Jerome Powell: Trade Tariffs Could Hamper Fed's Economic Policy

Table of Contents

Inflationary Pressures from Tariffs

Trade tariffs, essentially taxes on imported goods, exert significant inflationary pressure on the US economy. This pressure manifests in two key ways:

Increased Prices for Consumers

Tariffs directly increase the cost of imported goods, leading to higher prices for consumers. This is a fundamental principle of economics: increased supply-side costs translate into higher prices for consumers.

- Examples: Tariffs on steel and aluminum have increased the cost of automobiles and construction materials. Tariffs on imported goods from China have affected a wide range of consumer products, from clothing and electronics to furniture and toys.

- Statistics: Numerous studies have shown a direct correlation between the imposition of tariffs and subsequent price increases for affected goods. The impact varies depending on the specific tariff and the elasticity of demand for the imported good.

- The ripple effect is substantial. Higher prices lead to reduced consumer spending, impacting overall economic growth. Consumers, facing higher costs, are forced to cut back on discretionary spending, impacting various sectors of the economy.

Impact on Businesses and Supply Chains

Tariffs disrupt global supply chains, increasing input costs for businesses. This can lead to reduced investment, job losses, and decreased competitiveness.

- Industries Affected: Businesses heavily reliant on imported raw materials or intermediate goods are disproportionately affected. This includes manufacturers, construction companies, and retailers.

- Supply Chain Disruptions: Tariffs force businesses to seek alternative, often more expensive, suppliers, lengthening supply chains and increasing transportation costs. This added complexity reduces efficiency and increases uncertainty.

- Business Profitability: Increased input costs eat into profit margins, forcing businesses to either absorb the higher costs, raise prices, or reduce output. This can lead to job losses and reduced investment in expansion and innovation. The effect on business investment is a crucial factor influencing economic growth, as decreased investment leads to slower expansion.

The Fed's Balancing Act: Inflation vs. Growth

The Federal Reserve operates under a dual mandate: price stability and maximum employment. Trade tariffs make achieving both goals simultaneously significantly more challenging.

The Fed's Dual Mandate

The Fed employs monetary policy tools – primarily interest rate adjustments and quantitative easing – to manage inflation and employment. However, these tools are less effective when inflation is driven by external factors like tariffs.

- Monetary Policy Tools: Raising interest rates can curb inflation but may also slow economic growth and increase unemployment. Conversely, lowering interest rates to stimulate growth could exacerbate inflation already fueled by tariffs.

- The Inflation-Growth Trade-off: The Fed faces a difficult trade-off. Fighting inflation aggressively might stifle economic growth, while prioritizing growth could allow inflation to spiral out of control. Tariffs exacerbate this inherent tension.

Reduced Economic Predictability

The uncertainty generated by trade tariffs makes economic forecasting exceedingly difficult. This makes it harder for the Fed to adjust its monetary policy effectively.

- Economic Forecasting: Accurate economic forecasting is crucial for effective monetary policy. Tariffs introduce significant volatility and unpredictable shocks to the economic system, making accurate forecasting far more challenging.

- Investor and Business Confidence: Uncertainty undermines investor confidence and business investment decisions. Businesses are hesitant to invest in expansion or new projects when faced with unpredictable changes in input costs and market conditions caused by tariffs. This hesitancy slows economic growth and job creation.

Jerome Powell's Statements and Actions Regarding Tariffs

Jerome Powell has consistently acknowledged the economic impact of trade tariffs. His public statements and policy decisions reflect the Fed's efforts to navigate this complex environment.

Public Comments and Policy Decisions

Powell has repeatedly expressed concerns about the inflationary pressures and uncertainty created by tariffs.

- Speeches and Press Conferences: In numerous public addresses, Powell has highlighted the challenges tariffs pose to the Fed's ability to achieve its dual mandate. His remarks often emphasize the need for predictable and consistent policy from other branches of government.

- Fed Actions: The Fed has responded to tariff-induced inflationary pressures through gradual interest rate increases. However, the effectiveness of these actions is limited by the inherent uncertainty created by tariffs.

Challenges for the Fed's Independence

Politically driven trade policies pose a significant challenge to the Fed's independence. The Fed's effectiveness relies on its ability to make independent decisions based on economic data, rather than political considerations.

- Importance of Independence: The Fed's independence is essential for its credibility and effectiveness. Politicizing monetary policy decisions risks undermining the Fed's ability to manage the economy effectively.

- Potential Conflicts of Interest: When trade policies directly influence inflation and economic growth, the Fed's actions can be interpreted as either supporting or opposing specific political agendas, creating potential conflicts of interest. This compromises the stability of the economy by introducing unnecessary political pressures onto economic decisions.

Conclusion

Trade tariffs contribute to inflation, disrupt supply chains, create economic uncertainty, and complicate the Fed's efforts to manage the economy. Jerome Powell and the Federal Reserve face immense challenges in navigating this complex landscape. The impact of Jerome Powell trade tariffs is far-reaching and necessitates careful consideration and proactive strategies. It is crucial to understand the interplay between trade policies and monetary policy for informed economic decision-making. Stay informed about the ongoing impacts of trade tariffs on the US economy and the Federal Reserve’s responses. Further research into the economic consequences of protectionist trade policies is essential. We encourage you to share your thoughts on the Jerome Powell trade tariffs debate – your insights are valuable.

Featured Posts

-

Is Canada Post Losing Ground The Impact On The Delivery Landscape

May 26, 2025

Is Canada Post Losing Ground The Impact On The Delivery Landscape

May 26, 2025 -

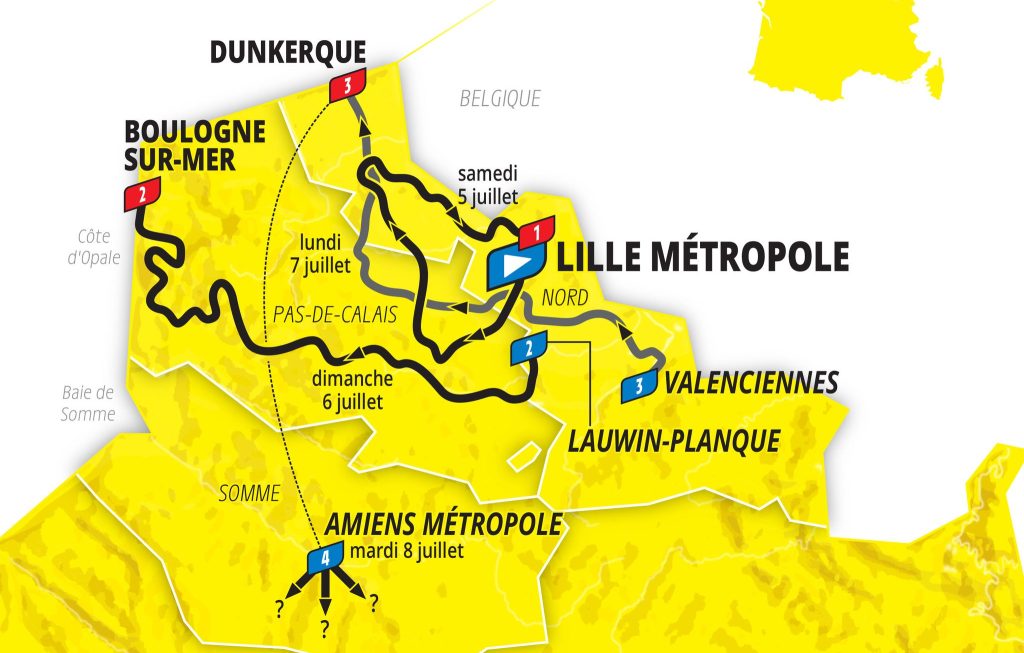

Jeu De Management Cycliste Rtbf Prenez Le Depart Pour Le Tour De France

May 26, 2025

Jeu De Management Cycliste Rtbf Prenez Le Depart Pour Le Tour De France

May 26, 2025 -

Astmrar Almzahrat Fy Tl Abyb Llmtalbt Bieadt Alasra

May 26, 2025

Astmrar Almzahrat Fy Tl Abyb Llmtalbt Bieadt Alasra

May 26, 2025 -

Italian Open Chinese Tennis Players Quarterfinal Berth

May 26, 2025

Italian Open Chinese Tennis Players Quarterfinal Berth

May 26, 2025 -

I Stratigiki Tis Mercedes Kai To Mellon Xoris Ton Ferstapen

May 26, 2025

I Stratigiki Tis Mercedes Kai To Mellon Xoris Ton Ferstapen

May 26, 2025

Latest Posts

-

Leeds United News Latest On Kalvin Phillips And The Clubs Second Signing

May 28, 2025

Leeds United News Latest On Kalvin Phillips And The Clubs Second Signing

May 28, 2025 -

Man City Transfer News Club Chief Addresses De Bruyne Contract Talks

May 28, 2025

Man City Transfer News Club Chief Addresses De Bruyne Contract Talks

May 28, 2025 -

Leeds United Summer Transfers Phillips Departure And Incoming Player Confirmed

May 28, 2025

Leeds United Summer Transfers Phillips Departure And Incoming Player Confirmed

May 28, 2025 -

Kalvin Phillips Transfer Leeds United Receive Green Light New Signing Imminent

May 28, 2025

Kalvin Phillips Transfer Leeds United Receive Green Light New Signing Imminent

May 28, 2025 -

Leeds United News Kalvin Phillips Transfer Update And Second Summer Signing

May 28, 2025

Leeds United News Kalvin Phillips Transfer Update And Second Summer Signing

May 28, 2025