Is This Entertainment Stock A Buy-the-Dip Opportunity?

Table of Contents

The entertainment industry is a rollercoaster, and lately, Disney has experienced some significant price fluctuations. The concept of "buy-the-dip" – purchasing a stock when its price has fallen – is tempting, offering the potential for significant returns if the stock rebounds. But is this a genuine buy-the-dip opportunity, or a potential trap? Let's delve into a comprehensive analysis to determine if Disney presents a compelling buy-the-dip scenario.

Analyzing the Recent Dip in Disney Stock Price

Understanding the Underlying Reasons for the Dip:

Several factors might contribute to Disney's recent price decline. Understanding these is crucial for assessing the buy-the-dip opportunity:

-

Market Correction: Broader stock market volatility can drag down even fundamentally strong companies like Disney. A general market downturn can create excellent buy-the-dip opportunities across sectors, impacting Disney alongside other stocks.

-

Streaming Wars and Subscriber Growth: The intense competition in the streaming landscape, including from Netflix and other emerging players, impacts subscriber growth and profitability. Slower-than-expected subscriber additions and increased competition are key factors affecting Disney's stock price. This highlights the entertainment industry trends impacting Disney's financial performance.

-

Company-Specific News: Disappointing earnings reports, changes in management, or announcements of significant strategic shifts can all trigger stock price drops. Negative news, even if temporary, can significantly impact investor sentiment and stock price volatility.

-

Macroeconomic Factors: Inflation, rising interest rates, and general economic uncertainty can affect consumer spending and investor confidence, impacting companies like Disney whose services are considered discretionary spending. This macroeconomic environment can lead to increased stock market volatility.

Technical Analysis of the Stock Chart:

Analyzing Disney's stock chart using technical indicators offers another perspective on the buy-the-dip opportunity. Let's examine key aspects:

-

Support and Resistance Levels: Identifying key support levels (where buying pressure may outweigh selling pressure) and resistance levels (where selling pressure might dominate) is crucial. A break below a key support level could signal further declines, while a bounce off support could suggest a buy-the-dip opportunity.

-

Moving Averages: Analyzing moving averages (e.g., 50-day, 200-day) can help determine the overall trend. A stock price crossing above its 50-day moving average after a dip might indicate a bullish signal.

-

Chart Patterns: Recognizing chart patterns like head-and-shoulders, double bottoms, or other formations can provide insights into potential price movements. These patterns, combined with other indicators and analysis of Disney's fundamentals, will contribute to a more comprehensive view.

-

Trading Volume: Increased trading volume accompanying a price drop could signal strong selling pressure, while decreased volume could indicate weakening selling pressure – potentially a more favorable setup for a buy-the-dip strategy. (Include a relevant chart here)

Evaluating Disney's Fundamentals and Future Prospects

Financial Health and Performance:

Examining Disney's financial performance is crucial to assess the long-term viability of a buy-the-dip strategy:

-

Revenue Growth: Analyzing Disney's revenue growth over time provides insight into its ability to generate income. Sustained revenue growth would strengthen the case for a buy-the-dip opportunity.

-

Profitability: Key metrics like earnings per share (EPS) and profit margins are crucial. Healthy profitability suggests the company is efficiently managing its operations and generating profits.

-

Debt-to-Equity Ratio: Assessing Disney's debt levels relative to its equity helps determine its financial stability. High debt levels could represent a risk, undermining the buy-the-dip case.

-

Cash Flow: Strong cash flow demonstrates the company's ability to generate cash from its operations, which is essential for investing in future growth, paying down debt, and returning value to shareholders.

Competitive Landscape and Market Position:

Disney's position in the entertainment industry is a key factor to consider:

-

Market Share: Maintaining or gaining market share in streaming and other entertainment segments is vital for long-term success. A strong market position can offset some of the risks associated with industry challenges.

-

Competitive Advantage: Disney possesses significant intellectual property (IP) and established brands. This provides a competitive advantage over many rivals in the entertainment industry.

-

Industry Growth: The continued growth of the entertainment industry, despite challenges, suggests that Disney, with its strong IP and brand recognition, is well-positioned for long-term growth.

-

Future Outlook: Analyzing future growth potential, considering factors like international expansion and new technological advancements, is crucial to assessing the stock's long-term prospects.

Management Team and Strategic Initiatives:

The quality of Disney's leadership and its strategic vision are essential:

-

Management Team: A strong and experienced management team can effectively navigate the challenges and capitalize on opportunities within the dynamic entertainment landscape.

-

Strategic Vision: Disney's strategic plans for future growth, including its approach to streaming, theme parks, and other segments, are crucial considerations.

-

Growth Strategy: Assessing the effectiveness of Disney's current growth strategies and their alignment with long-term industry trends will help determine the potential for future stock appreciation.

-

Innovation: Disney's capacity for innovation in content creation, technology, and distribution will shape its future competitiveness and market position.

Assessing the Risks and Rewards of a Buy-the-Dip Strategy

Potential Risks:

Investing in Disney during a dip carries several potential risks:

-

Investment Risk: The stock market is inherently volatile; further price declines are always possible.

-

Downside Risk: The entertainment sector could experience a prolonged downturn, impacting Disney's performance and stock price.

-

Market Uncertainty: Unexpected negative news, geopolitical events, or changes in consumer behavior could further depress the stock price.

-

Volatility: Disney's stock price could experience significant volatility, leading to potential losses if not managed carefully.

Potential Rewards:

Despite the risks, a successful buy-the-dip strategy could yield significant rewards:

-

Capital Appreciation: If Disney's stock price rebounds strongly, investors could enjoy substantial capital appreciation.

-

Return on Investment (ROI): Buying at a lower price point increases the potential for a higher return on investment compared to buying at higher prices.

-

Long-Term Growth: Investing in a fundamentally strong company like Disney, with a long-term perspective, can lead to significant long-term growth.

-

Stock Price Recovery: Successful navigation of current challenges could lead to a rapid stock price recovery, creating a lucrative buy-the-dip opportunity.

Conclusion

Analyzing Disney's current situation reveals a complex picture. While the recent dip presents a potential buy-the-dip opportunity, several risks need careful consideration. The company's strong fundamentals, substantial intellectual property, and experienced management team offer significant long-term potential. However, the competitive streaming landscape and macroeconomic uncertainties present significant challenges. Weighing these risks and rewards carefully, alongside a thorough understanding of your own risk tolerance and investment strategy, is paramount. While a buy-the-dip opportunity in Disney presents both risks and rewards, thorough research and a long-term perspective are crucial. Consider your individual risk tolerance and investment strategy before making any decisions. Learn more about identifying buy-the-dip opportunities and developing a sound investment strategy.

Featured Posts

-

The Witcher Stars Hidden Gem A Compelling Fantasy Show

May 29, 2025

The Witcher Stars Hidden Gem A Compelling Fantasy Show

May 29, 2025 -

Blake Shelton Criticizes Morgan Wallens Snl Walk Off

May 29, 2025

Blake Shelton Criticizes Morgan Wallens Snl Walk Off

May 29, 2025 -

Trumps Criticism Of Putin Dismissed As Emotional By Russia

May 29, 2025

Trumps Criticism Of Putin Dismissed As Emotional By Russia

May 29, 2025 -

Ramalan Cuaca Akurat Sumatra Utara Medan Karo Nias Toba Dan Sekitarnya

May 29, 2025

Ramalan Cuaca Akurat Sumatra Utara Medan Karo Nias Toba Dan Sekitarnya

May 29, 2025 -

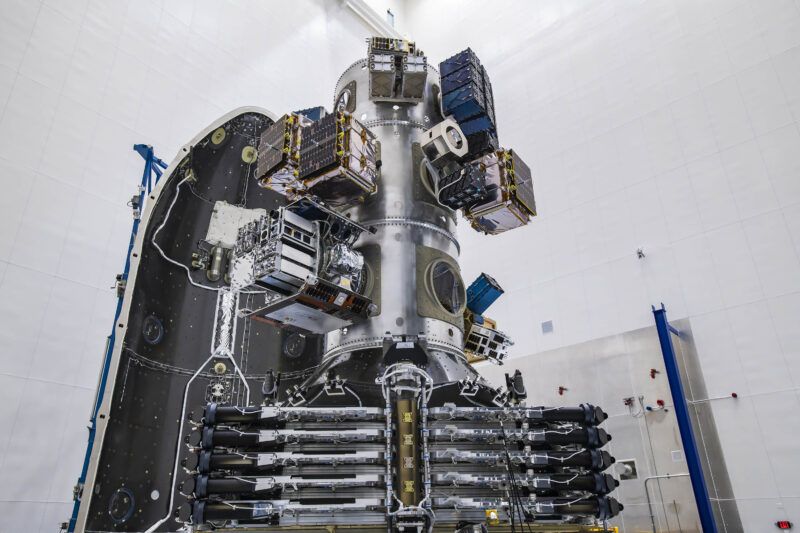

Space X Falcon 9 Mission Update 27 Starlink Satellites Launched

May 29, 2025

Space X Falcon 9 Mission Update 27 Starlink Satellites Launched

May 29, 2025

Latest Posts

-

Dara O Briain A Voice Of Reason In Comedy And Beyond

May 30, 2025

Dara O Briain A Voice Of Reason In Comedy And Beyond

May 30, 2025 -

Will Live Music Stocks Continue Their Slide On Friday

May 30, 2025

Will Live Music Stocks Continue Their Slide On Friday

May 30, 2025 -

Dara O Briain A Voice Of Reason In Modern Comedy

May 30, 2025

Dara O Briain A Voice Of Reason In Modern Comedy

May 30, 2025 -

Live Music Stocks Fridays Expected Decline

May 30, 2025

Live Music Stocks Fridays Expected Decline

May 30, 2025 -

Cts Eventim Early 2024 Figures Show Impressive Growth Trajectory

May 30, 2025

Cts Eventim Early 2024 Figures Show Impressive Growth Trajectory

May 30, 2025