Kering Stock Drops 6% On Weak First-Quarter Results

Table of Contents

Disappointing Sales Figures Across Key Brands

Kering's Q1 2024 results revealed a disappointing performance across its key brands. While specific figures may vary depending on reporting standards and currency fluctuations, the overall trend points towards a significant slowdown in growth compared to the same period last year and industry expectations.

-

Gucci: Gucci, historically Kering's flagship brand and a major contributor to its revenue, experienced a notable sales decline. This decrease can be attributed to several factors including a slowdown in demand from key markets, increased competition, and perhaps a need for a refreshed brand image. [Insert chart/graph visually representing Gucci sales decline].

-

Yves Saint Laurent (YSL): While YSL has shown relative strength in recent years, its Q1 performance also fell short of expectations, indicating a broader slowdown within the Kering portfolio. [Insert chart/graph visually representing YSL revenue].

-

Other Brands: Other brands under the Kering umbrella, such as Balenciaga and Bottega Veneta, also reported weaker-than-anticipated sales figures, highlighting the widespread nature of the challenges facing the company. Specific analyses of each brand's performance would reveal individual challenges and opportunities.

Several contributing factors explain this underperformance. Supply chain disruptions, lingering from the pandemic, continue to impact production and delivery. The economic slowdown in China, a crucial market for luxury goods, significantly affected sales. Moreover, evolving consumer behavior and a shift in preferences towards experiences over material goods have impacted demand.

Impact of Geopolitical and Economic Factors

The current global economic climate significantly influenced Kering's Q1 results. Rising inflation, recessionary fears in major economies, and geopolitical instability have all contributed to a decline in luxury spending.

-

Global Economic Uncertainty: Inflation erodes purchasing power, impacting consumer confidence and willingness to spend on luxury items. Recessionary fears further dampen consumer sentiment, leading to more cautious spending habits.

-

Geopolitical Instability: The ongoing war in Ukraine has created global uncertainty, negatively impacting consumer confidence and potentially disrupting supply chains.

-

China's Economic Slowdown: The Chinese economy has faced significant headwinds, impacting luxury goods sales considerably. China remains a critical market for Kering's brands, and its slowdown directly affected the company's overall performance. The zero-COVID policies and subsequent economic readjustment created significant uncertainty for luxury brands operating in the region.

Kering's Response and Future Outlook

In response to the weak Q1 results, Kering has outlined a number of strategies to address the challenges and improve future performance.

-

Product Innovation: Kering plans to focus on product innovation and new designs to attract and retain customers. This involves investing in research and development to create appealing products that meet evolving consumer preferences.

-

Targeted Marketing Campaigns: The company intends to launch targeted marketing campaigns to reinforce brand image and appeal to new and existing customer segments. This might include digital marketing strategies, collaborations, and influencer marketing initiatives.

-

Cost-Cutting Measures: Kering will likely implement cost-cutting measures to improve efficiency and profitability. This could involve streamlining operations, optimizing supply chains, and controlling expenses.

Analyst opinions on Kering's future outlook are varied. Some analysts remain optimistic, pointing to the company's strong brand portfolio and potential for recovery. Others express concerns, highlighting the persistent economic headwinds and the challenging luxury goods market. [Insert quotes from relevant financial analysts]. The company's revised financial projections for the year will offer further clarity on its expectations.

Investor Sentiment and Market Reaction

The immediate market reaction to Kering's Q1 results was negative, with the Kering stock price experiencing a significant drop. Trading volume also increased, reflecting heightened investor activity and concern. Analyst ratings have been revised downwards by some firms, reflecting a more cautious outlook. The overall investor sentiment towards Kering, and the luxury goods sector as a whole, has been dampened by the weak Q1 results. The volatility of the Kering share price reflects this uncertainty.

Analyzing the Kering Stock Drop – What's Next?

The 6% drop in Kering's stock price is primarily attributed to disappointing Q1 results across its key brands, coupled with the broader impact of global economic and geopolitical uncertainty. The slowdown in China and changing consumer behaviors significantly affected sales. While Kering has outlined strategies to address these challenges, including product innovation, marketing initiatives, and cost-cutting measures, the success of these initiatives remains to be seen. The future performance of Kering stock and the overall luxury goods market will depend on factors such as global economic recovery, consumer confidence, and the company's ability to execute its strategic plans effectively. Stay informed on the latest developments concerning Kering stock and the luxury market by subscribing to our newsletter and following us on social media. Understanding Kering stock performance and luxury market trends is crucial for informed investment decisions.

Featured Posts

-

A Relaxed Escape To The Country Homes Activities And More

May 25, 2025

A Relaxed Escape To The Country Homes Activities And More

May 25, 2025 -

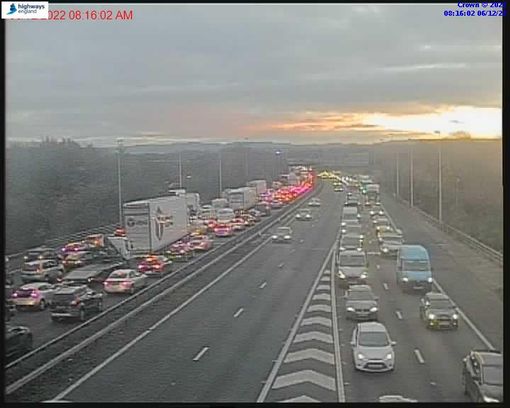

M56 Crash Live Traffic Updates And Long Queues

May 25, 2025

M56 Crash Live Traffic Updates And Long Queues

May 25, 2025 -

Eurovision Village 2025 Conchita Wurst And Jjs Joint Performance

May 25, 2025

Eurovision Village 2025 Conchita Wurst And Jjs Joint Performance

May 25, 2025 -

Find Tranquility An Andalusian Farmstay Retreat

May 25, 2025

Find Tranquility An Andalusian Farmstay Retreat

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Performance

May 25, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist Nav Analysis And Performance

May 25, 2025