Key Features Of The House Republican Trump Tax Cut Plan

Table of Contents

Individual Income Tax Rate Reductions

The House Republican Trump Tax Cut Plan dramatically reduced individual income tax rates. The plan compressed the existing seven tax brackets into four, resulting in substantial percentage changes across the board. This tax rate reduction aimed to stimulate the economy by boosting disposable income for individuals.

- Specific changes to each tax bracket: The highest individual income tax rate was lowered from 39.6% to 37%. Lower brackets also saw reductions, although the exact percentages varied.

- Impact on different income levels: While all income levels experienced some tax relief, the impact was disproportionately greater for higher-income earners. Lower-income taxpayers benefited from a larger standard deduction (discussed below).

- Mention of any sunset provisions: Many provisions of the TCJA, including some individual tax cuts, were not permanent, meaning they were set to expire after a certain period. This created uncertainty for long-term tax planning. Understanding these sunset provisions is vital when analyzing the long-term effects of the House Republican Trump Tax Cut Plan.

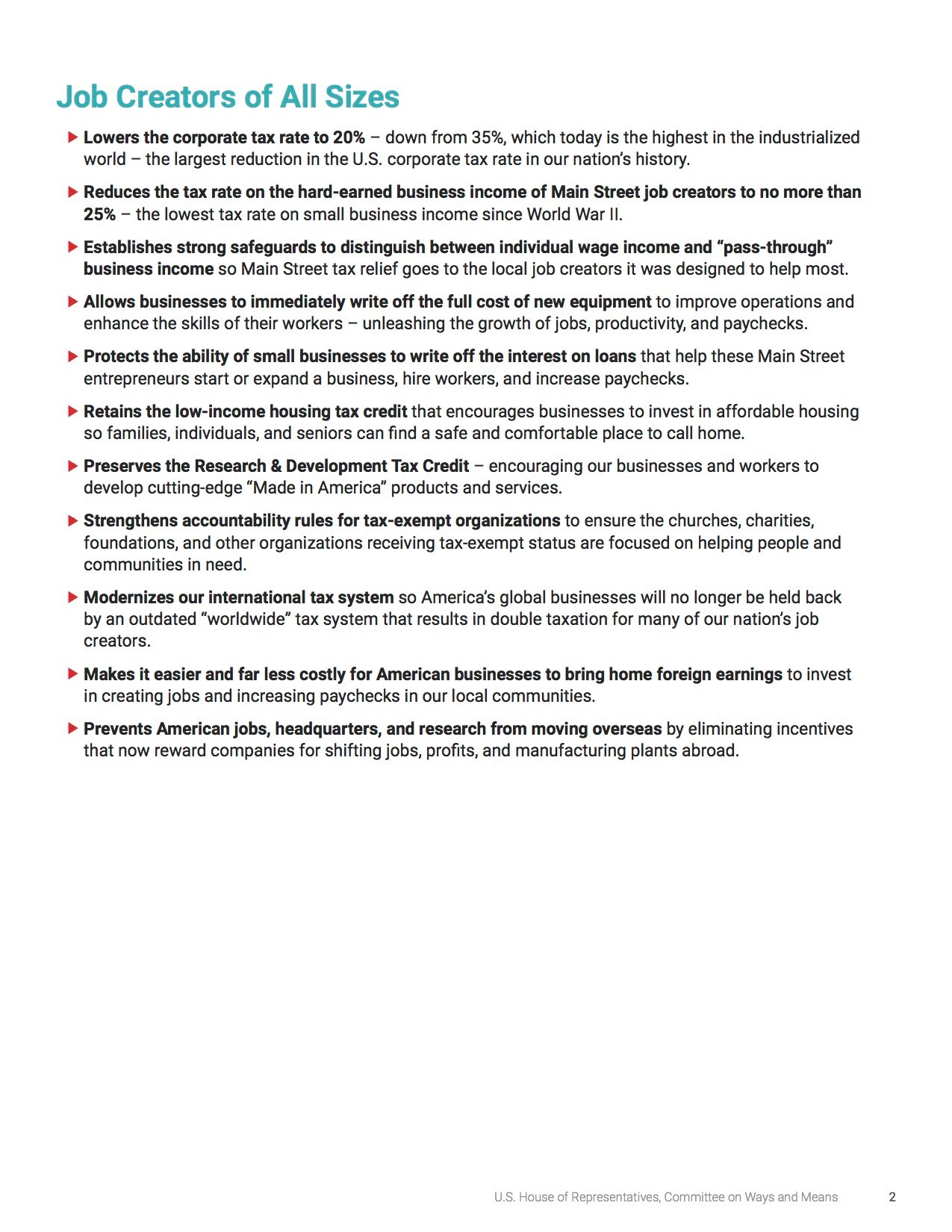

Corporate Tax Rate Cuts

Perhaps the most significant change introduced by the House Republican Trump Tax Cut Plan was the dramatic reduction in the corporate tax rate. This cut aimed to boost business investment, job creation, and overall economic growth.

- The previous corporate tax rate: Prior to the TCJA, the US corporate tax rate was 35%.

- The new corporate tax rate: The TCJA slashed the corporate tax rate to a flat 21%.

- Potential effects on business investment and job creation: Proponents argued that the lower rate would incentivize businesses to invest more in their operations, leading to increased job creation and higher wages. Opponents argued that the benefits did not reach all businesses equally.

- International implications: The reduced corporate tax rate also had international implications, impacting the competitiveness of US businesses in the global market. This created significant discussion about tax inversions and other strategies to minimize tax burdens.

Changes to the Standard Deduction and Itemized Deductions

The House Republican Trump Tax Cut Plan significantly altered the landscape of deductions for individuals. While the standard deduction was substantially increased, several itemized deductions were limited or eliminated.

- Increased standard deduction amounts for individuals and married couples: The standard deduction was nearly doubled, simplifying tax preparation for many individuals and pushing more taxpayers into the standard deduction rather than itemizing.

- Changes to the limitation or elimination of itemized deductions (e.g., state and local taxes (SALT)): The most controversial change was the limitation on the deduction for state and local taxes (SALT). This cap disproportionately affected taxpayers in high-tax states. Other itemized deductions also faced limitations or elimination.

- The overall impact on taxpayers' deductions: For many taxpayers, the increased standard deduction more than offset the loss of itemized deductions, resulting in a simpler and potentially lower tax bill. However, this simplification came at the cost of losing certain deductions for some individuals.

Pass-Through Business Tax Changes

The House Republican Trump Tax Cut Plan also introduced significant changes affecting pass-through entities like partnerships and S corporations. A key feature was the creation of the qualified business income (QBI) deduction.

- Explanation of the QBI deduction: The QBI deduction allows eligible taxpayers to deduct up to 20% of their qualified business income (QBI) from pass-through businesses.

- Eligibility requirements for the QBI deduction: Eligibility for the QBI deduction depends on factors like the taxpayer's taxable income and the type of business.

- Limitations and complexities of the QBI deduction: While beneficial, the QBI deduction has numerous limitations and complexities, including income limitations and restrictions on certain types of businesses. This makes claiming the deduction challenging for some taxpayers.

Impact on the National Debt

The long-term fiscal implications of the House Republican Trump Tax Cut Plan, particularly its impact on the national debt, remain a subject of ongoing debate.

- Projected increase in the national debt due to the tax cuts: The TCJA's significant tax cuts led to a projected increase in the national debt, raising concerns about the country's long-term fiscal sustainability.

- Debates and discussions surrounding the long-term fiscal sustainability: Economists and policymakers have engaged in extensive debates about the long-term consequences of the tax cuts on the budget deficit and the national debt.

- Analysis of projected revenue shortfalls: The tax cuts resulted in projected revenue shortfalls, leading to discussions about the need for future budget adjustments or spending cuts.

Conclusion

The House Republican Trump Tax Cut Plan fundamentally reshaped the US tax system. Understanding its effects on individual income tax rates, corporate taxes, deductions, and pass-through business taxation is vital for both individuals and businesses. While it aimed to boost economic growth, its long-term impact, especially on the national debt, continues to be assessed. To fully understand how the House Republican Trump Tax Cut Plan impacts your specific tax situation, further research is recommended. Consult with a tax professional for personalized advice and to navigate the complexities of this landmark legislation and its ongoing effects.

Featured Posts

-

Hertha Bscs Crisis Boateng And Kruses Differing Perspectives

May 13, 2025

Hertha Bscs Crisis Boateng And Kruses Differing Perspectives

May 13, 2025 -

Nba 2025 Draft Lottery Who Has The Best Chance At Landing Cooper Flagg

May 13, 2025

Nba 2025 Draft Lottery Who Has The Best Chance At Landing Cooper Flagg

May 13, 2025 -

The Unending Nightmare Gaza Hostages And Their Families

May 13, 2025

The Unending Nightmare Gaza Hostages And Their Families

May 13, 2025 -

Eva Longorias Hilarious Road Trip Disasters In Alexander And The Terrible Horrible No Good Very Bad Day

May 13, 2025

Eva Longorias Hilarious Road Trip Disasters In Alexander And The Terrible Horrible No Good Very Bad Day

May 13, 2025 -

Confirmed Tory Lanez Seriously Injured After Prison Stabbing

May 13, 2025

Confirmed Tory Lanez Seriously Injured After Prison Stabbing

May 13, 2025

Latest Posts

-

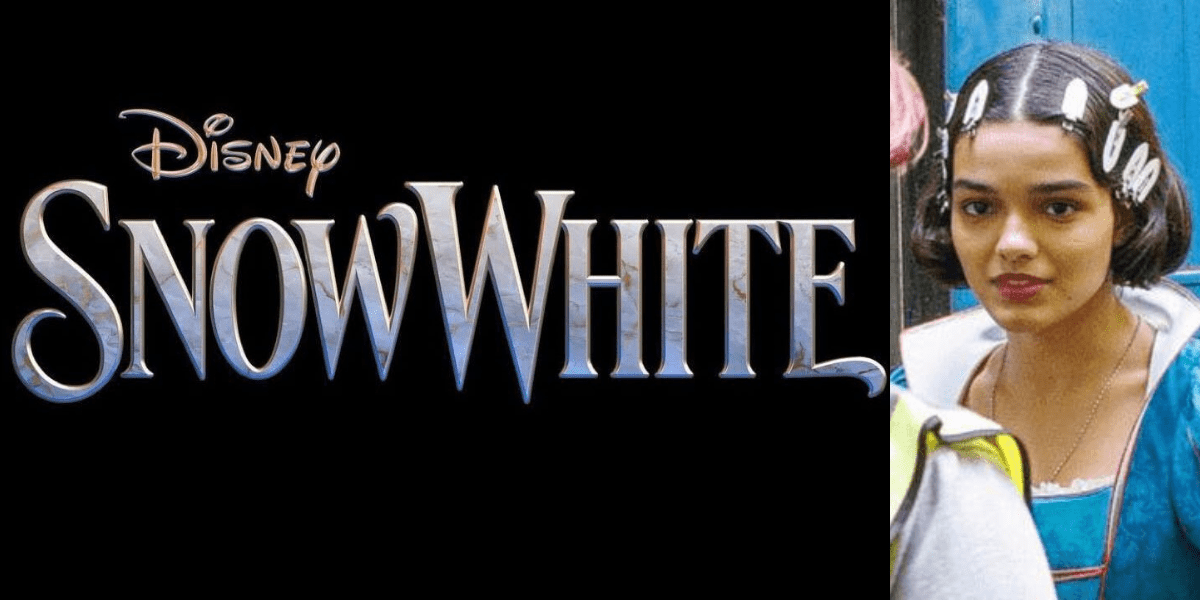

Disneys Woke Snow White Did Political Correctness Hurt The Films Success

May 14, 2025

Disneys Woke Snow White Did Political Correctness Hurt The Films Success

May 14, 2025 -

Snow Whites Opening Weekend A Critical And Commercial Failure

May 14, 2025

Snow Whites Opening Weekend A Critical And Commercial Failure

May 14, 2025 -

Disneys Snow White Remake Addressing The Biggest Issue

May 14, 2025

Disneys Snow White Remake Addressing The Biggest Issue

May 14, 2025 -

Snow White Box Office Bomb A Case Study In Alienating Audiences

May 14, 2025

Snow White Box Office Bomb A Case Study In Alienating Audiences

May 14, 2025 -

Snow Whites 169 Million Underperformance Signals A Shift In Disneys Live Action Strategy

May 14, 2025

Snow Whites 169 Million Underperformance Signals A Shift In Disneys Live Action Strategy

May 14, 2025