Jeremy Arndt And BVG Negotiations: Key Insights And Strategies

Table of Contents

Understanding Jeremy Arndt's Negotiation Style

Analyzing Arndt's Past Deals

To understand Arndt's approach to the BVG negotiations, examining his past performance is crucial. Analyzing his previous deals reveals recurring patterns and preferred strategies.

- Examples of past negotiations: While specific details may be confidential, publicly available information (e.g., news articles, press releases) can shed light on his negotiation history. For example, analyzing deals involving mergers and acquisitions, joint ventures, or licensing agreements will provide valuable data points.

- Strengths: Past successes likely highlight strengths like strategic planning, meticulous preparation, persuasive communication, and a deep understanding of market dynamics. His ability to build rapport and establish trust with counterparts could also be a significant factor.

- Weaknesses: Conversely, analyzing unsuccessful negotiations might reveal weaknesses. These could include inflexibility, an unwillingness to compromise, impatience in protracted discussions, or a tendency to overestimate his leverage.

- Specific tactics: Detailed analysis should focus on specific negotiation tactics employed in past deals. Did he utilize competitive bidding strategies, collaborative approaches, or a mix of both? Did he employ time pressure, or was he patient and methodical?

Assessing Arndt's Objectives in the BVG Deal

Understanding Arndt's goals in the BVG deal is paramount. His objectives likely encompass a mix of financial and strategic considerations.

- Potential financial targets: This might involve achieving a specific return on investment, securing favorable payment terms, or maximizing the valuation of his assets.

- Strategic objectives: Arndt’s aims could include expanding into new markets, acquiring valuable technology or intellectual property, or enhancing his company's competitive position within the industry.

- Personal motivations: Beyond financial and strategic objectives, personal factors—such as career advancement or building a legacy—could also influence his negotiation stance.

- Risks and opportunities: A thorough assessment should include identifying potential risks (e.g., regulatory hurdles, market fluctuations, integration challenges) and opportunities (e.g., synergies with BVG's existing operations, access to new customer segments).

BVG's Negotiation Posture and Objectives

Understanding BVG's perspective is equally crucial for a comprehensive analysis of the Jeremy Arndt BVG negotiations.

BVG's Corporate Strategy and Market Position

BVG's overall business strategy and its position within the market significantly shape its negotiation approach.

- Financial performance: BVG’s recent financial results, profitability, and cash flow will influence its willingness to compromise.

- Competitive landscape: Its position relative to its competitors will dictate the urgency and importance of the deal.

- Current projects and long-term goals: Existing commitments and future plans will affect its negotiation priorities.

- Previous negotiation styles and outcomes: Analyzing BVG's past behavior in similar negotiations provides valuable insight into their typical negotiation strategy.

Identifying BVG's Priorities in the Negotiations

BVG's priorities likely encompass a wide range of considerations, including financial, strategic, and regulatory factors.

- Financial considerations: This includes the purchase price, payment terms, and potential financial risks.

- Potential synergies: BVG will assess the potential benefits of integrating Arndt's assets or company into its existing operations.

- Risk mitigation strategies: BVG will likely seek to minimize potential risks associated with the deal.

- Regulatory compliance requirements: Compliance with relevant laws and regulations will play a critical role.

- Internal stakeholders: The influence of BVG's internal stakeholders, including the board of directors, management team, and shareholders, needs consideration.

Key Strategies and Tactics Employed

This section analyzes the strategic approaches employed by both parties in the Jeremy Arndt BVG negotiations.

Power Dynamics and Leverage

Analyzing the power dynamics between Arndt and BVG is essential.

- Strengths and weaknesses: Each party's relative strengths and weaknesses significantly influence their leverage. Factors such as market position, financial resources, and access to information are key determinants.

- Pressure points: Identifying pressure points—areas of vulnerability for each party—is critical for understanding how leverage is utilized.

- Negotiation tactics: The tactics used to leverage these pressure points could range from aggressive bargaining to collaborative problem-solving.

Communication and Persuasion Techniques

Effective communication is vital in high-stakes negotiations.

- Verbal and non-verbal communication: Analyzing the communication styles of both parties—including their verbal and non-verbal cues—reveals their approach to the negotiation.

- Persuasive arguments: Identifying the key persuasive arguments used by each side provides insight into their negotiation strategies.

- Negotiation techniques: Were collaborative or competitive techniques employed? Did they favor integrative bargaining or distributive bargaining?

Risk Management and Contingency Planning

Successful negotiations involve meticulous risk management and contingency planning.

- Potential risks: The identification of potential risks (legal challenges, market volatility, technological disruptions, etc.) is crucial.

- Mitigation strategies: The strategies employed to minimize these risks demonstrate the preparedness and foresight of each party.

- Contingency plans: Having robust contingency plans for unforeseen circumstances demonstrates a proactive approach to negotiation.

Conclusion

This article explored the key aspects of the Jeremy Arndt and BVG negotiations, analyzing the negotiation styles of both parties, their respective objectives, and the strategies employed. Understanding these insights offers valuable lessons for anyone involved in high-stakes business dealings. The power dynamics, communication strategies, and risk management approaches employed provide a compelling case study for future negotiations. Analyzing the success or failure of the Jeremy Arndt BVG negotiations is essential for future business strategies.

Call to Action: For further insights into effective negotiation strategies and to learn more about the complexities of high-stakes business deals like the Jeremy Arndt and BVG negotiations, explore our resources on business negotiation and strategic planning. Continue learning about successful Jeremy Arndt BVG negotiations and how to apply these strategies in your own business dealings.

Featured Posts

-

Pimblett Vs Chandler Adesanyas Approval Seals The Deal

May 16, 2025

Pimblett Vs Chandler Adesanyas Approval Seals The Deal

May 16, 2025 -

Jalen Brunson Injury Exposes Knicks Biggest Weakness

May 16, 2025

Jalen Brunson Injury Exposes Knicks Biggest Weakness

May 16, 2025 -

From Torpedo Bat To Game Tying Double Muncys Quick Switch

May 16, 2025

From Torpedo Bat To Game Tying Double Muncys Quick Switch

May 16, 2025 -

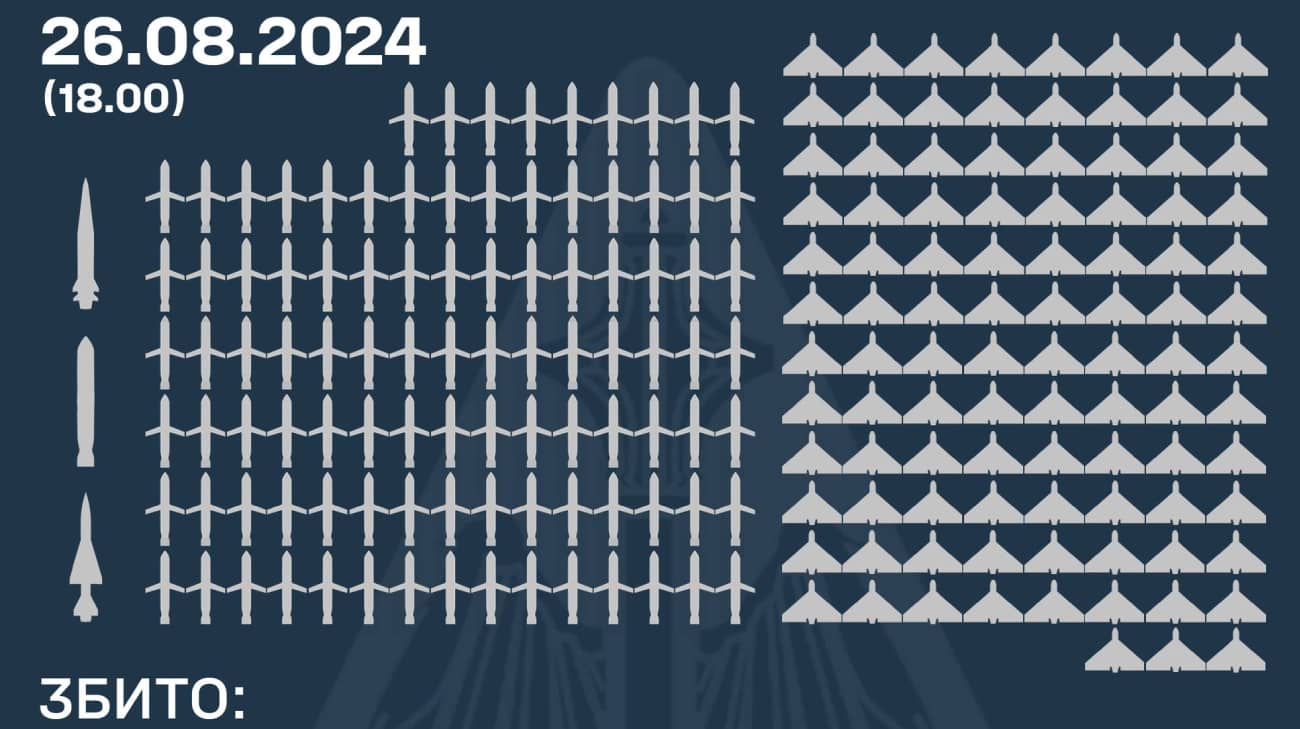

Rossiyskaya Ataka Na Ukrainu Bolee 200 Raket I Dronov Chto Eto Znachit

May 16, 2025

Rossiyskaya Ataka Na Ukrainu Bolee 200 Raket I Dronov Chto Eto Znachit

May 16, 2025 -

Did Elon Musk Father Amber Heards Twins A Closer Look

May 16, 2025

Did Elon Musk Father Amber Heards Twins A Closer Look

May 16, 2025

Latest Posts

-

Auction Of Kid Cudis Possessions Yields Unexpectedly High Bids

May 16, 2025

Auction Of Kid Cudis Possessions Yields Unexpectedly High Bids

May 16, 2025 -

Important Information Regarding Kid Cudis Joopiter Auction

May 16, 2025

Important Information Regarding Kid Cudis Joopiter Auction

May 16, 2025 -

Auction Of Kid Cudis Personal Items High Prices Revealed

May 16, 2025

Auction Of Kid Cudis Personal Items High Prices Revealed

May 16, 2025 -

Kid Cudis Personal Belongings Fetch Record Prices At Auction

May 16, 2025

Kid Cudis Personal Belongings Fetch Record Prices At Auction

May 16, 2025 -

Announcing The Kid Cudi Auction On Joopiter Dates Items And How To Bid

May 16, 2025

Announcing The Kid Cudi Auction On Joopiter Dates Items And How To Bid

May 16, 2025