Klarna's $1 Billion Filing And Imminent IPO: What To Expect

Table of Contents

Klarna, the Swedish buy now, pay later (BNPL) giant, has filed for a potential $1 billion IPO. This monumental event is shaking up the fintech world and has investors buzzing. This article delves into what we can expect from Klarna's imminent public offering, exploring its valuation, potential market impact, and risks involved. The Klarna IPO presents a unique opportunity, but careful consideration is crucial before investing.

Klarna's Financial Performance and Valuation

Keywords: Klarna revenue, Klarna profitability, Klarna market share, Klarna valuation, Klarna financials

Klarna's financial performance will be a key determinant of its IPO valuation. Analyzing its recent financial reports is crucial for understanding its potential.

-

Revenue Growth: Klarna has experienced significant revenue growth in recent years, fueled by the explosive growth of the BNPL market. However, profitability remains a challenge. Understanding the trajectory of this growth and its sustainability is key. We need to see clear evidence that this revenue growth translates into sustainable profitability.

-

Profitability (or Lack Thereof): While Klarna boasts impressive revenue figures, its path to profitability is a major point of investor scrutiny. The company has invested heavily in growth, leading to losses. The IPO prospectus will need to clearly outline its strategy for achieving profitability. Investors will be looking for evidence of a clear plan and tangible progress toward this goal.

-

Market Share: Klarna holds a significant market share in the global BNPL market, especially in Europe. This dominance is a strong positive factor in its valuation, but competition is fierce, and maintaining this share will be vital.

-

Valuation and IPO Price: Klarna's valuation will be heavily influenced by comparisons with other successful fintech IPOs and the overall health of the BNPL sector. The anticipated IPO price and the number of shares offered will significantly impact investor returns. Analysts' projections provide a range, but the final valuation will depend on market conditions at the time of the IPO. We can expect significant volatility.

(Include relevant charts and graphs illustrating Klarna’s financial performance here)

The Buy Now Pay Later (BNPL) Market and Klarna's Position

Keywords: Buy Now Pay Later, BNPL market growth, BNPL competition, BNPL regulation, Klarna competitors

The BNPL market is experiencing rapid global growth, offering immense potential. However, understanding Klarna's position within this competitive landscape is crucial.

-

BNPL Market Growth: The global BNPL market is booming, driven by consumer demand for flexible payment options and the ease of online shopping. This growth fuels Klarna's potential. However, this rapid expansion also brings challenges such as increased competition and regulatory scrutiny.

-

Klarna's Competition: Klarna faces stiff competition from established players like Affirm, Afterpay (now part of Block), and PayPal, as well as newer entrants. The competitive landscape is constantly evolving, requiring Klarna to continuously innovate and adapt.

-

Regulatory Environment: The regulatory landscape surrounding BNPL is evolving globally. Increased scrutiny regarding consumer protection and financial stability could impact Klarna's operations and profitability. Understanding the regulatory risks in each of Klarna's markets is critical.

-

BNPL Business Model Sustainability: The long-term sustainability of the BNPL business model is a key concern for investors. The inherent risks of defaults and potential economic downturns impacting consumer spending need careful consideration.

Risks and Opportunities Associated with the Klarna IPO

Keywords: Klarna IPO risks, Klarna investment risks, Klarna growth potential, Klarna stock risks, BNPL risks

The Klarna IPO presents both significant opportunities and considerable risks for investors. A balanced assessment is essential.

-

Potential Risks: Investing in a high-growth fintech company like Klarna involves inherent risks. Market volatility, increased competition, regulatory uncertainty, and macroeconomic factors (such as inflation and interest rate hikes) all pose potential challenges. Default rates and the potential for increased loan losses are also significant risks.

-

Potential Opportunities: Despite the risks, Klarna's established brand recognition, significant market share, and the potential for further expansion into new markets present considerable growth opportunities. The overall expansion of the BNPL sector also offers strong long-term potential.

-

Macroeconomic Impact: Economic downturns can significantly impact consumer spending and default rates, affecting Klarna's profitability. Interest rate hikes can increase borrowing costs and reduce consumer demand for BNPL services. Investors need to assess the potential impact of these factors.

-

Long-Term Growth Prospects: Klarna's long-term success depends on its ability to innovate, expand into new markets, and maintain its competitive edge. The company’s ability to adapt to evolving consumer preferences and technological advancements will be crucial.

Investor Considerations Before Investing in Klarna

Keywords: Klarna investment strategy, Klarna due diligence, Klarna risk assessment, Klarna investment analysis

Before investing in the Klarna IPO, thorough due diligence is paramount.

-

Due Diligence: Conduct comprehensive research, analyze Klarna's financial statements, understand its business model, and assess its competitive landscape. Don't rely solely on marketing materials.

-

Risk Tolerance: Assess your personal risk tolerance and investment goals. Klarna stock is considered a high-risk, high-reward investment. Only invest what you can afford to lose.

-

Financial Advisor Consultation: Consult with a qualified financial advisor to discuss the suitability of Klarna stock for your investment portfolio. A professional can help you assess the risks and opportunities based on your individual circumstances.

Conclusion

Klarna's upcoming IPO is a significant event with the potential to reshape the fintech landscape. While the company boasts impressive growth and market share, investors should carefully consider the inherent risks associated with the BNPL sector and the volatility of the IPO market. A thorough understanding of Klarna's financials, competitive position, and the broader regulatory environment is crucial for making informed investment decisions.

Call to Action: Stay informed on the latest developments regarding the Klarna IPO and make an informed decision about whether to invest in this potentially lucrative, yet risky, opportunity. Learn more about Klarna's financial performance and market position before making your investment decision. Continue your research on the Klarna IPO and the future of the BNPL industry.

Featured Posts

-

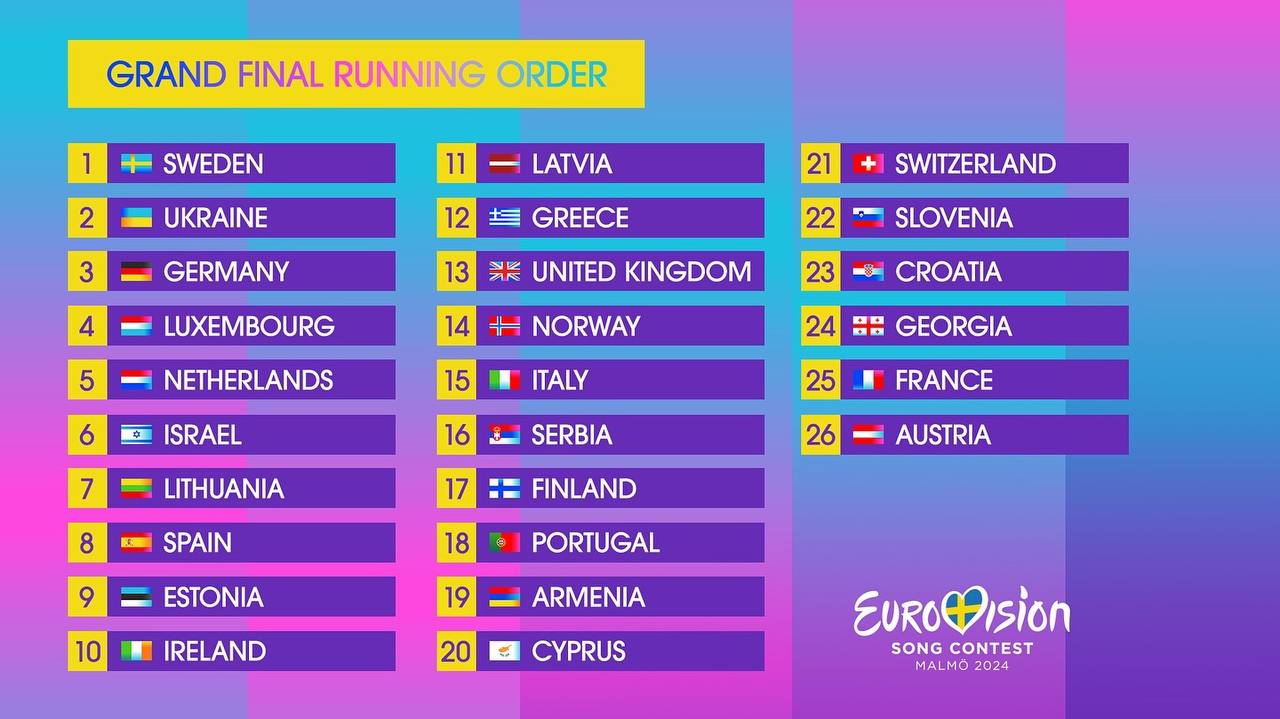

Yevrobachennya 2024 De I Koli Divitisya Spisok Uchasnikiv Ukrayinskiy Predstavnik

May 14, 2025

Yevrobachennya 2024 De I Koli Divitisya Spisok Uchasnikiv Ukrayinskiy Predstavnik

May 14, 2025 -

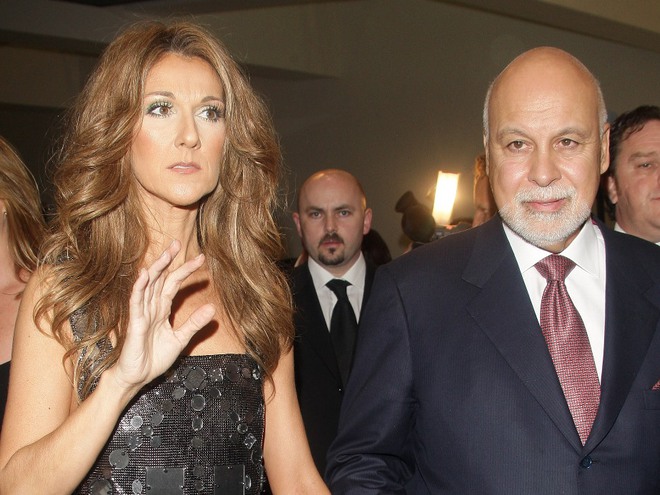

Selin Dion Biografiya Osobiste Zhittya Khvoroba Ta Potochniy Stan

May 14, 2025

Selin Dion Biografiya Osobiste Zhittya Khvoroba Ta Potochniy Stan

May 14, 2025 -

Muchova Defeats Raducanu At Dubai Tennis Championships

May 14, 2025

Muchova Defeats Raducanu At Dubai Tennis Championships

May 14, 2025 -

Ipo Slowdown How Tariffs Are Reshaping The Investment Landscape

May 14, 2025

Ipo Slowdown How Tariffs Are Reshaping The Investment Landscape

May 14, 2025 -

Disney Sets Release Date For Captain America Brave New World

May 14, 2025

Disney Sets Release Date For Captain America Brave New World

May 14, 2025

Latest Posts

-

Staten Island Eatery Featured In Netflix Film Handling The Hype

May 14, 2025

Staten Island Eatery Featured In Netflix Film Handling The Hype

May 14, 2025 -

Vince Vaughns Latest Netflix Film A Star Studded Crowd Pleaser

May 14, 2025

Vince Vaughns Latest Netflix Film A Star Studded Crowd Pleaser

May 14, 2025 -

Joe Manganiellos Nonna Height Doesnt Dim His Italian Pride

May 14, 2025

Joe Manganiellos Nonna Height Doesnt Dim His Italian Pride

May 14, 2025 -

Netflix Movies Staten Island Restaurant Inspiration A Rush Of Calls

May 14, 2025

Netflix Movies Staten Island Restaurant Inspiration A Rush Of Calls

May 14, 2025 -

Is Nonna On Netflix Worth Watching A Food Movie Review

May 14, 2025

Is Nonna On Netflix Worth Watching A Food Movie Review

May 14, 2025