Jeanine Pirro's Stock Market Warning: Ignore The Market For Weeks?

Table of Contents

H2: Understanding Jeanine Pirro's Concerns

Jeanine Pirro's market warning stems from a confluence of factors contributing to significant economic uncertainty. Her concerns are rooted in several key areas impacting market volatility and investor sentiment.

-

Specific economic indicators: Pirro likely cited persistently high inflation rates, fueled by factors such as supply chain disruptions and increased energy costs. The Federal Reserve's aggressive interest rate hikes, intended to curb inflation, also play a significant role in her assessment. These rate hikes increase borrowing costs for businesses and consumers, potentially slowing economic growth.

-

Geopolitical events: The ongoing war in Ukraine, creating energy price volatility and global supply chain issues, is a major factor. Increased tensions between the US and China, impacting trade relations and global stability, further contributes to her pessimistic outlook.

-

Potential impact on specific sectors: Pirro's warning likely highlights the vulnerability of specific sectors, particularly those highly sensitive to interest rate changes and global economic growth. The technology sector, often valued based on future growth expectations, could be significantly impacted by higher interest rates. The energy sector, meanwhile, faces fluctuating prices tied to geopolitical events.

H2: Evaluating the Validity of Pirro's Warning

While Jeanine Pirro's voice carries weight in the conservative media landscape, it's crucial to assess the validity of her financial prediction. Pirro's background is primarily in law and broadcasting, not finance. Therefore, her expertise on complex stock market predictions should be viewed with caution.

-

Comparison with other market analysts: It's essential to compare Pirro's prediction with forecasts from established financial analysts and economists. A diverse range of opinions offers a more comprehensive understanding of the market outlook. Many analysts see a mixed outlook, with some expecting a recession and others forecasting a soft landing.

-

Risks of ignoring the market: Completely ignoring the market for extended periods carries significant risks. You could miss out on potential market gains, especially if the market rebounds sooner than anticipated. Successfully timing the market is notoriously difficult, even for seasoned professionals.

-

Importance of diversification: Diversifying your investment portfolio across various asset classes (stocks, bonds, real estate) is a crucial risk-mitigation strategy. This approach reduces reliance on any single market segment's performance and helps navigate market volatility.

H2: Alternative Investment Strategies During Market Uncertainty

Completely ignoring the market isn't the only response to uncertainty. Several alternative strategies can help manage risk and potentially generate returns.

-

Dollar-cost averaging (DCA): DCA involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy mitigates the risk of investing a lump sum at a market peak.

-

Defensive assets: Consider shifting a portion of your portfolio towards defensive assets like government bonds or precious metals (gold, silver). These assets tend to hold their value better during periods of economic uncertainty.

-

Alternative investments: Explore alternative investment options such as real estate or commodities. These assets can offer diversification benefits and potentially hedge against inflation.

H3: The Role of Emotional Investing

Market volatility can trigger strong emotional responses, leading to impulsive decisions.

-

Panic selling: Panic selling—selling investments based on fear—often results in losses. It's crucial to avoid emotional reactions and stick to a well-defined investment strategy.

-

Long-term investment plan: A long-term investment plan helps navigate short-term market fluctuations. Focusing on long-term goals reduces the influence of daily market noise.

-

Professional financial advice: Seeking advice from a qualified financial advisor is highly recommended. A financial advisor can help manage emotional responses and create a personalized investment strategy aligned with your risk tolerance and financial goals.

3. Conclusion

Jeanine Pirro's stock market warning serves as a reminder of the inherent uncertainties in the market. While her concerns regarding inflation, geopolitical instability, and potential recession are valid points, the decision to completely ignore the market for an extended period requires careful consideration and professional advice. The alternative investment strategies discussed – dollar-cost averaging, defensive assets, and exploring alternative investments – offer potential ways to mitigate risk during periods of market uncertainty. Remember, understanding Jeanine Pirro's stock market warning, and all market predictions, is a crucial step in informed investing. Your personal risk tolerance and long-term financial goals should guide your investment choices. Consult with a financial advisor to create a personalized investment plan that aligns with your unique circumstances. Don't let market volatility dictate your long-term investment strategy; instead, actively manage your portfolio with a balanced approach and a clear understanding of the current economic landscape. Building a resilient investment strategy is key to navigating the complexities of Jeanine Pirro's stock market warning and future market fluctuations.

Featured Posts

-

Madeleine Mc Cann Case Womans Dna Test Results Fuel Speculation

May 09, 2025

Madeleine Mc Cann Case Womans Dna Test Results Fuel Speculation

May 09, 2025 -

Harry Styles Reaction To A Hilariously Bad Snl Impression

May 09, 2025

Harry Styles Reaction To A Hilariously Bad Snl Impression

May 09, 2025 -

Bundesliga 2 Matchday 27 Cologne Climbs Above Hamburg

May 09, 2025

Bundesliga 2 Matchday 27 Cologne Climbs Above Hamburg

May 09, 2025 -

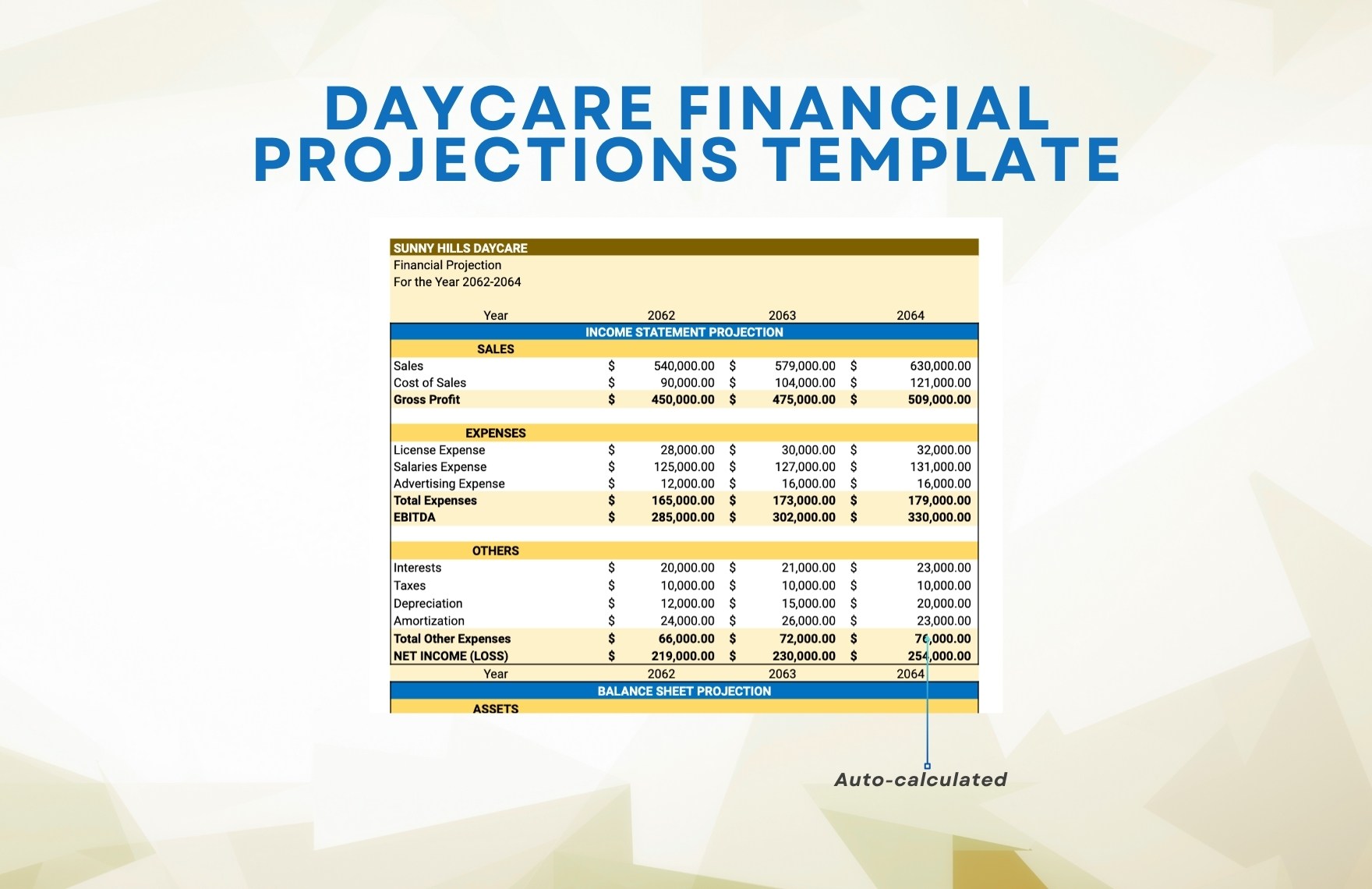

From 3 000 Babysitter To 3 600 Daycare A Financial Struggle For One Father

May 09, 2025

From 3 000 Babysitter To 3 600 Daycare A Financial Struggle For One Father

May 09, 2025 -

How Harry Styles Reacted To A Hilariously Bad Snl Impression

May 09, 2025

How Harry Styles Reacted To A Hilariously Bad Snl Impression

May 09, 2025