sector pension systems. It’s time for decisive action to ensure the sustainability of public sector pensions for generations to come.

Featured Posts

-

Louisville Residents Under Shelter In Place Order Reflecting On Past Tragedy

Apr 29, 2025

Louisville Residents Under Shelter In Place Order Reflecting On Past Tragedy

Apr 29, 2025 -

Us Attorney Generals Warning To Minnesota Compliance With Transgender Athlete Ban

Apr 29, 2025

Us Attorney Generals Warning To Minnesota Compliance With Transgender Athlete Ban

Apr 29, 2025 -

Mesas Upcoming Shen Yun Performance

Apr 29, 2025

Mesas Upcoming Shen Yun Performance

Apr 29, 2025 -

Fn Abwzby Dlyl Shaml Llmsharkyn Walzwar 19 Nwfmbr

Apr 29, 2025

Fn Abwzby Dlyl Shaml Llmsharkyn Walzwar 19 Nwfmbr

Apr 29, 2025 -

Vincenzo Grifo Ciro Immobile Luca Toni Andrea Barzagli Ruggiero Rizzitelli Italian Stars Who Conquered The Bundesliga

Apr 29, 2025

Vincenzo Grifo Ciro Immobile Luca Toni Andrea Barzagli Ruggiero Rizzitelli Italian Stars Who Conquered The Bundesliga

Apr 29, 2025

Latest Posts

-

Division Title Secured Celtics Impressive Blowout

May 12, 2025

Division Title Secured Celtics Impressive Blowout

May 12, 2025 -

Celtics Clinch Division A Blowout Victory

May 12, 2025

Celtics Clinch Division A Blowout Victory

May 12, 2025 -

Payton Pritchards Sixth Man Of The Year Bid A Deep Dive

May 12, 2025

Payton Pritchards Sixth Man Of The Year Bid A Deep Dive

May 12, 2025 -

Could Payton Pritchard Win Sixth Man Of The Year

May 12, 2025

Could Payton Pritchard Win Sixth Man Of The Year

May 12, 2025 -

Payton Pritchards Historic Season A Sixth Man Of The Year Campaign

May 12, 2025

Payton Pritchards Historic Season A Sixth Man Of The Year Campaign

May 12, 2025