Job Losses And Tariffs: Will The Bank Of Canada Respond With Further Rate Cuts?

Table of Contents

The Canadian economy is navigating turbulent waters. Rising tariffs, sparked by global trade tensions, are causing significant job losses and dampening economic growth. This raises a critical question: will the Bank of Canada (BoC) respond by implementing further interest rate cuts to stimulate the economy and soften the blow? This article delves into the potential for additional rate cuts, examining the current economic climate and the BoC's historical responses to similar challenges. We'll analyze the impact of tariffs, the BoC's current stance, and predictions for future monetary policy decisions.

<h2>The Impact of Tariffs on the Canadian Economy</h2>

Tariffs, essentially taxes on imported goods, have far-reaching consequences for the Canadian economy. They disrupt established trade relationships and create ripple effects throughout various sectors.

<h3>Job Losses in Key Sectors</h3>

Several key sectors of the Canadian economy are experiencing significant job losses due to tariffs. The manufacturing and agricultural industries have been particularly hard hit. For example, the automotive sector, heavily reliant on cross-border trade, has seen production cuts and layoffs as a direct result of increased import costs. Similarly, Canadian farmers face reduced export opportunities and decreased profitability due to retaliatory tariffs imposed by trading partners.

- Example 1: Statistics Canada reported a [insert percentage]% decline in manufacturing jobs in [insert year/period], directly correlated with increased tariff barriers. (Source: Statistics Canada)

- Example 2: The agricultural sector witnessed a [insert number] job loss in [insert region] due to reduced export volumes of [insert specific product] following tariff increases. (Source: [Relevant Agricultural Report])

- The ripple effect extends beyond these primary sectors. Reduced production in manufacturing leads to fewer orders for parts suppliers, resulting in further job losses and economic contraction.

<h3>Reduced Consumer Spending and Business Investment</h3>

Tariffs lead to higher prices for imported goods, directly impacting consumers' purchasing power. This reduced consumer spending power creates a downward spiral, affecting businesses and further slowing economic growth. Moreover, the uncertainty caused by unpredictable trade policies discourages businesses from investing in expansion or new projects.

- Example 1: Consumer confidence index fell to [insert value] in [insert month/year], the lowest in [insert timeframe], reflecting concerns about rising prices and economic uncertainty (Source: [Relevant Consumer Confidence Index]).

- Example 2: Business investment in machinery and equipment decreased by [insert percentage]% in [insert quarter/year] (Source: [Relevant Business Investment Data]).

<h3>Inflationary Pressures</h3>

While tariffs can initially depress demand, they can also create inflationary pressures. Increased import costs are passed on to consumers, leading to higher prices for goods and services. This is particularly concerning for the Bank of Canada, which has an inflation target of around 2%. The BoC must carefully balance its mandate of price stability with its goal of promoting full employment.

- Example 1: The Consumer Price Index (CPI) increased by [insert percentage]% in [insert period], partly attributable to tariff-related price increases in [insert specific product categories] (Source: Statistics Canada).

- Example 2: Import costs increased by [insert percentage]% in [insert period], contributing to higher production costs across various industries. (Source: [Relevant Trade Data]).

<h2>The Bank of Canada's Current Monetary Policy Stance</h2>

Understanding the BoC's current monetary policy stance is crucial to predicting potential future actions.

<h3>Current Interest Rate Levels</h3>

As of [insert date], the BoC's key interest rate stands at [insert current rate]%. The rationale behind this rate is typically a blend of considering inflation expectations, economic growth projections, and labour market conditions. The BoC aims to maintain price stability while supporting sustainable economic growth.

- Summary of recent BoC announcements: [Briefly summarize recent statements by the BoC Governor, highlighting key concerns and policy intentions].

<h3>Factors Influencing the Bank's Decision-Making</h3>

The BoC considers numerous factors beyond inflation when setting interest rates. Key indicators include:

- GDP Growth: A slowing GDP indicates weakened economic activity and may warrant rate cuts.

- Unemployment Rate: Rising unemployment is a significant concern, potentially prompting the BoC to stimulate the economy.

- Housing Market: The BoC monitors the housing market's health to avoid creating asset bubbles through excessively low interest rates.

<h3>Historical Precedents</h3>

The BoC has a history of using interest rate cuts to respond to economic downturns and high unemployment. Analyzing past responses can provide valuable insights into their potential actions in the current situation. However, each economic crisis presents unique characteristics that necessitate tailored responses.

- Examples of past rate cuts and their effectiveness: Briefly describe instances where the BoC cut rates in response to similar economic challenges, highlighting the outcomes.

<h2>Predicting Future Bank of Canada Actions</h2>

Predicting the BoC's future actions involves weighing various arguments for and against further rate cuts.

<h3>Arguments for Further Rate Cuts</h3>

The severity of job losses and the potential for a deeper recession strongly suggest the need for further rate cuts. Lower interest rates can stimulate borrowing, investment, and consumer spending, helping to revive the economy.

- Key arguments supporting further rate cuts: Summarize the compelling reasons for lowering interest rates based on the analysis above.

<h3>Arguments Against Further Rate Cuts</h3>

Cutting rates too aggressively can pose risks. Low interest rates can fuel inflation, potentially creating asset bubbles in the housing or stock markets. The BoC must carefully consider these potential drawbacks.

- Key arguments against further rate cuts: Outline the potential downsides of further rate reductions.

<h3>Expert Opinions and Forecasts</h3>

Economists and financial analysts offer diverse opinions on the likelihood of further rate cuts. [Insert a summary of forecasts from reputable sources, such as major financial institutions or respected economists, and cite those sources].

<h2>Conclusion</h2>

The impact of tariffs and associated job losses on the Canadian economy presents a significant challenge. The Bank of Canada's decision on whether to implement further interest rate cuts will depend on a careful weighing of various factors, including the severity of the economic slowdown, inflation pressures, and the potential risks of excessively low rates. While further rate cuts might stimulate the economy, they also carry potential risks. Staying informed about the BoC's decisions and their implications is crucial for individuals and businesses alike. Continue to follow our analysis on the interplay between job losses, tariffs, and Bank of Canada rate cuts for updates and insights. Understanding how the Bank of Canada manages interest rates is key to navigating these uncertain economic times.

Featured Posts

-

Ford Gt Restoration Lynxs Expertise In Action

May 11, 2025

Ford Gt Restoration Lynxs Expertise In Action

May 11, 2025 -

Rising Sea Levels Catastrophe For Coastal Communities

May 11, 2025

Rising Sea Levels Catastrophe For Coastal Communities

May 11, 2025 -

Celtics Payton Pritchard Signs With Converse

May 11, 2025

Celtics Payton Pritchard Signs With Converse

May 11, 2025 -

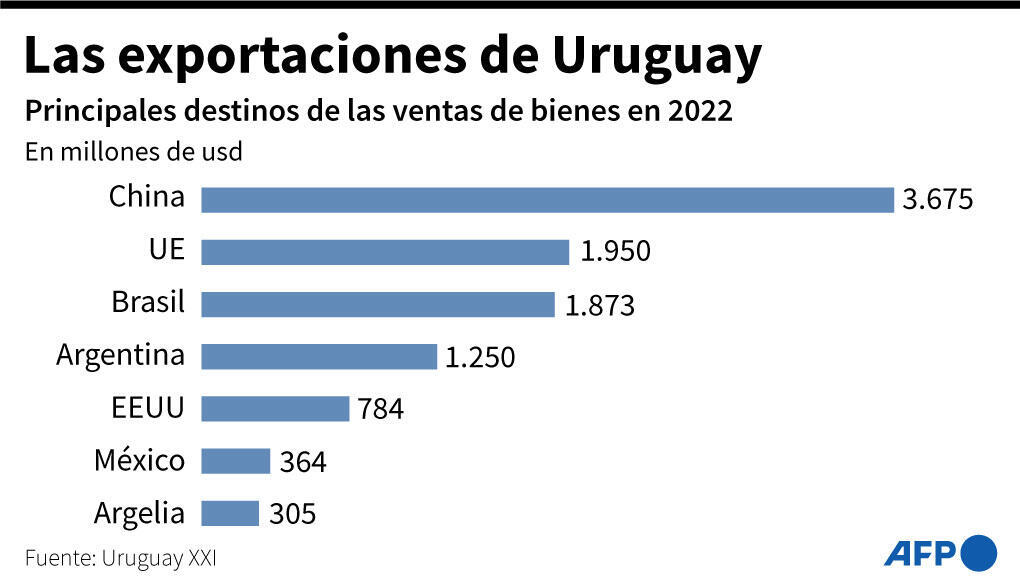

Uruguay Regala Inusual Obsequio A China Para Impulsar Exportaciones Ganaderas

May 11, 2025

Uruguay Regala Inusual Obsequio A China Para Impulsar Exportaciones Ganaderas

May 11, 2025 -

Meet The 500 Most Influential People In Washington Dc 2025

May 11, 2025

Meet The 500 Most Influential People In Washington Dc 2025

May 11, 2025