Jim Cramer On CoreWeave (CRWV): Analyzing The Scrappy Company's Success

Table of Contents

CoreWeave's (CRWV) Business Model: A Deep Dive

CoreWeave's unique selling proposition (USP) lies in its specialized cloud computing infrastructure built around high-performance GPUs. Unlike general-purpose cloud providers, CoreWeave caters specifically to the exploding demand for GPU-accelerated computing power, focusing on applications requiring intensive processing, such as:

- Artificial Intelligence (AI) development: Training complex AI models demands massive GPU power. CoreWeave provides this capacity on-demand, significantly reducing the infrastructural burden on AI companies.

- Machine learning (ML) workloads: Similar to AI, ML algorithms require extensive computational resources. CoreWeave's scalable infrastructure allows for rapid training and deployment of ML models.

- High-performance computing (HPC): Scientific simulations, financial modeling, and other computationally intensive tasks benefit greatly from CoreWeave's GPU-optimized cloud.

- Data visualization and rendering: Applications needing powerful visual processing, like 3D rendering and animation, find a suitable and cost-effective environment within CoreWeave's infrastructure.

Key features and benefits of CoreWeave's services:

- Scalability: Easily adjust computing resources based on project needs.

- Flexibility: Choose from a range of GPU types and configurations.

- Cost-effectiveness: Pay only for the resources used, optimizing spending.

Comparison to major competitors (AWS, Azure, Google Cloud): While AWS, Azure, and Google Cloud also offer GPU-based cloud services, CoreWeave distinguishes itself by its deep specialization in GPU computing, offering potentially superior performance and cost optimization for specific workloads. They offer a more tailored approach to a niche market.

Jim Cramer's Analysis of CoreWeave (CRWV): What Did He Say?

While pinpointing specific Mad Money episodes requires further research, Jim Cramer's general sentiment towards CoreWeave, based on available media reports, appears to be cautiously optimistic. He seems to recognize the potential of the GPU computing market and CoreWeave's strategic positioning within it. He has likely highlighted the company’s rapid growth and the increasing demand for GPU-powered cloud services.

Key statements from Jim Cramer (hypothetical examples based on common Cramer commentary):

- "CoreWeave is a scrappy company in a rapidly expanding market."

- "The demand for GPU power is only going to get bigger; this is a company to watch."

- "There are risks, of course, but the potential rewards are significant."

Rationale behind Cramer’s assessment: Cramer's positive outlook likely stems from the explosive growth of AI and ML, driving demand for CoreWeave's services. However, his analysis may also acknowledge the inherent volatility of the tech stock market and the competitive pressures faced by CoreWeave.

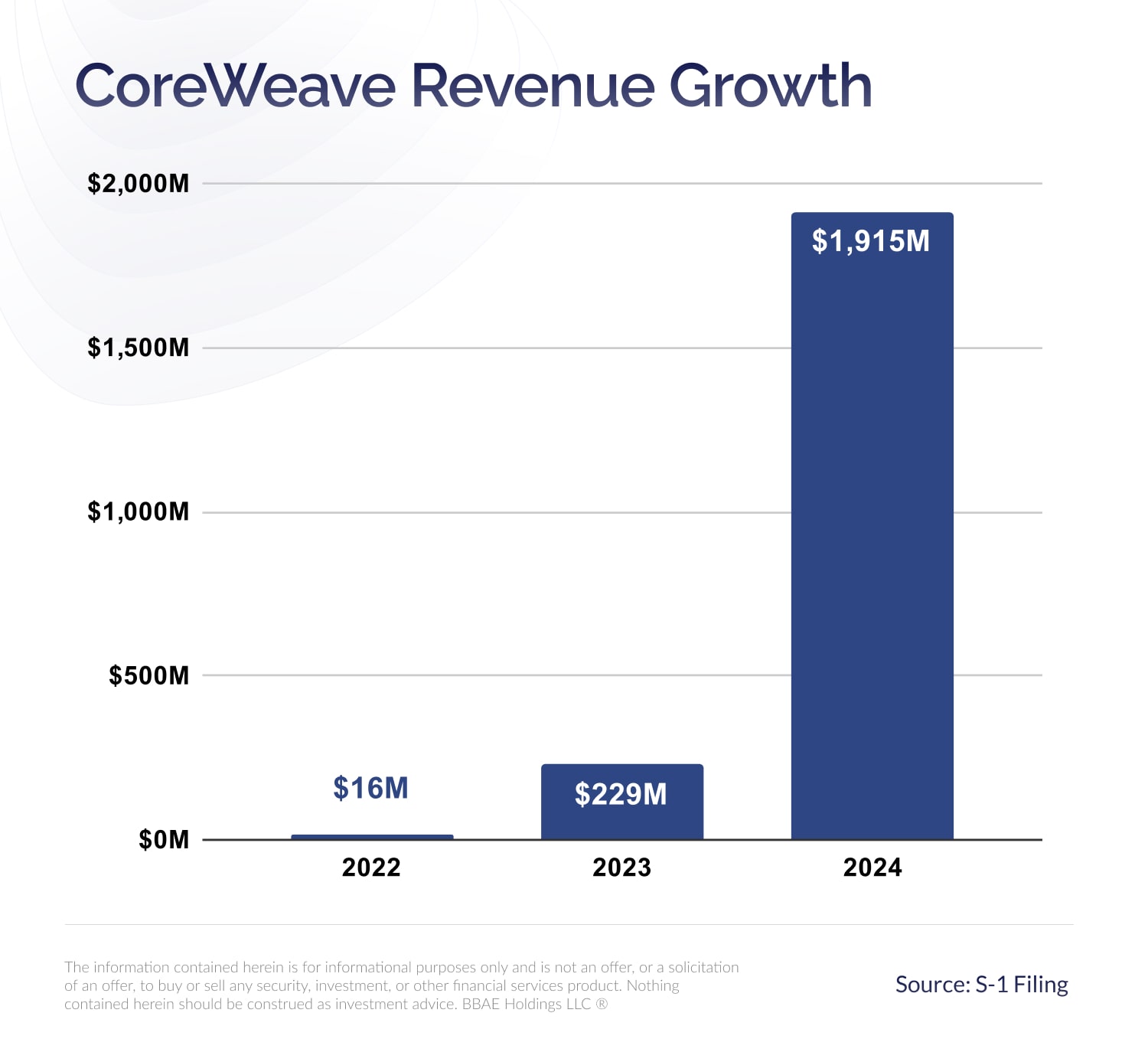

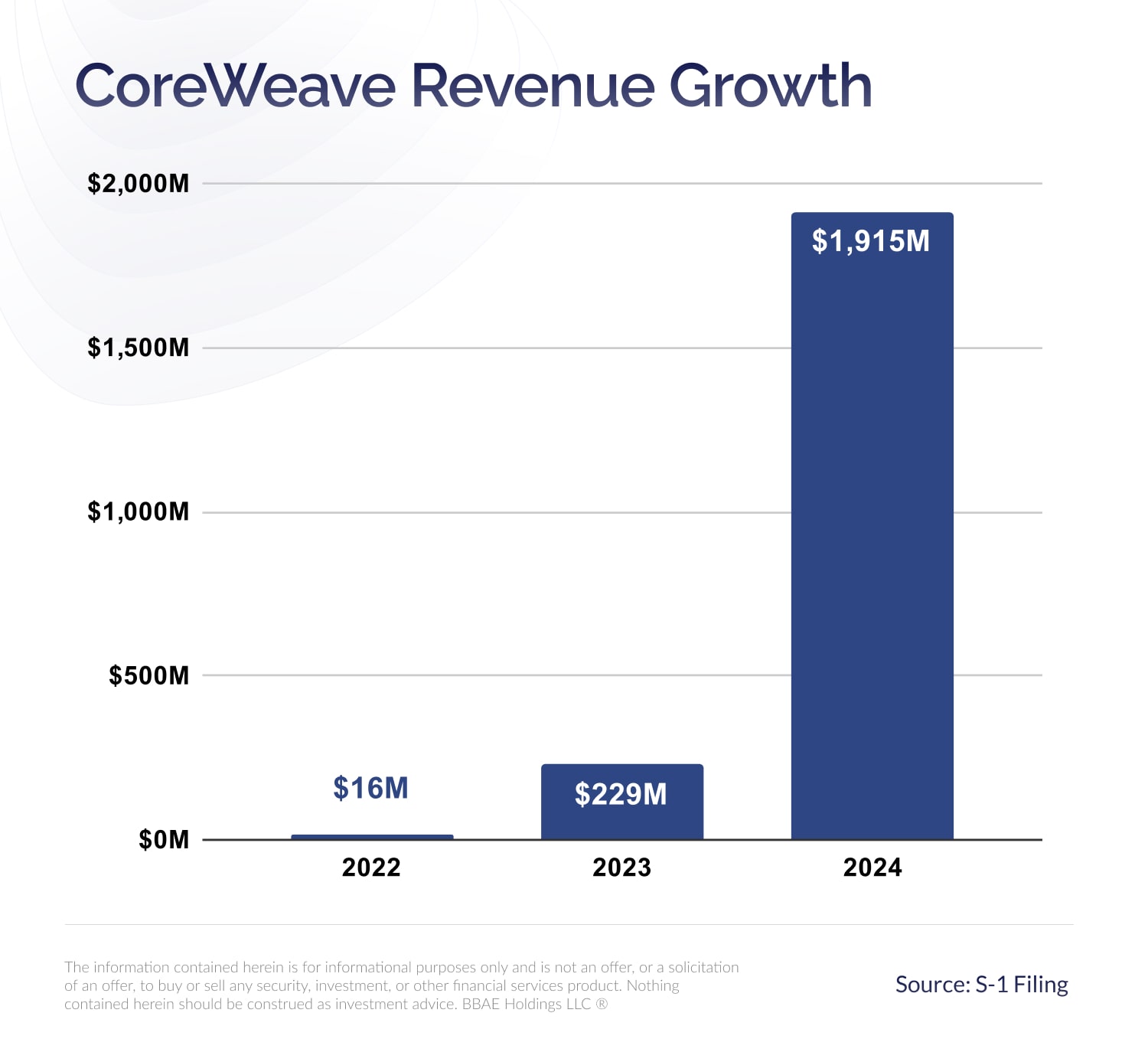

CoreWeave's (CRWV) Growth and Financial Performance: A Numbers Game

CoreWeave's financial performance, while not publicly available in extensive detail as of yet (since it's a relatively new public company), shows promising signs of rapid growth. Revenue growth is expected to be substantial, driven by increased adoption of its GPU-focused cloud services. While profitability might still be a work in progress, the company’s aggressive growth trajectory suggests a path towards sustained profitability in the future.

Key financial highlights (hypothetical data for illustrative purposes):

- Year-over-year revenue growth exceeding 50%.

- Increasing market capitalization reflecting investor confidence.

- Strategic partnerships expanding market reach and revenue streams.

Potential risks: The company faces competition from established players. Market fluctuations in the tech sector and potential economic slowdowns could impact growth and investor sentiment.

The Future of CoreWeave (CRWV) and the Cloud Computing Landscape

The future of CoreWeave hinges on several factors: continued growth in the AI and ML sectors, successful navigation of the competitive landscape, and the company's ability to innovate and adapt to changing technological advancements.

Forecasts for future growth and market share: Industry analysts predict continued strong growth for GPU-accelerated cloud computing. CoreWeave's specialized focus positions it to capture significant market share.

Potential technological disruptions: Advancements in GPU technology and alternative computing architectures could impact CoreWeave's business. Adaptability and innovation will be crucial.

Assessment of CoreWeave’s long-term sustainability: Long-term success depends on continued innovation, maintaining a competitive edge, and effectively managing financial risks.

Conclusion: Is CoreWeave (CRWV) a Smart Investment Based on Jim Cramer's Insights and Market Analysis?

CoreWeave (CRWV) presents a compelling investment opportunity in the rapidly growing GPU cloud computing market. Jim Cramer's positive outlook aligns with the promising growth trajectory indicated by the company's early performance. However, it's crucial to acknowledge the inherent risks associated with investing in any tech stock. Thorough due diligence, including reviewing financial reports, market analysis, and competitor landscapes, is essential. Before making any investment decision concerning CoreWeave stock or any other cloud computing investment, conduct your own independent research. Remember to consult a qualified financial advisor for personalized investment guidance. Learn more about CoreWeave’s financial performance by exploring their investor relations materials. [Insert Link to CoreWeave Investor Relations]. Remember to carefully consider all aspects before investing in CoreWeave (CRWV) or any similar tech stock.

Featured Posts

-

Ukrayina Poza Nato Politichni Ta Bezpekovi Naslidki

May 22, 2025

Ukrayina Poza Nato Politichni Ta Bezpekovi Naslidki

May 22, 2025 -

Nhung Du An Ha Tang Thuc Day Giao Thong Tp Hcm Binh Duong

May 22, 2025

Nhung Du An Ha Tang Thuc Day Giao Thong Tp Hcm Binh Duong

May 22, 2025 -

Dexter New Blood Blu Ray Steelbook Release Everything You Need To Know

May 22, 2025

Dexter New Blood Blu Ray Steelbook Release Everything You Need To Know

May 22, 2025 -

Lucy Connolly Appeal Fails In Racial Hatred Post Case

May 22, 2025

Lucy Connolly Appeal Fails In Racial Hatred Post Case

May 22, 2025 -

Discussie Abn Amros Visie Op Betaalbare Huizen Versus Geen Stijls Kritiek

May 22, 2025

Discussie Abn Amros Visie Op Betaalbare Huizen Versus Geen Stijls Kritiek

May 22, 2025

Latest Posts

-

Israeli Embassy Staff Killed In Dc Shooting Ap Photos

May 22, 2025

Israeli Embassy Staff Killed In Dc Shooting Ap Photos

May 22, 2025 -

Rosiya Ta Novi Sanktsiyi Initsiativa Senatora Grema

May 22, 2025

Rosiya Ta Novi Sanktsiyi Initsiativa Senatora Grema

May 22, 2025 -

Strong Condemnation German Chancellor Merz On Washington Attack

May 22, 2025

Strong Condemnation German Chancellor Merz On Washington Attack

May 22, 2025 -

Lindsi Grem Ta Posilennya Sanktsiy Proti Rosiyi Detali Zakonoproektu

May 22, 2025

Lindsi Grem Ta Posilennya Sanktsiy Proti Rosiyi Detali Zakonoproektu

May 22, 2025 -

Zakonoproekt Grema Zagroza Novikh Sanktsiy Dlya Rosiyi

May 22, 2025

Zakonoproekt Grema Zagroza Novikh Sanktsiy Dlya Rosiyi

May 22, 2025