Is The Venture Capital Secondary Market Overheated? A Current Analysis

Table of Contents

Increased Transaction Volume and Valuation Inflation

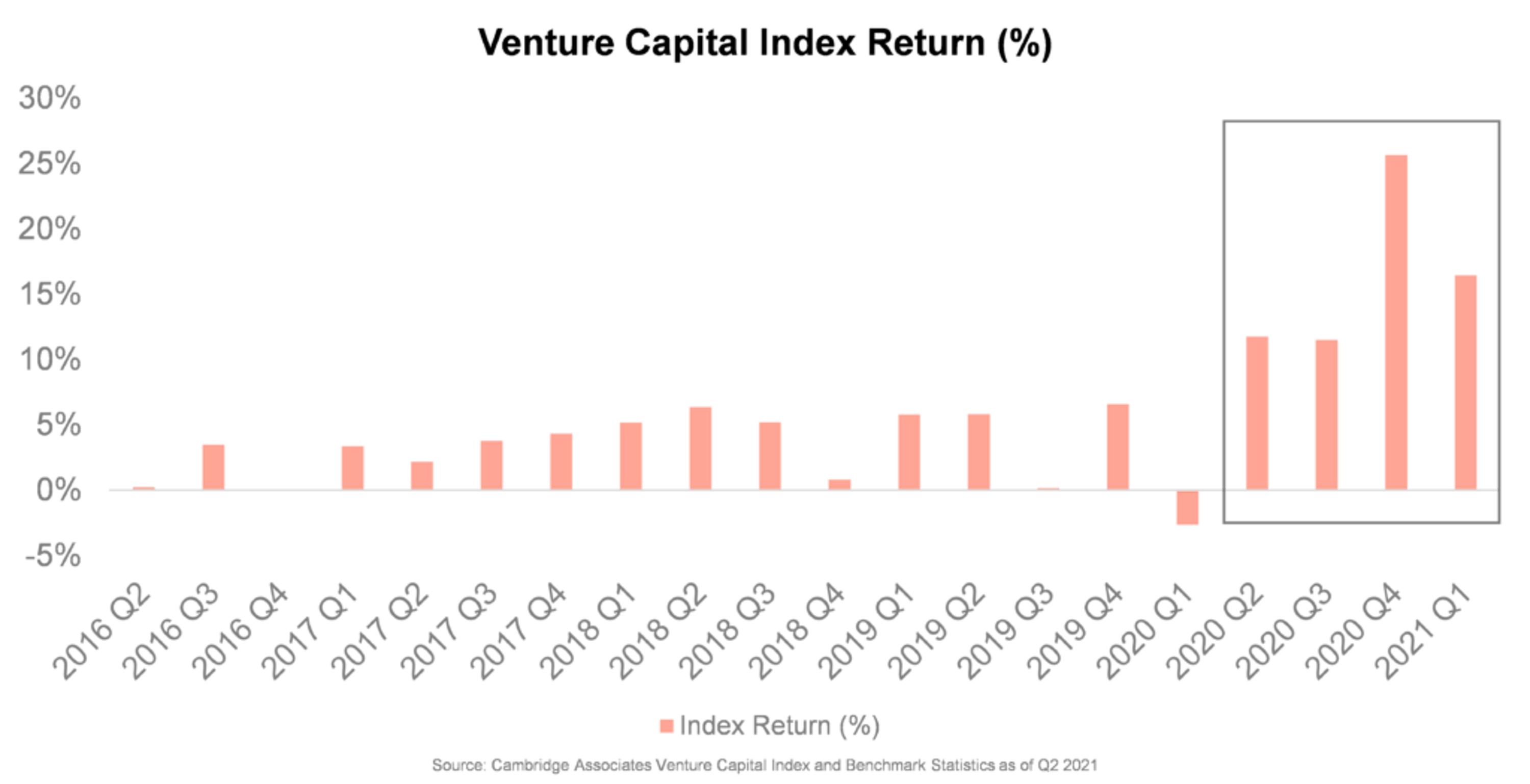

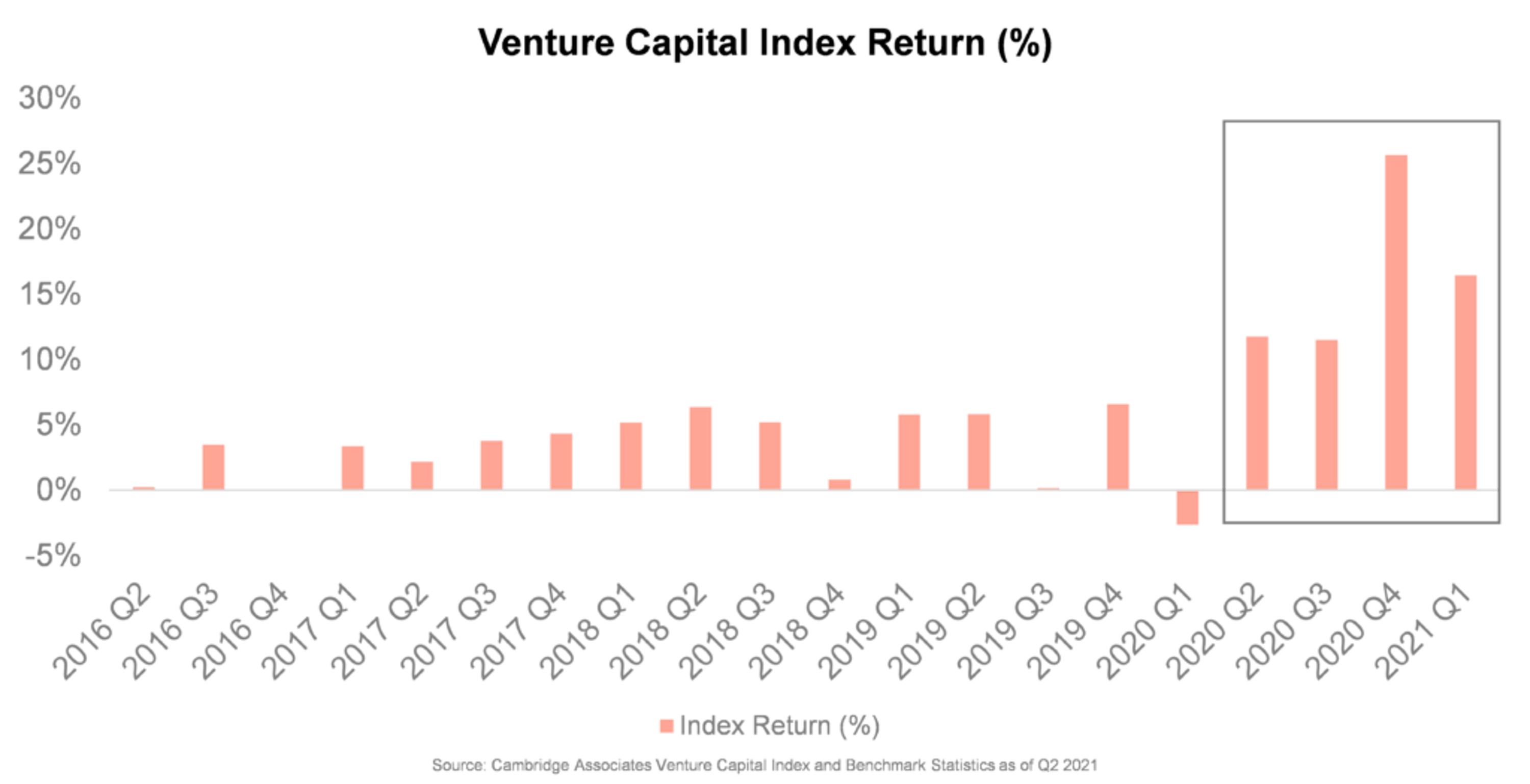

The venture capital secondary market's recent growth is undeniable, evidenced by a significant increase in transaction volume and a surge in valuations.

Record-breaking Deal Flow

The secondary market has seen a dramatic surge in deal flow. Data from PitchBook and Preqin show a significant increase in the number of secondary transactions and the total capital invested compared to previous years.

- Comparison with Previous Years: While precise figures vary depending on the data provider and the specific definition of "secondary transaction," many reports indicate a doubling or tripling of deal volume in recent years, compared to the pre-2020 average.

- Large Transactions as Examples: Several high-profile transactions involving large late-stage companies have highlighted the significant capital flowing into the secondary market. These deals often involve hundreds of millions, or even billions, of dollars.

- Data from Market Research Firms: Reports from leading market research firms consistently confirm the substantial rise in activity within the venture capital secondary market. These reports often provide granular data broken down by region, sector, and deal size.

Rising Valuations Despite Economic Uncertainty

Despite macroeconomic headwinds and concerns about a potential recession, valuations in the secondary market remain surprisingly robust. This disconnect from public market performance raises concerns.

- Disconnect Between Public and Private Markets: Public market corrections have not significantly impacted valuations in the private secondary market. This divergence suggests a potential disconnect between the perceived risk and the price being paid for private company stakes.

- The Role of FOMO (Fear of Missing Out): The fear of missing out on potential future returns may be driving up prices, particularly as high-growth companies continue to attract significant interest. This FOMO effect can lead to irrational exuberance and inflated valuations.

- Impact of Late-Stage Venture Capital Funding: Abundant late-stage venture capital funding has also supported higher valuations in the secondary market. This influx of capital creates a competitive bidding environment, further pushing prices upward.

The Role of Large Institutional Investors

The increased participation of large institutional investors is a key driver of the current activity in the venture capital secondary market.

Increased Participation of Sovereign Wealth Funds and Pension Funds

Sovereign wealth funds and pension funds are increasingly allocating capital to alternative asset classes, including the secondary market for venture capital.

- Strategic Reasons for Participation: These large institutions are seeking diversification beyond traditional asset classes and higher returns in a low-interest-rate environment. The secondary market offers a way to gain exposure to high-growth private companies.

- Impact on Market Liquidity and Pricing: The significant capital injections from these institutional players have significantly increased market liquidity and, arguably, contributed to upward pressure on valuations.

Shifting Investor Strategies and Risk Appetite

The strategies and risk appetites of investors are also shaping the secondary market's dynamics.

- Lower Returns in Traditional Asset Classes: Low returns in traditional asset classes, such as bonds and some equities, are encouraging investors to seek higher-yielding alternative investments.

- Role of Specialized Secondary Market Funds: The emergence of specialized secondary market funds further fuels this trend. These funds actively seek and manage secondary transactions, providing additional liquidity and expertise to the market.

Potential Risks and Signs of an Overheated Market

Despite the current boom, several potential risks and signs suggest the venture capital secondary market may be overheating.

Liquidity Risk and Potential for Price Corrections

The market's rapid expansion raises concerns about potential liquidity risk and the possibility of future price corrections.

- Limited Historical Data on Secondary Market Cycles: The relatively short history of the modern secondary market makes it difficult to predict its cyclical nature and potential for significant downturns.

- Potential for Illiquidity in a Market Downturn: If investor sentiment shifts negatively, liquidity in the secondary market could dry up quickly, making it difficult for investors to exit their positions at desirable prices.

- Risk of "Mark-to-Market" Losses: The lack of a readily available market price for many private companies means that "mark-to-market" losses can materialize quickly if valuations decline.

Valuation Discrepancies and Due Diligence Challenges

Accurately valuing private companies in a fast-moving market presents significant challenges.

- Lack of Transparency in Some Secondary Transactions: The lack of transparency in some secondary transactions makes it difficult for investors to assess the true value of the assets being traded.

- Complexities of Due Diligence in a Fast-Paced Environment: The need to conduct thorough due diligence in a fast-paced environment is challenging, increasing the risk of making poor investment decisions.

- Potential for Inflated Valuations Leading to Future Losses: Inflated valuations, driven by FOMO and competitive bidding, may lead to significant losses if the market corrects.

Conclusion

The venture capital secondary market is experiencing unprecedented growth, driven by factors such as increased institutional investment and the search for alternative asset classes. However, the surge in transaction volume and valuation inflation raises significant concerns about potential overheating. While the market offers attractive liquidity opportunities, investors must proceed cautiously, conducting thorough due diligence and carefully evaluating the risks associated with valuation discrepancies and potential market corrections. A comprehensive understanding of these market dynamics is crucial for navigating the complexities of the venture capital secondary market and making informed investment decisions. Continuously monitoring market trends and rigorously analyzing relevant data will help investors effectively manage their portfolios within this evolving landscape. Understanding the risks and opportunities within the venture capital secondary market is key to long-term success.

Featured Posts

-

Porsches New Macan Ev Electric Drive Experiences Unveiled

Apr 29, 2025

Porsches New Macan Ev Electric Drive Experiences Unveiled

Apr 29, 2025 -

Suspecting Adult Adhd A Guide To Diagnosis And Treatment

Apr 29, 2025

Suspecting Adult Adhd A Guide To Diagnosis And Treatment

Apr 29, 2025 -

Nyt Spelling Bee April 1 2025 Hints And Strategies For Success

Apr 29, 2025

Nyt Spelling Bee April 1 2025 Hints And Strategies For Success

Apr 29, 2025 -

Hollywood Production Halts As Sag Aftra Joins Writers Strike

Apr 29, 2025

Hollywood Production Halts As Sag Aftra Joins Writers Strike

Apr 29, 2025 -

Examining The Russian Military Europes Security Concerns

Apr 29, 2025

Examining The Russian Military Europes Security Concerns

Apr 29, 2025

Latest Posts

-

School Stabbing Victims Funeral A Community Grieves

May 13, 2025

School Stabbing Victims Funeral A Community Grieves

May 13, 2025 -

Funeral Services For Teenager Killed In School Stabbing

May 13, 2025

Funeral Services For Teenager Killed In School Stabbing

May 13, 2025 -

Community Mourns 15 Year Old Stabbed At School

May 13, 2025

Community Mourns 15 Year Old Stabbed At School

May 13, 2025 -

Newcastle United Supporters Championship Play Off Picks

May 13, 2025

Newcastle United Supporters Championship Play Off Picks

May 13, 2025 -

Pl Retro Accessing Sky Sports Premier League Classics In Hd

May 13, 2025

Pl Retro Accessing Sky Sports Premier League Classics In Hd

May 13, 2025