Iwi Assets Reach $8.2B: Report Shows Steady Growth

Table of Contents

Key Drivers of Iwi Asset Growth

The impressive growth in Iwi assets is the result of a confluence of factors, demonstrating the effectiveness of long-term strategic planning and innovative approaches to investment. Several key elements have contributed to this success:

-

Successful Investments Across Diverse Sectors: Iwi have strategically diversified their portfolios, investing wisely in sectors such as forestry, fisheries, tourism, and property development. This diversification mitigates risk and ensures robust returns, fostering sustainable Iwi business growth.

-

Strategic Partnerships and Collaborations: Collaborations with both private and public entities have been instrumental. These partnerships leverage external expertise and resources, expanding investment opportunities and enhancing project delivery. This collaborative approach to Iwi business is key to ongoing success.

-

Effective Resource Management and Sustainable Practices: A commitment to sustainable resource management ensures long-term value and minimizes environmental impact. This responsible approach aligns with the principles of kaitiakitanga (guardianship) and enhances the long-term viability of Iwi investments.

-

Supportive Government Policies and Initiatives: Government policies designed to support Iwi development have played a significant role, providing funding opportunities and creating a more enabling environment for Iwi businesses to thrive. This includes initiatives focused on Māori economic empowerment.

-

Growing Expertise in Financial Management and Investment Strategies: Iwi have invested significantly in developing expertise in financial management and investment strategies. This improved capacity enables more sophisticated investment decisions and maximizes returns, driving further Iwi asset growth.

Distribution of Iwi Assets and Their Impact

The impact of this substantial asset growth extends far beyond mere financial figures. The distribution of Iwi assets is strategically focused on improving the lives of Iwi members and strengthening their communities:

-

Infrastructure Development: A significant portion of Iwi assets are invested in vital infrastructure projects, including housing, education facilities, and healthcare improvements. This investment directly addresses community needs and enhances the quality of life for Iwi members.

-

Community Initiatives and Social Programs: Iwi assets fund crucial community initiatives and social programs aimed at improving education, employment opportunities, and overall well-being. This investment in community development is crucial for strengthening Iwi communities.

-

Job Creation and Economic Opportunities: Investments in various sectors create significant employment opportunities within Iwi communities, fostering economic independence and reducing reliance on external support. This fosters economic self-sufficiency within Iwi communities.

-

Support for Cultural Preservation and Revitalization: A considerable portion of Iwi assets is dedicated to preserving and revitalizing Māori language, arts, and cultural practices. This investment in cultural preservation ensures the transmission of valuable cultural heritage to future generations.

-

Intergenerational Wealth Building: The strategic management of Iwi assets ensures intergenerational wealth building, creating a sustainable foundation for the future prosperity of Iwi communities. This long-term perspective on wealth distribution ensures lasting benefits for future generations.

Future Projections for Iwi Asset Growth

The future looks bright for Iwi assets, with numerous potential avenues for continued growth:

-

Emerging Investment Opportunities: Iwi are exploring emerging investment opportunities in sectors such as renewable energy and technology, positioning themselves for future growth in these key sectors. This focus on future investment is crucial for long-term prosperity.

-

Continued Focus on Sustainable and Ethical Investments: The commitment to sustainable and ethical investment practices will remain a core principle, ensuring long-term value and minimizing environmental impact. This approach aligns with values of sustainable finance and responsible investment.

-

Importance of Capacity Building and Skills Development: Investing in capacity building and skills development within Iwi organizations is crucial to ensuring continued success. This focus on Iwi capacity building is vital for sustained growth.

-

Potential Challenges and Risks: While the outlook is positive, Iwi must also address potential challenges, including economic downturns and policy changes, through proactive risk management strategies.

-

The Role of Technology and Innovation: The strategic utilization of technology and innovation will play a key role in driving future growth, enhancing efficiency, and opening new investment opportunities. This technology investment is vital for enhancing Iwi businesses.

Securing a Strong Future Through Iwi Asset Growth

The remarkable growth of Iwi assets to $8.2 billion demonstrates the power of strategic planning, community collaboration, and sustainable practices. This achievement signifies not only substantial financial progress but also a profound impact on Iwi communities and the wider New Zealand economy. The positive social and economic impacts, from infrastructure development to cultural preservation, are undeniable. To learn more about the innovative investment strategies and the ongoing success of Iwi businesses, explore resources dedicated to Iwi asset management and Māori economic empowerment. Embrace the future of sustainable Iwi growth by staying informed and supporting initiatives that promote Māori economic prosperity.

Featured Posts

-

Tommy Fury Vs Jake Paul Rematch Furys U Turn After Fight

May 14, 2025

Tommy Fury Vs Jake Paul Rematch Furys U Turn After Fight

May 14, 2025 -

Man United Transfer Targets Amorims Seven Player List Revealed

May 14, 2025

Man United Transfer Targets Amorims Seven Player List Revealed

May 14, 2025 -

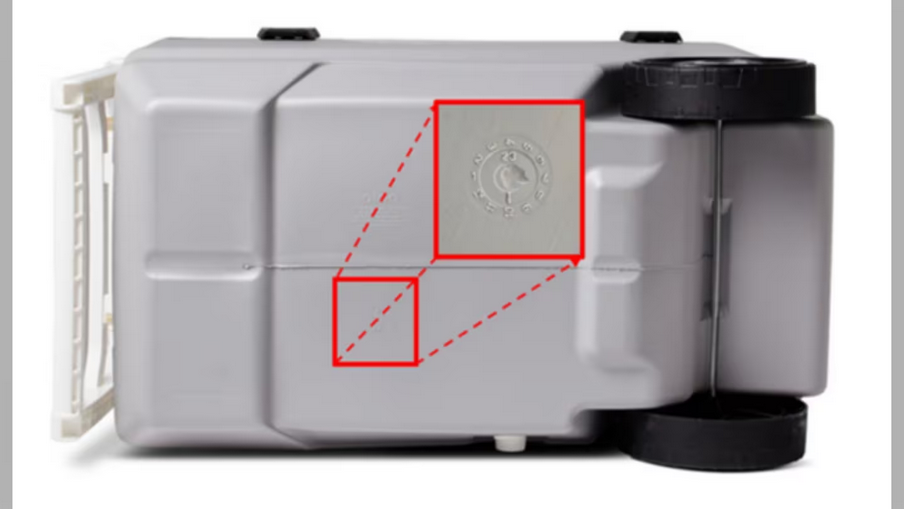

Walmart Igloo Cooler Recall Nationwide Warning For Fingertip Amputation Risk

May 14, 2025

Walmart Igloo Cooler Recall Nationwide Warning For Fingertip Amputation Risk

May 14, 2025 -

Ice Parent Nyse Exceeds Q1 Profit Expectations On Strong Trading Volume

May 14, 2025

Ice Parent Nyse Exceeds Q1 Profit Expectations On Strong Trading Volume

May 14, 2025 -

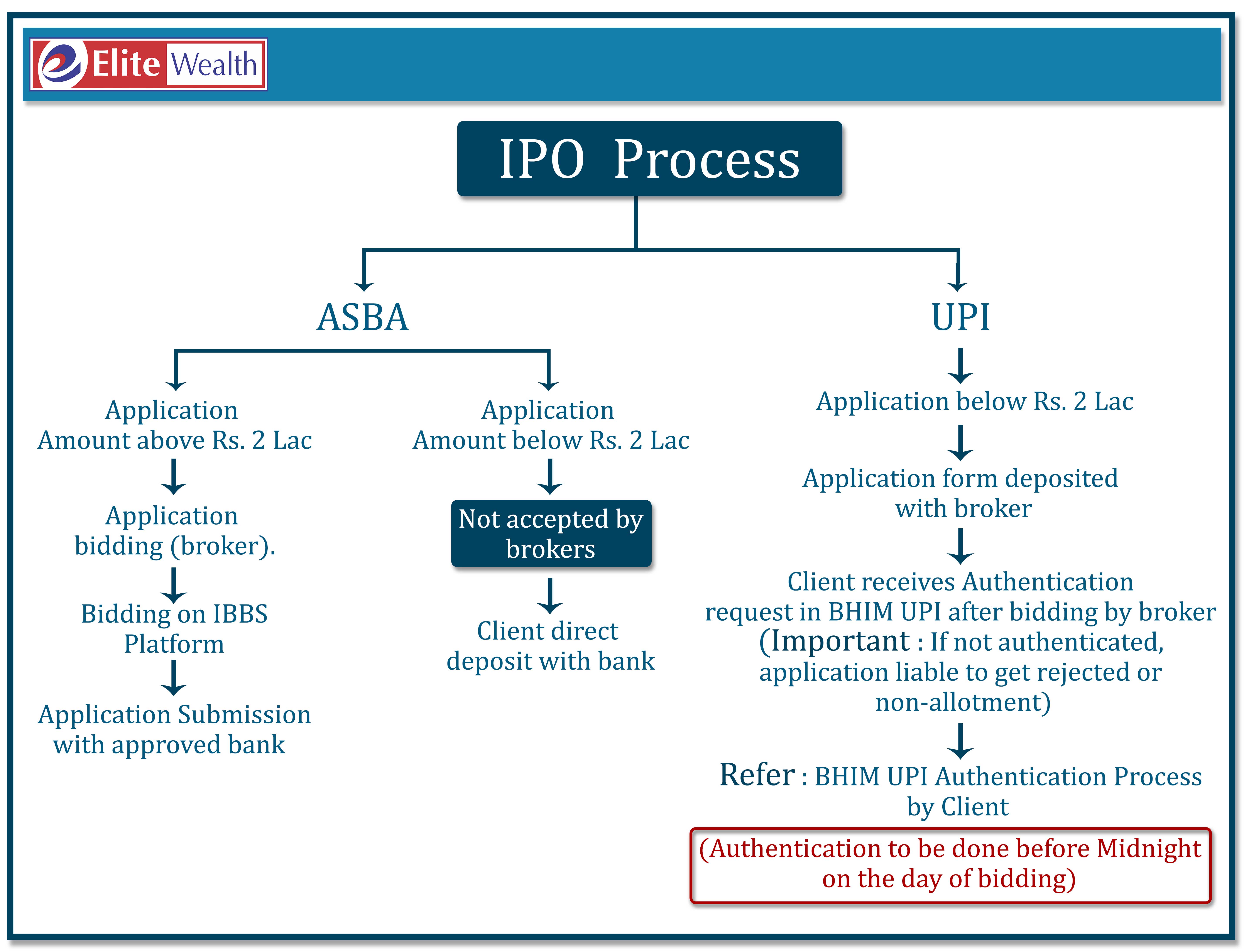

Navan Targets Us Stock Market Exclusive News On Ipo Banking Partners

May 14, 2025

Navan Targets Us Stock Market Exclusive News On Ipo Banking Partners

May 14, 2025

Latest Posts

-

Us Ipo In The Works Exclusive Report On Navans Banking Partners

May 14, 2025

Us Ipo In The Works Exclusive Report On Navans Banking Partners

May 14, 2025 -

Navan Targets Us Stock Market Exclusive News On Ipo Banking Partners

May 14, 2025

Navan Targets Us Stock Market Exclusive News On Ipo Banking Partners

May 14, 2025 -

Navans Us Ipo Exclusive Details On Bank Selection For Travel Tech Firm

May 14, 2025

Navans Us Ipo Exclusive Details On Bank Selection For Travel Tech Firm

May 14, 2025 -

Ipo Slowdown How Tariffs Are Reshaping The Investment Landscape

May 14, 2025

Ipo Slowdown How Tariffs Are Reshaping The Investment Landscape

May 14, 2025 -

The Impact Of Tariffs On Ipo Activity A Comprehensive Analysis Of The Current Market Situation

May 14, 2025

The Impact Of Tariffs On Ipo Activity A Comprehensive Analysis Of The Current Market Situation

May 14, 2025