Is Uber Recession-Proof? Analyzing The Stock's Resilience

Table of Contents

Uber's Business Model and Recessionary Resilience

Uber's business model, encompassing ride-sharing, food delivery (Uber Eats), and freight services, plays a crucial role in its potential recession resistance. Its ability to adapt and provide essential services makes it a compelling case study in economic resilience.

Essential Services and Price Sensitivity

Uber's services often fill essential transportation and delivery needs. Even during economic hardship, people still require transportation to work, medical appointments, and other crucial activities, and food delivery remains a convenient option. However, the price sensitivity of these services is a critical factor.

- Price Elasticity: Uber's services demonstrate some price elasticity; demand tends to decrease as prices rise, particularly during recessions when disposable income shrinks.

- Past Recessionary Behavior: During past economic downturns, we've observed fluctuations in ridership and delivery orders. While demand doesn't entirely disappear, it does soften. Lower-income consumers are more likely to reduce their usage.

- Lower-Income Consumer Behavior: Analyzing the spending patterns of lower-income consumers on the platform during previous recessions reveals a correlation between reduced disposable income and decreased Uber usage. This highlights the vulnerability of certain user segments.

Diversification of Revenue Streams

Uber's multiple revenue streams are a significant asset in mitigating recessionary risk. The company isn't solely reliant on ride-sharing. This diversification can provide a buffer against downturns affecting one sector.

- Revenue Breakdown: Uber's revenue is spread across rides, Eats, and Freight, with each sector contributing a varying percentage depending on market conditions.

- Sectoral Performance During Downturns: Historical data shows that while ride-sharing might experience a decline during a recession, food delivery often sees a more resilient (or even increased) demand as people opt for home-based meals. Freight, too, can hold up reasonably well depending on the nature of the recession.

Factors Affecting Uber's Stock Performance During Recessions

While Uber's business model offers some protection, several external factors significantly influence its stock performance during recessions.

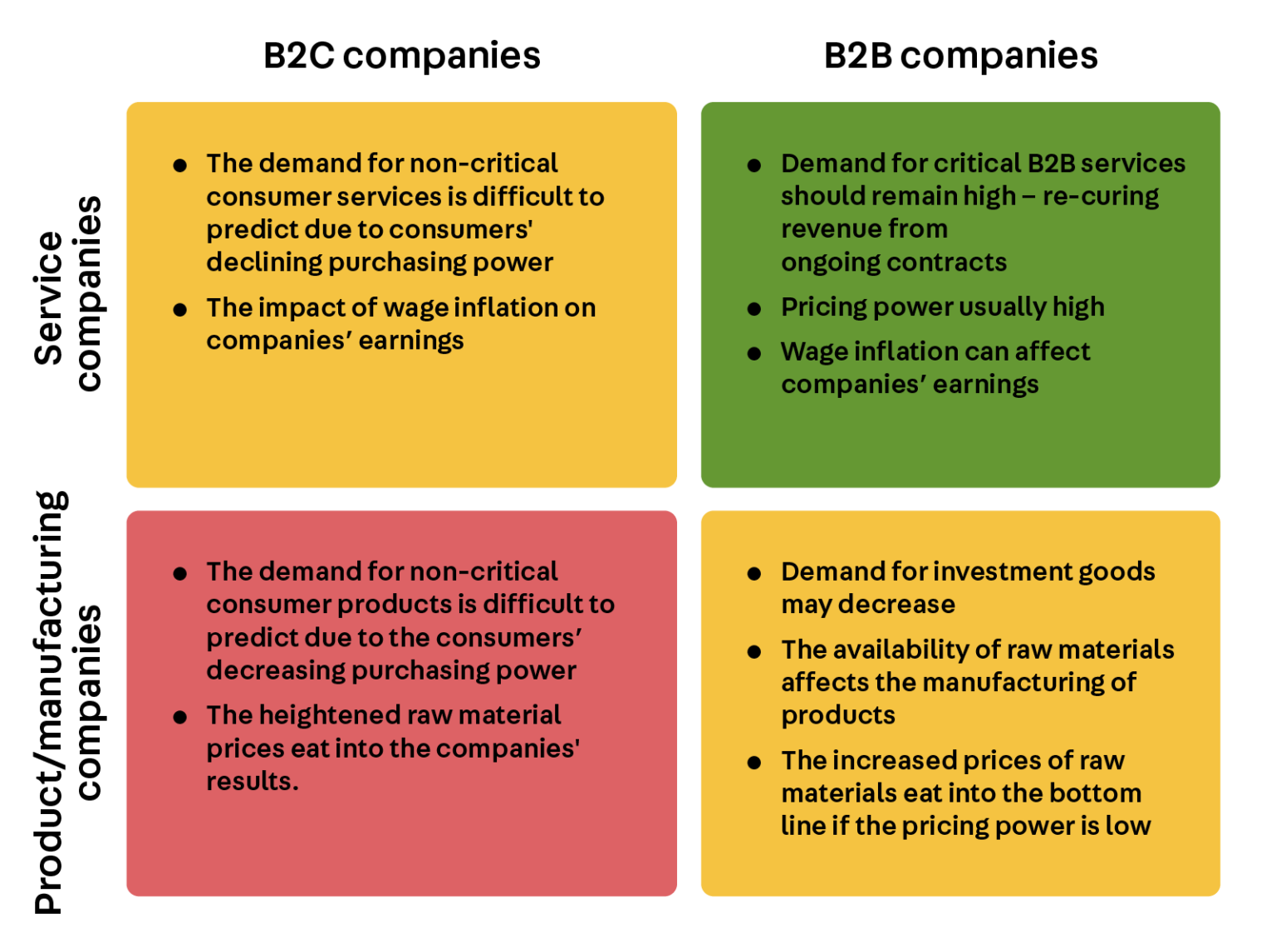

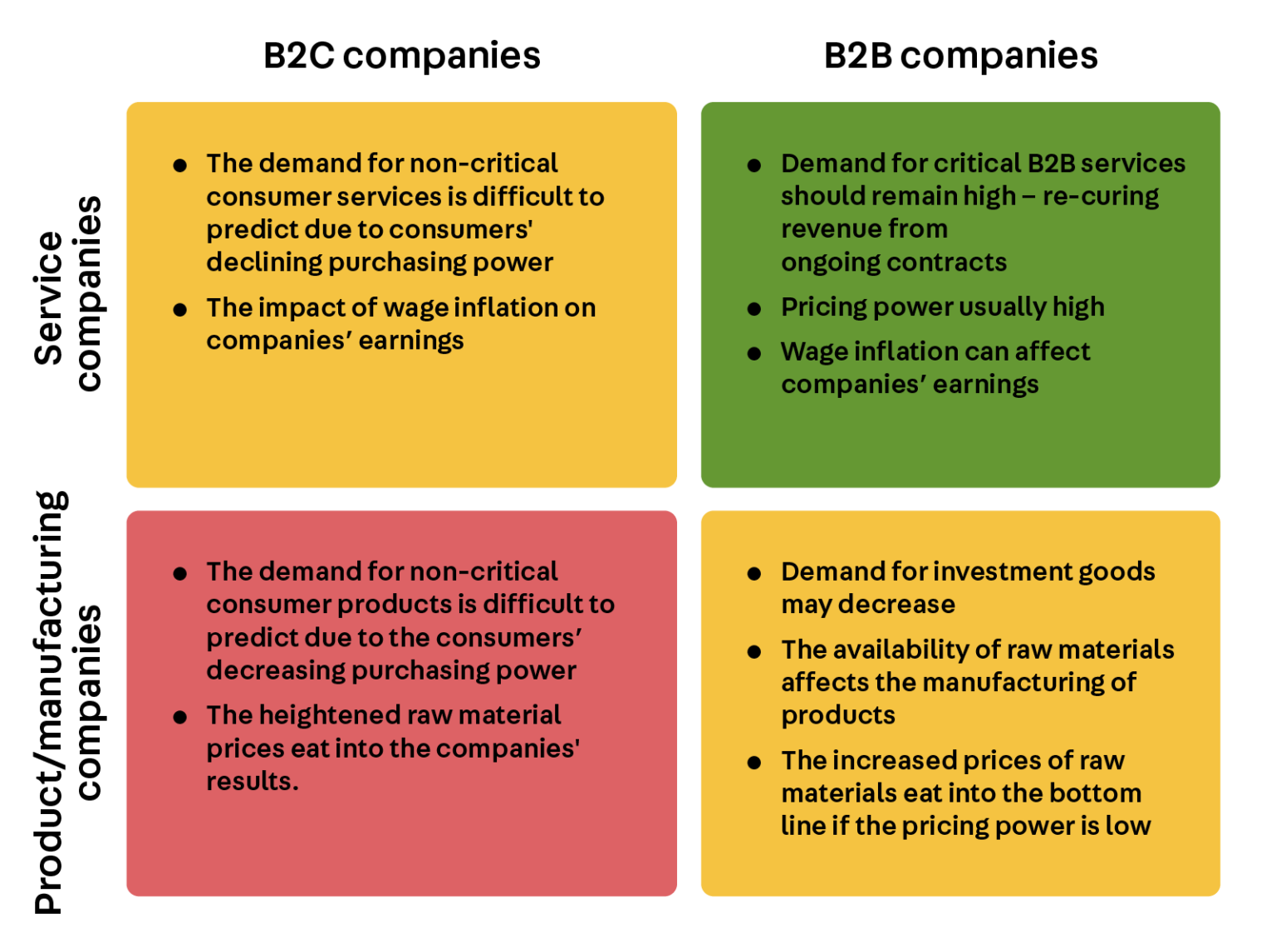

Inflation and Fuel Prices

Fluctuating fuel prices and inflation directly impact Uber's operational costs and profitability. These factors influence both driver earnings and consumer spending.

- Rising Fuel Costs and Driver Earnings: Increases in fuel prices directly affect driver earnings, potentially leading to reduced driver supply and higher fares.

- Inflation and Consumer Spending: Inflation erodes purchasing power, reducing consumer spending on discretionary services like ride-sharing and food delivery.

- Uber's Cost Mitigation Strategies: Uber employs various strategies to mitigate these cost increases, including dynamic pricing, operational efficiencies, and negotiations with suppliers.

Competition and Market Share

The competitive landscape, including rivals like Lyft and DoorDash, plays a vital role in determining Uber's resilience. Market share fluctuations during economic downturns are crucial.

- Competitor Performance: Analyzing how competitors perform during economic downturns provides a comparative perspective. Companies with stronger cost structures or niche markets might fare better.

- Market Consolidation: Market consolidation (mergers, acquisitions) can impact Uber's profitability and market dominance, potentially influencing its resilience during a downturn.

- Uber's Competitive Advantages: Uber's vast network, brand recognition, and technological advancements provide some competitive advantages that might help it maintain its market share during a downturn.

Investor Sentiment and Market Volatility

Investor sentiment and overall market conditions heavily impact Uber's stock price, especially during periods of economic uncertainty.

- Correlation with Market Indices: Uber's stock price often correlates with broader market indices, meaning overall market downturns can negatively affect its valuation regardless of its operational performance.

- Investor Behavior During Uncertainty: Investors tend to be more risk-averse during recessions, leading to potential sell-offs even in fundamentally strong companies.

- News and Events: Negative news about Uber (e.g., regulatory changes, labor disputes) can amplify negative investor sentiment during an already volatile market.

Long-Term Growth Prospects and Recession Resistance

Uber's long-term growth prospects and its ability to withstand future recessions depend heavily on its ability to adapt and innovate.

Technological Advancements and Innovation

Technological advancements, such as autonomous vehicles, hold the potential to revolutionize Uber's operations and enhance its recession resistance.

- Cost Reductions through Automation: Autonomous vehicles could significantly reduce labor costs, a major expense for Uber.

- Impact on Driver Employment: Automation's impact on driver employment is a complex issue with ethical and societal implications.

- Increased Efficiency and Profitability: Automation and other technological advancements can increase efficiency and profitability, improving Uber's resilience to economic shocks.

Expanding into New Markets and Services

Expanding into new geographic markets and offering additional services can diversify Uber's revenue streams and enhance its resilience.

- New Markets and Services: Uber continues to explore new markets and services, such as expanding its freight business and venturing into new transportation modes.

- Risk and Return Assessment: Each new venture involves a careful assessment of risk and return, crucial for managing economic uncertainty.

- Impact on Revenue Diversification: Successful expansion into new markets and services improves revenue diversification, making Uber less reliant on any single sector.

Conclusion: Is Uber Truly Recession-Proof? A Final Verdict

Uber's resilience during a recession is a complex issue. While its diversification into essential services and multiple revenue streams offer some protection, its susceptibility to inflation, fuel price fluctuations, competition, and broader market volatility cannot be ignored. Therefore, declaring Uber completely "recession-proof" would be an overstatement.

However, its adaptable business model, technological innovation potential, and capacity for expansion suggest a reasonable degree of resilience compared to some other companies. The long-term outlook for Uber's stock remains positive, contingent on its continued ability to innovate and adapt to changing economic conditions.

To form your own informed opinion on whether Uber represents a sound investment during uncertain economic times, we encourage you to conduct further research. Learn more about Uber's financial reports and consult with a financial advisor to assess its "Uber recession-proof" potential within your personal investment strategy.

Featured Posts

-

Generalka Kosarkaske Reprezentacije Srbije Pregled Utakmice Pred Evrobasket U Minhenu

May 17, 2025

Generalka Kosarkaske Reprezentacije Srbije Pregled Utakmice Pred Evrobasket U Minhenu

May 17, 2025 -

Quiet Winter For Mariners Former Infielder Sounds Off

May 17, 2025

Quiet Winter For Mariners Former Infielder Sounds Off

May 17, 2025 -

Novak Djokovic Miami Acik Ta Finalde

May 17, 2025

Novak Djokovic Miami Acik Ta Finalde

May 17, 2025 -

Canadas Tsx Composite Index Hits All Time Intraday High

May 17, 2025

Canadas Tsx Composite Index Hits All Time Intraday High

May 17, 2025 -

186 Milyon Dolar Novak Djokovic In Gelir Kaynaklari Ve Basarisi

May 17, 2025

186 Milyon Dolar Novak Djokovic In Gelir Kaynaklari Ve Basarisi

May 17, 2025

Latest Posts

-

Jalen Brunsons Ankle Latest Update And Sundays Game Outlook

May 17, 2025

Jalen Brunsons Ankle Latest Update And Sundays Game Outlook

May 17, 2025 -

Market Rally Rockwell Automation Angi Borg Warner And Others Post Significant Gains

May 17, 2025

Market Rally Rockwell Automation Angi Borg Warner And Others Post Significant Gains

May 17, 2025 -

The Jalen Brunson Injury Highlighting The Knicks Depth Issues

May 17, 2025

The Jalen Brunson Injury Highlighting The Knicks Depth Issues

May 17, 2025 -

Rockwell Automations Strong Earnings Drive Market Gains Analysis Of Wednesdays Stock Surge

May 17, 2025

Rockwell Automations Strong Earnings Drive Market Gains Analysis Of Wednesdays Stock Surge

May 17, 2025 -

Knicks Playoff Hopes Hampered By Jalen Brunsons Injury

May 17, 2025

Knicks Playoff Hopes Hampered By Jalen Brunsons Injury

May 17, 2025