Klarna's US IPO Filing: 24% Revenue Surge Revealed

Table of Contents

Klarna's Impressive Revenue Growth and Financial Performance

Klarna's IPO filing showcased impressive financial performance, particularly its 24% year-over-year revenue increase. This substantial growth underscores the increasing popularity and adoption of BNPL services globally. Let's break down the key aspects of Klarna's financials:

-

Detailed Revenue Breakdown: While specific figures may vary pending final IPO documentation, the reported 24% increase signals strong market penetration and efficient customer acquisition. This growth likely stems from both an increase in existing customer spending and the acquisition of new users.

-

Financial Health and Profitability: Although the specifics aren't fully disclosed before the IPO is finalized, Klarna's impressive revenue growth suggests a healthy financial position. However, analysts will closely scrutinize the company's profitability (or lack thereof), operating expenses, and margins to fully assess its long-term financial sustainability. The IPO filing will offer a detailed picture of these aspects, which will be crucial for investors.

-

Key Financial Metrics: Investors and analysts will be examining key performance indicators (KPIs) including customer acquisition cost (CAC), average order value (AOV), and customer lifetime value (CLTV). Low CAC coupled with high AOV and CLTV will indicate a robust and profitable business model.

-

Comparison to Competitors: Klarna faces stiff competition from other BNPL providers such as Affirm and Afterpay. A comprehensive analysis comparing Klarna's financial performance to these competitors will be critical to evaluating its market positioning and future prospects. Its competitive advantage likely lies in its established brand recognition and global presence.

Implications of the IPO Filing for the BNPL Market

Klarna's IPO filing has significant implications for the broader BNPL market:

-

Increased Investment in BNPL: The successful IPO is likely to attract further investment into the BNPL space, bolstering innovation and competition. Investors will view Klarna's success as a validation of the BNPL model and its future potential.

-

Market Competition and Consolidation: Klarna's strong market position and substantial resources could intensify competition within the BNPL sector, potentially leading to consolidation through mergers and acquisitions. Smaller players might struggle to compete against a larger, well-funded player like Klarna.

-

Impact on Existing Players: Established players in the BNPL market will need to adapt their strategies to compete effectively with Klarna's aggressive expansion and well-funded marketing campaigns. This could lead to price wars, increased innovation, and a focus on customer loyalty programs.

-

Regulatory Scrutiny and Future Growth: The rapid growth of the BNPL sector has also increased regulatory scrutiny, which could impact the future growth of all companies within the space. Klarna's response to these regulations will shape its future trajectory.

Klarna's Strategic Positioning and Future Outlook

Klarna's IPO filing also offers insights into its strategic priorities:

-

Strategic Priorities: The filing will detail Klarna's strategic focus, likely highlighting geographic expansion, strategic partnerships, and product diversification. This will help investors assess the company's long-term vision and ability to maintain its growth trajectory.

-

Market Expansion and Growth: Klarna's international presence is a significant advantage. The IPO filing may elaborate on its plans for further market expansion, particularly in regions with high growth potential for BNPL services.

-

Competitive Advantages and Weaknesses: Klarna's competitive advantages include its established brand, global reach, and diversified product offerings. However, its weaknesses could lie in its profitability and competition from established financial institutions entering the BNPL space.

-

Future Performance and Market Capitalization: Predicting Klarna's future performance and market capitalization requires analyzing several factors including market growth, competition, regulatory changes, and its ability to execute its strategic plans. Analysts will provide projections based on these considerations.

Conclusion

Klarna's US IPO filing, revealing a significant 24% revenue surge, underscores the remarkable growth of the BNPL sector and the company's strong position within it. The filing offers crucial insights into Klarna's financial health, strategic direction, and potential impact on the broader market. Its success will undoubtedly shape the future of fintech and the evolution of the buy now pay later landscape.

Call to Action: Stay informed about the latest developments in the Klarna IPO and the evolving BNPL market. Follow our blog for in-depth analyses and updates on the Klarna IPO and its impact on the fintech industry. Learn more about the future of Klarna and the buy now pay later revolution.

Featured Posts

-

How To Watch The Snow White Live Action Movie At Home

May 14, 2025

How To Watch The Snow White Live Action Movie At Home

May 14, 2025 -

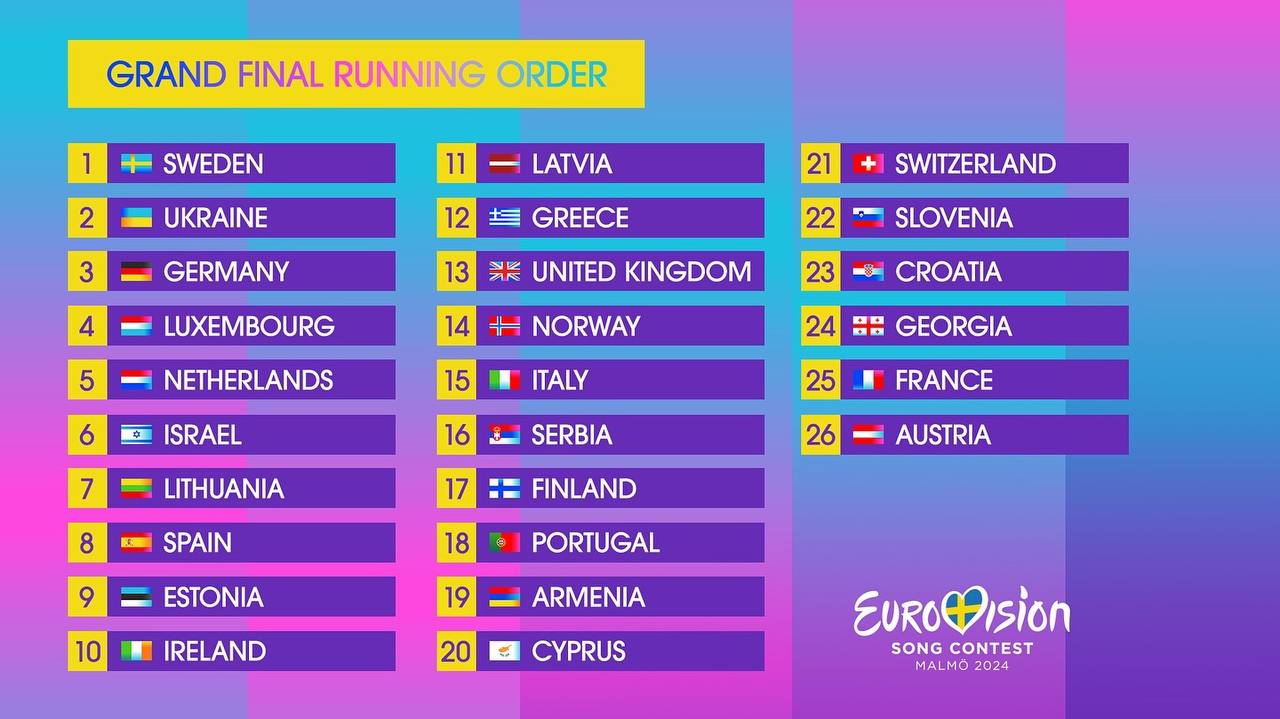

Yevrobachennya 2024 De I Koli Divitisya Spisok Uchasnikiv Ukrayinskiy Predstavnik

May 14, 2025

Yevrobachennya 2024 De I Koli Divitisya Spisok Uchasnikiv Ukrayinskiy Predstavnik

May 14, 2025 -

Bell Campaign Demands Change To Federal Wholesale Fibre Policy

May 14, 2025

Bell Campaign Demands Change To Federal Wholesale Fibre Policy

May 14, 2025 -

Recalled Coffee Creamer A Warning For Michigan Coffee Lovers

May 14, 2025

Recalled Coffee Creamer A Warning For Michigan Coffee Lovers

May 14, 2025 -

Wynonna And Ashley Judd Open Up Intimate Family Portraits In New Docuseries

May 14, 2025

Wynonna And Ashley Judd Open Up Intimate Family Portraits In New Docuseries

May 14, 2025

Latest Posts

-

Spanish Television Ignites Debate Should Israel Be In Eurovision

May 14, 2025

Spanish Television Ignites Debate Should Israel Be In Eurovision

May 14, 2025 -

Dont Hate The Playaz Respect And Competition In Hip Hop

May 14, 2025

Dont Hate The Playaz Respect And Competition In Hip Hop

May 14, 2025 -

Israels Eurovision Bid Faces Scrutiny From Spanish Broadcaster

May 14, 2025

Israels Eurovision Bid Faces Scrutiny From Spanish Broadcaster

May 14, 2025 -

Dont Hate The Playaz A Cultural Analysis

May 14, 2025

Dont Hate The Playaz A Cultural Analysis

May 14, 2025 -

Eurovision 2024 Spanish Media Spars Over Israels Song Contest Entry

May 14, 2025

Eurovision 2024 Spanish Media Spars Over Israels Song Contest Entry

May 14, 2025