Japan's Steep Yield Curve: A Growing Concern For Investors And The Economy

Table of Contents

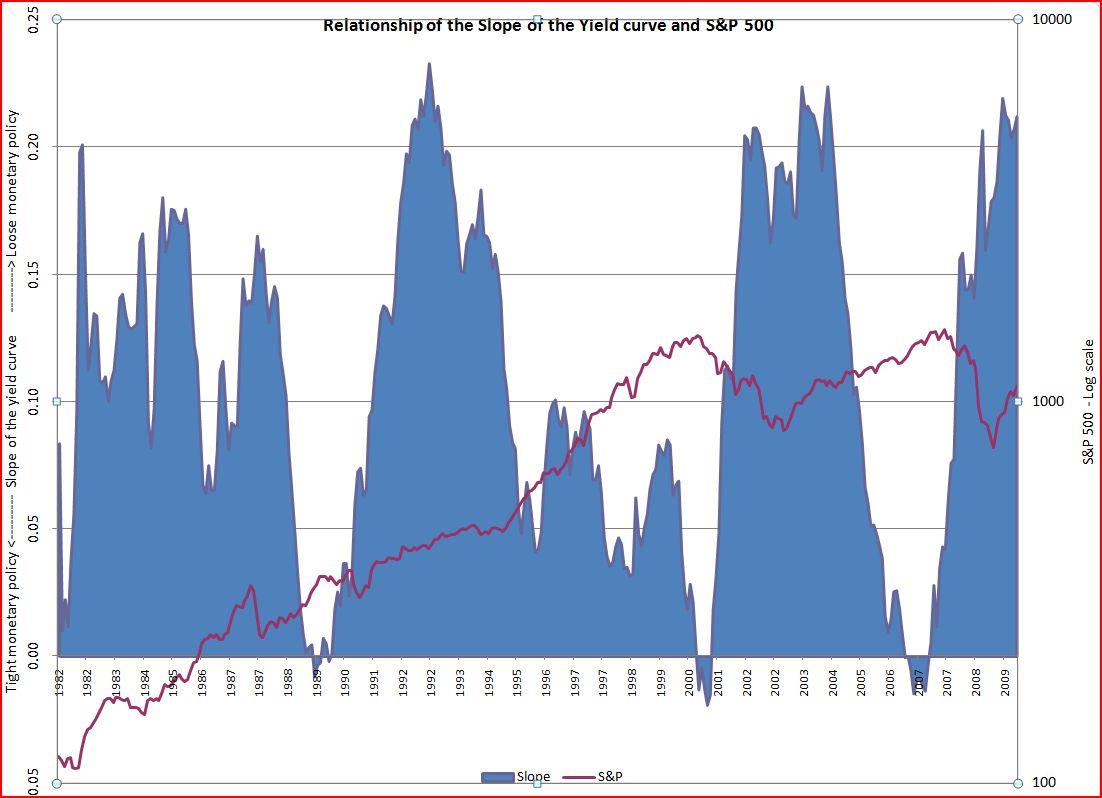

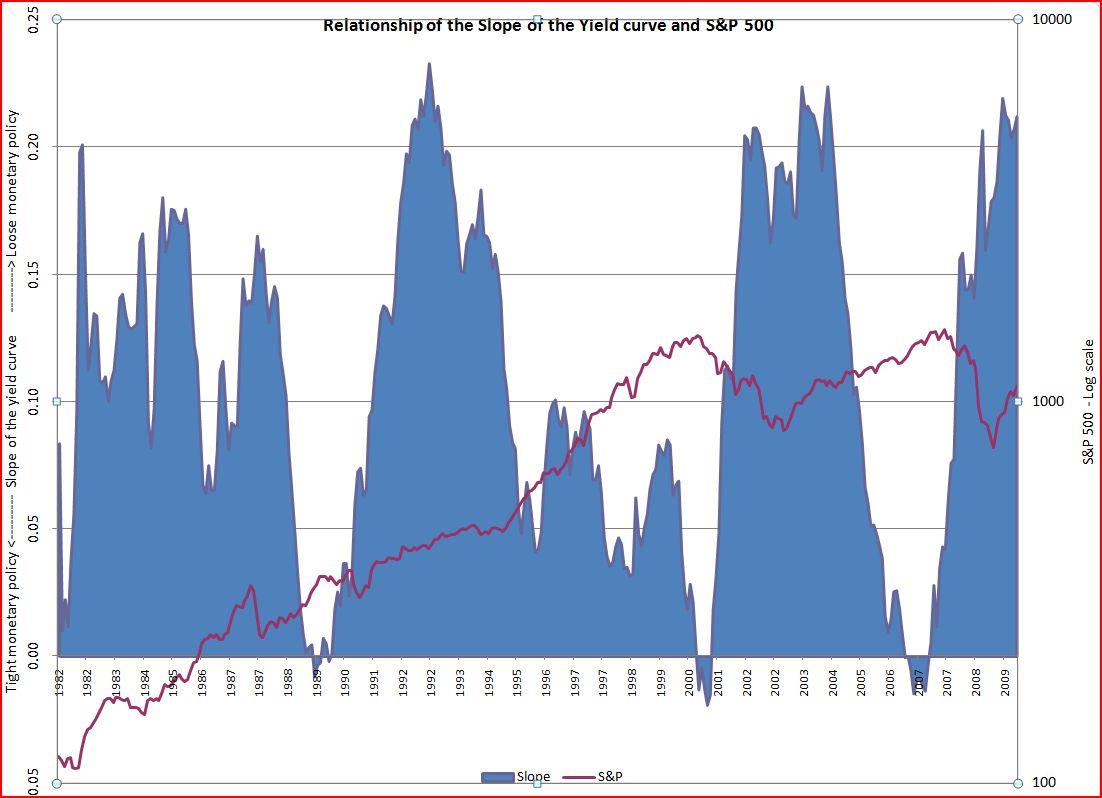

Understanding Japan's Yield Curve

A yield curve illustrates the relationship between the yields (returns) of bonds with different maturities. A typical, "normal," yield curve slopes upward; longer-term bonds offer higher yields than short-term bonds to compensate investors for the increased risk associated with longer time horizons. A flat yield curve shows little difference in yields across maturities, while an inverted yield curve, where short-term yields exceed long-term yields, is often considered a recessionary predictor.

Japan's yield curve, historically quite flat due to the Bank of Japan's (BOJ) monetary policies, is now experiencing a significant steepening. This means the difference between short-term and long-term bond yields is widening considerably. For instance, the difference between 10-year and 2-year Japanese Government Bond (JGB) yields has increased substantially in recent months.

- Definition of Yield Curve: Relationship between bond yields and their maturities.

- Normal Yield Curve: Longer-term bonds have higher yields than short-term bonds.

- Steep Yield Curve: Significant difference between short and long-term yields, indicating strong expectations for future rate hikes.

- Current Japanese Yield Curve: As of [Insert date], the 10-year JGB yield stands at approximately [Insert current yield]% while the 2-year yield is at [Insert current yield]%. This difference represents a significant steepening compared to historical averages.

Factors Contributing to the Steepening Yield Curve

Several factors are driving the steepening of Japan's yield curve:

Bank of Japan's (BOJ) Policy Shift

The BOJ's recent adjustments to its yield curve control (YCC) policy are a primary driver. YCC, previously designed to keep long-term interest rates near zero, has undergone modifications, allowing for greater fluctuation in long-term yields. This shift, aimed at combating persistent deflation and managing inflation, has directly contributed to the increased spread between short-term and long-term rates.

- Explanation of YCC policy and its previous limitations: YCC aimed to suppress long-term interest rates to stimulate the economy. However, its rigid nature proved increasingly difficult to maintain.

- Details on recent modifications to YCC: The BOJ has widened the acceptable range for 10-year JGB yields, allowing them to rise higher than previously tolerated.

- How the policy changes led to increased long-term yields: Relaxing YCC constraints allows market forces to influence long-term yields more freely, resulting in their increase.

Inflationary Pressures

Japan is experiencing a rise in inflation, albeit still relatively moderate compared to other developed economies. This inflation, coupled with expectations of further increases, is pushing bond yields higher. Investors demand higher yields to compensate for the erosion of purchasing power caused by inflation.

- Current inflation rate in Japan and its deviation from historical norms: Japan's inflation rate is currently [Insert current inflation rate]%, a notable increase from its historical average.

- Market expectations regarding future BOJ actions: Markets anticipate further adjustments to the BOJ's monetary policy, potentially including additional interest rate hikes.

- How inflation expectations impact bond prices and yields: Higher inflation expectations lead to lower bond prices and consequently, higher yields.

Global Economic Factors

Global economic trends are also impacting Japan's yield curve. Aggressive interest rate hikes by central banks worldwide, particularly the US Federal Reserve, are influencing global capital flows and putting upward pressure on Japanese bond yields.

- Global interest rate trends and their correlation with Japanese yields: Rising global interest rates make Japanese bonds relatively less attractive, leading to capital outflows and higher yields.

- Impact of US Federal Reserve policy on global capital flows and Japanese markets: The Fed's actions influence global investor sentiment, impacting capital allocation and Japanese bond prices.

- How global economic uncertainty influences investor behavior in Japan: Global uncertainty tends to increase demand for safe-haven assets like Japanese government bonds, temporarily counteracting the upward pressure on yields but impacting longer-term expectations.

Implications for Investors and the Economy

The steepening yield curve presents both opportunities and challenges for investors and the Japanese economy:

Impact on Investors

The steepening yield curve creates a more complex environment for bond investors. While higher yields offer potential returns, they also introduce increased risks, particularly for those holding longer-term bonds. Japanese pension funds and other institutional investors face significant challenges in managing their portfolios in this shifting landscape.

- Investment strategies for navigating a steep yield curve: Diversification, shorter-term bonds, and potentially hedging strategies become crucial.

- Risks associated with rising interest rates for fixed-income investments: Rising rates lead to capital losses on existing fixed-income investments.

- Potential opportunities in specific sectors of the Japanese bond market: Specific sectors may offer attractive yields, although careful analysis is required.

Economic Consequences

The higher borrowing costs associated with a steepening yield curve can impact economic growth. Increased interest rates may curb corporate investment and consumer spending, potentially leading to a slowdown in economic activity.

- Potential impact on business investment due to higher borrowing costs: Companies may postpone or cancel investment projects due to the increased cost of financing.

- Effects on consumer spending as interest rates rise: Higher interest rates can reduce consumer purchasing power and discourage borrowing for purchases.

- Potential for a slowdown in economic growth: The combined effects of reduced investment and consumer spending could dampen overall economic growth.

Conclusion

The steepening of Japan's yield curve is a significant development with far-reaching implications for investors and the Japanese economy. The Bank of Japan's policy shifts, coupled with rising inflation and global economic pressures, have created a complex landscape. Investors must carefully assess the risks and opportunities presented by this evolving market environment. Understanding the dynamics of Japan's steep yield curve is crucial for making informed investment decisions and navigating the future of the Japanese economy. Further research into the Japan's steep yield curve and its implications is strongly recommended. Staying abreast of changes in the Japanese bond market and the BOJ's policy responses is essential for investors seeking to manage risk and capitalize on potential opportunities related to Japan's steep yield curve.

Featured Posts

-

The Red Carpets Rule Breakers A Cnn Perspective

May 17, 2025

The Red Carpets Rule Breakers A Cnn Perspective

May 17, 2025 -

The Knicks Resurgence Thibodeaus Successful Adaptation And Improved Results

May 17, 2025

The Knicks Resurgence Thibodeaus Successful Adaptation And Improved Results

May 17, 2025 -

Analyzing Cassie Venturas Testimony In Sean Combs Case

May 17, 2025

Analyzing Cassie Venturas Testimony In Sean Combs Case

May 17, 2025 -

Seaweed Breakthrough Condo Collapse Concerns And Company Crisis News Summary

May 17, 2025

Seaweed Breakthrough Condo Collapse Concerns And Company Crisis News Summary

May 17, 2025 -

Vehicle Subsystem Issue Delays Blue Origin Rocket Launch

May 17, 2025

Vehicle Subsystem Issue Delays Blue Origin Rocket Launch

May 17, 2025

Latest Posts

-

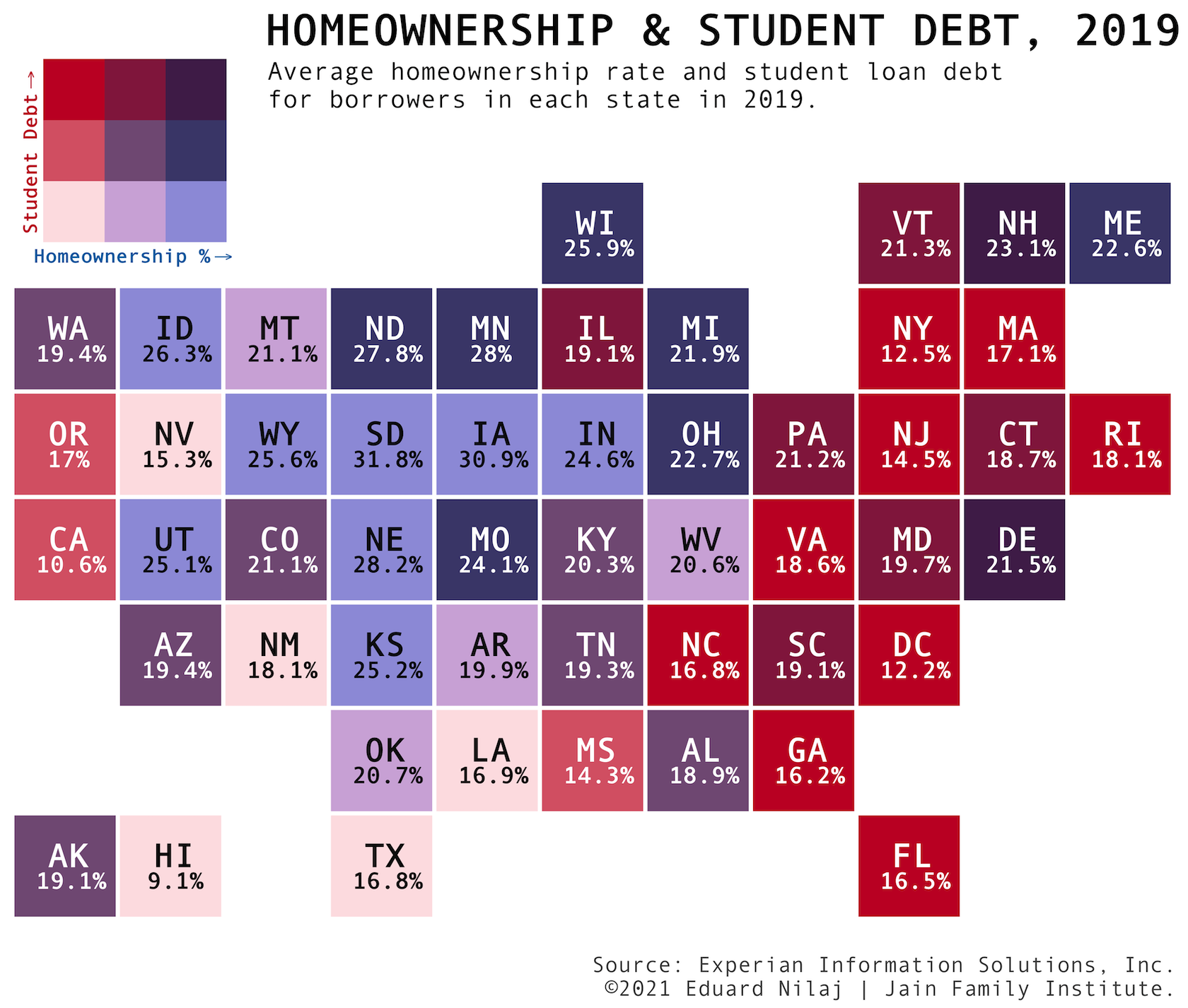

Homeownership With Student Loan Debt Tips And Strategies

May 17, 2025

Homeownership With Student Loan Debt Tips And Strategies

May 17, 2025 -

Refinancing Federal Student Loans Is It Right For You

May 17, 2025

Refinancing Federal Student Loans Is It Right For You

May 17, 2025 -

Navigating Home Buying While Paying Off Student Loans

May 17, 2025

Navigating Home Buying While Paying Off Student Loans

May 17, 2025 -

Nota Maxima Do Mec 4 Cursos No Vale E Regiao Se Destacam

May 17, 2025

Nota Maxima Do Mec 4 Cursos No Vale E Regiao Se Destacam

May 17, 2025 -

Student Loan Debt And Homeownership A Realistic Look

May 17, 2025

Student Loan Debt And Homeownership A Realistic Look

May 17, 2025